OPTIONS, GREEKS, AND RISK MANAGEMENT Jelena Paunović *

... of shares of the stock to hold at time t in order to replicate the call. The key variable which determines the option price is volatility, σ. The strike and the maturity are determined by the contract, the underlying asset price is monitored, and the risk free rate is easily approximated by, for ins ...

... of shares of the stock to hold at time t in order to replicate the call. The key variable which determines the option price is volatility, σ. The strike and the maturity are determined by the contract, the underlying asset price is monitored, and the risk free rate is easily approximated by, for ins ...

Solutions January 2009

... The put’s payoff is bounded: at maturity, the maximal gain is K (less the premium) if the underlying is worth 0 (It is not the same with the call where the potential gain is unlimited). In the case of an American put, this fact limits the benefit of waiting to exercise: an early exercise is optimal ...

... The put’s payoff is bounded: at maturity, the maximal gain is K (less the premium) if the underlying is worth 0 (It is not the same with the call where the potential gain is unlimited). In the case of an American put, this fact limits the benefit of waiting to exercise: an early exercise is optimal ...

Ride The Seller220512

... Of course, with so much uncertainty still hanging over future conditions, the threat of more volatility remains very real and it’s impossible to say how long the current trend will last. Looking back, we saw a similar surge in buyer activity late last year, when the two rate cuts in November and Dec ...

... Of course, with so much uncertainty still hanging over future conditions, the threat of more volatility remains very real and it’s impossible to say how long the current trend will last. Looking back, we saw a similar surge in buyer activity late last year, when the two rate cuts in November and Dec ...

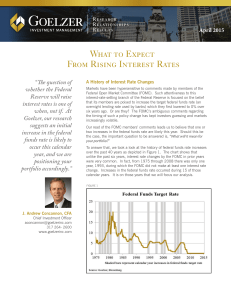

Why Has Good Economic News Hurt Financial Markets?

... 2010, it halted bond purchases because the economy was growing, only to renew them a couple of months later. Fed Chairman Ben Bernanke has said that when the Fed does begin to reverse course, it will be more like a driver easing off the gas pedal rather than slamming on the brakes. If you hold indiv ...

... 2010, it halted bond purchases because the economy was growing, only to renew them a couple of months later. Fed Chairman Ben Bernanke has said that when the Fed does begin to reverse course, it will be more like a driver easing off the gas pedal rather than slamming on the brakes. If you hold indiv ...

Title A Note on Look-Back Options Based on Order - HERMES-IR

... Note that G ( ' ) is different from the ordinary empirical distribution function since the Y4" are not independent at all. We first give an asymptotic distribution of G*( ' ). ...

... Note that G ( ' ) is different from the ordinary empirical distribution function since the Y4" are not independent at all. We first give an asymptotic distribution of G*( ' ). ...

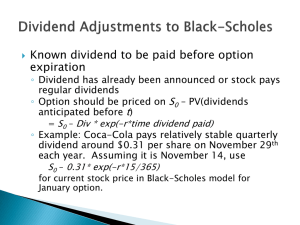

Absolute Dividends

... • When there no jumps, the variance swaps valuation and hedging are model independent. • The vega-hedge portfolio for variance swaps is static and the value is directly calculated from the current smile. • The valuation of a volatility swap is model dependent and the pricing requires model calibrati ...

... • When there no jumps, the variance swaps valuation and hedging are model independent. • The vega-hedge portfolio for variance swaps is static and the value is directly calculated from the current smile. • The valuation of a volatility swap is model dependent and the pricing requires model calibrati ...

note on weighted average strike asian options

... Ruttiens(1990) and Vorst(1990) employing the solution to the corresponding geometric average problem improves the speed of calculation. On the other hand, Levy(1992) proposes a more accurate method which relies on the assumption that the distribution of sum of log normal variables is itself well app ...

... Ruttiens(1990) and Vorst(1990) employing the solution to the corresponding geometric average problem improves the speed of calculation. On the other hand, Levy(1992) proposes a more accurate method which relies on the assumption that the distribution of sum of log normal variables is itself well app ...

Option Price and Portfolio Simulation

... Want to guarantee that t periods from now you will have at least I*z ◦ z is a number generally between 0 and 1that guarantees a minimum value ◦ Want to invest in Stock with price S0 and Put for stock with exercise price X ◦ A package of share + put costs S0 + P(S0,X) ◦ Buy a packages where a =I/(S ...

... Want to guarantee that t periods from now you will have at least I*z ◦ z is a number generally between 0 and 1that guarantees a minimum value ◦ Want to invest in Stock with price S0 and Put for stock with exercise price X ◦ A package of share + put costs S0 + P(S0,X) ◦ Buy a packages where a =I/(S ...

LESSONS FROM THE HOUSING CRISIS BOG_Karakitsos

... – House prices: stabilise in spring 2010 at 40% lower than peak in mid-2006 – Debt:> +50% (61% to 101%) in the upswing, 98-07 ...

... – House prices: stabilise in spring 2010 at 40% lower than peak in mid-2006 – Debt:> +50% (61% to 101%) in the upswing, 98-07 ...

Lecture 6 Classification of Interest Rate Models

... • Designed to be exactly consistent with current term structure of interest rates • Current term structure is an input • Useful for valuing interest rate contingent securities • Requires frequent recalibration to use model over any length of time • Difficult to use for time series modeling ...

... • Designed to be exactly consistent with current term structure of interest rates • Current term structure is an input • Useful for valuing interest rate contingent securities • Requires frequent recalibration to use model over any length of time • Difficult to use for time series modeling ...

Financial Derivatives - William & Mary Mathematics

... • Example: Stock A is selling at 100 and its options are selling at $2.50 with a strike price of $120 – You want to invest $1,000 – So you can buy 10 shares of stock or…. – 4 options contracts – In a week the price of the stock is now at 110 so your profit with just the stocks is 10*10 = 100 but let ...

... • Example: Stock A is selling at 100 and its options are selling at $2.50 with a strike price of $120 – You want to invest $1,000 – So you can buy 10 shares of stock or…. – 4 options contracts – In a week the price of the stock is now at 110 so your profit with just the stocks is 10*10 = 100 but let ...

Chapter 11

... Shift risk from those who don’t want to carry risk to those who are willing to do so. Bring additional information into the market from hedgers, speculators, market expectations. Lower commissions and margin requirements than in spot market ...

... Shift risk from those who don’t want to carry risk to those who are willing to do so. Bring additional information into the market from hedgers, speculators, market expectations. Lower commissions and margin requirements than in spot market ...

backknowprobe10.pdf

... adviser gives you a choice of the following payouts for the prize: (a) $10,000 right now (b) $10,300 1 year from now (c) $245 each year forever, starting now (d) $1,025 for each of ten years, starting now Which is the most valuable payout in terms of present value? Assume the interest rate is 3.0% a ...

... adviser gives you a choice of the following payouts for the prize: (a) $10,000 right now (b) $10,300 1 year from now (c) $245 each year forever, starting now (d) $1,025 for each of ten years, starting now Which is the most valuable payout in terms of present value? Assume the interest rate is 3.0% a ...

Data Structures in Java

... nodes such that the next node in the sequence is a child of the previous ...

... nodes such that the next node in the sequence is a child of the previous ...

Derivative Financial instrument whose payoff depends on the value

... Financial instrument whose payoff depends on the value of the underlying asset. Derivative can be used to hedge risk because there is a correlation with the underlying. Also reflect a view on the future, speculate, arbitrage profit, change the nature of the liability/investment. Forward OTC agreemen ...

... Financial instrument whose payoff depends on the value of the underlying asset. Derivative can be used to hedge risk because there is a correlation with the underlying. Also reflect a view on the future, speculate, arbitrage profit, change the nature of the liability/investment. Forward OTC agreemen ...

Traditional Interest Rate Channels

... Tobin’s q Theory: monetary policy affects the real sector through its effect on the valuation of equities. ...

... Tobin’s q Theory: monetary policy affects the real sector through its effect on the valuation of equities. ...

Note présentée au Collège

... The vega notional provides a theoretical measure of the profit or loss resulting from a 1% change in volatility. As realised volatility cannot be less than zero, a long swap position has a known maximum loss. The maximum loss on a short swap is often limited by the inclusion of a cap on volatility. ...

... The vega notional provides a theoretical measure of the profit or loss resulting from a 1% change in volatility. As realised volatility cannot be less than zero, a long swap position has a known maximum loss. The maximum loss on a short swap is often limited by the inclusion of a cap on volatility. ...

CLOSED FORM SOLUTION FOR HESTON PDE BY GEOMETRICAL

... models are not complete, and thus a typical contingent claim (such as a European option) cannot be priced by arbitrage. In other words, the standard replication arguments can no longer be applied. For this reason, the issue of valuation of derivative securities under market incompleteness has attrac ...

... models are not complete, and thus a typical contingent claim (such as a European option) cannot be priced by arbitrage. In other words, the standard replication arguments can no longer be applied. For this reason, the issue of valuation of derivative securities under market incompleteness has attrac ...

Recovering Risk-Neutral Densities from Exchange Rate Options: Evidence in Turkey

... expectations and market uncertainty about the future course of the financial asset prices. Options contracts give the right to buy or sell an asset in the future at a price (strike) set now. Options have a value since there is a chance that the options can be exercised, that is, the underlying asset ...

... expectations and market uncertainty about the future course of the financial asset prices. Options contracts give the right to buy or sell an asset in the future at a price (strike) set now. Options have a value since there is a chance that the options can be exercised, that is, the underlying asset ...

Chapter 10: Bonds Payable

... Chapter 10: Bonds Payable • Non-Current Liabilities – Due more than one year from balance sheet date – Currently maturing bonds payable need to be transferred to current liability status ...

... Chapter 10: Bonds Payable • Non-Current Liabilities – Due more than one year from balance sheet date – Currently maturing bonds payable need to be transferred to current liability status ...

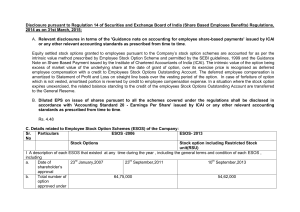

Share Based Employee Benefits

... Number of options granted during the year Number of options forfeited / lapsed during the year Number of options vested during the year Number of options exercised during the year Number of shares arising as a result of exercise of options Money realised by exercise of options (INR), if Scheme is im ...

... Number of options granted during the year Number of options forfeited / lapsed during the year Number of options vested during the year Number of options exercised during the year Number of shares arising as a result of exercise of options Money realised by exercise of options (INR), if Scheme is im ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.