dO t - University of Pennsylvania

... An easy exercise gives one a formula for the price of a European call option. At first it may be surprising, but you get EXACTLY the Black-Scholes formula, Except that the old σ is replaced by a function of the new model parameters. The PDE approach is meaningless in this context, but … ...

... An easy exercise gives one a formula for the price of a European call option. At first it may be surprising, but you get EXACTLY the Black-Scholes formula, Except that the old σ is replaced by a function of the new model parameters. The PDE approach is meaningless in this context, but … ...

489f10h2.pdf

... for at least one year. Suppose also that the government has issued 1year bonds denominated in the EBB. The government is so shaky that it must pay a continuously compounded interest rate of 20%. Assuming that the corresponding continuously compounded interest rate for US lending and borrowing is 4%, ...

... for at least one year. Suppose also that the government has issued 1year bonds denominated in the EBB. The government is so shaky that it must pay a continuously compounded interest rate of 20%. Assuming that the corresponding continuously compounded interest rate for US lending and borrowing is 4%, ...

IEOR E4718 Topics in Derivatives Pricing

... become a feature of not just equity index options markets (CAC, DAX, Nikkei, S&P, etc.) but also single-stock options markets, interest-rate options markets, currency options markets, credit derivatives markets, and almost any other volatility market. New markets typically begin with traders using t ...

... become a feature of not just equity index options markets (CAC, DAX, Nikkei, S&P, etc.) but also single-stock options markets, interest-rate options markets, currency options markets, credit derivatives markets, and almost any other volatility market. New markets typically begin with traders using t ...

Key Issues and Ideas - BYU Marriott School

... 10. An investor is in a 28% tax bracket. If corporate bonds offer 9% yields, what must municipals offer for the investor to prefer them to corporate bonds? 13. Which security should sell at a greater price? a. A 10-year Treasury bond with a 9% coupon rate or a 10-year T-bond with a 10% coupon. b. A ...

... 10. An investor is in a 28% tax bracket. If corporate bonds offer 9% yields, what must municipals offer for the investor to prefer them to corporate bonds? 13. Which security should sell at a greater price? a. A 10-year Treasury bond with a 9% coupon rate or a 10-year T-bond with a 10% coupon. b. A ...

Implied Trinomial Trees - EDOC HU - Humboldt

... where Δt refers to the time step and σ is the (constant) volatility. The forward price F = erΔt S in the node S is determined by the the continuous interest rate r (for the sake of simplicity, we assume that the dividend yield equals zero; see Cox, Ross, and Rubinstein, 1979, for treatment of divide ...

... where Δt refers to the time step and σ is the (constant) volatility. The forward price F = erΔt S in the node S is determined by the the continuous interest rate r (for the sake of simplicity, we assume that the dividend yield equals zero; see Cox, Ross, and Rubinstein, 1979, for treatment of divide ...

Lachov G

... The Bulgarian land market has been under development for the past 15 years. Many of the actual owners have got back their land but the problems with land market, land pricing and opportunity to invest in agricultural land still exist. At the moment, sale transactions in Bulgarian land exist only bet ...

... The Bulgarian land market has been under development for the past 15 years. Many of the actual owners have got back their land but the problems with land market, land pricing and opportunity to invest in agricultural land still exist. At the moment, sale transactions in Bulgarian land exist only bet ...

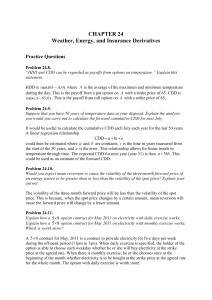

Chapter 24

... during the off-peak period (11pm to 7am). When daily exercise is specified, the holder of the option is able to choose each weekday whether he or she will buy electricity at the strike price at the agreed rate. When there is monthly exercise, he or she chooses once at the beginning of the month whet ...

... during the off-peak period (11pm to 7am). When daily exercise is specified, the holder of the option is able to choose each weekday whether he or she will buy electricity at the strike price at the agreed rate. When there is monthly exercise, he or she chooses once at the beginning of the month whet ...

Fall 10 489f10t1.pdf

... extensive audit, the company has determined that overstatements (claims for more health insurance money than is justified by the medical procedures performed) vary randomly with an exponential distribution X with a parameter 1/100 which implies that E [X] = 100 and Var [X] = 1002 . The company can a ...

... extensive audit, the company has determined that overstatements (claims for more health insurance money than is justified by the medical procedures performed) vary randomly with an exponential distribution X with a parameter 1/100 which implies that E [X] = 100 and Var [X] = 1002 . The company can a ...

Binomial Trees

... “Risk-neutral” probabilities are artificial (not real) probabilities that match the observed security prices. They are a mixture of subjective probabilities (people’s expectation, right or wrong), and risk preferences (hate or love risk). I We can estimate the risk-neutral probabilities from the cur ...

... “Risk-neutral” probabilities are artificial (not real) probabilities that match the observed security prices. They are a mixture of subjective probabilities (people’s expectation, right or wrong), and risk preferences (hate or love risk). I We can estimate the risk-neutral probabilities from the cur ...

PowerPoint Slides

... – Form a hedge portfolio with 1 option and ∆ shares of the underlying stock – Any instantaneous movement of the stock price is exactly offset by the change in the option – Resulting portfolio is riskless and must earn ...

... – Form a hedge portfolio with 1 option and ∆ shares of the underlying stock – Any instantaneous movement of the stock price is exactly offset by the change in the option – Resulting portfolio is riskless and must earn ...

MATH2510 MATH2510 This paper consists of 3 printed Only

... B4. Given that the house price futures are based on a UK-wide index/average, is the hedge from B3 likely to be perfect, i.e. to remove all risk? How can this be taken into account when hedging? ...

... B4. Given that the house price futures are based on a UK-wide index/average, is the hedge from B3 likely to be perfect, i.e. to remove all risk? How can this be taken into account when hedging? ...

VALUATION IN DERIVATIVES MARKETS

... • A contract that specifies the rights and obligations between two parties to receive or deliver future cash flows (or exchange of other securities or assets) based on some future event. ...

... • A contract that specifies the rights and obligations between two parties to receive or deliver future cash flows (or exchange of other securities or assets) based on some future event. ...

$doc.title

... 1. binary option: pays $100mm if the rate is below 0.600£/US$ exactly one year from now. 2. barrier option: pays $100mm if the rate crosses below 0.600£/US$ at any point before one year. 3. step option: pays $100mm if the rate ends between 0.590-0.600£/US$, $200mm if the rate ends 0.575-0.590£/US$, ...

... 1. binary option: pays $100mm if the rate is below 0.600£/US$ exactly one year from now. 2. barrier option: pays $100mm if the rate crosses below 0.600£/US$ at any point before one year. 3. step option: pays $100mm if the rate ends between 0.590-0.600£/US$, $200mm if the rate ends 0.575-0.590£/US$, ...

9 Complete and Incomplete Market Models

... But the second integral can not be written as an integral w.r.t. dS̃s . ...

... But the second integral can not be written as an integral w.r.t. dS̃s . ...

The Black-Scholes Analysis

... Causes of Volatility • To a large extent, volatility appears to be caused by trading rather than by the arrival of new information to the market ...

... Causes of Volatility • To a large extent, volatility appears to be caused by trading rather than by the arrival of new information to the market ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.