1 (i) - the David R. Cheriton School of Computer Science

... Start with Jacobson, then others: There are about 4n/(πn)3/2 ordered rooted trees, and same number of binary trees Lower bound on specifying is about 2n bits What are the natural representations? ...

... Start with Jacobson, then others: There are about 4n/(πn)3/2 ordered rooted trees, and same number of binary trees Lower bound on specifying is about 2n bits What are the natural representations? ...

Exchange Rate Volatility and Productivity Growth: The Role

... constraints if net wealth is considered as collateral Private credit to GDP and output per worker are strongly correlated, so are results on financial development proxy for convergence relationship? ...

... constraints if net wealth is considered as collateral Private credit to GDP and output per worker are strongly correlated, so are results on financial development proxy for convergence relationship? ...

Mackenzie Cundill Value Fund – Series C

... as of March 31, 2016 including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values ...

... as of March 31, 2016 including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values ...

FedViews

... Corporate profits have rebounded in the last two quarters, perhaps reflecting aggressive cost cutting more than top-line revenue growth. Nevertheless, equity analysts are projecting relatively respectable profit growth over the next four quarters. In response to corporate earnings announcements and ...

... Corporate profits have rebounded in the last two quarters, perhaps reflecting aggressive cost cutting more than top-line revenue growth. Nevertheless, equity analysts are projecting relatively respectable profit growth over the next four quarters. In response to corporate earnings announcements and ...

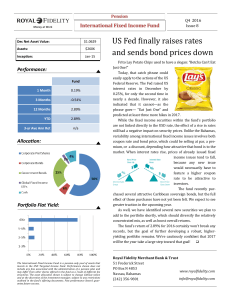

US Fed finally raises rates and sends bond prices down

... While the fixed income securities within the fund’s portfolio are not linked directly to the USD rate, the effect of a rise in rates still had a negative impact on security prices. Unlike the Bahamas, variability among international fixed income issues involves both coupon rate and bond price, which ...

... While the fixed income securities within the fund’s portfolio are not linked directly to the USD rate, the effect of a rise in rates still had a negative impact on security prices. Unlike the Bahamas, variability among international fixed income issues involves both coupon rate and bond price, which ...

KARTHIKA S NAIR - BFSI hiring.com

... 10 year government bond yield, money supply, foreign exchange reserves, real effect exchange rate and LIBOR on bond indices is examined using Multiple regression and GARCH model. The effect of financial crisis on bond returns is examined using Adaptive Market Hypothesis. The bond indices of deve ...

... 10 year government bond yield, money supply, foreign exchange reserves, real effect exchange rate and LIBOR on bond indices is examined using Multiple regression and GARCH model. The effect of financial crisis on bond returns is examined using Adaptive Market Hypothesis. The bond indices of deve ...

Recent Financial Turmoil - What`s New by Dr Peter

... “… the heightened concern with credit risk, reflecting both a perception of increased default risk and greater difficulties in assessing counterparties’ strength, has led many banks to reduce the size of interbank credit exposures that can be authorised, to shorten the maturity of the business they ...

... “… the heightened concern with credit risk, reflecting both a perception of increased default risk and greater difficulties in assessing counterparties’ strength, has led many banks to reduce the size of interbank credit exposures that can be authorised, to shorten the maturity of the business they ...

Investment Analysis

... The discount function d(t) indicates how much we are willing to pay for €1 at some specific future point in time t. Typically, we assume that the discount function is less than one. Example: d(1) = 0.952, d(2) = 0.890, d(3) = 0.838, d(4) = 0.763 ...

... The discount function d(t) indicates how much we are willing to pay for €1 at some specific future point in time t. Typically, we assume that the discount function is less than one. Example: d(1) = 0.952, d(2) = 0.890, d(3) = 0.838, d(4) = 0.763 ...

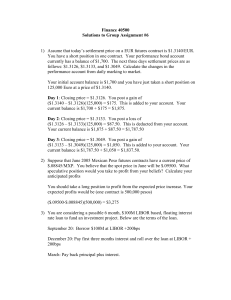

Chapter 5a Recommended End-of-Chapter Problems and Solutions

... $1,000 at end of 3 years. What discount rate equates this payment stream to $978.30? ...

... $1,000 at end of 3 years. What discount rate equates this payment stream to $978.30? ...

ppt

... Recursive Definition of a Tree: A tree is a set of nodes that is a. an empty set of nodes, or b. has one node called the root from which zero or more trees (subtrees) descend. A tree with N nodes always has N-1 edges Two nodes in a tree have at most one path between them Can a non-zero path fr ...

... Recursive Definition of a Tree: A tree is a set of nodes that is a. an empty set of nodes, or b. has one node called the root from which zero or more trees (subtrees) descend. A tree with N nodes always has N-1 edges Two nodes in a tree have at most one path between them Can a non-zero path fr ...

Presentation on Implementing Binary Trees

... • As with linked lists, write a class to create the nodes and their properties, but including two pointers (left and right). ...

... • As with linked lists, write a class to create the nodes and their properties, but including two pointers (left and right). ...

Binomial Model

... Probabilities of future up and down are already incorporated into the price of the stock so we do not need to take them into account again when valuing the option in term of stock price Implication of the riskless hedge approach for option valuation are : 1) Option is risky but it is not necessary ...

... Probabilities of future up and down are already incorporated into the price of the stock so we do not need to take them into account again when valuing the option in term of stock price Implication of the riskless hedge approach for option valuation are : 1) Option is risky but it is not necessary ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.