* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Introduction to Investments

Survey

Document related concepts

Transcript

Introduction to Investments

MTH6100 Actuarial Mathematics

Fixed Interest Securities

• Issued by Governments & companies when they wish to borrow

money (usually long term money).

• Usually listed & tradeable

• Priced per nominal amount of bond (eg per £100 nominal)

• Regular interest payments (“coupons”) of known amount paid until

date of maturity (“redemption date”)

• “Par” means the nominal amount

• Bond prices and redemption amounts are defined in relation to par “at par” “above par” and “below par”

Fixed Interest Securities - Example

Vodaphone 5.625% 4 Dec 2025

• Annual coupon of £5.625 per £100 nominal.

• Repayable at par in December 2025.

• Current price is above par at £122.281 per £100

nominal.

• Pre-tax IRR to an investor at current price is 2.75% pa.

This is known as the “gross redemption yield”.

• The running yield is the term for the immediate cash

return to an investor before allowing for tax and any

capital gains or losses on the bond.

• Running Yield = 𝐶𝑜𝑢𝑝𝑜𝑛 𝑝𝑒𝑟 £100 𝑛𝑜𝑚𝑖𝑛𝑎𝑙

=

5.625% 𝑥 100

122.281

= 4.6%

𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 £100 𝑛𝑜𝑚𝑖𝑛𝑎𝑙

Government Bonds v Corporate Bonds

Government Bonds

Corporate Bonds

• UK gilts, US treasuries, JGB, German

bund

• Known by name of issuer

• Often considered very low risk (but…)

• Risk depends on quality of issuer

• Markets usually large and liquid

• Markets largely illiquid except for

largest issues

• Usually easy to buy/sell with low

trading costs

• Higher trading costs

• Insurer/pension fund demand for long • Many insurers and pension schemes

term and index linked bonds reducing

would follow a “buy and hold”

liquidity for some issues

strategy

“57 Varieties” of Corporate Bond

Debentures

Bonds that provide some sort of security to investors.

Example: A mortgage debenture

Unsecured

Bonds with no special security for investors. Investors rank

alongside other creditors in the event of bankruptcy.

Eurobonds

A particular form of bond which is traded internationally and

which is often issued in $ or Euro. Typically for larger more

liquid issues.

Convertibles

Convertible into shares of the company in some conditions.

Two broad scenarios:

i) Issued by bank/insurance company as part of their

regulatory capital; or

ii) “conversion option” added to make bond more attractive

to investors.

Asset Backed Securities

Fixed interest securities backed by income producing assets.

Example: utility cashflows, “Bowie bond”

Certificates of Deposit

Short term borrowings (up to 6 months by banks and building

societies).

Typical Problems

• Explain the key characteristics of a {government security}

• Determine the price…

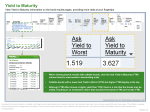

• Determine the gross or net redemption yield…

• Analyse impact of bond restructuring

• Complexities:

• Tax

• Optional redemption dates

• Index Linked Securities