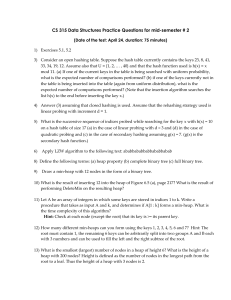

CS 315 Week 2 (Feb 5 and 7) summary and review questions

... 20) What is the height of the above tree? What is the depth of the node containing the key 14? Recall that the height of the binary search tree is defined as the number of edges in the longest path from root to a leaf. 21) There are 24 possible ways in which we could insert the keys 1, 2, 3 and 4 in ...

... 20) What is the height of the above tree? What is the depth of the node containing the key 14? Recall that the height of the binary search tree is defined as the number of edges in the longest path from root to a leaf. 21) There are 24 possible ways in which we could insert the keys 1, 2, 3 and 4 in ...

Minimum Spanning Trees - Baylor School of Engineering

... of edges A Pick a light edge and add it to A. Repeat until all nodes are in V. ...

... of edges A Pick a light edge and add it to A. Repeat until all nodes are in V. ...

Management`s primary goal is to maximize stockholder

... The yield curve is a graph of the term structure of interest rates, which is the relationship of yield and maturity for securities of similar risk. When we think of the yield curve we typically think of the Treasury yield curve, as found each day in financial publications like the Wall Street Journa ...

... The yield curve is a graph of the term structure of interest rates, which is the relationship of yield and maturity for securities of similar risk. When we think of the yield curve we typically think of the Treasury yield curve, as found each day in financial publications like the Wall Street Journa ...

Asset/Liability Management Day 4

... rates change when management at the bank say they change. We do know however that there is often some response to market rate changes. To model this sensitivity we use a Beta factor. This is the percentage of rate change each account will move with a 100 basis point movement in Fed Funds. ...

... rates change when management at the bank say they change. We do know however that there is often some response to market rate changes. To model this sensitivity we use a Beta factor. This is the percentage of rate change each account will move with a 100 basis point movement in Fed Funds. ...

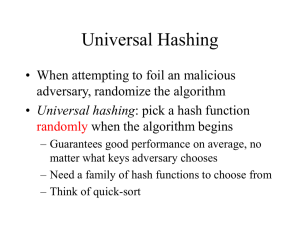

slides

... • Decompose key x into r+1 bytes, so that x = {x0, x1, …, xr} – Only requirement is that max value of byte < m – Let a = {a0, a1, …, ar} denote a sequence of r+1 elements chosen randomly from {0, 1, …, m - 1} – Define corresponding hash function ha G: r ...

... • Decompose key x into r+1 bytes, so that x = {x0, x1, …, xr} – Only requirement is that max value of byte < m – Let a = {a0, a1, …, ar} denote a sequence of r+1 elements chosen randomly from {0, 1, …, m - 1} – Define corresponding hash function ha G: r ...

Hedging Interest Rate Risk

... In 1972, the Chicago Mercantile Exchange began trading currency Futures. By 2004, the number of currency futures outstanding stood at 48M with a value of ...

... In 1972, the Chicago Mercantile Exchange began trading currency Futures. By 2004, the number of currency futures outstanding stood at 48M with a value of ...

Here - Fakultät für Mathematik

... These notes are the basis of my lecture Numerical methods in mathematical finance given at Karlsruhe Institute of Technology in the winter term 2014/15. The purpose of this notes is to help students who have missed parts of the course to fill these gaps, and to provide a service for those students w ...

... These notes are the basis of my lecture Numerical methods in mathematical finance given at Karlsruhe Institute of Technology in the winter term 2014/15. The purpose of this notes is to help students who have missed parts of the course to fill these gaps, and to provide a service for those students w ...

Synopsis_2014_v3 ed 7 and 8

... a future interest rate, a maximum sum, lending or borrowing. This instrument can then be made into futures, swaps and option. We defined three basic option contracts building on FRA. The basis of hedging is that we identify a position (and thus an exposure) long or short. A derivative contract can h ...

... a future interest rate, a maximum sum, lending or borrowing. This instrument can then be made into futures, swaps and option. We defined three basic option contracts building on FRA. The basis of hedging is that we identify a position (and thus an exposure) long or short. A derivative contract can h ...

x - My LIUC

... Portfolio is adjusted by selecting companies that should perform well for the stage of the business cycle Peaks – natural resource extraction firms ...

... Portfolio is adjusted by selecting companies that should perform well for the stage of the business cycle Peaks – natural resource extraction firms ...

Trees

... LinkedBinaryTree only actually uses the BTNode class explicitly when instantiating a node of the tree, in

method createNode. In all other methods it refers to the nodes of the tree using the BTPosition class (i.e., a

widening cast). This layer of abstraction makes it easier to change the sp ...

... LinkedBinaryTree

RISK DISCLOSURE STATEMENT FOR INVESTMENTS

... 3. Because prices and characteristics of over-the-counter financial instruments are often individually negotiated, there may be no central source for obtaining prices and there can be inefficiencies in the pricing of such instruments. The Bank makes no representation or warranty that its prices will ...

... 3. Because prices and characteristics of over-the-counter financial instruments are often individually negotiated, there may be no central source for obtaining prices and there can be inefficiencies in the pricing of such instruments. The Bank makes no representation or warranty that its prices will ...

Solvency II – San Diego

... - unchanged minimum: max(75th%ile, µ+½) - but focus is more on modeling, looking to the particular circumstances of the individual insurer, (- information in FCR&ILVR) • Requirement to follow the “relevant professional standard” (PS300 for liabilities) where no conflict - so wording of that also im ...

... - unchanged minimum: max(75th%ile, µ+½) - but focus is more on modeling, looking to the particular circumstances of the individual insurer, (- information in FCR&ILVR) • Requirement to follow the “relevant professional standard” (PS300 for liabilities) where no conflict - so wording of that also im ...

Solution - GitHub Pages

... 3.26 Describe in a few sentences how to implement three stacks in one array. Ans Three stacks can be implemented by having one grow from the bottom up, another from the top down and a third somewhere in the middle growing in some (arbitrary) direction. If the third stack collides with either of the ...

... 3.26 Describe in a few sentences how to implement three stacks in one array. Ans Three stacks can be implemented by having one grow from the bottom up, another from the top down and a third somewhere in the middle growing in some (arbitrary) direction. If the third stack collides with either of the ...

EMH Lecture

... • Not whether or not the markets are efficient – this is a side issue – but how investors should act, given how the markets work • Unfortunately, there is a dichotomy between the short run and the long run: – Over the long run, value-type strategies perform best – But, over the short run, growth sto ...

... • Not whether or not the markets are efficient – this is a side issue – but how investors should act, given how the markets work • Unfortunately, there is a dichotomy between the short run and the long run: – Over the long run, value-type strategies perform best – But, over the short run, growth sto ...

Institute of Actuaries of India Subject ST5 – Finance and Investment A

... Hedging is possible if company goes long on futures rather than short as suggested by CFO but the strategy is fraught with risks Highlight the lack of expertise of the company in entering into the deal Futures trading in chemical X have recently started. What if the exchange finds that the required ...

... Hedging is possible if company goes long on futures rather than short as suggested by CFO but the strategy is fraught with risks Highlight the lack of expertise of the company in entering into the deal Futures trading in chemical X have recently started. What if the exchange finds that the required ...

v - Researchmap

... • Divide the sequence into blocks of length wc Let M1,…, Mt, m1,…, mt be max/min values of the blocks • To compute fwd_search(E,i,d), if E[i]+d < (the minimum value of the block containing i), the block containing the answer is the first block j with mj < E[i]+d ...

... • Divide the sequence into blocks of length wc Let M1,…, Mt, m1,…, mt be max/min values of the blocks • To compute fwd_search(E,i,d), if E[i]+d < (the minimum value of the block containing i), the block containing the answer is the first block j with mj < E[i]+d ...

Using The Lognormal Random Variable to Model Stock Prices

... Here S = current stock price. may be thought of as the instantaneous rate of return on the stock. By the way, this model leads to really "jumpy" changes in stock prices (like real life). This is because during a small period of time the standard deviation of the stock's movement will greatly excee ...

... Here S = current stock price. may be thought of as the instantaneous rate of return on the stock. By the way, this model leads to really "jumpy" changes in stock prices (like real life). This is because during a small period of time the standard deviation of the stock's movement will greatly excee ...

Revenue Recognition Certificates

... Assume: 3% nominal growth, 30 year maturity Given today’s Treasury rates of 2%, Govt needs to pay 0.3% of GDP of which principal is some $20 billion ...

... Assume: 3% nominal growth, 30 year maturity Given today’s Treasury rates of 2%, Govt needs to pay 0.3% of GDP of which principal is some $20 billion ...

The Behavior of Interest Rates

... If the money market is ___________, the bond market is ____________also. Excess ________ in the bond market implies excess _______ in the money market and the reverse. The bond market can be analyzed by analyzing the money market. (Note: method doesn’t work if there are more than 2 assets) Demand fo ...

... If the money market is ___________, the bond market is ____________also. Excess ________ in the bond market implies excess _______ in the money market and the reverse. The bond market can be analyzed by analyzing the money market. (Note: method doesn’t work if there are more than 2 assets) Demand fo ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.