Downlaod File

... Indirect finance is where borrowers borrow funds from the financial market through indirect means, such as through a financial intermediary. Direct finance where there is a direct connection to the financial markets as indicated by the borrower issuing securities directly on the market. ...

... Indirect finance is where borrowers borrow funds from the financial market through indirect means, such as through a financial intermediary. Direct finance where there is a direct connection to the financial markets as indicated by the borrower issuing securities directly on the market. ...

FinalExamReviewS07

... tree will be O(lgn) • You should be able to show how these algorithms perform on a given red-black tree (except for delete), and tell their running time ...

... tree will be O(lgn) • You should be able to show how these algorithms perform on a given red-black tree (except for delete), and tell their running time ...

Commodities and Sentiment

... Générale (“SG”) believe it to be fair and not misleading or deceptive. SG, and their affiliated companies in the SG Group, may from time to time deal in, profit from the trading of, hold or act as market-makers or act as advisers, brokers or bankers, in relation to the securities, or derivatives of ...

... Générale (“SG”) believe it to be fair and not misleading or deceptive. SG, and their affiliated companies in the SG Group, may from time to time deal in, profit from the trading of, hold or act as market-makers or act as advisers, brokers or bankers, in relation to the securities, or derivatives of ...

Telkom - Duke University`s Fuqua School of Business

... – highest murder rate in the world – investors cite crime as the biggest deterrent to doing business in SA ...

... – highest murder rate in the world – investors cite crime as the biggest deterrent to doing business in SA ...

Session 1

... Stacks and Queues 5. Introduction, Stacks, Implementation of Stacks using Arrays, Implementing Stacks using Linked Lists, Queues, Implementing Queues using Arrays, Queues using linked lists, Circular Queue, Circular Queue using linked list [Circular Lists], Evaluation of expressions, Postfix express ...

... Stacks and Queues 5. Introduction, Stacks, Implementation of Stacks using Arrays, Implementing Stacks using Linked Lists, Queues, Implementing Queues using Arrays, Queues using linked lists, Circular Queue, Circular Queue using linked list [Circular Lists], Evaluation of expressions, Postfix express ...

Document

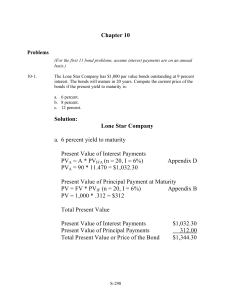

... This shows that for the price in excess of 90, this investor will earn more than 5, and for the price under 85, the investor will also earn more than 5. Therefore, the minimum earned on the option position is 5, while the net cost of the options is 5 – 2 = 3, for a total net gain of 5 – 3 = 2. Answe ...

... This shows that for the price in excess of 90, this investor will earn more than 5, and for the price under 85, the investor will also earn more than 5. Therefore, the minimum earned on the option position is 5, while the net cost of the options is 5 – 2 = 3, for a total net gain of 5 – 3 = 2. Answe ...

10-5 Factoring Quadratic Trinomials

... coefficients and there is a way to check for factorability. Using the discriminant, b2 – 4ac, to check for factorability. If your answer is a perfect square, it can be factored, but if it is not a perfect square then you must use other methods. ...

... coefficients and there is a way to check for factorability. Using the discriminant, b2 – 4ac, to check for factorability. If your answer is a perfect square, it can be factored, but if it is not a perfect square then you must use other methods. ...

On the pricing and hedging of volatility derivatives 1 Introduction

... Like several of these authors, we take a stochastic volatility model as our starting point; we also provide formulae for the case that the volatility follows a jumpdiffusion process of the type described in [18]. The fact that stochastic volatility models are able to fit skews and smiles, while simu ...

... Like several of these authors, we take a stochastic volatility model as our starting point; we also provide formulae for the case that the volatility follows a jumpdiffusion process of the type described in [18]. The fact that stochastic volatility models are able to fit skews and smiles, while simu ...

Chapter 4. Understanding Interest Rates

... • true YTM = 7.37% • lousy approximation only 2 years to maturity selling 2.5% below F ...

... • true YTM = 7.37% • lousy approximation only 2 years to maturity selling 2.5% below F ...

Lecture 23

... are efficient because half the tree is eliminated at each comparison (cf binary search with arrays). In searching for an item in a binary search tree only involves going left or right for each node as we descend the tree. This is similar to choosing first or second half during a binary search for an ...

... are efficient because half the tree is eliminated at each comparison (cf binary search with arrays). In searching for an item in a binary search tree only involves going left or right for each node as we descend the tree. This is similar to choosing first or second half during a binary search for an ...

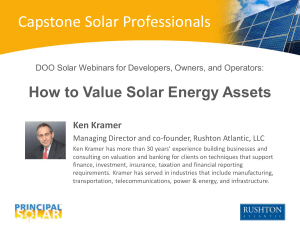

How to Value Solar Energy Assets

... Authority in Washington state issued a new set of rules governing when they would buy hydropower preferentially over wind – thus re-writing the contracts and revenue estimations that many wind generators were relying on. How can you account for something of this nature when valuing an asset with a 2 ...

... Authority in Washington state issued a new set of rules governing when they would buy hydropower preferentially over wind – thus re-writing the contracts and revenue estimations that many wind generators were relying on. How can you account for something of this nature when valuing an asset with a 2 ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.