Capital Markets Institutions, Instruments, and Risk

... Description of Preferences between Current and Future Consumption Opportunity in the Loan Market 470 Economic Forces Affecting the Market Rate 472 Carryover through Investment 473 Consumer Choices 473 Market Equilibrium 478 Efficiency Properties of Markets 482 Real and Nominal Interest Rates: Fisher ...

... Description of Preferences between Current and Future Consumption Opportunity in the Loan Market 470 Economic Forces Affecting the Market Rate 472 Carryover through Investment 473 Consumer Choices 473 Market Equilibrium 478 Efficiency Properties of Markets 482 Real and Nominal Interest Rates: Fisher ...

Chapter 9

... MATURITY RISK PREMIUM (MRP): Compensation expected by investors due to interest rate risk on debt instruments with longer maturities LIQUIDITY PREMIUM (LP): Compensation for securities that cannot easily be converted to cash ...

... MATURITY RISK PREMIUM (MRP): Compensation expected by investors due to interest rate risk on debt instruments with longer maturities LIQUIDITY PREMIUM (LP): Compensation for securities that cannot easily be converted to cash ...

The Case for Middle Market Lending

... Because past performance does not guarantee future results, we believe investors should seek to understand how the lender is positioned to handle a turn in the credit cycle. Here are some questions to consider: ...

... Because past performance does not guarantee future results, we believe investors should seek to understand how the lender is positioned to handle a turn in the credit cycle. Here are some questions to consider: ...

CHAPTER 7

... of maturity value; result is very much like a Tbill except the maturity can be up to 30 years a. ...

... of maturity value; result is very much like a Tbill except the maturity can be up to 30 years a. ...

P(D, S 0 ) - Department of Computer Science

... If I and J are connected by multiple paths, pick the sign implied by the dominant path Use greedy hillclimbing with scoring function ...

... If I and J are connected by multiple paths, pick the sign implied by the dominant path Use greedy hillclimbing with scoring function ...

IT4105-Part1

... If he/she uses three (03) stacks and a variable to perform the above addition, what would be the top element in the resulting stack at each intermediate step during the addition? Hint : When performing the addition, a variable has to be used to store the tenth’s position value and one’s position val ...

... If he/she uses three (03) stacks and a variable to perform the above addition, what would be the top element in the resulting stack at each intermediate step during the addition? Hint : When performing the addition, a variable has to be used to store the tenth’s position value and one’s position val ...

Abbott Laboratories (NYSE: ABT) Executive Summary and

... company operates in five key divisions – proprietary pharmaceuticals, nutritional products, established pharmaceuticals, diagnostic products, and vascular products. However, in January 2013, Abbott will spin off its proprietary pharmaceutical division, which accounts for about 44% of 2011 revenue, i ...

... company operates in five key divisions – proprietary pharmaceuticals, nutritional products, established pharmaceuticals, diagnostic products, and vascular products. However, in January 2013, Abbott will spin off its proprietary pharmaceutical division, which accounts for about 44% of 2011 revenue, i ...

- 8Semester

... Properties of B-Tree 1) All leaves are at same level. 2) A B-Tree is defined by the term minimum degree ‘t’. The value of t depends upon disk block ...

... Properties of B-Tree 1) All leaves are at same level. 2) A B-Tree is defined by the term minimum degree ‘t’. The value of t depends upon disk block ...

Interest rate

... MATURITY RISK PREMIUM (MRP): Compensation expected by investors due to interest rate risk on debt instruments with longer maturities LIQUIDITY PREMIUM (LP): Compensation for securities that cannot easily be converted to cash ...

... MATURITY RISK PREMIUM (MRP): Compensation expected by investors due to interest rate risk on debt instruments with longer maturities LIQUIDITY PREMIUM (LP): Compensation for securities that cannot easily be converted to cash ...

ppt presentation

... Then after the call to BALANCE(x), all nodes in T that actively participated (the squares from the last figure) in the rebalancing will be ...

... Then after the call to BALANCE(x), all nodes in T that actively participated (the squares from the last figure) in the rebalancing will be ...

Weekly Commentary 04-17-17

... of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. * Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to ...

... of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. * Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to ...

ppt

... Splay Trees “blind” rebalancing – no height info kept • amortized time for all operations is O(log n) • worst case time is O(n) • insert/find always rotates node to the root! – Good locality – most common keys move high in tree ...

... Splay Trees “blind” rebalancing – no height info kept • amortized time for all operations is O(log n) • worst case time is O(n) • insert/find always rotates node to the root! – Good locality – most common keys move high in tree ...

Capital Markets Update

... – Market is pricing in two Fed hikes for 2017, however Fed commentary has indicated a potential for three – 1-month LIBOR moved 0.35% higher in 2016 ...

... – Market is pricing in two Fed hikes for 2017, however Fed commentary has indicated a potential for three – 1-month LIBOR moved 0.35% higher in 2016 ...

Grades 7-8 Mathematics Training Test Answer Key

... Option A is incorrect because the common factor of both terms is not 2 and the expression is not factored correctly. Option B is correct because the common factor of both terms in the expression is 3 and the expression is correctly factored. Option C is incorrect because the constant term and the co ...

... Option A is incorrect because the common factor of both terms is not 2 and the expression is not factored correctly. Option B is correct because the common factor of both terms in the expression is 3 and the expression is correctly factored. Option C is incorrect because the constant term and the co ...

Dictionary / Dynamic Set Operations

... parents child pointer. Case (b), where a node has one chld, the doomed node can just be cut out. Case (c), relabel the node as its successor (which has at most one child when z has two children!) and delete the successor! ...

... parents child pointer. Case (b), where a node has one chld, the doomed node can just be cut out. Case (c), relabel the node as its successor (which has at most one child when z has two children!) and delete the successor! ...

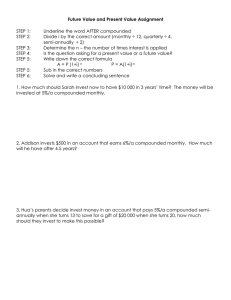

Future Value and Present Value Assignment

... Underline the word AFTER compounded Divide i by the correct amount (monthly ÷ 12, quarterly ÷ 4, semi-annually ÷ 2) Determine the n – the number of times interest is applied Is the question asking for a present value or a future value? Write down the correct formula A = P (1+i) n P = A(1+i)-n Sub in ...

... Underline the word AFTER compounded Divide i by the correct amount (monthly ÷ 12, quarterly ÷ 4, semi-annually ÷ 2) Determine the n – the number of times interest is applied Is the question asking for a present value or a future value? Write down the correct formula A = P (1+i) n P = A(1+i)-n Sub in ...

Lecture of Week 4

... • Possible implementation: a trie tree node structure contains an array of N links to child nodes (a link to a child node can be also nil) and a link to the current strings value (it can be also nil). ...

... • Possible implementation: a trie tree node structure contains an array of N links to child nodes (a link to a child node can be also nil) and a link to the current strings value (it can be also nil). ...

Lecture 15 Trees

... Tree Terminology (Depth of a node) • The depth of a node v in T is the number of ancestors of v, excluding v itself. ...

... Tree Terminology (Depth of a node) • The depth of a node v in T is the number of ancestors of v, excluding v itself. ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.