Credit Risk: Individual Loan Risk Chapter 11

... • May be generalized to loans with any maturity or to adjust for varying default recovery rates. • The loan can be assessed using the inferred probabilities from comparable quality bonds. Irwin/McGraw-Hill ...

... • May be generalized to loans with any maturity or to adjust for varying default recovery rates. • The loan can be assessed using the inferred probabilities from comparable quality bonds. Irwin/McGraw-Hill ...

Key

... Search your java source files for the string LLNode ___grep LLNode *.java____________ You want to create an alias for a complex command. You store the alias command in the file__.bashrc__ To activate the changes in the file above, __source .bashrc_______ To run the java program bigoutput and control ...

... Search your java source files for the string LLNode ___grep LLNode *.java____________ You want to create an alias for a complex command. You store the alias command in the file__.bashrc__ To activate the changes in the file above, __source .bashrc_______ To run the java program bigoutput and control ...

CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

... compares the first two elements, and if the first is greater than the second, then it swaps them. It continues doing this for each pair of adjacent elements to the end of the data set. It then starts again with the first two elements, repeating until no swaps have occurred on the last pass. This al ...

... compares the first two elements, and if the first is greater than the second, then it swaps them. It continues doing this for each pair of adjacent elements to the end of the data set. It then starts again with the first two elements, repeating until no swaps have occurred on the last pass. This al ...

The Greek Letters

... An extra 0.05 x 2,000 = 100 shares would then have to be purchased to maintain the hedge. A procedure such as this, where the hedge is adjusted on a regular basis, is referred to as dynamic hedging. It can be contrasted with static hedging, where a hedge is set up initially and never adjusted. Stati ...

... An extra 0.05 x 2,000 = 100 shares would then have to be purchased to maintain the hedge. A procedure such as this, where the hedge is adjusted on a regular basis, is referred to as dynamic hedging. It can be contrasted with static hedging, where a hedge is set up initially and never adjusted. Stati ...

Applications of Trees

... • Driving in Los Angeles, NY, or Boston for that matter • Playing cards • Invest on stocks • Choose a university ...

... • Driving in Los Angeles, NY, or Boston for that matter • Playing cards • Invest on stocks • Choose a university ...

U.S. Government and Federal Agency Securities

... pre-determined price. At issuance, the issuer states the amount of time from inception during which the bond cannot be called (the lockout period) ...

... pre-determined price. At issuance, the issuer states the amount of time from inception during which the bond cannot be called (the lockout period) ...

Trees - Carnegie Mellon School of Computer Science

... · Initialize randomly · converges to local maximum of the likelihood ...

... · Initialize randomly · converges to local maximum of the likelihood ...

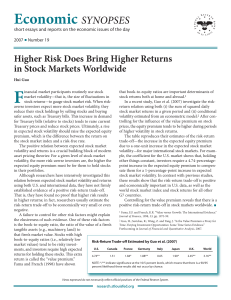

Higher Risk Does Bring Higher Returns in Stock Markets Worldwide

... inancial market participants routinely use stock that book-to-equity ratios are important determinants of market volatility—that is, the size of fluctuations in stock returns both at home and abroad.1 In a recent study, Guo et al. (2007) investigate the riskstock returns—to gauge stock market risk. ...

... inancial market participants routinely use stock that book-to-equity ratios are important determinants of market volatility—that is, the size of fluctuations in stock returns both at home and abroad.1 In a recent study, Guo et al. (2007) investigate the riskstock returns—to gauge stock market risk. ...

Chapter12

... – For complete binary tree with n nodes: worst case θ(lg n). – For linear chain of n nodes: worst case θ(n). – Different types of search trees include binary search trees, red-black trees (covered in Chapter 13), and B-trees (covered in Chapter 18). ...

... – For complete binary tree with n nodes: worst case θ(lg n). – For linear chain of n nodes: worst case θ(n). – Different types of search trees include binary search trees, red-black trees (covered in Chapter 13), and B-trees (covered in Chapter 18). ...

Lecture 8 1 Overview 2 Motivation for Binary Search Trees

... The merge operation is the inverse of split and can occur when deleting a key from the tree. If we delete a key from a node with minimum keys (1 for a (2,3) tree), we merge the node with its neighbor to create a node with more keys. We can then delete the key from this new node. For the case of (2,3 ...

... The merge operation is the inverse of split and can occur when deleting a key from the tree. If we delete a key from a node with minimum keys (1 for a (2,3) tree), we merge the node with its neighbor to create a node with more keys. We can then delete the key from this new node. For the case of (2,3 ...

Reducing US Stocks to Bring Balanced Portfolios Closer to Long

... Duration is a measure of the sensitivity of the price of a fixed income investment to a change in interest rates. Duration is expressed as a number of years. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. In a rising interest rate environment, ...

... Duration is a measure of the sensitivity of the price of a fixed income investment to a change in interest rates. Duration is expressed as a number of years. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. In a rising interest rate environment, ...

ch05s3

... Decision trees can also model algorithms that sort a list of items by a sequence of comparisons between two items from the list. The internal nodes of such a decision tree are labeled L[i]:L[j ] to indicate a comparison of list item i to list item j. The outcome of such a comparison is either L[i] < ...

... Decision trees can also model algorithms that sort a list of items by a sequence of comparisons between two items from the list. The internal nodes of such a decision tree are labeled L[i]:L[j ] to indicate a comparison of list item i to list item j. The outcome of such a comparison is either L[i] < ...

Proofs, Recursion and Analysis of Algorithms

... Decision trees can also model algorithms that sort a list of items by a sequence of comparisons between two items from the list. The internal nodes of such a decision tree are labeled L[i]:L[j ] to indicate a comparison of list item i to list item j. The outcome of such a comparison is either L[i] < ...

... Decision trees can also model algorithms that sort a list of items by a sequence of comparisons between two items from the list. The internal nodes of such a decision tree are labeled L[i]:L[j ] to indicate a comparison of list item i to list item j. The outcome of such a comparison is either L[i] < ...

Lists and Trees (continued)

... Lists and Trees (continued) CS-2301 System Programming D-term 2009 (Slides include materials from The C Programming Language, 2nd edition, by Kernighan and Ritchie and from C: How to Program, 5th and 6th editions, by Deitel and Deitel) ...

... Lists and Trees (continued) CS-2301 System Programming D-term 2009 (Slides include materials from The C Programming Language, 2nd edition, by Kernighan and Ritchie and from C: How to Program, 5th and 6th editions, by Deitel and Deitel) ...

The Term Structure of Interest Rates

... Preferred Habitat Theory Combines expectation and segmentation theory Investors have preferred maturities Borrowers and lenders move within their habitats based on their expectations Borrowers and lenders can be induced to shift maturities with appropriate risk premium compensation Shape o ...

... Preferred Habitat Theory Combines expectation and segmentation theory Investors have preferred maturities Borrowers and lenders move within their habitats based on their expectations Borrowers and lenders can be induced to shift maturities with appropriate risk premium compensation Shape o ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.