Strong Demand for Muni Bonds Yields Pros, Cons

... The fixed income securities are subject to price volatility and a number of risks, including interest rate risk. Interest rates and bond prices move in opposite directions so that as interest rates rise, bond prices usually fall and vice versa. Interest rates are currently at historically low levels ...

... The fixed income securities are subject to price volatility and a number of risks, including interest rate risk. Interest rates and bond prices move in opposite directions so that as interest rates rise, bond prices usually fall and vice versa. Interest rates are currently at historically low levels ...

5-7 Reteaching answers

... What is the expansion of (3x 1 2)3 ? Use the Binomial Theorem. Step 1 Determine a, b, and n. a 5 3x, b 5 2, n 5 3 Step 2 Use the formula to write the equation. (3x 1 2)3 5 3C0(3x)3 1 3C1(3x)2(2) 1 3C2(3x)(2)2 1 3C3(2)3 Step 3 Simplify. 5 1(27x3) 1 3(9x2)(2) 1 3(3x)(4) 2 1(8) 5 27x3 1 54x2 1 36x 1 8 ...

... What is the expansion of (3x 1 2)3 ? Use the Binomial Theorem. Step 1 Determine a, b, and n. a 5 3x, b 5 2, n 5 3 Step 2 Use the formula to write the equation. (3x 1 2)3 5 3C0(3x)3 1 3C1(3x)2(2) 1 3C2(3x)(2)2 1 3C3(2)3 Step 3 Simplify. 5 1(27x3) 1 3(9x2)(2) 1 3(3x)(4) 2 1(8) 5 27x3 1 54x2 1 36x 1 8 ...

Essentials of Finance

... An increase in interest rates will cause the price of an outstanding bond to fall. A decrease in interest rates will cause the price to rise. The market value of a bond will always approach its par value as its maturity date approaches, provided the firm does not go bankrupt. ...

... An increase in interest rates will cause the price of an outstanding bond to fall. A decrease in interest rates will cause the price to rise. The market value of a bond will always approach its par value as its maturity date approaches, provided the firm does not go bankrupt. ...

Discussion of “Could capital gains smooth a current account

... US Real Effective Exchange Rate and Current Account ...

... US Real Effective Exchange Rate and Current Account ...

Bond Strategies for Rising Rate Environments

... investors should shorten maturity, and thereby reduce duration (the price sensitivity of a bond— longer duration means the price fluctuates more as the yield moves up and down). By reducing maturity, the thinking goes, investors avoid large potential price shocks in their bond portfolio. In today's ...

... investors should shorten maturity, and thereby reduce duration (the price sensitivity of a bond— longer duration means the price fluctuates more as the yield moves up and down). By reducing maturity, the thinking goes, investors avoid large potential price shocks in their bond portfolio. In today's ...

NBER WORKING PAPER SERIES PANELS Torben G. Andersen

... over the estimation period using the parametric option pricing model. The second piece of the objective function penalizes estimates depending on how much the option-implied volatility state deviates from a local nonparametric estimate of spot volatility constructed from high-frequency data on the ...

... over the estimation period using the parametric option pricing model. The second piece of the objective function penalizes estimates depending on how much the option-implied volatility state deviates from a local nonparametric estimate of spot volatility constructed from high-frequency data on the ...

Review Questions: Trees

... root-to-leaf paths. So for example, the following tree has exactly four root-to-leaf paths: ...

... root-to-leaf paths. So for example, the following tree has exactly four root-to-leaf paths: ...

cs2110-15-trees

... Binary Search Trees • Associated with each node is a key value that can be compared. • Binary search tree property: – every node in the left subtree has key whose value is less than the value of the root’s key value, and – every node in the right subtree has ...

... Binary Search Trees • Associated with each node is a key value that can be compared. • Binary search tree property: – every node in the left subtree has key whose value is less than the value of the root’s key value, and – every node in the right subtree has ...

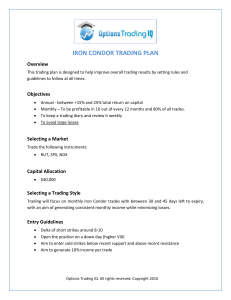

a sample iron condor trading plan here

... with an aim of generating consistent monthly income while minimizing losses. ...

... with an aim of generating consistent monthly income while minimizing losses. ...

Morgan Stanley Newsletter

... International investing entails greater risk, as well as greater potential rewards compared to U.S. investing. These risks include political and economic uncertainties of foreign countries as well as the risk of currency fluctuations. These risks are magnified in countries with emerging markets, sin ...

... International investing entails greater risk, as well as greater potential rewards compared to U.S. investing. These risks include political and economic uncertainties of foreign countries as well as the risk of currency fluctuations. These risks are magnified in countries with emerging markets, sin ...

1 , 2

... derivative security is the conditional expectation of its terminal value under the risk-neutral probability measure. ...

... derivative security is the conditional expectation of its terminal value under the risk-neutral probability measure. ...

Econ 161A: Money and Banking Spring 2017: Jenkins Exam 1

... 7. (a) Income earned from muni bonds is not subject to federal income tax while income earned on US Treasury bonds is subject to federal income tax. (b) Most likely, the rising risk premium on muni bonds reflects the perception that state/local governments have been becoming more likely to default ...

... 7. (a) Income earned from muni bonds is not subject to federal income tax while income earned on US Treasury bonds is subject to federal income tax. (b) Most likely, the rising risk premium on muni bonds reflects the perception that state/local governments have been becoming more likely to default ...

Chapter 17

... Example: hedging a currency option on £ requires a short position in £458,000. If r=10% and rf = 13%, how many 9-month futures contracts on £ would achieve the same objective? ...

... Example: hedging a currency option on £ requires a short position in £458,000. If r=10% and rf = 13%, how many 9-month futures contracts on £ would achieve the same objective? ...

Rate Hike Probability

... Market Committee (FOMC) meetings. The tool then calculates the likelihood of where the target Fed Funds rate might be by the end of the month during which a meeting is held. In other words, it assigns probabilities, derived from the market’s expectations, to the policy rate set by the FOMC. Every ti ...

... Market Committee (FOMC) meetings. The tool then calculates the likelihood of where the target Fed Funds rate might be by the end of the month during which a meeting is held. In other words, it assigns probabilities, derived from the market’s expectations, to the policy rate set by the FOMC. Every ti ...

The Greek Letters

... value of a derivatives portfolio with respect to volatility • See Figure 15.11 for the variation of n with respect to the stock price for a call or put option ...

... value of a derivatives portfolio with respect to volatility • See Figure 15.11 for the variation of n with respect to the stock price for a call or put option ...

Trees

... int result = 1; // count the root. while (enum.hasMoreElement()) { result += size((TreeNode) enum.nextElement()); ...

... int result = 1; // count the root. while (enum.hasMoreElement()) { result += size((TreeNode) enum.nextElement()); ...

Lattice model (finance)

For other meanings, see lattice model (disambiguation)In finance, a lattice model [1] is a technique applied to the valuation of derivatives, where, because of path dependence in the payoff, 1) a discretized model is required and 2) Monte Carlo methods fail to account for optimal decisions to terminate the derivative by early exercise. For equity options, a typical example would be pricing an American option, where a decision as to option exercise is required at ""all"" times (any time) before and including maturity. A continuous model, on the other hand, such as Black Scholes, would only allow for the valuation of European options, where exercise is on the option's maturity date. For interest rate derivatives lattices are additionally useful in that they address many of the issues encountered with continuous models, such as pull to par.