* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Management`s primary goal is to maximize stockholder

Survey

Document related concepts

Securitization wikipedia , lookup

Yield spread premium wikipedia , lookup

Present value wikipedia , lookup

Interest rate swap wikipedia , lookup

Quantitative easing wikipedia , lookup

Credit card interest wikipedia , lookup

History of the Federal Reserve System wikipedia , lookup

Monetary policy wikipedia , lookup

Stagflation wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Inflation targeting wikipedia , lookup

Interbank lending market wikipedia , lookup

United States Treasury security wikipedia , lookup

Transcript

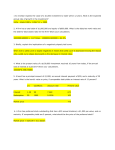

Yield curves and interest rates – St. Louis Federal Reserve website The yield curve is a graph of the term structure of interest rates, which is the relationship of yield and maturity for securities of similar risk. When we think of the yield curve we typically think of the Treasury yield curve, as found each day in financial publications like the Wall Street Journal. The yield curve’s shape and level changes due to a variety of monetary, economic, and political factors. The Federal Reserve Bank of St. Louis website (http://www.stls.frb.org) is a useful site for obtaining actual economic and monetary data. To access information from the Federal Reserve, you will be using FRED (the Federal Reserve Economic Database). From this web page, click on the link to FRED II (Federal Reserve Economic Data), and then select “Interest Rates” from the list of database categories. On this page and those that follow, you will find links to all of the information needed for this cyberproblem. Upon finding the appropriate interest rate series, click on “View Data” to find the value in a particular month. a. Construct four distinct Treasury yield curves using monthly interest rate data for February of the years 1982, 1988, 1993, and 1998. Use the Constant Maturity Interest rates for maturities of 3-months, 6months, 1-year, 5-years, 10-years, and 30-years. For this problem, we will access the Constant Maturity Rates for each of the given maturities and pull data from the database that corresponds with our scope of data. We will be concerning ourselves with only rates from February 1982, 1988, 1993, and 1998. The results of that search yield the following data set: Security Maturity 3-month T-bill 6-month T-bill 1-year T-bill 5-year Tbond/note 10-year Tbond/note 30-year Tbond/note February 1982 14.28 14.81 14.73 February 1988 5.84 6.21 6.64 February 1993 2.99 3.16 3.39 February 1998 5.23 5.27 5.31 14.54 7.71 5.43 5.49 14.43 8.21 6.26 5.57 14.22 8.43 7.09 5.89 1 b. Examine the yield curves you have constructed. Knowing what the components of the 3-month Treasury bill are, what could explain the large variation in the 3-month risk-free rate over the different time periods? We know that rRF,T-bill = r* + IP; the 3-month risk-free rate is composed of a real rate of return and an inflation premium. The real rate of return does change, but usually not much and not rapidly. The dramatic change in rRF over these different time periods can be attributed to changes in investors' inflation expectations. Investors require compensation for higher expected inflation in the form of a higher interest rate. Thus, when expectations of the rate of future inflation change, we see changes in the risk-free rate. c. (a) Contrast the slopes of the February 1982 yield curve with that of February 1993. What do we call a yield curve that possesses the shape of the 1982 yield curve? (b) Why might the 1982 yield curve be downward sloping? What does this indicate? (c) What does the 1993 yield curve say about long-term versus short-term interest rates? The February 1982 yield curve is inverted or "abnormal". It has a slight downward slope indicating that long-term interest rates were slightly lower than short term interest rates at that point in time. One interpretation based on Expectations theory is that investors and market participants expected lower inflation in the future and thus required a lower long-term inflation premium (IP) than short-term inflation premium. The view that long-term securities are riskier than short-term 2 securities is consistent with the Liquidity Preference theory. We then expect long-term rates to normally be higher than short-term rates. This normal relationship may have been at least temporarily displaced and lenders did not require a larger risk premium for lending long-term as opposed to short-term. d. Contrast the yield curves of 1993 and 1998. Notice that the 1998 yield curve is almost flat, it has very little slope, while the 1993 yield curve has a very steep slope. What could account for this difference in slopes? Once again, expectations theory and liquidity preference theory could be used to help explain the difference. This answer focuses on expectations theory. In 1993, short-term interest rates declined to levels not seen in decades, possibly indicating very low expected short-term inflation. While actual inflation had dropped significantly, perhaps investors believed that low inflation was not likely to persist for long and thus rates for Treasury maturities five years and beyond were much higher. In February 1998 long-term rates had declined 120 basis points (1.20%) but short-term rates had risen by over 200 basis points (despite low inflation). A "flat" yield curve, where short-term rates are similar to long-term rates, is often associated with the peak of a business cycle. One could argue that investors were more confident that a low inflation environment would persist for awhile but that conditions in the short-term market were markedly different than they were in February 1993. 3