Measuring CRI`s Impact on Performance

... violate the core values of our participants. For example, as of March 31, 2013, 33 companies (about 12% of the S&P 500’s total capitalization) were restricted from the CUIT Core Equity Fund, an S&P 500 index tracking portfolio. We develop our screening criteria by examining Church teaching (includin ...

... violate the core values of our participants. For example, as of March 31, 2013, 33 companies (about 12% of the S&P 500’s total capitalization) were restricted from the CUIT Core Equity Fund, an S&P 500 index tracking portfolio. We develop our screening criteria by examining Church teaching (includin ...

Document

... Financial Markets and Economy Corporate Governance and Ethics: Fin. Markets play an imp. Role in facilitating excess funds to their most productive uses. In order to provide this effectively, there must be enough transpapency for investors to make well-informed decisions. Firms must not mislead pub ...

... Financial Markets and Economy Corporate Governance and Ethics: Fin. Markets play an imp. Role in facilitating excess funds to their most productive uses. In order to provide this effectively, there must be enough transpapency for investors to make well-informed decisions. Firms must not mislead pub ...

SIS Performance versus Benchmark to 31 March 2016

... The Federal Reserve (Fed) put any further increase in US interest rates on hold, after fears of a slowdown in China and collapsing oil prices which hit record lows. Security was also a concern for European markets in the wake of the Brussels terrorist attacks in March. In addition, the European Cent ...

... The Federal Reserve (Fed) put any further increase in US interest rates on hold, after fears of a slowdown in China and collapsing oil prices which hit record lows. Security was also a concern for European markets in the wake of the Brussels terrorist attacks in March. In addition, the European Cent ...

Fact Sheet - Columbia Management

... expenses and the reinvestment of dividends and capital gains distributions. The highest (most favorable) percentile rank is 1 and the lowest (least favorable) percentile rank is 100. Share class rankings vary due to different expenses. If sales charges or redemption fees were included, total returns ...

... expenses and the reinvestment of dividends and capital gains distributions. The highest (most favorable) percentile rank is 1 and the lowest (least favorable) percentile rank is 100. Share class rankings vary due to different expenses. If sales charges or redemption fees were included, total returns ...

Portfolio1 - people.bath.ac.uk

... – Investors, in aggregate, own the entire market, so they cannot outperform it. Active strategies underperform due to fees. – Performance is unpredictable. Fund managers’ performance is hardly persistent. Mimicking the strategies of the top performers does not generate abnormal returns. Moreover, th ...

... – Investors, in aggregate, own the entire market, so they cannot outperform it. Active strategies underperform due to fees. – Performance is unpredictable. Fund managers’ performance is hardly persistent. Mimicking the strategies of the top performers does not generate abnormal returns. Moreover, th ...

FCA bans the promotion of UCIS and close substitutes to ordinary

... potential for detriment. Under the new rules, promotions of UCIS and other NMPIs in the retail market will generally be restricted to sophisticated investors and high net worth individuals (generally retail clients with an annual income of more than £100,000 or investable net assets of more than £25 ...

... potential for detriment. Under the new rules, promotions of UCIS and other NMPIs in the retail market will generally be restricted to sophisticated investors and high net worth individuals (generally retail clients with an annual income of more than £100,000 or investable net assets of more than £25 ...

objective straightforward communications built for

... Dodge Plaza, First Floor Omaha, NE 68154 toll free 888.321.0808 fax 402.330.1668 ...

... Dodge Plaza, First Floor Omaha, NE 68154 toll free 888.321.0808 fax 402.330.1668 ...

Compensation Structure Response

... Brandes views compensation differently than many others asset managers do. Since our goal is to incentivize Analysts to produce consistent high-quality company research that is unbiased and objective, compensation is not tied directly to asset levels or the number of covered companies in the portfol ...

... Brandes views compensation differently than many others asset managers do. Since our goal is to incentivize Analysts to produce consistent high-quality company research that is unbiased and objective, compensation is not tied directly to asset levels or the number of covered companies in the portfol ...

Fig. 1: Annual* Inflation and Depreciation in Israel, 1958

... Public, Excl. Common Stock (percent) Unindexed ...

... Public, Excl. Common Stock (percent) Unindexed ...

executive assistant/hospitality coordinator

... organizational, administrative, communication and scheduling skills. This person will represent Trinity Capital Management in a personable manner by demonstrating flexibility, resourcefulness and a professional attitude. ...

... organizational, administrative, communication and scheduling skills. This person will represent Trinity Capital Management in a personable manner by demonstrating flexibility, resourcefulness and a professional attitude. ...

Real vs Financial Assets

... Long-term securities such as U.S. Treasury bonds, bonds issued by state, federal, or local municipalities, and corporations. Equity securities – Unlike debt, equity holders are not promised an income stream in exchange for an ownership share of the corporation. They receive any dividends and the p ...

... Long-term securities such as U.S. Treasury bonds, bonds issued by state, federal, or local municipalities, and corporations. Equity securities – Unlike debt, equity holders are not promised an income stream in exchange for an ownership share of the corporation. They receive any dividends and the p ...

minutes - San Antonio Fire and Police Pension Fund

... capitalized (small cap) stocks. As of fiscal-year first quarter end (FYQ1-07), SAFP had 13.15% in small cap stock with a target rate of 13.00%. The asset class has a range of 818%. Given present market valuations, CSG preferred reallocating to an all-cap manager which could seek out the best invest ...

... capitalized (small cap) stocks. As of fiscal-year first quarter end (FYQ1-07), SAFP had 13.15% in small cap stock with a target rate of 13.00%. The asset class has a range of 818%. Given present market valuations, CSG preferred reallocating to an all-cap manager which could seek out the best invest ...

American Private Enterprise System College of Agriculture, Food and Environment

... Stock Market “Hub of the Investment World” More than 40 Million individuals own shares in the U.S. corporations (valued at $1 Trillion) Stocks can provide: Dividend- profits a firm distributes to its shareholders Capital gain- investor reaps when a stock is sold for more than the original P ...

... Stock Market “Hub of the Investment World” More than 40 Million individuals own shares in the U.S. corporations (valued at $1 Trillion) Stocks can provide: Dividend- profits a firm distributes to its shareholders Capital gain- investor reaps when a stock is sold for more than the original P ...

statement of investment policy

... A. Safety: Safety of principal is the foremost objective of the investment program. Investments of the Corning Healthcare District shall be undertaken in a manner that seeks to ensure the preservation of capital in the overall portfolio. B. Liquidity: An adequate percentage of the portfolio will be ...

... A. Safety: Safety of principal is the foremost objective of the investment program. Investments of the Corning Healthcare District shall be undertaken in a manner that seeks to ensure the preservation of capital in the overall portfolio. B. Liquidity: An adequate percentage of the portfolio will be ...

Exam review solutions ch-1

... c) The regular payment investment is worth about $5000. The single payment investment has doubled to $7200, so it is worth more. 2. a) He would need 9.607… or 9.61% annual interest compounded every 2 weeks. b) i) $66.51 ii) $812.22 c) It would take 10.4 years, or 10 years 21 weeks, for $3000 to grow ...

... c) The regular payment investment is worth about $5000. The single payment investment has doubled to $7200, so it is worth more. 2. a) He would need 9.607… or 9.61% annual interest compounded every 2 weeks. b) i) $66.51 ii) $812.22 c) It would take 10.4 years, or 10 years 21 weeks, for $3000 to grow ...

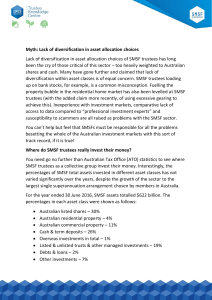

Myth: Lack of diversification in asset allocation

... You can’t help but feel that SMSFs must be responsible for all the problems besetting the whole of the Australian investment markets with this sort of track record, if it is true! Where do SMSF trustees really invest their money? You need go no further than Australian Tax Office (ATO) statistics to ...

... You can’t help but feel that SMSFs must be responsible for all the problems besetting the whole of the Australian investment markets with this sort of track record, if it is true! Where do SMSF trustees really invest their money? You need go no further than Australian Tax Office (ATO) statistics to ...

FUND FACTSHEET – JULY 2016 RHB DANA HAZEEM (formerly

... Domestically, the second quarter GDP growth was at 4.0% driven by domestic demands. The growth was in line with expectations, within the official growth trajectory of 4.0%-4.5%. The overall economic growth remains resilient, with proactive measures taken by the central bank and government to support ...

... Domestically, the second quarter GDP growth was at 4.0% driven by domestic demands. The growth was in line with expectations, within the official growth trajectory of 4.0%-4.5%. The overall economic growth remains resilient, with proactive measures taken by the central bank and government to support ...

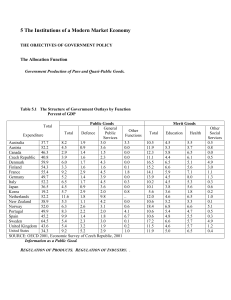

In chapter 1 we discussed in broad outline some of the institutions

... The United States has traditionally seen itself as a strong advocate of free trade and it has been, to a large degree, responsible for pushing international trade liberalization agreements since World War II. Most economists believe that free trade enhances both world welfare and the aggregate welfa ...

... The United States has traditionally seen itself as a strong advocate of free trade and it has been, to a large degree, responsible for pushing international trade liberalization agreements since World War II. Most economists believe that free trade enhances both world welfare and the aggregate welfa ...

CC Marsico Global Fund APIR CHN0002AU

... show revenue growth contributions from market share gains, rather than dependence on the macroeconomic environment. In a slow global growth environment, these stocks should outperform as investors seek out secular growth companies that can grow revenues. We tend to invest in companies that have stro ...

... show revenue growth contributions from market share gains, rather than dependence on the macroeconomic environment. In a slow global growth environment, these stocks should outperform as investors seek out secular growth companies that can grow revenues. We tend to invest in companies that have stro ...

Local Leaders in South East Europe: Lead for Change – LL SEE

... A comprehensive needs assessment determined the capacity development needs of SEE leaders and managers in the water sector: − Overarching priority area: Better organisation of water supply and waste water services − Specific priority area: Better project management & change management skills impro ...

... A comprehensive needs assessment determined the capacity development needs of SEE leaders and managers in the water sector: − Overarching priority area: Better organisation of water supply and waste water services − Specific priority area: Better project management & change management skills impro ...

Quarter Review Outlook Cash and Fixed Interest

... This market report has been prepared by Virgin Money Financial Services Pty Ltd ABN 51 113 285 395 AFSL 286869 (VMFS) for The Trust Company (Superannuation) Limited ABN 49 006 421 638 AFSL 235153 RSE L0000635 as Trustee for Virgin Superannuation ABN 88 436 608 094. This information is current as at ...

... This market report has been prepared by Virgin Money Financial Services Pty Ltd ABN 51 113 285 395 AFSL 286869 (VMFS) for The Trust Company (Superannuation) Limited ABN 49 006 421 638 AFSL 235153 RSE L0000635 as Trustee for Virgin Superannuation ABN 88 436 608 094. This information is current as at ...

Investment Update February 2011

... The information and opinions contained in this presentation have been obtained from sources of Elstree Investment Management Limited (ABN 20 079 036 810) believed to be reliable, but no representation or warranty, express or implied, is made that such information is accurate or complete and it shoul ...

... The information and opinions contained in this presentation have been obtained from sources of Elstree Investment Management Limited (ABN 20 079 036 810) believed to be reliable, but no representation or warranty, express or implied, is made that such information is accurate or complete and it shoul ...

Government Obligations Fund (TR Shares)

... of their fees or reimbursed the fund for certain operating expenses. These voluntary waivers and reimbursements may be modified or terminated at any time; accordingly, the fund’s expenses may vary (i.e., increase or decrease) during the fund’s fiscal year. These waivers increase income to the fund a ...

... of their fees or reimbursed the fund for certain operating expenses. These voluntary waivers and reimbursements may be modified or terminated at any time; accordingly, the fund’s expenses may vary (i.e., increase or decrease) during the fund’s fiscal year. These waivers increase income to the fund a ...

Large Cap Sustainable Growth Fact Sheet

... in commodity prices, they have not yet returned to a level that would stimulate demand for Schlumberger’s deep water drilling services and equipment sales. ...

... in commodity prices, they have not yet returned to a level that would stimulate demand for Schlumberger’s deep water drilling services and equipment sales. ...