Investment Strategy Net Monthly Returns (1)

... (2) The HFRX Equity Market Neutral Index ("HFRX EMN") is a leading market index prepared by Hedge Fund Research (HFR). This index is designed to be representative of the segment of the hedge fund universe representing equity market neutral investment strategies seeking to generate consistent returns ...

... (2) The HFRX Equity Market Neutral Index ("HFRX EMN") is a leading market index prepared by Hedge Fund Research (HFR). This index is designed to be representative of the segment of the hedge fund universe representing equity market neutral investment strategies seeking to generate consistent returns ...

Will Brexit spark a much-needed market revaluation?

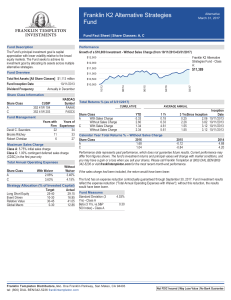

... You should consider the Fund's investment objectives, risks, and charges and expenses carefully before you invest. The Prospectus details the Fund's objective and policies and other matters of interest to the prospective investor. Please read this Prospectus carefully before investing. The Prospectu ...

... You should consider the Fund's investment objectives, risks, and charges and expenses carefully before you invest. The Prospectus details the Fund's objective and policies and other matters of interest to the prospective investor. Please read this Prospectus carefully before investing. The Prospectu ...

The RAM Opportunistic Value Portfolio

... We believe that including the Roumell Opportunistic Value Strategy will benefit overall portfolios in the following ways: Return Pattern Diversifier: Our strategy is a non-traditional, multi-asset portfolio combining liquid & illiquid securities and cash in a single account. Thus, offering a return ...

... We believe that including the Roumell Opportunistic Value Strategy will benefit overall portfolios in the following ways: Return Pattern Diversifier: Our strategy is a non-traditional, multi-asset portfolio combining liquid & illiquid securities and cash in a single account. Thus, offering a return ...

Mutual Funds May 2012

... For much more detail on IRAs: FPW website: www.usu.edu/fpw click on: “past presentations” IRAs March 2006 IRAs convert to Roth Nov. 2009 ...

... For much more detail on IRAs: FPW website: www.usu.edu/fpw click on: “past presentations” IRAs March 2006 IRAs convert to Roth Nov. 2009 ...

2050 Retirement Strategy Fund

... Third-party, trademarks and service marks belong to their respective owners. AllianceBernstein provided the information on its custom benchmark. ...

... Third-party, trademarks and service marks belong to their respective owners. AllianceBernstein provided the information on its custom benchmark. ...

Key Investor Information Franklin Global Aggregate Investment

... investment team. The Fund aims to maximise investment return over the medium to long term through a combination of income, capital appreciation and currency gains while approximating the benchmark (Bloomberg Barclays Global Aggregate Index) risk. The Fund invests in a large number of small, low-corr ...

... investment team. The Fund aims to maximise investment return over the medium to long term through a combination of income, capital appreciation and currency gains while approximating the benchmark (Bloomberg Barclays Global Aggregate Index) risk. The Fund invests in a large number of small, low-corr ...

Q1: What is your reading of the state of Indian economy

... Mr. Aniket Inamdar is the Senior Fund Manager, Equities with Deutsche Mutual Fund and is currently managing two schemes namely DWS Investment Opportunities and DWS Alpha Equity. He has joined the AMC as recently as in May 2007 and the sudden turnaround in the returns of the schemes managed by him is ...

... Mr. Aniket Inamdar is the Senior Fund Manager, Equities with Deutsche Mutual Fund and is currently managing two schemes namely DWS Investment Opportunities and DWS Alpha Equity. He has joined the AMC as recently as in May 2007 and the sudden turnaround in the returns of the schemes managed by him is ...

Callable Class, Series 2: Payout Scenarios #3

... “Nesbitt Burns” is a registered trademark of BMO Nesbitt Burns Corporation Limited used under license. ...

... “Nesbitt Burns” is a registered trademark of BMO Nesbitt Burns Corporation Limited used under license. ...

l+m development and nelson management acquire 257

... residents. One of Nelson Management’s core missions is to practice environmentally conscientious ownership, by increasing energy-efficiency, decreasing the carbon footprint of properties and forging a more sustainable future for all New Yorkers. For more information, please visit www.nelsonmanagemen ...

... residents. One of Nelson Management’s core missions is to practice environmentally conscientious ownership, by increasing energy-efficiency, decreasing the carbon footprint of properties and forging a more sustainable future for all New Yorkers. For more information, please visit www.nelsonmanagemen ...

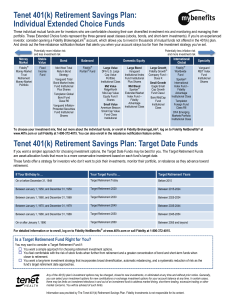

Tenet 401(k) Retirement Savings Plan: Individual Extended Choice

... Individual Extended Choice Funds ...

... Individual Extended Choice Funds ...

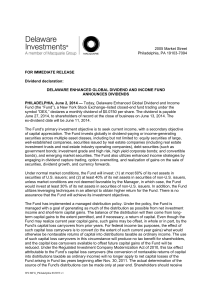

2005 Market Street Philadelphia, PA 19103-7094

... June 27, 2014, to shareholders of record at the close of business on June 13, 2014. The ex-dividend date will be June 11, 2014. The Fund's primary investment objective is to seek current income, with a secondary objective of capital appreciation. The Fund invests globally in dividend-paying or incom ...

... June 27, 2014, to shareholders of record at the close of business on June 13, 2014. The ex-dividend date will be June 11, 2014. The Fund's primary investment objective is to seek current income, with a secondary objective of capital appreciation. The Fund invests globally in dividend-paying or incom ...

bonds plus 400 fund - Insight Investment

... The investment objective of the Fund is to seek to deliver an annualised return, gross of all fees and expenses, that is at least 4% (or 400 basis points) above the return provided by the Fund’s benchmark. INVESTMENT APPROACH The Fund aims to outperform its cash benchmark by four percentage points p ...

... The investment objective of the Fund is to seek to deliver an annualised return, gross of all fees and expenses, that is at least 4% (or 400 basis points) above the return provided by the Fund’s benchmark. INVESTMENT APPROACH The Fund aims to outperform its cash benchmark by four percentage points p ...

CEAP RB FORM NO - CEAP Retirement Plan Office

... stocks, securities issued or guaranteed by the Philippine government or any of its subdivisions and instrumentalities, notes, bonds, deposits, money market placements, and any and all forms of securities with any financial institution, including the Trustees’ affiliates and/or subsidiaries. There ar ...

... stocks, securities issued or guaranteed by the Philippine government or any of its subdivisions and instrumentalities, notes, bonds, deposits, money market placements, and any and all forms of securities with any financial institution, including the Trustees’ affiliates and/or subsidiaries. There ar ...

Seix Investment Advisors Perspective

... dangerously low and with it the tax revenues that are the life blood of these bloated governments. The politicians in many of these countries either fail to recognize this reality or are in denial since they do not want to consider abandoning the Euro as a serious option. Instead, they have embraced ...

... dangerously low and with it the tax revenues that are the life blood of these bloated governments. The politicians in many of these countries either fail to recognize this reality or are in denial since they do not want to consider abandoning the Euro as a serious option. Instead, they have embraced ...

What does teR mean and What is it foR?

... any income retained from scrip-lending, and not passed back to the fund. Expenses not included in TER Charges not included are generally of a one-off nature, and deducted from the investment capital as opposed to the underlying portfolio: initial charges (including commission) – deducted from th ...

... any income retained from scrip-lending, and not passed back to the fund. Expenses not included in TER Charges not included are generally of a one-off nature, and deducted from the investment capital as opposed to the underlying portfolio: initial charges (including commission) – deducted from th ...

B Althelia Ecosphere completes first closing for Althelia Climate

... Dr Charlotte Streck, independent member of the Fund’s investment committee stresses the importance of the closing of the Fund ‘as it demonstrates that financial managers with long-term investment strategies are able to move towards valuing assets that are sustainable and environmentally robust. This ...

... Dr Charlotte Streck, independent member of the Fund’s investment committee stresses the importance of the closing of the Fund ‘as it demonstrates that financial managers with long-term investment strategies are able to move towards valuing assets that are sustainable and environmentally robust. This ...

Emerging Markets Extended Opportunities Fund

... increased significantly over the last few years and the more liquid areas of the market have become increasingly crowded. Consequently, the expectations for active returns are becoming more differentiated across different segments of the asset class. In some areas they are converging with those we w ...

... increased significantly over the last few years and the more liquid areas of the market have become increasingly crowded. Consequently, the expectations for active returns are becoming more differentiated across different segments of the asset class. In some areas they are converging with those we w ...

Every investor, whether conservative or aggressive, wants to see

... savings, insurance policies, public provident fund (PPF), bonds etc. In contrast, an aggressive one would probably look at equity, real estate, etc. Although the investment style of each group is different, the objective is to accelerate wealth creation. Investing through the mutual fund route over ...

... savings, insurance policies, public provident fund (PPF), bonds etc. In contrast, an aggressive one would probably look at equity, real estate, etc. Although the investment style of each group is different, the objective is to accelerate wealth creation. Investing through the mutual fund route over ...

as PDF for Printing

... of the stocks in which the portfolio invests may never be recognized by the broader market. Investing in equity stocks is risky and subject to the volatility of the markets. Ariel Appreciation Fund often invests a significant portion of its assets in companies within the financial services and consu ...

... of the stocks in which the portfolio invests may never be recognized by the broader market. Investing in equity stocks is risky and subject to the volatility of the markets. Ariel Appreciation Fund often invests a significant portion of its assets in companies within the financial services and consu ...

Determination of Interest Rate on Subordinated Corporate Bonds

... (Note 2) Interest payments are due on the last day of February, August annually and on the maturity date. The principal may be returned in whole or in part before maturity in the proportion of 100 yen per 100 yen value of the subordinated bonds on any interest payment date falling in or after August ...

... (Note 2) Interest payments are due on the last day of February, August annually and on the maturity date. The principal may be returned in whole or in part before maturity in the proportion of 100 yen per 100 yen value of the subordinated bonds on any interest payment date falling in or after August ...