NOMN Case Study Digital Advice Platforms and

... assets under management, before portfolio manager fees. ...

... assets under management, before portfolio manager fees. ...

Leveraged ETF credit risks

... invest directly in their underlying assets, relying on swaps, futures, or other derivatives to match the return on their index. These derivatives open those ETFs to counterparty risk, the risk that the institution on the other side of their trade will default, which could leave a fund with no return ...

... invest directly in their underlying assets, relying on swaps, futures, or other derivatives to match the return on their index. These derivatives open those ETFs to counterparty risk, the risk that the institution on the other side of their trade will default, which could leave a fund with no return ...

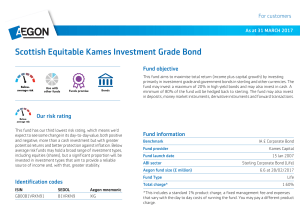

Scottish Equitable Kames Investment Grade Bond

... for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you're not entirely reliant on the success of one region or type of company. Some funds in this category may be more suitable f ...

... for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you're not entirely reliant on the success of one region or type of company. Some funds in this category may be more suitable f ...

CI LifeCycle Portfolios

... returns, adjusted for volatility, relative to peers. Lipper Leader ratings change monthly. For more information, see lipperweb.com. Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. Users acknowledg ...

... returns, adjusted for volatility, relative to peers. Lipper Leader ratings change monthly. For more information, see lipperweb.com. Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. Users acknowledg ...

Income Tax Act 9 - Amendment 64G

... Commissioner otherwise directs, withhold tax at the rate of 25 per cent from the investment of an individual who is a resident investor in the mutual fund, where that investment is withdrawn within 5 years of being invested.”* (2) The tax withheld under subsection (1) shall be paid to the Commission ...

... Commissioner otherwise directs, withhold tax at the rate of 25 per cent from the investment of an individual who is a resident investor in the mutual fund, where that investment is withdrawn within 5 years of being invested.”* (2) The tax withheld under subsection (1) shall be paid to the Commission ...

closed-end fund “at the market” equity shelf offerings

... world, as well as the world’s largest institutions and governments, pursue their investing goals. We offer: solutions, including mutual funds, separately managed accounts, alternatives and iShares® ETFs ...

... world, as well as the world’s largest institutions and governments, pursue their investing goals. We offer: solutions, including mutual funds, separately managed accounts, alternatives and iShares® ETFs ...

press release ojk issues regulation on capital market investment

... Financial Services Authority, Jakarta, August 5, 2016: The Financial Services Authority (OJK) has issued the Financial Services Authority Regulation (POJK) No. 26/POJK.04/2016 on Investment Products within the Capital Market in order to Support the Law on Tax Amnesty. The POJK signifies the OJK’s co ...

... Financial Services Authority, Jakarta, August 5, 2016: The Financial Services Authority (OJK) has issued the Financial Services Authority Regulation (POJK) No. 26/POJK.04/2016 on Investment Products within the Capital Market in order to Support the Law on Tax Amnesty. The POJK signifies the OJK’s co ...

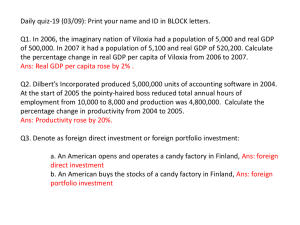

03/09

... Daily quiz-19 (03/09): Print your name and ID in BLOCK letters. Q1. In 2006, the imaginary nation of Viloxia had a population of 5,000 and real GDP of 500,000. In 2007 it had a population of 5,100 and real GDP of 520,200. Calculate the percentage change in real GDP per capita of Viloxia from 2006 to ...

... Daily quiz-19 (03/09): Print your name and ID in BLOCK letters. Q1. In 2006, the imaginary nation of Viloxia had a population of 5,000 and real GDP of 500,000. In 2007 it had a population of 5,100 and real GDP of 520,200. Calculate the percentage change in real GDP per capita of Viloxia from 2006 to ...

Portfolio Management

... Beta as a marginal risk Example 8: A 3-year investment in company AA has registered the following one-year total returns: 5% in year 1, 8% in year 2 and 2% in year 3. A 3-year investment in company BB has registered the following oneyear total returns: 3% in year 1, -1% in year 2 and 6% in year 3. W ...

... Beta as a marginal risk Example 8: A 3-year investment in company AA has registered the following one-year total returns: 5% in year 1, 8% in year 2 and 2% in year 3. A 3-year investment in company BB has registered the following oneyear total returns: 3% in year 1, -1% in year 2 and 6% in year 3. W ...

OneEarth ETF - Morgan Stanley Sustainable Investing Challenge

... demonstrates how an investor can construct a portfolio of multiple assets that maximize returns for a given level of risk. By tracking the S&P 500, ONEE offers investors the benefits of a broad, diverse portfolio at a low cost, and the ability to hold the market while voting for impact. This impact ...

... demonstrates how an investor can construct a portfolio of multiple assets that maximize returns for a given level of risk. By tracking the S&P 500, ONEE offers investors the benefits of a broad, diverse portfolio at a low cost, and the ability to hold the market while voting for impact. This impact ...

Willis Owen | Industry Insight | Article Print |Investment grade bonds

... consumer facing, ‘reason to exist’ credits such as Kraft Heinz, Boots Walgreen and Verizon. Why? Because in 30 years’ time we believe these companies will still be paying reliable, dependable coupons to their bondholders. If anything, we may pursue this ‘global titans’ strategy even ...

... consumer facing, ‘reason to exist’ credits such as Kraft Heinz, Boots Walgreen and Verizon. Why? Because in 30 years’ time we believe these companies will still be paying reliable, dependable coupons to their bondholders. If anything, we may pursue this ‘global titans’ strategy even ...

Measuring Risk Adjusted Return (Sharpe Ratio) of the Selected

... Indian economy were opened one by one and many are in pipeline. Financial sector was also one of the part of it. Indian capital market has observed so many fundamental changes by SEBI. In earlier times there were only few investment options available to investors for investment but with the initiali ...

... Indian economy were opened one by one and many are in pipeline. Financial sector was also one of the part of it. Indian capital market has observed so many fundamental changes by SEBI. In earlier times there were only few investment options available to investors for investment but with the initiali ...

Stock Market -Trading

... To Diversify Or Not To Diversify? • While diversification reduces risk (in theory), some professional asset managers have different views: • Warren Buffet: − From 1976-2006, the top 5 holdings of Berkshire on average accounted for 73% of the portfolio − The average annual return of Berkshire’s sto ...

... To Diversify Or Not To Diversify? • While diversification reduces risk (in theory), some professional asset managers have different views: • Warren Buffet: − From 1976-2006, the top 5 holdings of Berkshire on average accounted for 73% of the portfolio − The average annual return of Berkshire’s sto ...

CLOs, CDOs and the Search for High Yield

... Whilst considerable care has been taken to ensure the information contained within is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of t ...

... Whilst considerable care has been taken to ensure the information contained within is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of t ...

SMSFs drop the ball on risk in asset allocation

... never predict the year of the next major fall, how long it will last and how long it will take to recover. Furthermore, many of these investors have probably piled into the market after the first few years of the bull market since 2008-2009. Cash These investors were probably burnt during the last m ...

... never predict the year of the next major fall, how long it will last and how long it will take to recover. Furthermore, many of these investors have probably piled into the market after the first few years of the bull market since 2008-2009. Cash These investors were probably burnt during the last m ...

Investments PPT

... Federal Funds Rate • This is the amount of interest that the Federal Reserve charges banks to borrow money from the government. • The current Federal Funds Rate is: ...

... Federal Funds Rate • This is the amount of interest that the Federal Reserve charges banks to borrow money from the government. • The current Federal Funds Rate is: ...

Invesco Great Wall Core Competence Mixed Securities Fund

... ChiNext and the main board market, emerging nature of ChiNext companies, higher fluctuation on stock prices, delisting risk and valuation risk) and (d) Mainland debt securities risks (including volatility and liquidity risks, counterparty risk, interest rate risk, downgrading risk, credit rating age ...

... ChiNext and the main board market, emerging nature of ChiNext companies, higher fluctuation on stock prices, delisting risk and valuation risk) and (d) Mainland debt securities risks (including volatility and liquidity risks, counterparty risk, interest rate risk, downgrading risk, credit rating age ...