The Creation Process for Financial Assets

... Investors can avoid the risk inherent in a single claim against a party who may fail to meet its obligations by holding shares in a mutual fund Insurance companies can pool premiums and provide risk management services at much lower cost ...

... Investors can avoid the risk inherent in a single claim against a party who may fail to meet its obligations by holding shares in a mutual fund Insurance companies can pool premiums and provide risk management services at much lower cost ...

Schroders - Economic Infographic: January 2015

... should not be placed on the views and information in the document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results, prices of shares and the income from them may fall as well as rise and investors may not get back the amount ...

... should not be placed on the views and information in the document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results, prices of shares and the income from them may fall as well as rise and investors may not get back the amount ...

Capital Market Line and Beta

... relationship between risk measured by standard deviation and return of portfolios consisting of risk-free asset and market portfolio in all possible proportions. ...

... relationship between risk measured by standard deviation and return of portfolios consisting of risk-free asset and market portfolio in all possible proportions. ...

2016 Paris Financial Management Conference

... A selection of high-quality research papers will be published in a Special Issue of International Review Financial Analysis on conference themes. Special sessions of Finance Research Letters (FRL): Comments from one of the Co-Editors who participate at the FRL sessions during the PFMC2015 conference ...

... A selection of high-quality research papers will be published in a Special Issue of International Review Financial Analysis on conference themes. Special sessions of Finance Research Letters (FRL): Comments from one of the Co-Editors who participate at the FRL sessions during the PFMC2015 conference ...

Beyond Libor: The Evolution of `Risk-Free` Benchmarks

... All investments contain risk and may lose value. Investors should consult their investment professional prior to making an investment decision. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informatio ...

... All investments contain risk and may lose value. Investors should consult their investment professional prior to making an investment decision. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informatio ...

Key Investor Information

... The fund aims to provide income. Investment Policy At least 80% of the fund will be invested in shares of UK companies. The fund aims to provide an income in excess of 110% of the FTSE All Share index yield. The fund invests in 'value' stocks – those whose share prices appear low relative to their l ...

... The fund aims to provide income. Investment Policy At least 80% of the fund will be invested in shares of UK companies. The fund aims to provide an income in excess of 110% of the FTSE All Share index yield. The fund invests in 'value' stocks – those whose share prices appear low relative to their l ...

Management of Banks and Financial Institutions

... Management of Banks and Financial Institutions Instructor: Ashok Thampy Term: IV Programme: PGP Credit: 3 Objective: This course aims to equip students with an understanding of the issues in the management of financial institutions. Financial institutions are subject to risk on both sides of their b ...

... Management of Banks and Financial Institutions Instructor: Ashok Thampy Term: IV Programme: PGP Credit: 3 Objective: This course aims to equip students with an understanding of the issues in the management of financial institutions. Financial institutions are subject to risk on both sides of their b ...

(wealth accumulator established).

... Confidence of knowing a plan is in place to achieve their goals. As a result of the strategies in place, Peter and Lauren are well on track towards retiring at age fifty five. They have the comfort of knowing that they are actively working towards their long term goal and that they have a plan in pl ...

... Confidence of knowing a plan is in place to achieve their goals. As a result of the strategies in place, Peter and Lauren are well on track towards retiring at age fifty five. They have the comfort of knowing that they are actively working towards their long term goal and that they have a plan in pl ...

Ch.1 - 13ed Overview of Fin Mgmt

... that try to maximize stock price. On average, employment goes up in: ...

... that try to maximize stock price. On average, employment goes up in: ...

Bank Loans vs. Global High Yield

... have experienced the magnitude of the spread compression seen in the U.S. high yield markets (see figure 9). In fact, most international markets are developing their belowinvestment credit markets out of necessity (as the U.S. did in the early 1990s). European financial institutions are shrinking th ...

... have experienced the magnitude of the spread compression seen in the U.S. high yield markets (see figure 9). In fact, most international markets are developing their belowinvestment credit markets out of necessity (as the U.S. did in the early 1990s). European financial institutions are shrinking th ...

Are hedge funds a suitable investment for taxable investors?

... creating an even larger tax burden. The hedge fund industry’s growth is reflected in the current 10,000 individual hedge funds, with more than $2.7 trillion dollars in assets under management. High net worth individuals, or taxable investors, represent 9 percent of hedge fund investors by type and 3 ...

... creating an even larger tax burden. The hedge fund industry’s growth is reflected in the current 10,000 individual hedge funds, with more than $2.7 trillion dollars in assets under management. High net worth individuals, or taxable investors, represent 9 percent of hedge fund investors by type and 3 ...

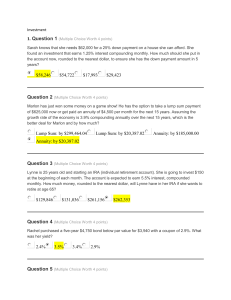

Investment - OpenStudy

... Lucas purchased 90 shares of stock in a computer company at $87.92 per share and Peyton purchased 55 shares of stock in a different computer company for $72.03 per share. After holding the stock for two years, Lucas sold his for a total of $8,476.20, and Peyton sold hers for a total of $4,192.10. Wh ...

... Lucas purchased 90 shares of stock in a computer company at $87.92 per share and Peyton purchased 55 shares of stock in a different computer company for $72.03 per share. After holding the stock for two years, Lucas sold his for a total of $8,476.20, and Peyton sold hers for a total of $4,192.10. Wh ...

Less is More Size: 29kb Last modified: Sat

... Regulators are encouraging even larger future systemic crises as they encourage the growth of universal institutions. This is likely to produce a Detroit like ending for these banks. Many of the current hastily arranged and potentially poorly integrated mergers will undoubtedly end up like those at ...

... Regulators are encouraging even larger future systemic crises as they encourage the growth of universal institutions. This is likely to produce a Detroit like ending for these banks. Many of the current hastily arranged and potentially poorly integrated mergers will undoubtedly end up like those at ...

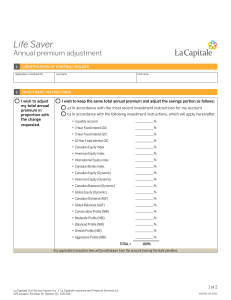

IND001E Life Saver - Annual Premium Adjustment

... generated by these accounts are tied to the performance of a market index or underlying fund, less any applicable management fees. The value of the market index or underlying fund fluctuates depending on the market value of the securities that make up the index or fund. The value of these accounts m ...

... generated by these accounts are tied to the performance of a market index or underlying fund, less any applicable management fees. The value of the market index or underlying fund fluctuates depending on the market value of the securities that make up the index or fund. The value of these accounts m ...

Chapter 13

... coupon rate they should Bonds usually have a maturity date (up to 30 years or so) Receive benefits through interest income ...

... coupon rate they should Bonds usually have a maturity date (up to 30 years or so) Receive benefits through interest income ...

Beyond brinkmanship

... you’d best do it quietly to avoid a ‘run on the bank’. The more interesting issue is that we can’t all devalue our currencies, so who is willing to let their currency appreciate? Investment objectives for the future If I were the chief investment officer of an Australian fund at the moment, I’d take ...

... you’d best do it quietly to avoid a ‘run on the bank’. The more interesting issue is that we can’t all devalue our currencies, so who is willing to let their currency appreciate? Investment objectives for the future If I were the chief investment officer of an Australian fund at the moment, I’d take ...

Downlaod File

... they make it easier and quicker to sell there financial instruments to raise cash (more liquid) and increasing liquidity makes them more desirable and thus easier for the issuing firm to sell in the primary market. Second they determine the price of the security that the issuing firm sells in the pr ...

... they make it easier and quicker to sell there financial instruments to raise cash (more liquid) and increasing liquidity makes them more desirable and thus easier for the issuing firm to sell in the primary market. Second they determine the price of the security that the issuing firm sells in the pr ...

Asset ALLOCAtION FUNDs - PGIM Investments

... Source: DALBAR Quantitative Analysis of Investor Behavior (QAIB), © 2016 DALBAR, Inc. DALBAR is an independent, Boston-based financial research firm which is not affiliated with Prudential Financial, Inc. and its affiliates. The “average investor” refers to the universe of all mutual fund investors ...

... Source: DALBAR Quantitative Analysis of Investor Behavior (QAIB), © 2016 DALBAR, Inc. DALBAR is an independent, Boston-based financial research firm which is not affiliated with Prudential Financial, Inc. and its affiliates. The “average investor” refers to the universe of all mutual fund investors ...

28-2

... • Defined contribution plans – Investment policy is essentially the same as for a tax-qualified individual retirement account • Defined benefit plans – Contractual arrangement setting out the rights and obligations of all parties ...

... • Defined contribution plans – Investment policy is essentially the same as for a tax-qualified individual retirement account • Defined benefit plans – Contractual arrangement setting out the rights and obligations of all parties ...

401(k) Plan Account Summary Total Account Balance by

... Investment Fund Choices for Future Contributions This chart shows how you have chosen to invest future contributions by fund. You may change your investment fund choices at any time. Future Contributions Roth Before-Tax ...

... Investment Fund Choices for Future Contributions This chart shows how you have chosen to invest future contributions by fund. You may change your investment fund choices at any time. Future Contributions Roth Before-Tax ...