description

... expose U.S. pension funds and other institutional investors to opportunities to co-invest in infrastructure with African counterparts for mutually beneficial gains. The prevailing consensus suggests that there is alignment between pension funds and insurance companies’ need for enhanced yields and l ...

... expose U.S. pension funds and other institutional investors to opportunities to co-invest in infrastructure with African counterparts for mutually beneficial gains. The prevailing consensus suggests that there is alignment between pension funds and insurance companies’ need for enhanced yields and l ...

Fixed Impact: Green Bonds Primer

... Given the prevalence of equity-based solutions, many investors assume the practice of sustainable investing relates only to stock selection. As investors navigate different sustainable investment opportunities, it is essential that they learn about the range of fixed income approaches and structures ...

... Given the prevalence of equity-based solutions, many investors assume the practice of sustainable investing relates only to stock selection. As investors navigate different sustainable investment opportunities, it is essential that they learn about the range of fixed income approaches and structures ...

Slide 1 - Binus Repository

... – In practice, materiality standars are determined by what is " generally accepted". ...

... – In practice, materiality standars are determined by what is " generally accepted". ...

Justin Byers - AP Scholar, 4

... diligently researching various industries, commodities, and currencies to understand their impact on world markets. This passion fueled my undergraduate studies at the University of Nebraska-Lincoln with a focus on analytical Finance and strategic Management. I plan to pursue the proper licenses aft ...

... diligently researching various industries, commodities, and currencies to understand their impact on world markets. This passion fueled my undergraduate studies at the University of Nebraska-Lincoln with a focus on analytical Finance and strategic Management. I plan to pursue the proper licenses aft ...

Investor Education: Investing globally can help your money grow

... performance in the global emerging markets. The MSCI World Index (ND) is an unmanaged index of equity securities from developed countries. The S&P 500 Index is an unmanaged index of common stock performance. All returns are quoted in U.S. dollars. Indexes assume reinvestment of distributions and do ...

... performance in the global emerging markets. The MSCI World Index (ND) is an unmanaged index of equity securities from developed countries. The S&P 500 Index is an unmanaged index of common stock performance. All returns are quoted in U.S. dollars. Indexes assume reinvestment of distributions and do ...

Econ-Growth-for-Development

... consumption in favour of future consumption • Investment requires saving • May not be able to afford to give up current consumption thus constraining growth • Return on investment in primary education is 40%! ...

... consumption in favour of future consumption • Investment requires saving • May not be able to afford to give up current consumption thus constraining growth • Return on investment in primary education is 40%! ...

maximizing the financial value of ip assets

... expected value of your IP portfolio and to determine whether new technologies may impair that value. • Make calculated and informed decisions to maximize the expected value of your portfolio. ...

... expected value of your IP portfolio and to determine whether new technologies may impair that value. • Make calculated and informed decisions to maximize the expected value of your portfolio. ...

Who Says Real Estate is a Bad Investment?

... been a valuable tool in reducing volatility and enhancing portfolio returns through income and the potential for capital appreciation. Real estate returns have also demonstrated low correlation with the returns of common stock and bond type investments. A look at the last decade of performance shows ...

... been a valuable tool in reducing volatility and enhancing portfolio returns through income and the potential for capital appreciation. Real estate returns have also demonstrated low correlation with the returns of common stock and bond type investments. A look at the last decade of performance shows ...

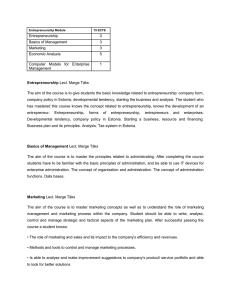

Entrepreneurship Module 15 ECTS Entrepreneurship 3 Basics of

... The aim of the course is to master marketing concepts as well as to understand the role of marketing management and marketing process within the company. Student should be able to write, analyse, control and manage strategic and tactical aspects of the marketing plan. After successful passing the co ...

... The aim of the course is to master marketing concepts as well as to understand the role of marketing management and marketing process within the company. Student should be able to write, analyse, control and manage strategic and tactical aspects of the marketing plan. After successful passing the co ...

Economic Expert Panel: 2013 Outlook Chapter 1: BMO`s economic

... It’s quite interesting, as part of the ETF team at BMO Asset Management. You just recently introduced four new, and innovative ETFs, for a total of forty-eight; now having amassed in excess of 8 billion dollars since the launch of the first ETF in 2009. In this type of investment and economic enviro ...

... It’s quite interesting, as part of the ETF team at BMO Asset Management. You just recently introduced four new, and innovative ETFs, for a total of forty-eight; now having amassed in excess of 8 billion dollars since the launch of the first ETF in 2009. In this type of investment and economic enviro ...

Mutual Funds Sharekhan`s Top Equity Fund Picks

... With a long history of more than 11years, the MF scheme has been an outperformer compared to both, the benchmark Nifty 50 index and the Large Cap category average. Despite the volatility and uncertainties in the market, the MF scheme has performed better than its peers, giving a return of 20% over t ...

... With a long history of more than 11years, the MF scheme has been an outperformer compared to both, the benchmark Nifty 50 index and the Large Cap category average. Despite the volatility and uncertainties in the market, the MF scheme has performed better than its peers, giving a return of 20% over t ...

Global Institutional Consulting An Investor

... probability that the organization will meet its intermediateto longer-term needs. 3. Strategic assets: For an opportunity to achieve a significant surplus that could help an institution transcend its mission, grow its impact, and surpass its peer group, it may consider exposure to strategic assets. ...

... probability that the organization will meet its intermediateto longer-term needs. 3. Strategic assets: For an opportunity to achieve a significant surplus that could help an institution transcend its mission, grow its impact, and surpass its peer group, it may consider exposure to strategic assets. ...

A Time for Strategy - Tealwood Asset Management

... and a half years into this expansion (and expansions average around eight years in duration), to date the economic data has not indicated an increased risk of recession. We do not see it as time to adjust strategy to assume a more defensive position. Continue to page 2 ...

... and a half years into this expansion (and expansions average around eight years in duration), to date the economic data has not indicated an increased risk of recession. We do not see it as time to adjust strategy to assume a more defensive position. Continue to page 2 ...

EIF Presentation Template - EU Strategy for the Baltic Sea Region

... This presentation was prepared by EIF. The information included in this presentation is based on figures available for March 2011 Any estimates and projections contained herein involve significant elements of subjective judgment and analysis, which may or may not be correct. ...

... This presentation was prepared by EIF. The information included in this presentation is based on figures available for March 2011 Any estimates and projections contained herein involve significant elements of subjective judgment and analysis, which may or may not be correct. ...

our theory of change - Big Society Capital

... intermediaries • Increased growth and sustainability of intermediaries • Increased understanding of how capital can be used to create impact through sustainable models ...

... intermediaries • Increased growth and sustainability of intermediaries • Increased understanding of how capital can be used to create impact through sustainable models ...

Municipal Bond Funds Commentary

... returned 1.45% and 0.20%, respectively. Intermediateand long-maturity bonds outperformed short-maturity bonds due to the more hawkish statements by the Fed that contributed to a flattening of the municipal bond yield curve. The high-yield tax-exempt market outperformed the broader municipal bond mar ...

... returned 1.45% and 0.20%, respectively. Intermediateand long-maturity bonds outperformed short-maturity bonds due to the more hawkish statements by the Fed that contributed to a flattening of the municipal bond yield curve. The high-yield tax-exempt market outperformed the broader municipal bond mar ...

Equity-Style Portfolio Construction

... Fundamental Factor Models Example: BARRA Model (Barra Consulting Firm) Features: – Regress 1300 stocks against 13 factors: P/e, P/B, size, ROE, etc. – Construct portfolios with different sensitivities. – Define portfolios with different styles: Value, growth, Value-low cap, etc. ...

... Fundamental Factor Models Example: BARRA Model (Barra Consulting Firm) Features: – Regress 1300 stocks against 13 factors: P/e, P/B, size, ROE, etc. – Construct portfolios with different sensitivities. – Define portfolios with different styles: Value, growth, Value-low cap, etc. ...

Infinera to Participate in Investment Community Conference in New

... the most demanding networks. To learn more about Infinera visit www.infinera.com, follow us on Twitter @Infinera and read our latest blog posts at blog.infinera.com. Infinera and the Infinera logo are registered trademarks of Infinera Corporation. ...

... the most demanding networks. To learn more about Infinera visit www.infinera.com, follow us on Twitter @Infinera and read our latest blog posts at blog.infinera.com. Infinera and the Infinera logo are registered trademarks of Infinera Corporation. ...

Portfolio rebalancing: Why it`s important, what to consider

... Yan Zilbering: Well, the right time to rebalance is very different for everyone. Some investors are very sensitive to risk, and they may want to choose to rebalance more frequently or have a very tight threshold for their allocation. [For] those investors, our primary concern would be their target ...

... Yan Zilbering: Well, the right time to rebalance is very different for everyone. Some investors are very sensitive to risk, and they may want to choose to rebalance more frequently or have a very tight threshold for their allocation. [For] those investors, our primary concern would be their target ...

ELENA Project Factsheet European Energy Efficiency Fund (EEEF)

... The public authority beneficiaries will be responsible for managing the implementation of the investment programmes and will be required to publish tenders and assign the contract(s) to the winning bidder private or public-private companies to implement these investments. The winning private or publ ...

... The public authority beneficiaries will be responsible for managing the implementation of the investment programmes and will be required to publish tenders and assign the contract(s) to the winning bidder private or public-private companies to implement these investments. The winning private or publ ...