Chapter 11

... Would you put your entire savings into one company? Diversification: strategy of spreading out of investments to reduce risk ...

... Would you put your entire savings into one company? Diversification: strategy of spreading out of investments to reduce risk ...

CFA Outlook 4Q15

... goods. Ironically, the Federal Reserve has been trying for quite some time to trick the economy into growing faster than it probably can with its easy money policies of ZIRP (zero interest rate policies) and QE (quantitative easing). Theoretically, this is accomplished by lowering the risk-free rate ...

... goods. Ironically, the Federal Reserve has been trying for quite some time to trick the economy into growing faster than it probably can with its easy money policies of ZIRP (zero interest rate policies) and QE (quantitative easing). Theoretically, this is accomplished by lowering the risk-free rate ...

- Todd Asset Management

... US. We would point out we were very concerned in the run up to the Fiscal Cliff on the US outlook, and that turned out to be the wrong position. Also, in prior years we have noted that European markets have had a recession to deal with and Emerging markets were slowing, so we are not always positive ...

... US. We would point out we were very concerned in the run up to the Fiscal Cliff on the US outlook, and that turned out to be the wrong position. Also, in prior years we have noted that European markets have had a recession to deal with and Emerging markets were slowing, so we are not always positive ...

Successful secondaries

... secondaries funds. In fact, there have recently been some major transactions with private equity secondaries in particular, and there is a significant amount of unspent money about which must either be invested in secondaries or returned to investors. Nevertheless, there are funds which still trade ...

... secondaries funds. In fact, there have recently been some major transactions with private equity secondaries in particular, and there is a significant amount of unspent money about which must either be invested in secondaries or returned to investors. Nevertheless, there are funds which still trade ...

euro high yield bond fund - Henderson Global Investors

... ▪ Bank deposits In choosing investments the manager focuses on identifying the best risk-return prospects within the European high yield corporate bond market. The Fund may use derivatives to achieve the Fund's investment objective, to reduce risk or to manage the Fund more efficiently. Recommendati ...

... ▪ Bank deposits In choosing investments the manager focuses on identifying the best risk-return prospects within the European high yield corporate bond market. The Fund may use derivatives to achieve the Fund's investment objective, to reduce risk or to manage the Fund more efficiently. Recommendati ...

Important information on Fidelity Advisor Stable Value Portfolio

... until the security reaches maturity, and also takes into account certain maturity shortening features (e.g., demand features, interest rate resets, and call options) when applicable. Securities with longer durations generally tend to be more sensitive to interest rate changes than securities with sh ...

... until the security reaches maturity, and also takes into account certain maturity shortening features (e.g., demand features, interest rate resets, and call options) when applicable. Securities with longer durations generally tend to be more sensitive to interest rate changes than securities with sh ...

Strong Demand for Muni Bonds Yields Pros, Cons

... The fixed income securities are subject to price volatility and a number of risks, including interest rate risk. Interest rates and bond prices move in opposite directions so that as interest rates rise, bond prices usually fall and vice versa. Interest rates are currently at historically low levels ...

... The fixed income securities are subject to price volatility and a number of risks, including interest rate risk. Interest rates and bond prices move in opposite directions so that as interest rates rise, bond prices usually fall and vice versa. Interest rates are currently at historically low levels ...

Chapter 10

... We can examine returns in the financial markets to help us determine the appropriate returns on non-financial assets Lessons from capital market history Risk Risk/reward relationship ...

... We can examine returns in the financial markets to help us determine the appropriate returns on non-financial assets Lessons from capital market history Risk Risk/reward relationship ...

Pyramid and Ponzi schemes

... fake investment opportunity. Investors are lured into the scheme with the promise of a high return on their investment by way of an elaborate investment plan. This type of scheme can be harder to recognize as investors traditionally place a great deal of trust in people who directly manage investmen ...

... fake investment opportunity. Investors are lured into the scheme with the promise of a high return on their investment by way of an elaborate investment plan. This type of scheme can be harder to recognize as investors traditionally place a great deal of trust in people who directly manage investmen ...

Due Diligence - Risk Profiling Tool

... Whole of market funds – active & passive Multi-manager funds including risk targeted / managed Distributor Influenced Funds External Discretionary Fund Managers (considered for investments over £xxxxxxx) External Model Portfolios ...

... Whole of market funds – active & passive Multi-manager funds including risk targeted / managed Distributor Influenced Funds External Discretionary Fund Managers (considered for investments over £xxxxxxx) External Model Portfolios ...

Detailed request to act, or continue to act, as manager of a regulated

... “_________________________________________ (Name of law firm) hereby confirm that the principle documents and scheme particulars of __________________________________________ (Name of fund) contain information to comply with each of the applicable rules contained in the Collective Investment Schemes ...

... “_________________________________________ (Name of law firm) hereby confirm that the principle documents and scheme particulars of __________________________________________ (Name of fund) contain information to comply with each of the applicable rules contained in the Collective Investment Schemes ...

3rd Quarter 2016 Barometer Capital Management Inc. provides the

... long as those trends remain intact. This approach also places particular emphasis on the protection of capital. By consistently monitoring for change, applying a disciplined selling strategy and making tactical use of cash, the Barometer team works to protect portfolios against the negative effect o ...

... long as those trends remain intact. This approach also places particular emphasis on the protection of capital. By consistently monitoring for change, applying a disciplined selling strategy and making tactical use of cash, the Barometer team works to protect portfolios against the negative effect o ...

MODEL ANSWERS TO FINANCIAL ECONOMICS (IOBM

... To enhance strategic focus: a firm may divest/sell business that are not part of its core business so that it can focus on what it does best To raise funding: by selling one of its businesses in exchange for cash, divestitures help generate funds for a firm. ...

... To enhance strategic focus: a firm may divest/sell business that are not part of its core business so that it can focus on what it does best To raise funding: by selling one of its businesses in exchange for cash, divestitures help generate funds for a firm. ...

board of retirement

... Mr. Heath Cardie, and Mr. Dale Connors gave the retirement Board a presentation/training on two types of investment options that are available. Mr. Cardie, introduced Private Equity investments as a means of enhancing the portfolio on a return of investment standpoint. Private Equity historically ha ...

... Mr. Heath Cardie, and Mr. Dale Connors gave the retirement Board a presentation/training on two types of investment options that are available. Mr. Cardie, introduced Private Equity investments as a means of enhancing the portfolio on a return of investment standpoint. Private Equity historically ha ...

Investment

... speculator quickly gets in and out of the market (buying & selling) based on an accumulated experience about the market and more ability to analyze the impact of information on prices. Speculators focus on achieving the greatest possible amount of instant profits which are usually accompanied by hig ...

... speculator quickly gets in and out of the market (buying & selling) based on an accumulated experience about the market and more ability to analyze the impact of information on prices. Speculators focus on achieving the greatest possible amount of instant profits which are usually accompanied by hig ...

Amarillo College Book Value Market Value

... advice with respect to our non-endowed local funds. Their address is 300 West 6th Street, Suite 1940, Austin, Texas 78701. They do not have the authority to make investment decisions or initiate transactions. Amarillo College does not use soft dollar arrangements. Amarillo College is associated with ...

... advice with respect to our non-endowed local funds. Their address is 300 West 6th Street, Suite 1940, Austin, Texas 78701. They do not have the authority to make investment decisions or initiate transactions. Amarillo College does not use soft dollar arrangements. Amarillo College is associated with ...

Silicon Hills Client Newsletter - Silicon Hills Wealth Management

... The act of planning for something does not make it more likely. We plan every day for things that we don’t expect to happen. We buy insurance on our property and lives, store flashlights around our home, and carry jumper cables in our car. The fact that we are prepared for these things only makes li ...

... The act of planning for something does not make it more likely. We plan every day for things that we don’t expect to happen. We buy insurance on our property and lives, store flashlights around our home, and carry jumper cables in our car. The fact that we are prepared for these things only makes li ...

EDHEC and EuroPerformance release the Alpha League Table 2007 for the UK

... EDHEC is one of the leading French and European business schools. It ranked 7th in the Financial Times “Masters in Management” Rankings in 2006. With 35 professors, engineers and associate researchers, the EDHEC Risk and Asset Management Research Centre is the leading European research centre in ass ...

... EDHEC is one of the leading French and European business schools. It ranked 7th in the Financial Times “Masters in Management” Rankings in 2006. With 35 professors, engineers and associate researchers, the EDHEC Risk and Asset Management Research Centre is the leading European research centre in ass ...

FSM260 Portfolio Analysis

... Evaluate Relative and Absolute Performance Understand how management decisions such as security selection, group allocation, and currency tilts may have affected performance results. • Evaluate relative performance using several different attribution models, including equity, fixed income, balanced ...

... Evaluate Relative and Absolute Performance Understand how management decisions such as security selection, group allocation, and currency tilts may have affected performance results. • Evaluate relative performance using several different attribution models, including equity, fixed income, balanced ...

the benefit of actively managed bond separate accounts in a portfolio

... In other words, how much risk did it take to produce superior returns? If you beat the benchmark by 0.5% but take twice the risk, is that a good proposition when risk doesn’t pay? This is a question that is illuminated in a period of market turmoil. In fact, actively managed fixed income separate ac ...

... In other words, how much risk did it take to produce superior returns? If you beat the benchmark by 0.5% but take twice the risk, is that a good proposition when risk doesn’t pay? This is a question that is illuminated in a period of market turmoil. In fact, actively managed fixed income separate ac ...

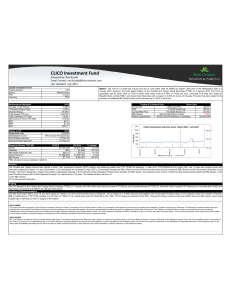

CLICO Investment Fund

... RBL's market price is TTD115.00 resulting in a CIF NAV of TTD26.17. At a listed share price of TTD22.65 on the TTSE, CIF is trading at a discount to the NAV. Through the listing, investors will have indirect access to RBL shares, which have usually high in demand but short in supply on the market. ...

... RBL's market price is TTD115.00 resulting in a CIF NAV of TTD26.17. At a listed share price of TTD22.65 on the TTSE, CIF is trading at a discount to the NAV. Through the listing, investors will have indirect access to RBL shares, which have usually high in demand but short in supply on the market. ...

Where`s The Exit? New Opportunities In China For PE

... We are aware that there are a number of similar transactions being pursued in the market at present, and further insights will no doubt be gained in due course. For now, private equity firms that have invested into Chinese companies can, at the very least, take comfort that an additional exit route ...

... We are aware that there are a number of similar transactions being pursued in the market at present, and further insights will no doubt be gained in due course. For now, private equity firms that have invested into Chinese companies can, at the very least, take comfort that an additional exit route ...

Financial Planner`s Approach to Investment Selections for Clients

... given category then meaningfully deviate from its stated investment style. The result could be significantly different risk and return characteristics than originally bargained for. Morningstar scores stock funds on the degree to which they veer off course on the dimensions of value/growth and size. ...

... given category then meaningfully deviate from its stated investment style. The result could be significantly different risk and return characteristics than originally bargained for. Morningstar scores stock funds on the degree to which they veer off course on the dimensions of value/growth and size. ...