Chapter 3

... Part-Cash Distribution — a certain percentage of your retirement fund (subject to regulatory and tax approvals) can be taken as a cash lump-sum to be used for investment or personal consumption purposes. ...

... Part-Cash Distribution — a certain percentage of your retirement fund (subject to regulatory and tax approvals) can be taken as a cash lump-sum to be used for investment or personal consumption purposes. ...

Investment demand

... • Capital and Investment –Gross investment –The total amount spent on new capital goods. ...

... • Capital and Investment –Gross investment –The total amount spent on new capital goods. ...

Inside Job – Vocabulary Asset Backed Security (ABS) An asset

... and international markets with the goal of generating high returns (either in an absolute sense or over a specified market benchmark). Legally, hedge funds are most often set up as private investment partnerships that are open to a limited number of investors and require a very large initial minimum ...

... and international markets with the goal of generating high returns (either in an absolute sense or over a specified market benchmark). Legally, hedge funds are most often set up as private investment partnerships that are open to a limited number of investors and require a very large initial minimum ...

On the Significance of the Investment Chapter of the Energy Charter

... • Japan is Party to 21 IIAs (only signed 2 IIAs). → ECT is Very Valuable for Japan. • The Investment Chapter of the ECT only Covers Energy Field. • How shall we Assess such Coverage? ...

... • Japan is Party to 21 IIAs (only signed 2 IIAs). → ECT is Very Valuable for Japan. • The Investment Chapter of the ECT only Covers Energy Field. • How shall we Assess such Coverage? ...

Appendix F 151202-lgps-investment-pooling-next

... All funds need to do the following: 1) Form a view on your preferred approach to pooling (what you will do) – an approach that meets your needs and government objectives. In forming a view you may find it useful to draw on the work of the local authorities participating in Project POOL 3 which is co ...

... All funds need to do the following: 1) Form a view on your preferred approach to pooling (what you will do) – an approach that meets your needs and government objectives. In forming a view you may find it useful to draw on the work of the local authorities participating in Project POOL 3 which is co ...

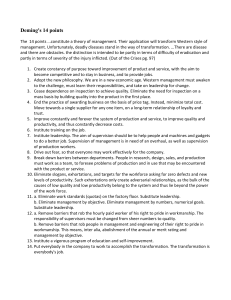

Deming`s 14 points - Institute for Healthcare Improvement

... 14. Put everybody in the company to work to accomplish the transformation. The transformation is everybody's job. ...

... 14. Put everybody in the company to work to accomplish the transformation. The transformation is everybody's job. ...

BlackRock US Corporate Bond Index Fund

... The custodian of the Fund is J.P. Morgan Bank (Ireland) plc. Further information about the Fund can be obtained from the latest annual report and half-yearly reports of the BlackRock Fixed Income Dublin Funds plc (BFIDF). These documents are available free of charge in English and certain other lang ...

... The custodian of the Fund is J.P. Morgan Bank (Ireland) plc. Further information about the Fund can be obtained from the latest annual report and half-yearly reports of the BlackRock Fixed Income Dublin Funds plc (BFIDF). These documents are available free of charge in English and certain other lang ...

Long term implications - College of Law Practice Management

... China and India will eclipse the G-6 very quickly, and the U.S. during the careers of current associates; Brazil will also be a mega-economic power China may be the world’s largest economy within 20 years India will eclipse China Protective policies will make it difficult for US firms to penetra ...

... China and India will eclipse the G-6 very quickly, and the U.S. during the careers of current associates; Brazil will also be a mega-economic power China may be the world’s largest economy within 20 years India will eclipse China Protective policies will make it difficult for US firms to penetra ...

Standard Life Global Absolute Return Strategies Fund

... value from an underlying asset, such as a share or bond, and are used routinely in global ...

... value from an underlying asset, such as a share or bond, and are used routinely in global ...

Active Management and Emerging Markets Equities

... variation exists across asset classes and EM equity is still a relatively inefficient asset class where price information is released slowly and reliable data is scarce. As such, this provides opportunities for experienced and skilled managers to add value through stock picking. For that reason, whi ...

... variation exists across asset classes and EM equity is still a relatively inefficient asset class where price information is released slowly and reliable data is scarce. As such, this provides opportunities for experienced and skilled managers to add value through stock picking. For that reason, whi ...

Investment Bond Option B

... Investment Bond is a unit-linked product that allows you to invest a single contribution into a range of different funds. It is intended as a medium to long-term investment, offering the potential to benefit from growth in the stock, bond, property markets and other asset classes and strategies. ...

... Investment Bond is a unit-linked product that allows you to invest a single contribution into a range of different funds. It is intended as a medium to long-term investment, offering the potential to benefit from growth in the stock, bond, property markets and other asset classes and strategies. ...

Recuperation and repair

... 1, 1993, Scotiabank Global Growth Fund was August 31, 1994, Scotiabank US Growth Fund was November 19, 1999 and Scotiabank Canadian Growth Fund was August 31, 1994. The minimum initial investment in the Scotia DBG Caribbean Income Fund is US $5,000 with subsequent investments of US $1,000. Pre-Autho ...

... 1, 1993, Scotiabank Global Growth Fund was August 31, 1994, Scotiabank US Growth Fund was November 19, 1999 and Scotiabank Canadian Growth Fund was August 31, 1994. The minimum initial investment in the Scotia DBG Caribbean Income Fund is US $5,000 with subsequent investments of US $1,000. Pre-Autho ...

Investment and saving

... – Investment demand – The relationship between the quantity of investment demanded and the interest rate, other things remaining the same. – Investment demand is shown by an investment demand schedule or and investment demand curve. – As the interest rate decreases, more investment projects become ...

... – Investment demand – The relationship between the quantity of investment demanded and the interest rate, other things remaining the same. – Investment demand is shown by an investment demand schedule or and investment demand curve. – As the interest rate decreases, more investment projects become ...

insights - Private Ocean

... are most likely the basis for the common belief that stock returns have outperformed bond returns by 5% over the last several decades. It is also commonly asserted that if stocks are held long enough, perhaps 10 years, they will outperform bonds. The level of the equity risk premium has been one of ...

... are most likely the basis for the common belief that stock returns have outperformed bond returns by 5% over the last several decades. It is also commonly asserted that if stocks are held long enough, perhaps 10 years, they will outperform bonds. The level of the equity risk premium has been one of ...

Chapter 2

... from the newly industrialized countries are producing low-cost, high-quality products with which firms from industrial countries must compete. Also firms should protect their home markets. Thus they have to be very efficient. ...

... from the newly industrialized countries are producing low-cost, high-quality products with which firms from industrial countries must compete. Also firms should protect their home markets. Thus they have to be very efficient. ...

A Case for Active Management - Mawer Investment Management

... fact, passive investment fees are often not dramatically less than those of some active managers. And if the active manager provides superior returns after fees are taken into account...well, we think it’s a no-brainer. And at Mawer, we do believe that there are good managers out there. To us, being ...

... fact, passive investment fees are often not dramatically less than those of some active managers. And if the active manager provides superior returns after fees are taken into account...well, we think it’s a no-brainer. And at Mawer, we do believe that there are good managers out there. To us, being ...

403(b) - ADMIN Partners

... Should you choose to take advantage of this retirement savings opportunity, you will need to complete enrollment paperwork provided by the investment provider and a salary reduction agreement that authorizes us to deduct money from your paycheck. A salary reduction agreement is available [INSERT]. W ...

... Should you choose to take advantage of this retirement savings opportunity, you will need to complete enrollment paperwork provided by the investment provider and a salary reduction agreement that authorizes us to deduct money from your paycheck. A salary reduction agreement is available [INSERT]. W ...

renaissance view - Renaissance Financial

... earnings reports. As longer-term interest rates drift higher, the banks become more interested in lending, especially if shorter-term rates remain low. A common fear is that interest rates will rise when the Fed reduces and eventually stops its purchases, and higher rates will choke off what little ...

... earnings reports. As longer-term interest rates drift higher, the banks become more interested in lending, especially if shorter-term rates remain low. A common fear is that interest rates will rise when the Fed reduces and eventually stops its purchases, and higher rates will choke off what little ...

OUR INVESTMENT PROCESS - RBC Wealth Management

... returns long-term. Company Selection Backed by research from leading North American firms and independent analysis from portfolio managers and research analysts, the selection process is based on a multi-disciplinary approach. Each company is assigned a score based on fundamental, technical, and qua ...

... returns long-term. Company Selection Backed by research from leading North American firms and independent analysis from portfolio managers and research analysts, the selection process is based on a multi-disciplinary approach. Each company is assigned a score based on fundamental, technical, and qua ...