Investment News - AEPG Wealth Strategies

... The fastest-growing firms focus on measures of productivity, said Brandon Odell, director of business consulting for The Ensemble Practice, consultants on the performance report. A key parameter is revenue per professional, which was $942,317 on average last year for the top quartile of firms, compa ...

... The fastest-growing firms focus on measures of productivity, said Brandon Odell, director of business consulting for The Ensemble Practice, consultants on the performance report. A key parameter is revenue per professional, which was $942,317 on average last year for the top quartile of firms, compa ...

ch03 - U of L Class Index

... Trade all day on exchanges, can be bought on margin, and can be shorted Currently passive in nature Can be traded at discount or premiums. Offer an important advantage over funds with regard to flexibility on taxes Mutual Funds Bought and sold at the end of the trading day when the NAV i ...

... Trade all day on exchanges, can be bought on margin, and can be shorted Currently passive in nature Can be traded at discount or premiums. Offer an important advantage over funds with regard to flexibility on taxes Mutual Funds Bought and sold at the end of the trading day when the NAV i ...

GLOSSARY OF KEY TERMS DISCUSSED IN

... of short term (less than one year) securities representing high-quality, liquid debt and monetary instruments. Monetary Policy Committee (MPC) Government body that sets the bank rate (commonly referred to as being base rate). Its primary target is to keep inflation within plus or minus 1% of a centr ...

... of short term (less than one year) securities representing high-quality, liquid debt and monetary instruments. Monetary Policy Committee (MPC) Government body that sets the bank rate (commonly referred to as being base rate). Its primary target is to keep inflation within plus or minus 1% of a centr ...

Buy and Hold is Dead (Again)

... planning research shows that portfolio returns in the first decade of retirement are critically important. Although a portfolio may earn average expected returns over the life expectancy of the retiree following retirement, it is the order of how the returns are earned that matter the most. All of t ...

... planning research shows that portfolio returns in the first decade of retirement are critically important. Although a portfolio may earn average expected returns over the life expectancy of the retiree following retirement, it is the order of how the returns are earned that matter the most. All of t ...

Declaration for the COP21

... d. Pay attention to the carbon intensity of our portfolios, strengthen the climate resilience of our investments, and incite companies we invest in to take into account environmental and social impacts in their business models, strategic decisions and performance measures. 4. These commitments could ...

... d. Pay attention to the carbon intensity of our portfolios, strengthen the climate resilience of our investments, and incite companies we invest in to take into account environmental and social impacts in their business models, strategic decisions and performance measures. 4. These commitments could ...

An Alternative Strategy for Seekers of Absolute Return

... With the bursting of the equity bubble in 2001 and 2002, fear replaced greed. Throughout this time, more than $8 trillion dollars of assets were lost by investors, particularly those invested in stocks traded on the Nasdaq. Suddenly, being invested everyday in momentum strategies did not seem so sma ...

... With the bursting of the equity bubble in 2001 and 2002, fear replaced greed. Throughout this time, more than $8 trillion dollars of assets were lost by investors, particularly those invested in stocks traded on the Nasdaq. Suddenly, being invested everyday in momentum strategies did not seem so sma ...

Emerging Research on Climate Change Risk and Fossil

... (thereby leaving the other 67% stranded). Some of the key issues associated with stranded carbon assets that impact the value of fossil fuels include: • A switch to lower carbon: “Lighter carbon” fossil fuels will displace “heavy carbon” fuels: e.g. from coal to oil to natural gas. This affects fos ...

... (thereby leaving the other 67% stranded). Some of the key issues associated with stranded carbon assets that impact the value of fossil fuels include: • A switch to lower carbon: “Lighter carbon” fossil fuels will displace “heavy carbon” fuels: e.g. from coal to oil to natural gas. This affects fos ...

January 25, 2013 Greetings All: I once again find it hard to believe

... your needs and block out these often incorrect assessments of the future. As we enter the New Year, we enter a new earnings quarter. Alcoa was the first company to release earnings. On Jan 8th it did so and exceeded expectations, but in their press release, their words were more interesting than the ...

... your needs and block out these often incorrect assessments of the future. As we enter the New Year, we enter a new earnings quarter. Alcoa was the first company to release earnings. On Jan 8th it did so and exceeded expectations, but in their press release, their words were more interesting than the ...

Word - corporate

... success on the general economy and its impact on the industries in which we invest; the ability of our portfolio companies to achieve their objectives; our expected financings and investments; the adequacy of our cash resources and working capital; and the timing of cash flows, if any, from the oper ...

... success on the general economy and its impact on the industries in which we invest; the ability of our portfolio companies to achieve their objectives; our expected financings and investments; the adequacy of our cash resources and working capital; and the timing of cash flows, if any, from the oper ...

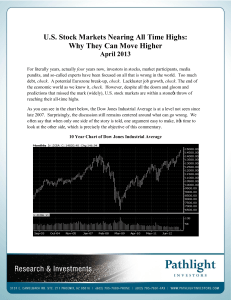

U.S. Stock Markets Nearing All Time Highs: Why They Can Move

... But let’s look at what actually happened. The European Central Bank backstopped its banking system. We are aware that European troubles still persist and that a real solution is not in place; however, we think those betting on an imminent Euro collapse are severely underestimating the power of monet ...

... But let’s look at what actually happened. The European Central Bank backstopped its banking system. We are aware that European troubles still persist and that a real solution is not in place; however, we think those betting on an imminent Euro collapse are severely underestimating the power of monet ...

Venture_Capital_ENG_

... not a sale is made) to “variable costs” (incurred only when a sale is made) Outsourcing – reduce capital needs Universities – expertise, pro bono work Suppliers – terms, loans, leads, etc. Factors – advance money, reduce collection risk ...

... not a sale is made) to “variable costs” (incurred only when a sale is made) Outsourcing – reduce capital needs Universities – expertise, pro bono work Suppliers – terms, loans, leads, etc. Factors – advance money, reduce collection risk ...

Landing in Investment Banking

... Overview of careers in a variety of areas of Finance and Investment Banking. The website includes information on careers, major players, job skills and requirements, and recommended books ...

... Overview of careers in a variety of areas of Finance and Investment Banking. The website includes information on careers, major players, job skills and requirements, and recommended books ...

Investment in Financial Capital

... Calculating the Return on an Investment Rate of Return is the total income you receive on an investment over a specific period of time divided by the original amount invested. ...

... Calculating the Return on an Investment Rate of Return is the total income you receive on an investment over a specific period of time divided by the original amount invested. ...

Notes 2

... Investor with longer horizon should allocate a larger fraction of their saving to risky assets than investor with shorter horizon. Over a long horizon, favorable short-term stock returns are likely to offset poor shortterm stock returns. ...

... Investor with longer horizon should allocate a larger fraction of their saving to risky assets than investor with shorter horizon. Over a long horizon, favorable short-term stock returns are likely to offset poor shortterm stock returns. ...

FIRST ASSET CANADIAN DIVIDEND LOW VOLATILITY INDEX ETF

... First Asset, a CI Financial Company, is a Canadian investment firm delivering a comprehensive suite of smart ETF solutions. Rooted in strong fundamentals, First Asset`s smart solutions strive to deliver better risk-adjusted returns than the broad market while helping investors achieve their personal ...

... First Asset, a CI Financial Company, is a Canadian investment firm delivering a comprehensive suite of smart ETF solutions. Rooted in strong fundamentals, First Asset`s smart solutions strive to deliver better risk-adjusted returns than the broad market while helping investors achieve their personal ...

Panelist Biographies

... Miller speaks and writes extensively about nonprofit capitalization and finance and has been published recently in The New York Times, The Financial Times, The Chronicle of Philanthropy, Community Wealth Vanguard, Stanford Social Innovation Review; The Nonprofit Quarterly; and Worth Magazine. Monona ...

... Miller speaks and writes extensively about nonprofit capitalization and finance and has been published recently in The New York Times, The Financial Times, The Chronicle of Philanthropy, Community Wealth Vanguard, Stanford Social Innovation Review; The Nonprofit Quarterly; and Worth Magazine. Monona ...

Franklin Growth Fund Fact Sheet - Franklin Templeton Investments

... Overall Morningstar Rating™ As of June 30, 2017 the fund’s Class A shares received a 4 star overall Morningstar Rating™, measuring risk-adjusted returns against 1277, 1152 and 803 U.S.-domiciled Large Growth funds over the 3-, 5- and 10- year periods, respectively. A fund’s overall rating is derived ...

... Overall Morningstar Rating™ As of June 30, 2017 the fund’s Class A shares received a 4 star overall Morningstar Rating™, measuring risk-adjusted returns against 1277, 1152 and 803 U.S.-domiciled Large Growth funds over the 3-, 5- and 10- year periods, respectively. A fund’s overall rating is derived ...

Investment Management Logic Workshop Facilitation

... Dr David Cochrane is the national leader for the Economics, Regulation and Policy group in Ernst & Young. David is an economist and an accountant with over 30 years’ practical experience providing economic, commercial and strategic advice to all levels of government and public sector agencies on maj ...

... Dr David Cochrane is the national leader for the Economics, Regulation and Policy group in Ernst & Young. David is an economist and an accountant with over 30 years’ practical experience providing economic, commercial and strategic advice to all levels of government and public sector agencies on maj ...

“International” Finance?

... Crossing, managers may pursue their own private interests at the expense of shareholders when they are not closely monitored. These calamities have painfully reinforced the importance of corporate governance i.e. the financial and legal framework for regulating the relationship between a firm’s mana ...

... Crossing, managers may pursue their own private interests at the expense of shareholders when they are not closely monitored. These calamities have painfully reinforced the importance of corporate governance i.e. the financial and legal framework for regulating the relationship between a firm’s mana ...