Warren Buffett: Why stocks beat gold and bonds

... spired by what the asset itself can produce — it will remain lifeless forever — but rather by the belief that others will desire it even more avidly in the future. The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper mone ...

... spired by what the asset itself can produce — it will remain lifeless forever — but rather by the belief that others will desire it even more avidly in the future. The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper mone ...

Investments in high-growth gold and silver mining companies

... production within the coming two years. Since companies are measured on their production capacities, those companies that are able to substantially expand their output over many years will be rewarded with out-performing valuations. The Timeless Precious Metal Fund received their license on 16 July ...

... production within the coming two years. Since companies are measured on their production capacities, those companies that are able to substantially expand their output over many years will be rewarded with out-performing valuations. The Timeless Precious Metal Fund received their license on 16 July ...

How are infrastructure stocks affected by rising interest rates?

... Looking at interest-rate sensitivity in Exhibit 2, electric utilities are at the top end of the spectrum due to their relatively bond-like cash flows and high dividend yields. However, high yields do not automatically equate to high rate sensitivity. For example, while ...

... Looking at interest-rate sensitivity in Exhibit 2, electric utilities are at the top end of the spectrum due to their relatively bond-like cash flows and high dividend yields. However, high yields do not automatically equate to high rate sensitivity. For example, while ...

CMAA Investment Policy - Construction Management Association of

... along with any recommended changes they deem necessary. ...

... along with any recommended changes they deem necessary. ...

Fall 2009 - Stonebrooke Asset Management Ltd

... vigilant and to protect capital. If is our belief market valuations are now too high. It is also our belief that a stronger period of economic growth is unlikely to be realized in the short term. It is difficult to justify a full portfolio position in stocks. Our investment objectives are to perform ...

... vigilant and to protect capital. If is our belief market valuations are now too high. It is also our belief that a stronger period of economic growth is unlikely to be realized in the short term. It is difficult to justify a full portfolio position in stocks. Our investment objectives are to perform ...

If You`re So Smart Why Aren`t You Rich

... saving and investment possibilities, understanding and evaluating the options can be confusing. The purpose of this lesson is to introduce students to some basic saving and investment options and vocabulary. Students apply The Decision Grid introduced in Lesson 2 to evaluate the trade-offs involved ...

... saving and investment possibilities, understanding and evaluating the options can be confusing. The purpose of this lesson is to introduce students to some basic saving and investment options and vocabulary. Students apply The Decision Grid introduced in Lesson 2 to evaluate the trade-offs involved ...

CCTrack April Investment Letter – Learning from the Rain Just as

... does not constitute an offer to sell securities or a solicitation of any offer to buy an interest in any security or investment managed by CCTrack Solutions, LLC (hereinafter “CCTrack”) or its affiliates or any other product or service to any person in any jurisdiction where such offer, solicitation ...

... does not constitute an offer to sell securities or a solicitation of any offer to buy an interest in any security or investment managed by CCTrack Solutions, LLC (hereinafter “CCTrack”) or its affiliates or any other product or service to any person in any jurisdiction where such offer, solicitation ...

Forms of Business - St Kevins College

... The syllabus states that students should be able to choose between alternatives and know about changing trends in ownership and structure. Choosing between alternatives. This would involve comparing advantages and disadvantages. The following headings could be used: 1. Formation. 2. Dissolution. 3. ...

... The syllabus states that students should be able to choose between alternatives and know about changing trends in ownership and structure. Choosing between alternatives. This would involve comparing advantages and disadvantages. The following headings could be used: 1. Formation. 2. Dissolution. 3. ...

Cross-Currents (2012-Dec) - Assante Wealth Management

... roofing tiles from us for a long time. Euro, peseta, they will still be buying roofing tiles and we will still be selling them. It will not stop us.” The exit cat is creeping out of the bag. Nordea, the largest bank in Finland, published a white paper recently outlining how a country, like Finland f ...

... roofing tiles from us for a long time. Euro, peseta, they will still be buying roofing tiles and we will still be selling them. It will not stop us.” The exit cat is creeping out of the bag. Nordea, the largest bank in Finland, published a white paper recently outlining how a country, like Finland f ...

Funds Investment Questionnaire

... help by providing you with the tools and products to help you align your financial goals with a strategy that makes the most sense. In determining your Personal Investment Profile, it’s important to understand the following basic principles for devising an investment strategy: your time horizon, you ...

... help by providing you with the tools and products to help you align your financial goals with a strategy that makes the most sense. In determining your Personal Investment Profile, it’s important to understand the following basic principles for devising an investment strategy: your time horizon, you ...

Bob Geldof`s private equity firm 8 Miles to make first investment

... vibrant exchanges across frontier economies, going beyond Africa and beyond agriculture, to transform not only commodity markets but also the livelihoods of millions of producers.” 8 Miles reached a $200m first close for its maiden fund in February last year. The fund, which is looking to raise abou ...

... vibrant exchanges across frontier economies, going beyond Africa and beyond agriculture, to transform not only commodity markets but also the livelihoods of millions of producers.” 8 Miles reached a $200m first close for its maiden fund in February last year. The fund, which is looking to raise abou ...

PDF article file - Krungsri Asset Management

... ETF (master fund) iShares Core S&P 500 ETF (master fund), which focuses to invest in stocks that are included in the S&P 500 Index. The master fund`s objective is to provide investment results that, before expenses, correspond to the price and yield of the S&P 500 Index. KF-HJPINDX allocates at leas ...

... ETF (master fund) iShares Core S&P 500 ETF (master fund), which focuses to invest in stocks that are included in the S&P 500 Index. The master fund`s objective is to provide investment results that, before expenses, correspond to the price and yield of the S&P 500 Index. KF-HJPINDX allocates at leas ...

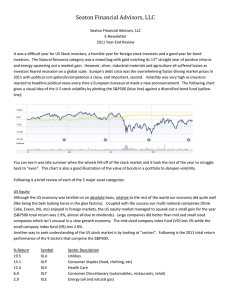

2011 - Seaton Financial Advisors, LLC

... opportunities after the dust has settled. For US equities, this means maintaining an allocation on the lower end of your strategic allocation range and favoring large companies with strong cash flows and a history of growing dividends. I continue to believe foreign equities remain too risky at least ...

... opportunities after the dust has settled. For US equities, this means maintaining an allocation on the lower end of your strategic allocation range and favoring large companies with strong cash flows and a history of growing dividends. I continue to believe foreign equities remain too risky at least ...

Mutual Fund Performance and Manager Style. J.L. Davis, FAJ, Jan

... included in the data set: 1. If a fund’s stated objective was growth, growth and income, maximum capital gains, small-cap growth, or aggressive growth; 2. Objective not listed but policy statement indicated that they primarily invested in common stocks. ...

... included in the data set: 1. If a fund’s stated objective was growth, growth and income, maximum capital gains, small-cap growth, or aggressive growth; 2. Objective not listed but policy statement indicated that they primarily invested in common stocks. ...

Fund Facts

... • Highest yielding of the major asset classes • Capital growth – good over time • Risk control – strong diversification benefits But • High specific risks • Expensive/illiquid • Invest via efficient funds ...

... • Highest yielding of the major asset classes • Capital growth – good over time • Risk control – strong diversification benefits But • High specific risks • Expensive/illiquid • Invest via efficient funds ...

Are infrastructure projects sufficiently structured

... For the EU to set up such a programme it is fundamentally a very good signal for the market. The biggest challenge facing the market is not, however, raising the financing. On the contrary – thanks to the historically low interest rates, there is plenty of external financing available. Finding the r ...

... For the EU to set up such a programme it is fundamentally a very good signal for the market. The biggest challenge facing the market is not, however, raising the financing. On the contrary – thanks to the historically low interest rates, there is plenty of external financing available. Finding the r ...

techteaching_lubin_presentation

... you would work for a company to help it find money to run the business, grow the business, make acquistions, plan for it's financial future and manage any cash on hand. ...

... you would work for a company to help it find money to run the business, grow the business, make acquistions, plan for it's financial future and manage any cash on hand. ...

tax loss selling strategies for closed-end fund investors

... } Sophisticated risk and portfolio analytics We work only for our clients, who have entrusted us with managing $4.89 trillion, earning BlackRock the distinction of being trusted to manage more money than any other investment firm in the world.* ...

... } Sophisticated risk and portfolio analytics We work only for our clients, who have entrusted us with managing $4.89 trillion, earning BlackRock the distinction of being trusted to manage more money than any other investment firm in the world.* ...