The Failure of US Neoliberalism: Financial Panic, Economic

... The Collapse of the Housing Bubble: Financial Panic of 2008 • The 2008 financial market panic – Bear Stearns collapsed March 2008. – Merrill Lynch on verge of collapse–acquired by Bank of America Sept. 14, 2008. ...

... The Collapse of the Housing Bubble: Financial Panic of 2008 • The 2008 financial market panic – Bear Stearns collapsed March 2008. – Merrill Lynch on verge of collapse–acquired by Bank of America Sept. 14, 2008. ...

Net investment income (Millions) 2006 2005 Public markets 4,870

... year earlier. The increase from the prior year is attributable to significantly higher returns in nonCanadian public equity markets in 2006. Private equity investments generated net investment income of $360 million, compared with $383 million last year. Although income was quite strong in 2006, the ...

... year earlier. The increase from the prior year is attributable to significantly higher returns in nonCanadian public equity markets in 2006. Private equity investments generated net investment income of $360 million, compared with $383 million last year. Although income was quite strong in 2006, the ...

Investment Guidelines

... • Where products with underlying capital guarantees are chosen, i.e. Structured Notes, these will be permitted up to a maximum of 66% of the portfolio’s values, with no more than one quarter of the portfolio to be subject to the same issuer / guarantor default risk • Where no such capital guarantee ...

... • Where products with underlying capital guarantees are chosen, i.e. Structured Notes, these will be permitted up to a maximum of 66% of the portfolio’s values, with no more than one quarter of the portfolio to be subject to the same issuer / guarantor default risk • Where no such capital guarantee ...

ICMA

... • While there are pension trusts that are fully funded with enough assets for current pension obligations, there also are legitimate concerns about the extent of underfunding, due primarily to the Great Recession and stock market declines. In most cases, a modest increase in contributions to take a ...

... • While there are pension trusts that are fully funded with enough assets for current pension obligations, there also are legitimate concerns about the extent of underfunding, due primarily to the Great Recession and stock market declines. In most cases, a modest increase in contributions to take a ...

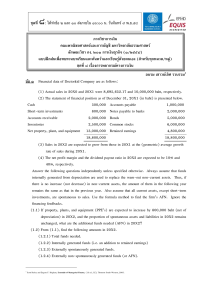

อบรม เชาวน์เลิศ รวบรวม1 ข้อ ๑ Financial data of Doctorkid Company

... percent in 20X1. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Shome typically uses no current liabilities other than accounts payable. Common stock amounted to THB425,000 in 20X0, and retained earnings were THB295,000. Shome plans.to sell new ...

... percent in 20X1. Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Shome typically uses no current liabilities other than accounts payable. Common stock amounted to THB425,000 in 20X0, and retained earnings were THB295,000. Shome plans.to sell new ...

Chapter_17_Cross_Border_Mergers_and_Acquisitions

... commonly made to discount rates applied to projected cash flows of target firms in emerging countries? Be specific. In your opinion is it more appropriate to adjust the discount rate for various perceived risks or to introduce risk by utilizing alternative scenarios? Explain your answer. ...

... commonly made to discount rates applied to projected cash flows of target firms in emerging countries? Be specific. In your opinion is it more appropriate to adjust the discount rate for various perceived risks or to introduce risk by utilizing alternative scenarios? Explain your answer. ...

Invesco Core Plus Bond Fund investment philosophy and process

... more than those of high quality bonds and can decline significantly over short time periods. Mortgage- and asset-backed securities are subject to prepayment or call risk, which is the risk that the borrower’s payments may be received earlier or later than expected due to changes in prepayment rate ...

... more than those of high quality bonds and can decline significantly over short time periods. Mortgage- and asset-backed securities are subject to prepayment or call risk, which is the risk that the borrower’s payments may be received earlier or later than expected due to changes in prepayment rate ...

Financial Ratios

... Mitsubishi’s acid test ratio has increased a bit further than what Dodge’s ratio resulting in it becoming less risky. ...

... Mitsubishi’s acid test ratio has increased a bit further than what Dodge’s ratio resulting in it becoming less risky. ...

PRIVATE EQUITY IN REAL ESTATE

... The term private equity refers to equity investment in growth oriented businesses, majority of which are unlisted. The capital is provided for medium to long term to enable such businesses to grow and expand. Private equity investors assume the role of active investors and work closely with their po ...

... The term private equity refers to equity investment in growth oriented businesses, majority of which are unlisted. The capital is provided for medium to long term to enable such businesses to grow and expand. Private equity investors assume the role of active investors and work closely with their po ...

Answers to end of chapter questions

... Financial markets are essential for both businesses and governments in raising capital to finance their operations. Both experience demands for funds that are not in balance with their actual funds on hand. Financial markets are absolutely essential to the functioning of our capitalistic economy. ...

... Financial markets are essential for both businesses and governments in raising capital to finance their operations. Both experience demands for funds that are not in balance with their actual funds on hand. Financial markets are absolutely essential to the functioning of our capitalistic economy. ...

Lecture 8

... currency which is different from the home currency of the investor. • The bond will NOT be offered in the capital market of the country whose currency it is denominated in. • Example: A Chinese company issuing a U.S. dollar denominated bond in Japan. This bond will NOT be issued in the United States ...

... currency which is different from the home currency of the investor. • The bond will NOT be offered in the capital market of the country whose currency it is denominated in. • Example: A Chinese company issuing a U.S. dollar denominated bond in Japan. This bond will NOT be issued in the United States ...

Alternative Minimum Tax Relief For Private Activity Bonds Must Be

... provisions would help airports move forward with projects that improve safety, security and capacity while stimulating the economy by creating much-needed jobs. Eliminate the AMT Penalty on Airport Private Activity Bonds: For airports the cost of auction and variable rate debt has spiked to unpreced ...

... provisions would help airports move forward with projects that improve safety, security and capacity while stimulating the economy by creating much-needed jobs. Eliminate the AMT Penalty on Airport Private Activity Bonds: For airports the cost of auction and variable rate debt has spiked to unpreced ...

5vcforum - Attica Ventures

... To date it has not been possible for TSMEDE to carry out its investment decision due to the reasons set out above. ...

... To date it has not been possible for TSMEDE to carry out its investment decision due to the reasons set out above. ...

EdgePoint Canadian Growth and Income Portfolio 3rd quarter, 2011

... You’ve invested your money with EdgePoint because you’re saving for something. Maybe it’s for retirement, or your children’s education or a new home. While this money is invested, every day the media pushes out what feels like a relentless stream of bad news about the global economy. This has create ...

... You’ve invested your money with EdgePoint because you’re saving for something. Maybe it’s for retirement, or your children’s education or a new home. While this money is invested, every day the media pushes out what feels like a relentless stream of bad news about the global economy. This has create ...

While investments always carry a certain amount of risk, the iStar

... While investments always carry a certain amount of risk, the iStar range of protected models are structured to help give you peace of mind. With the iStar range you can sacrifice a part of your return in order to protect your investments against a certain amount of downside risk. As an example, an i ...

... While investments always carry a certain amount of risk, the iStar range of protected models are structured to help give you peace of mind. With the iStar range you can sacrifice a part of your return in order to protect your investments against a certain amount of downside risk. As an example, an i ...

Russell Continental European Equity Fund

... The fund benchmark is the FTSE World Europe ex-UK Index. A Multi-Manager fund, suitable for institutional investors. Actively managed fund with 100% equity content. Aims for consistent performance with lower levels of risk. Managed from the point of view of a European institutional investor. Investm ...

... The fund benchmark is the FTSE World Europe ex-UK Index. A Multi-Manager fund, suitable for institutional investors. Actively managed fund with 100% equity content. Aims for consistent performance with lower levels of risk. Managed from the point of view of a European institutional investor. Investm ...

THEORETICAL MODEL

... issue is the choice between acquisition of the innovator versus purchase of a call option to acquire the innovator. While having the ability to delay investment is important, it is not the only element necessary for characterizing investments as options. Options must provide firms with a claim on fu ...

... issue is the choice between acquisition of the innovator versus purchase of a call option to acquire the innovator. While having the ability to delay investment is important, it is not the only element necessary for characterizing investments as options. Options must provide firms with a claim on fu ...

DESCRIPTION OF FINANCIAL INSTRUMENT TYPES AND

... derivative instruments are used, thus increasing the investment risk degree, but at the same time also increasing the expected profitability. Investments in hedge funds are subject to considerable fluctuations, and at the same time it ought to be taken into account that hedge funds may have certain ...

... derivative instruments are used, thus increasing the investment risk degree, but at the same time also increasing the expected profitability. Investments in hedge funds are subject to considerable fluctuations, and at the same time it ought to be taken into account that hedge funds may have certain ...

Infrastructure for Development - Africa

... 1 ‘Public sources’ includes government financing, ODA, and non-OECD financing (e.g., from China). Public-private split is assumed same as current spending and, as such, may understate the potential private sector contribution 2 Split of equity and debt is approximate, based on 30-40% equity (includi ...

... 1 ‘Public sources’ includes government financing, ODA, and non-OECD financing (e.g., from China). Public-private split is assumed same as current spending and, as such, may understate the potential private sector contribution 2 Split of equity and debt is approximate, based on 30-40% equity (includi ...

Derivatives

... Quantitative and fundamental valuation techniques Integration of convertible with other strategies within the firm ...

... Quantitative and fundamental valuation techniques Integration of convertible with other strategies within the firm ...

Slide 1

... The Government of Nigeria currently has double taxation agreements with several countries with respect to taxes paid in Nigeria when remitting funds into a counterpart country ...

... The Government of Nigeria currently has double taxation agreements with several countries with respect to taxes paid in Nigeria when remitting funds into a counterpart country ...

Venture Capital Market in Poland and Polish government activities

... There was no single transaction carried by VC in 2004 and the only investments in 2005 which amounted to 0,66 mln EUR applied to start-ups. At the same time (in 2005) total investments made by private equity (PE) including venture capital investments in Poland amounted to EUR 154 million, increased ...

... There was no single transaction carried by VC in 2004 and the only investments in 2005 which amounted to 0,66 mln EUR applied to start-ups. At the same time (in 2005) total investments made by private equity (PE) including venture capital investments in Poland amounted to EUR 154 million, increased ...

E4 - Art Durnev

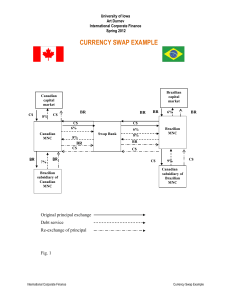

... has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing five-year bonds at 8%. The parent then would convert C$ to BR to pay the project cost. The Brazilia ...

... has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing five-year bonds at 8%. The parent then would convert C$ to BR to pay the project cost. The Brazilia ...

Investment Grade Corporate Strategy

... The index is defined as publicly issued U.S. corporate and or sub-advisor (fee-based ”advisor-sponsored” accounts). For specified foreign debentures and secured notes that meet certain strategies, NAM may also offer models to financial the specified maturity, liquidity, and quality requirements. adv ...

... The index is defined as publicly issued U.S. corporate and or sub-advisor (fee-based ”advisor-sponsored” accounts). For specified foreign debentures and secured notes that meet certain strategies, NAM may also offer models to financial the specified maturity, liquidity, and quality requirements. adv ...

High earnings growth on low interest rates

... The second derivatives for value revisions have improved. In Q3, the value drop was only SEK 284m or 0.4%. Also, the value is down 4.5% YTD. We believe it is too early to say that values have reached a trough, but the risk of a 5%+ value drop from the current level is limited. Overall vacancy rates ...

... The second derivatives for value revisions have improved. In Q3, the value drop was only SEK 284m or 0.4%. Also, the value is down 4.5% YTD. We believe it is too early to say that values have reached a trough, but the risk of a 5%+ value drop from the current level is limited. Overall vacancy rates ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.