* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Infrastructure for Development - Africa

History of private equity and venture capital wikipedia , lookup

Private money investing wikipedia , lookup

Socially responsible investing wikipedia , lookup

Private equity wikipedia , lookup

Private equity secondary market wikipedia , lookup

Financial crisis wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

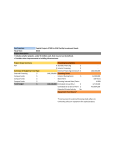

Leveraged buyout wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Investment fund wikipedia , lookup

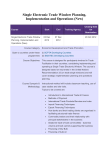

Infrastructure for Development Meeting the Challenge in Africa November 14th 2012 Dr Mattia Romani Senior Visiting Fellow Grantham Research Institute London School of Economics and Political Science and Director, Green Growth Planning and Implementation Global Green Growth Institute Contents ▪ Why infrastructure for Africa? The needs ▪ The gap ▪ The risk profile ▪ Potential solutions 1 Contents ▪ Why infrastructure for Africa? The needs ▪ The gap ▪ The risk profile ▪ Potential solutions 2 Why infrastructure for Africa? 1. Infrastructure contributed over half of Africa’s improved growth performance (1999-2005). IT contributed significantly more than any other structural policy in the continent. 2. Africa’s infrastructure lags well behind that of other developing countries, particularly in terms of pave roads and power generation. On the latter, it started from similar levels to South Asia in the 1960s, and is significantly behind now. 3. Africa’s infrastructure services are twice as expensive as elsewhere. This is true across tariffs for different types of infrastructure. This is particularly severe for power and water, where average tariffs are a multiple of tariffs in South Asia. 4. Today Africa faces a resource gap of approx $35bn/year. This includes taking into account the potential for efficiency improvements (as much as $20bn). This gap could double in the coming decade due to growth, as well as limited public funding and lack of private capital. Source OECD (2012) Romani, Bhattacharya and Stern (2012) 3 Global scale and nature of needs ▪ the incremental investment spending across emerging markets and developing countries is estimated at around $1 trillion a year more than what is currently spent. ▪ This excludes investment in maintenance and upkeep. Annual Infrastructure Spending in the Developing World ($tr, 2008) 1.8–2.3 0.2–0.3 0.8 - 0.9 Estimated current annual spending, 2008 Additional investments for climate mitigation and adaptation 1.6–2.0 Estimated annual infrastructure spending need, 2020 NOTES: $ trillion per year, (2008 real prices), capital investments only (excl. operation and maintenance costs) SOURCE: Current spending from Fay et al. (2010), “Infrastructure and Sustainable Development”; Estimated annual infrastructure spending need for 2020 calculated by taking the Fay et al (2010) estimate and assuming a 4% annual growth rate from 4 2013-20 Global scale and nature of needs ▪ ▪ East Asia will require up to 50% of the total – in the region of $2tn a year ▪ If maintenance was included, then the transport sector requirements would be much larger More than half is required for the power sector, across generation, transmission and distribution; water and land transportation also are very prominent sectors Annual infrastructure spending requirements in the developing world ($tr, 2008) 1.8–2.3 EAP 35-50% ECA 5-15% LAC MENA 10-15% 5-10% SA 20-25% SSA 5-15% Split by region 1.8–2.3 Transport 15-25% Telecomms 10-15% 1.8–2.3 Construction 90-95% Electricity 45-60% Water 15-30% Split by sector Preparation 5-10% Split by phase NOTES: $ trillion per year, (2008 real prices), capital investments only (excl. operation and maintenance costs) SOURCE: the by region, sector, and phase are authors’ own calculations taking ranges from Yepes (2008), MDB G20 working group on infrastructure (2011), and Foster and Briceño-Garmendia (2010); note the $200-300 billion annual requirement for sustainability is assumed split in the same ratio as the other 5 investments across regions, sectors and phases Contents ▪ Why infrastructure for Africa? The needs ▪ The gap ▪ The risk profile ▪ Potential solutions 6 The gap: existing institutions and financial architecture are not adequate to meet the needs ▪ Currently, an estimated $0.8-0.9 trillion is invested annually, mostly financed by public sector budgets, with lesser shares provided by the private sector and foreign countries through development finance ▪ Private sector investment heavily concentrated in the ICT sector ▪ 95% of all private finance is concentrated in middle-income countries (Estache 2010) ▪ Public-Private Investments concentrated in ICT, other sectors investments dried up during the crisis Private sector Other developing countries’ financing Concessional ODA MDB financing Government budgets 1,800–2,300 1,000-1,400 800–900 150-250 20-30 20-30 <20 500-600 Estimated split of current annual investment, 2008 Future annual investment needs, 2020 NOTE: Split by sources of finance are approximate ranges only and don’t add to exactly to the totals given for that reason SOURCE: Split of current sources of finance is a G-24 own assessment based on various estimates including 7 Estache (2010); MDB working group paper on infrastructure (2011); Macquarie (2009). Today’s need for capital expenditure in SSA is in the region of $60bn, likely to increase substantially over the next decade. SOURCE: WB and AFD (2010). Africa’s infrastructure: a time for transformation 8 The gap in SSA: current capital expenditure is $25bn, gap is $35bn ▪ ▪ ICT receives more than 2/3 of total private sector investment in Africa (7 out of 9bn) ▪ ODA and MDB financing are relatively small (3.8bn), other developing is not insignificant (2.4bn) The financial crisis reduced substantially the already small amounts going to other sectors Africa’s infrastructure capital investment, by source of finance (real $bn, 2006) 8.5 Private sector Other developing countries ‘ financing 7.0 0.5 Concessional ODA 1.4 4.7 MDB financing 4.6 Government budgets 0.2 0.5 0 0 4.5 0.9 2.4 1.3 Information & Communication Technology 0.2 0.3 1.1 Power Transport Water, Sanitation, Sewerage SOURCE: Adapted from Briceño-Garmendia, Smits, and Foster 2008, splitting ODA financing between 75% MDB financing and 25% concessional ODA based on Foster and Briceño-Garmendia (2010) 9 In SSA, the unmet need to support infrastructure development is for both debt and equity Estimated current infrastructure financing need for Sub-Saharan Africa $ billion per year ICT 60 7 25 7 5 Unmet capital need 9 Power 27 0 Transport WSS Irrigation 5 35 9 22 15 0 10 3 3 Annual need Current spend Total of $ 4-5 billion needed in equity for unmet infrastructure demand 22 13 ~1 Unmet need Unmet need that could be met by public sources1 Unmet need that could be met by private sources1 Estimated unmet need for project development equity2 3-4 Estimated unmet need for other equity2 8-9 Estimated unmet need for debt2 1 ‘Public sources’ includes government financing, ODA, and non-OECD financing (e.g., from China). Public-private split is assumed same as current spending and, as such, may understate the potential private sector contribution 2 Split of equity and debt is approximate, based on 30-40% equity (including c.5-10% of total for project development equity), 60-70% debt SOURCE: Adapted from Foster and Briceño-Garmendia (2010) 1 Can SSA afford its infrastructure? ▪ To meet needs, approximate payment of 0.40 dollars per day in Sub-Saharan Africa ▪ Equal to 35-50% of individual income where a significant proportion of the population lives off less than $1-2 per day ▪ If we add the additional cost of finance on this, the figures look even more worrying Source Climate Policy Initiative (2011). The Landscape of Climate Finance. ▪ Concessionality, intergenerational transfers of financial burden, cash transfers to enable people to pay fees, ODA to cover fees from donor countries are all potential mechanisms to alleviate this issue ▪ This adds a layer of political uncertainty on the sustainability of user fees which discourages investment: will subsidies be removed or reduced? Will the government have enough liquidity to pay out cash transfers for the foreseeable future? 11 In 2011 private investment in developing country infrastructure fell by more than half due to the financial crisis PPI in infrastructure, all developing countries, $ billion per year Others DAC I & II 180 160 140 -51% 120 100 80 60 40 20 0 1990 1995 2000 2005 2010 NOTE: 2011 data has been estimated by doubling H1 data for 2011 in PPI database. SOURCE: World Bank PPI database 12 Contents ▪ Why infrastructure for Africa? The needs ▪ The gap ▪ The risk profile ▪ Potential solutions 13 Experience shows that complex infrastructure projects are plagued by risks Under-estimate of; ▪ Environmental and safety concerns ▪ Construction costs ▪ Capital costs for development 140% higher ▪ Re-financing delayed and costly due to; – Governance structure leading to delay in turnaround plans – Debt holders did not want to take on more risk Budget overrun of over 80% ▪ Caused partly by design 6 month delay on delivery Financing and governance issues ▪ Economic loss > €10 billion Unforeseen ▪ Several major issues; disasters – Train stuck in tunnel – Major Fire in 2008 – Asylum seekers leading ▪ to loss of capacity Litigation with insurers still in process (> €250 mln) Demand forecasts 200% off SPV (MTL) separate from operating SPV (Eurotunnel) 18 months of unreliable service after opening ▪ Passenger volume forecast ▪ at >15 mln in 1st year, yet 10 mln mark not reached today Partly underestimated competition from ferries and airlines SOURCE: CIA Factbook, EIB, UN, National Resources Defense Council, Gates Foundation, WEF, McKinsey 14 Infrastructure finance underwrites risks along the life of the project Enabling environment Project development Financing Construction Early operations Mature operations Risks Demand / revenue ▪ ▪ ▪ ▪ ▪ Inaccurate revenue forecasts Change in environment e.g. customer requirements Unforeseen competition ▪ Market ▪ ▪ ▪ Fluctuation in interest and/or exchange rates Increase in input (e.g. fuel, commodities, labour) costs and availability High inflation Credit ▪ ▪ ▪ Financing terms Availability of financing Liquidity challenges Regulatory & legal ▪ ▪ ▪ ▪ Suboptimal regulation Change in regulation Contractual conditions/interpretation of contract Regulatory oversight & (stakeholder) conflict ▪ Operational ▪ ▪ ▪ ▪ ▪ ▪ Construction ▪ Political & external Inaccurate revenue forecasts Change in environment e.g. customer requirements Unforeseen competition ▪ ▪ ▪ ▪ Project-related external (strike, sabotage, theft) Rise in wages, taxes or labour-related costs Inefficiencies due to process or organisation Other counterparty and procurement risks (e.g., corruption) Incomplete / optimistic budget Lack of project / supplier control EPC quality, technological or equipment issues Incomplete planning & permitting status Political unrest, war, terrorism, corruption Natural disaster, outbreak of disease Nationalisation Embargoes, supply chain disruption 15 The risk profile: the nature of risk for infrastructure makes it a complex proposition for investment Preparation Construction Operation Description ▪ Developer/government organizes feasibility studies; models cash flows, finances; organizes contracts with utilities, operators and construction firms ▪ Construction firms build the project to specifications ▪ Separate operating company takes over operation and maintenance of the project Main risks ▪ ▪ ▪ Macroeconomic & political risks Technical risks to project viability Environmental and planning risks ▪ ▪ Macroeconomic & political risks Construction risks (e.g., of overrun, delay) ▪ ▪ ▪ ▪ Macroeconomic & political risks Demand / traffic risks Operating risks Policy risks (e.g., tariff changes) Cash flows (stylized) Source: AGF Report (2011) 16 The risk profile: the nature of risk for infrastructure makes it a complex proposition for investment Preparation Description Main risks Construction Operation investors in the early phases (greenfield) need▪ to consider ▪ Developer/government organizes ▪ Construction firms build the Separate operating company models project to specifications takessince over operation allfeasibility risks studies; across thecash different stages of the projecta and flows, finances; organizes maintenance of the project return on their investment will only be possible if the return contracts with utilities, operators and construction firms profile of the later stages of the project life are sufficiently ▪ Macroeconomic political risks & politicalrisks risks ▪ Macroeconomic & political risks attractive to &make up for▪ Macroeconomic the early stage ▪ Technical risks to project viability ▪ Construction risks (e.g., of ▪ Demand / traffic risks ▪ Environmental and planning risks overrun, delay) ▪ ▪ Operating risks Policy risks (e.g., tariff changes) Cash flows (stylized) Financing moments During project preparation and feasibility studies the developer seeks patient capital or, often, public funds Once project is ‘bankable’ the developer will seek equity investors and debt providers to finance the project Source: AGF Report (2011) Once construction is complete and started to operate project can be refinanced to reflect the changing risk profile 17 The upfront investment often relies on a very uncertain future cash flow Base Case + Volatility Base case + volatility 5.000.000 4.000.000 3.000.000 2.000.000 1.000.000 1 2 3 4 5 6 7 8 9 1 11 -1.000.000 -2.000.000 -3.000.000 SOURCE: McKinsey 18 Most recent and future projects are greenfield Already today, opportunities are mostly in greenfield… And the pipeline is even more skewed towards new construction projects Projects 2005-10 Average number p.a. Projects since 2010 Projected number 415 29% 61% Greenfield Mature1 Greenfield2 Mature3 ▪ The prospective increase in the scale of ‘greenfield’ investments that are required in developing countries – which typically have higher risks than ‘brownfield’ expansions - means that the risks of a substantial bottleneck where financiers are not ready to invest are greater. 1 Includes Secondary stage and Brownfield 2 Includes Greenfield (112) and Expansion (12) 3 Includes Asset Acquisition, M&A, Brownfield, Privatisation SOURCE: Preqin, Infrastructure Journal, Public Works Financing, Infrastructure Investor 19 The risk profile: constraints to matching demand of investment with supply of available financial instruments ▪ Infrastructure investment projects in developing countries have high risks across most of the above categories ▪ Macroeconomic and political risk in developing countries compounds with high risks of early phases of investment ▪ This problem is further compounded by the fact that many potential financiers have few if any benchmark projects to serve as comparison for pricing these risks. Difficult to match project needs and financial archetypes, making investment at scale unfeasible 20 Contents ▪ Why infrastructure for Africa? The needs ▪ The gap ▪ The risk profile ▪ Potential solutions 21 The shift in wealth has implications for asset allocations: Most emerging market investors have very low allocations to equities Asset allocation by investor, 2010 %; $ trillion, 2010 exchange rates Traditional investors 100% = Other Cash and deposits Fixed income 43.6 6 28.3 5 19 Emerging investors 4.3 6 15 39 29 45 2.7 3 3.5 6.5 8 9 65 54 Compound annual growth rate, 2000–10 % 4 5.9 10 76 74 90 13 52 34 14 Western Sovereign Europe wealth pensions funds and private investors 3 24 32 18 US pensions and private investors 1.8 54 29 23 Equities 3.6 0 15 Developed MENA Asian private private investors investors 9 23 14 Latin American private investors 16 5 12 13 Chinese private investors Emerging Asian private investors 16 11 14 Emerging market central banks 22 1 Includes Singapore, Hong Kong, Korea, and Taiwan. Excludes Japan, where private investors have 10% in equities 22 The BRICS are now playing a larger role in infrastructure financing and are taking a new approach China is now a larger contributor to infrastructure financing in Africa than the World Bank Infrastructure financing in Africa $ billion ▪ World Bank Group China 9.0 8.1 ▪ ▪ 3.3 2.5 ▪ 1.9 1.3 2004 2007 China and Gulf countries offer cheap capital and turnkey solutions conditional to geo political objectives rather economics Chinese commitments are 15% of total African infrastructure investment Chinese commitments including non-infrastructure sectors are even higher at $15.9bn in 2010 Two-thirds of Chinese infrastructure financing is in energy and transport 2010 SOURCE: Infrastructure Consortium for Africa 2010 annual report; ICA 2010 annual report; World Bank, “Building bridges: China’s growing role as infrastructure financier for sub-Saharan Africa” (2008); World Bank Group, Infrastructure Strategy Update paper (2011) 23 Potential solutions: reforming IFIs and need for new institutions ① Innovative public finance instruments (project preparation funds, political risk guarantees, etc) FINANCE ② Complementing private finance instruments (both debt and equity) ③ Financial solutions that combine these public and private instruments effectively at low transactional cost ④ Large data-banks providing benchmark for assessing risk-return of projects PROJECTS ⑤ Governance of public money that allows a more efficient use of scarce public finance resources ⑥ Project preparation facilities that support countries in creating a healthy pipeline of investable projects ⑦ Mechanisms to guarantee revenues from user fees at the end of the investment cycle Current IFIs : • ensure that current money made available by members is leveraged more efficiently • Change governance to reflect both new geopolitics and current risk frameworks New institution(s): • Institutions that reflect in their governance, capital and instruments the new economic and financial reality of the world and use resources from emerging and developing countries efficiently ⑧ Excellent data rooms on projects to facilitate assessments of risk and returns for private investors 24 Rationale for a new a bank fit for purpose: modern in its mandate, instruments and ownership o Resolving the infrastructure challenge for the next 2 decades means laying the foundations for global growth. o Most greenfield infrastructure projects in developing and emerging markets face upfront risks that current market players are unable to take on. A new institution could have the scale of capital, the portfolio of projects and the instruments required to take on this risk and unlock private investment. o Public finances under pressure and domestic financial systems relatively young. New bank can help deepen domestic financial markets, channel savings to profitable investment and reduce exposure to currency risk, particularly with respect to $US/Euro o BRICS keen to expand their commercial and strategic links with resource rich countries, mostly pursuing this through bilateral deals. A new bank could help achieve such objective with less financial and political exposure with a multi-lateral approach o Existing IFIs not in a position to take on scale (due to institutional limits and governance) and nature (long term financing, large proportion of equity) although can be good partners o Project preparation is not happening at the scale and quality required which results in a poor pipeline of bankable projects. A successful new institution needs to develop world-class, global project preparation facilities over time Source Romani and Stern (2011) 25 Proposed G24-GGGI work program in collaboration with other partners 1. Deepening the assessment of infrastructure investment needs – by region, country, sector 2. Risk analysis framework: assessing the risk return profiles of projects across regions, sectors, phases 3. Evaluating experience on existing financial instruments: what works and what doesn’t 4. Assessing the constraints on the development of a strong pipeline of investable projects across different sectors, countries, regions; explore experience on project preparation facilities and technical assistance 5. Assessing the existing financial architecture and its delivery: 1.Public finance (budgets) 2.MDBs and RDBs 3.National Development Banks 4.Private finance 6. Considerations and implications on developing new institutional arrangements: range of functions, instruments, membership, governance, capitalization, etc Source Romani and Stern (2011) 26