Exploiting Inefficiencies Across Asset Classes, Globally

... First, at the underlying fund level there is the inefficiencies within the underlying asset class in which the CEF invests. The extent of these inefficiencies will vary via asset class. For example, inefficiencies are likely to be small in a US Large Cap Equity but may be much larger in say European ...

... First, at the underlying fund level there is the inefficiencies within the underlying asset class in which the CEF invests. The extent of these inefficiencies will vary via asset class. For example, inefficiencies are likely to be small in a US Large Cap Equity but may be much larger in say European ...

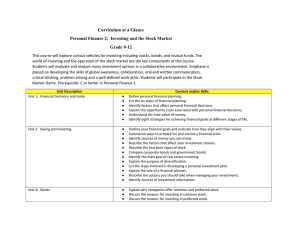

Curriculum at a Glance Personal Finance 2: Investing and the Stock

... Outline your financial goals and evaluate how they align with their values. Summarize ways to prepare for and survive a financial crisis. Identify sources of money you can invest. Describe the factors that affect your investment choices. Describe the two basic types of stock. Compare corporate bonds ...

... Outline your financial goals and evaluate how they align with their values. Summarize ways to prepare for and survive a financial crisis. Identify sources of money you can invest. Describe the factors that affect your investment choices. Describe the two basic types of stock. Compare corporate bonds ...

1 climate assets fund quarterly update - q1 2017

... The fund’s c. 5% allocation to gold was a strong positive contributor to performance as increased global inflation expectations lifted the spot gold price. References to specific securities are not recommendations to buy or sell those securities. ...

... The fund’s c. 5% allocation to gold was a strong positive contributor to performance as increased global inflation expectations lifted the spot gold price. References to specific securities are not recommendations to buy or sell those securities. ...

Templeton Latin America Fund

... the relevant Key Investor Information Document, accompanied by the latest available audited annual report and the latest semi-annual report if published thereafter. The value of shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount i ...

... the relevant Key Investor Information Document, accompanied by the latest available audited annual report and the latest semi-annual report if published thereafter. The value of shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount i ...

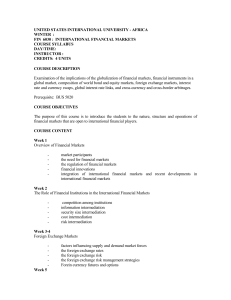

united states international university - africa

... lending and capital flows in the 1970s the debt crisis debt crisis and the policy response with hindsight central banks and international cooperation, the European monetary system international coordination ...

... lending and capital flows in the 1970s the debt crisis debt crisis and the policy response with hindsight central banks and international cooperation, the European monetary system international coordination ...

Wharton Finance - University of Pennsylvania

... Finance), FNCE 101 (Monetary Economics and the Global Economy), and any other FOUR courses offered by the Finance Department, of which only one unit may be FNCE 399, Supervised Study. The student must earn the equivalent of two B and two C grades (2.5 GPA) in the four courses counted toward the conc ...

... Finance), FNCE 101 (Monetary Economics and the Global Economy), and any other FOUR courses offered by the Finance Department, of which only one unit may be FNCE 399, Supervised Study. The student must earn the equivalent of two B and two C grades (2.5 GPA) in the four courses counted toward the conc ...

financial crisis timeline

... back all business accounts (non-interest-bearing checking accounts) in the U.S. ...

... back all business accounts (non-interest-bearing checking accounts) in the U.S. ...

This “High Alpha” REIT Is Poised To Profit Much of the power of the

... good execution and pricing, utilizing proceeds to fund new investments and significantly de-lever the company. As former CEO Tim Mihalick referenced on the previous earnings call, “Long-term, we believe these efforts to focus our Company on multifamily will have significant benefits, including great ...

... good execution and pricing, utilizing proceeds to fund new investments and significantly de-lever the company. As former CEO Tim Mihalick referenced on the previous earnings call, “Long-term, we believe these efforts to focus our Company on multifamily will have significant benefits, including great ...

The Market Participant Acquisition Premium

... significant MPAP benefit, but where there is robust bidder interest, the price may reflect a higher portion of the available benefits of the MPAP ...

... significant MPAP benefit, but where there is robust bidder interest, the price may reflect a higher portion of the available benefits of the MPAP ...

June - sibstc

... conditional, made in new or untried concepts, promoted by a technically or professionally qualified entrepreneur. VC can also include managerial and technical expertise. Most VC comes from a group of wealthy investors, investment banks and other financial institutions that pool such investments or p ...

... conditional, made in new or untried concepts, promoted by a technically or professionally qualified entrepreneur. VC can also include managerial and technical expertise. Most VC comes from a group of wealthy investors, investment banks and other financial institutions that pool such investments or p ...

Introduction of Mega Solar Project Bond Trust

... 1. Access to capital markets for long tenor fixed-rate debt (20 years max.) 2. Complete non-recourse financing Rated securitized product provides access to the Japanese capital markets, the second largest in the world An asset backed -securitization approach of the Project Bond enables the struc ...

... 1. Access to capital markets for long tenor fixed-rate debt (20 years max.) 2. Complete non-recourse financing Rated securitized product provides access to the Japanese capital markets, the second largest in the world An asset backed -securitization approach of the Project Bond enables the struc ...

Chapter 2

... • Foreign Bonds: sold in a foreign country and denominated in that country’s currency • Eurobond: bond denominated in a currency other than that of the country in which it is sold ...

... • Foreign Bonds: sold in a foreign country and denominated in that country’s currency • Eurobond: bond denominated in a currency other than that of the country in which it is sold ...

global fixed income core plus bond

... *Experience includes investment management activities of predecessor firms beginning in the investment department of Principal Life Insurance Company. The information in this document has been derived from sources believed to be accurate as of 31 December 2015. Information derived from sources other ...

... *Experience includes investment management activities of predecessor firms beginning in the investment department of Principal Life Insurance Company. The information in this document has been derived from sources believed to be accurate as of 31 December 2015. Information derived from sources other ...

Finance Career Information

... companies or potential investors. ▫ Many financial analysts work at large financial institutions based in New York City or other major financial centers. ▫ In 2012, about 45 percent of financial analysts worked in finance and insurance industries. They worked primarily for security and commodity bro ...

... companies or potential investors. ▫ Many financial analysts work at large financial institutions based in New York City or other major financial centers. ▫ In 2012, about 45 percent of financial analysts worked in finance and insurance industries. They worked primarily for security and commodity bro ...

John Hancock International Value ADR Strategy

... and “Sovereign Asset Management.” We also may further describe each of these brands as “a division of Manulife Asset Management (US) LLC.” These are brand names only, not entities separate from Manulife AM (US). Certain of these companies within Manulife Financial may provide services to John Hancoc ...

... and “Sovereign Asset Management.” We also may further describe each of these brands as “a division of Manulife Asset Management (US) LLC.” These are brand names only, not entities separate from Manulife AM (US). Certain of these companies within Manulife Financial may provide services to John Hancoc ...

ECON330/FSMA 330 – FINANCIAL MARKETS AND INSTITUTIONS BUSINESS DEPARTMENT

... This course provides an understanding of financial markets and financial institutions that operate within the financial markets. It introduces the financial markets where flow of funds occur through financial markets instruments, such as bonds, money markets, mortgage markets, foreign exchanges, sto ...

... This course provides an understanding of financial markets and financial institutions that operate within the financial markets. It introduces the financial markets where flow of funds occur through financial markets instruments, such as bonds, money markets, mortgage markets, foreign exchanges, sto ...

By Robert C Merton, John and Natty McArthur

... into the archaic trading pits just under a decade later, trading costs have plummeted and derivatives trading volumes have escalated dramatically. The major advantages of using derivatives are that they are efficient in transferring huge amounts of risk; they can be customised, they are reversible a ...

... into the archaic trading pits just under a decade later, trading costs have plummeted and derivatives trading volumes have escalated dramatically. The major advantages of using derivatives are that they are efficient in transferring huge amounts of risk; they can be customised, they are reversible a ...

ESCA New Investment Management Regulation Webinar Natalie Boyd

... Applies to all firms operating within and outside the UAE, including UAE free zones (query application to new Abu Dhabi free zone) Definition of 'investment management activities' and 'securities' is broadly interpreted ...

... Applies to all firms operating within and outside the UAE, including UAE free zones (query application to new Abu Dhabi free zone) Definition of 'investment management activities' and 'securities' is broadly interpreted ...

What do Millennials Want From A Realtor

... friend or relative. “As this is probably their first venture into the real estate market, a recommendation from mom or dad, or perhaps a good friend who just went through the process is going to carry more weight than any online reviews,” says [last name of your ...

... friend or relative. “As this is probably their first venture into the real estate market, a recommendation from mom or dad, or perhaps a good friend who just went through the process is going to carry more weight than any online reviews,” says [last name of your ...

The Venture Capital Industry`s Crisis: A Problem of

... report offers evidence that small funds tend to offer bigger returns than larger funds9. This suggests that VC firms with superior talent and tight focus offer attractive returns. Exogenous events may create opportunity but good management is still needed for the harvest. Therefore it appears reason ...

... report offers evidence that small funds tend to offer bigger returns than larger funds9. This suggests that VC firms with superior talent and tight focus offer attractive returns. Exogenous events may create opportunity but good management is still needed for the harvest. Therefore it appears reason ...

treasurer- manager responsible for financing, cash management

... owners. It is based on articles of incorporation that set out the purpose of the business, how many shares can be issued, the number of directors to be appointed, and so on. These articles must conform to the laws of the state in which the business is incorporated. The corporation is owned by its st ...

... owners. It is based on articles of incorporation that set out the purpose of the business, how many shares can be issued, the number of directors to be appointed, and so on. These articles must conform to the laws of the state in which the business is incorporated. The corporation is owned by its st ...

2017 1Q LCIV - Todd Asset Management Large Cap Intrinsic Value

... composite was 0.50%. Actual investment advisory fees incurred by clients may vary. The currency used to calculate and express performance is U.S. dollars. All cash reserves and equivalents have been included in the performance. The composite performance has been compared to the following benchmarks. ...

... composite was 0.50%. Actual investment advisory fees incurred by clients may vary. The currency used to calculate and express performance is U.S. dollars. All cash reserves and equivalents have been included in the performance. The composite performance has been compared to the following benchmarks. ...

3rd Quarter 2016 Barometer Capital Management Inc. provides the

... Barometer Capital Management Inc. manages investment portfolios for private investors, foundations and endowments. Barometer offers a unique investment solution through its suite of private pools and prospectus fund offerings. Barometer’s business was formed in 2001. In 2006, the business became Bar ...

... Barometer Capital Management Inc. manages investment portfolios for private investors, foundations and endowments. Barometer offers a unique investment solution through its suite of private pools and prospectus fund offerings. Barometer’s business was formed in 2001. In 2006, the business became Bar ...

Slides

... Merchant Processor: Performs credit check on merchant, sells or leases a terminal, establishes a connection between merchant and the Credit Card processor Credit Card Association: Establishes rules and guidelines for card issuance and acceptance, markets brand name and various products. North Americ ...

... Merchant Processor: Performs credit check on merchant, sells or leases a terminal, establishes a connection between merchant and the Credit Card processor Credit Card Association: Establishes rules and guidelines for card issuance and acceptance, markets brand name and various products. North Americ ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.