What is a Chartered Financial Planner?

... the UK. An adviser who has achieved the level of Chartered Financial Planner has demonstrated both a high level of commitment to their profession through exam qualification and a high level of technical ability and experience. In order to achieve Chartered Financial Planner status an individual must ...

... the UK. An adviser who has achieved the level of Chartered Financial Planner has demonstrated both a high level of commitment to their profession through exam qualification and a high level of technical ability and experience. In order to achieve Chartered Financial Planner status an individual must ...

The notion and types of exchange rate

... BP deficit ER depreciation relative decrease of the domestic prices decrease of imports, increase of exports the equilibrium is reinstated BP surplus ER appreciation relative growth of domestic prices decrease of exports, increase of imports the equilibrium is reinstated ...

... BP deficit ER depreciation relative decrease of the domestic prices decrease of imports, increase of exports the equilibrium is reinstated BP surplus ER appreciation relative growth of domestic prices decrease of exports, increase of imports the equilibrium is reinstated ...

Chapter 1

... for individuals, but not for institutions such as pension funds and life insurance companies. for institutions such as pension funds and life insurance companies, but not for individuals. for individuals and institutions, depending upon their time horizons and investment goals. for investors in debt ...

... for individuals, but not for institutions such as pension funds and life insurance companies. for institutions such as pension funds and life insurance companies, but not for individuals. for individuals and institutions, depending upon their time horizons and investment goals. for investors in debt ...

File

... – Use of a temporary surplus of funds by banks or businesses – Commercial paper—short-term liabilities of prime business firms and finance companies • Bank Certificates of Deposits—liabilities of issuing bank, interest bearing to corporations that hold them • U.S. Treasury bills—short-term debts of ...

... – Use of a temporary surplus of funds by banks or businesses – Commercial paper—short-term liabilities of prime business firms and finance companies • Bank Certificates of Deposits—liabilities of issuing bank, interest bearing to corporations that hold them • U.S. Treasury bills—short-term debts of ...

Yield Curve Targeting

... September 1950: Fed ‘compelled’ to buy most of US Treasury’s autumn refunding at 1.25% March 1951: Fed-Treasury Accord ended direct long-term yield targets at 2.5% “The Treasury and the Federal Reserve System have reached full accord with respect to debt management and monetary policies to be pursue ...

... September 1950: Fed ‘compelled’ to buy most of US Treasury’s autumn refunding at 1.25% March 1951: Fed-Treasury Accord ended direct long-term yield targets at 2.5% “The Treasury and the Federal Reserve System have reached full accord with respect to debt management and monetary policies to be pursue ...

Emerging Markets Local Currency

... any investment or strategy is suitable or appropriate to you. The value of any investment may fluctuate. Past performance is not indicative of future results. Specific sectors mentioned do not represent all sectors in which AUIM seeks investments. It should not be assumed that investments of securit ...

... any investment or strategy is suitable or appropriate to you. The value of any investment may fluctuate. Past performance is not indicative of future results. Specific sectors mentioned do not represent all sectors in which AUIM seeks investments. It should not be assumed that investments of securit ...

Movie-theater company gets two thumbs down

... firms. And because Regal tends to build big complexes -- where it can leverage labor costs over many screens -- the company has the highest operating margins in the industry. Next comes the yield, which now stands north of 12%, a nice cushion against any continued price erosion and particularly attr ...

... firms. And because Regal tends to build big complexes -- where it can leverage labor costs over many screens -- the company has the highest operating margins in the industry. Next comes the yield, which now stands north of 12%, a nice cushion against any continued price erosion and particularly attr ...

Securities Markets Primary Versus Secondary Markets How

... borrow up to 50% of the stock value Set by the Fed Maintenance margin: margin: minimum amount equity in trading can be before additional funds must be put into the account Margin call: call: notification from broker you must put up additional funds ...

... borrow up to 50% of the stock value Set by the Fed Maintenance margin: margin: minimum amount equity in trading can be before additional funds must be put into the account Margin call: call: notification from broker you must put up additional funds ...

Investment Guidelines - Cloudsplitter Foundation

... annual distributions of the Foundation while allowing for the long-term growth of the endowment net of management fees. Total return is defined as the aggregate investment return, which includes a combination of current income plus the net impact of price changes. Income return is defined as the act ...

... annual distributions of the Foundation while allowing for the long-term growth of the endowment net of management fees. Total return is defined as the aggregate investment return, which includes a combination of current income plus the net impact of price changes. Income return is defined as the act ...

- Schroders

... have become convinced that the diversification properties of commodities warrant their inclusion as a new asset class. Their lack of cashflow, valuation metrics or any other traditional metrics have proven no barrier. The debate on whether trading in commodities has an important impact on pricing is ...

... have become convinced that the diversification properties of commodities warrant their inclusion as a new asset class. Their lack of cashflow, valuation metrics or any other traditional metrics have proven no barrier. The debate on whether trading in commodities has an important impact on pricing is ...

The Pros and Cons of Going Public

... 2. Less control — As a public company, you will have much less freedom to make your own business decisions and run the company in your own way. Instead, you will answer to a whole new set of stakeholders, including your public shareholders, institutional investors, a board of directors, brokerage fi ...

... 2. Less control — As a public company, you will have much less freedom to make your own business decisions and run the company in your own way. Instead, you will answer to a whole new set of stakeholders, including your public shareholders, institutional investors, a board of directors, brokerage fi ...

Absolute and Relative Measures Explaining Consumption Risk

... model. The benchmark model predicts that investors maximize their risk-return trade-off by investing in identical international portfolios, which resemble the world portfolio. In our analysis, we capture the idea of the I-CAPM with two measures. First, we define an absolute home bias measure that sp ...

... model. The benchmark model predicts that investors maximize their risk-return trade-off by investing in identical international portfolios, which resemble the world portfolio. In our analysis, we capture the idea of the I-CAPM with two measures. First, we define an absolute home bias measure that sp ...

Indexed Emerging Markets Equity Fund

... may fall as well as rise in value. The performance of contributions in any given year will depend on both the frequency and the duration of the contributions. Income may fluctuate in accordance with the market conditions and taxation arrangements. Simulated performance may not be a reliable guide to ...

... may fall as well as rise in value. The performance of contributions in any given year will depend on both the frequency and the duration of the contributions. Income may fluctuate in accordance with the market conditions and taxation arrangements. Simulated performance may not be a reliable guide to ...

External Sector

... of less than 10 percent. Individuals and legal entities holding different types of claims, other than equity capital participation, on non-resident enterprises are also categorized as portfolio investors. Financial Derivatives item was subcategory of Portfolio Investments before, but with the very i ...

... of less than 10 percent. Individuals and legal entities holding different types of claims, other than equity capital participation, on non-resident enterprises are also categorized as portfolio investors. Financial Derivatives item was subcategory of Portfolio Investments before, but with the very i ...

internationalizing the entrepreneurial firm

... 1. Define entrepreneurship, entrepreneurs, and entrepreneurial firms 2. Understand how institutions and sources affect entrepreneurship 3. Identify the three characteristics of a growing entrepreneurial firm 4. Differentiate international strategies that enter foreign markets and that stay in domest ...

... 1. Define entrepreneurship, entrepreneurs, and entrepreneurial firms 2. Understand how institutions and sources affect entrepreneurship 3. Identify the three characteristics of a growing entrepreneurial firm 4. Differentiate international strategies that enter foreign markets and that stay in domest ...

INTRODUCTION TO

... of Fund schemes create conflict of interest. Henceforth, AMCs shall not enter into any revenue sharing arrangement with the underlying funds in any manner and shall not receive any revenue by whatever means from the underlying fund. These guidelines set by the SEBI will lead to greater transparenc ...

... of Fund schemes create conflict of interest. Henceforth, AMCs shall not enter into any revenue sharing arrangement with the underlying funds in any manner and shall not receive any revenue by whatever means from the underlying fund. These guidelines set by the SEBI will lead to greater transparenc ...

Investment Insights

... but experienced a slight decline in the first quarter of 2015. Total sales volume for the first quarter totaled approximately $151 million, a 9.0 percent decrease compared to the same time last year. There were 29 multi-residential properties that traded over $1 million this quarter, representing an ...

... but experienced a slight decline in the first quarter of 2015. Total sales volume for the first quarter totaled approximately $151 million, a 9.0 percent decrease compared to the same time last year. There were 29 multi-residential properties that traded over $1 million this quarter, representing an ...

85 Weighted average assumptions used to determine net periodic

... yet been recognized in net periodic pension cost: unrecognized prior service credits of $2 million ($1 million, net of tax) and unrecognized actuarial losses of approximately $1.0 billion ($649 million, net of tax). The unrecognized losses and prior service credits, net, is calculated as the differe ...

... yet been recognized in net periodic pension cost: unrecognized prior service credits of $2 million ($1 million, net of tax) and unrecognized actuarial losses of approximately $1.0 billion ($649 million, net of tax). The unrecognized losses and prior service credits, net, is calculated as the differe ...

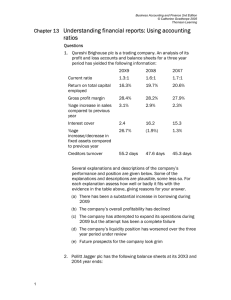

Chapter 13 Understanding financial reports: Using accounting ratios

... benefits of the increased investment have not yet emerged in the form of additional profits. (c) The company has attempted to expand its operations during 20X9 but the attempt has been a complete failure The company’s investment in fixed assets has increased substantially during 20X9 so the first pa ...

... benefits of the increased investment have not yet emerged in the form of additional profits. (c) The company has attempted to expand its operations during 20X9 but the attempt has been a complete failure The company’s investment in fixed assets has increased substantially during 20X9 so the first pa ...

Columbia Marsico International Opportunities Fund

... Australia and the Far East. The index represents the growth half of the market capitalizations of each country index, determined by price/book value (P/BV), from the standard MSCI country indices. The MSCI EAFE Value Index captures large and mid cap securities exhibiting overall value style characte ...

... Australia and the Far East. The index represents the growth half of the market capitalizations of each country index, determined by price/book value (P/BV), from the standard MSCI country indices. The MSCI EAFE Value Index captures large and mid cap securities exhibiting overall value style characte ...

bastion worldwide flexible fund of funds bastion

... commissions is available on request from company/scheme. Commission and incentives may be paid and if so, are included in the overall cost. This fund may be closed to new investors. A fund of funds collective investments may invest in other collective investments, which levy their own charges, which ...

... commissions is available on request from company/scheme. Commission and incentives may be paid and if so, are included in the overall cost. This fund may be closed to new investors. A fund of funds collective investments may invest in other collective investments, which levy their own charges, which ...

CR 37/2014 Title: Capital Increase and Private Offering of Shares to

... 14 April 2014 the Issuer's Management Board adopted Resolution No. 1 on the increase of the Company's share capital through the issue of series L shares while excluding subscription rights of the existing shareholders in whole and on the amendment of the Company's Articles of Association. In its Res ...

... 14 April 2014 the Issuer's Management Board adopted Resolution No. 1 on the increase of the Company's share capital through the issue of series L shares while excluding subscription rights of the existing shareholders in whole and on the amendment of the Company's Articles of Association. In its Res ...

infrastructure as an alternative strategy

... creating a single purpose investment vehicle • Invest as one “large” pool of consolidated capital ...

... creating a single purpose investment vehicle • Invest as one “large” pool of consolidated capital ...

Northern Trust Offers Innovative Historical Corporate Actions

... SCORPEO is an independent financial service company which captures and delivers back to its clients any intrinsic value that may be embedded within a corporate event. Northern Trust’s corporate actions teams handle more than 80,000 corporate action events a year across 105 global securities markets ...

... SCORPEO is an independent financial service company which captures and delivers back to its clients any intrinsic value that may be embedded within a corporate event. Northern Trust’s corporate actions teams handle more than 80,000 corporate action events a year across 105 global securities markets ...

chapter 2 - CSUN.edu

... Accounting information is also relevant to business decisions because it confirms or corrects prior expectations. Financial statements both help predict future events and confirm or correct prior expectations about the financial health of the company. In order to be relevant accounting information ...

... Accounting information is also relevant to business decisions because it confirms or corrects prior expectations. Financial statements both help predict future events and confirm or correct prior expectations about the financial health of the company. In order to be relevant accounting information ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.