Ch 8 - Finance

... big) then first reduce short-term debt to zero. If assets are still too small, then instead of sticking the excess cash in short-term investments, pay out the excess as a dividend. So, instead of accumulating marketable securities when it has excess cash, the firm will pay dividends. DES Chapter 8 ...

... big) then first reduce short-term debt to zero. If assets are still too small, then instead of sticking the excess cash in short-term investments, pay out the excess as a dividend. So, instead of accumulating marketable securities when it has excess cash, the firm will pay dividends. DES Chapter 8 ...

Investments

... Financial markets also allow the separation of ownership from management and increase the utilization of the assets of the economy. For example , if some stockholders decide they no longer wish to hold shares in the firm, they can sell their assets to other investors, with no impact on the managemen ...

... Financial markets also allow the separation of ownership from management and increase the utilization of the assets of the economy. For example , if some stockholders decide they no longer wish to hold shares in the firm, they can sell their assets to other investors, with no impact on the managemen ...

7th International Conference on Accounting and Finance (ICAF)

... ISERD - 7th International Conference on Accounting and Finance (ICAF) ISERD – 7th International Conference on Accounting and Finance (ICAF) aimed at presenting current research being carried out in that area and scheduled to be held on January 13th, 2016 in Seoul, South Korea. The idea of the confer ...

... ISERD - 7th International Conference on Accounting and Finance (ICAF) ISERD – 7th International Conference on Accounting and Finance (ICAF) aimed at presenting current research being carried out in that area and scheduled to be held on January 13th, 2016 in Seoul, South Korea. The idea of the confer ...

Frequently Asked Questions:

... analysis seeks to identify profitable companies with superior environmental management capabilities, best-of-class relationships with employees and communities, and outstanding corporate governance. Responsible investors generally seek the lower risk and higher returns over time that such companies ...

... analysis seeks to identify profitable companies with superior environmental management capabilities, best-of-class relationships with employees and communities, and outstanding corporate governance. Responsible investors generally seek the lower risk and higher returns over time that such companies ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Our green shoots have sprouted! After a period of stabilization in most areas of the portfolio, we have begun to see year-over-year EBITDA improvement and indications this will continue. We believe that one of the reasons we are experiencing improvement faster than others is that small companies rea ...

... Our green shoots have sprouted! After a period of stabilization in most areas of the portfolio, we have begun to see year-over-year EBITDA improvement and indications this will continue. We believe that one of the reasons we are experiencing improvement faster than others is that small companies rea ...

Financing and Procurement of EU Infrastructure

... broadband sectors are approximately EUR 2 trillion over the next decade. Financing needs for major transport infrastructure investments go well beyond the means of national budgets PPPs currently finance an important but minority share of EU infrastructure investments ...

... broadband sectors are approximately EUR 2 trillion over the next decade. Financing needs for major transport infrastructure investments go well beyond the means of national budgets PPPs currently finance an important but minority share of EU infrastructure investments ...

(Attachment: 11)App 1

... 14. Consequently the closing debt at 31st March 2015 is significantly lower than the figure at the end of March 2014. The difference is accounted for by the £8 million repayment and some payments of principal on the Council’s annuity loans. Details of the Council’s loan portfolio at 31st March 2015 ...

... 14. Consequently the closing debt at 31st March 2015 is significantly lower than the figure at the end of March 2014. The difference is accounted for by the £8 million repayment and some payments of principal on the Council’s annuity loans. Details of the Council’s loan portfolio at 31st March 2015 ...

here

... Worst of all, we know that these measures of underperformance, while academic for those of us in this room, translate to genuine human suffering. We know that the WB estimates that 1 out of 4 people live on less than P 60 / day. Let’s put that in perspective: 1 out of 4 people in our country live o ...

... Worst of all, we know that these measures of underperformance, while academic for those of us in this room, translate to genuine human suffering. We know that the WB estimates that 1 out of 4 people live on less than P 60 / day. Let’s put that in perspective: 1 out of 4 people in our country live o ...

Revolving doors, musical chairs and portfolio performance

... Recent research into the performance implications of staff turnover confirms this reality. This study compares the performance of Australian equity and fixed-interest portfolios before and after the departure of the head of the portfolio management team allocated to the account. It finds that, on av ...

... Recent research into the performance implications of staff turnover confirms this reality. This study compares the performance of Australian equity and fixed-interest portfolios before and after the departure of the head of the portfolio management team allocated to the account. It finds that, on av ...

Specific Investment Policy and Procedures – Restricted and

... management of risk or to facilitate an economical substitution for a direct investment. Under no circumstances will derivatives be used to create leveraging of the portfolios. Asset-backed commercial paper is considered a prohibited investment. 3.01 Return Objectives / Expectations The portfolios ar ...

... management of risk or to facilitate an economical substitution for a direct investment. Under no circumstances will derivatives be used to create leveraging of the portfolios. Asset-backed commercial paper is considered a prohibited investment. 3.01 Return Objectives / Expectations The portfolios ar ...

“Lost” Decade 2000 – 2009

... time. The target date is the approximate date when investors plan to start withdrawing their money, such as retirement. The principal value of the funds is not guaranteed at any time, including at the target date. More complete information can be found in the prospectus for the fund. ...

... time. The target date is the approximate date when investors plan to start withdrawing their money, such as retirement. The principal value of the funds is not guaranteed at any time, including at the target date. More complete information can be found in the prospectus for the fund. ...

Corporate Senior Loans Role Model US?

... Courbevoie, registered with the Nanterre Trade and Companies Register under number 353 534 506, a Portfolio Management Company, holder of AMF approval no. GP 92-08, issued on 7 April 1992. Any investment in a transaction may be speculative and involve certain substantial risks. If and when shares ar ...

... Courbevoie, registered with the Nanterre Trade and Companies Register under number 353 534 506, a Portfolio Management Company, holder of AMF approval no. GP 92-08, issued on 7 April 1992. Any investment in a transaction may be speculative and involve certain substantial risks. If and when shares ar ...

Solicitor struck off after referring clients to tied adviser

... trying to keep this under the radar by suggesting they are not advising on regulated business. . It seems there is still some way to go before St James Place, and certainly other firms not so well known, can be brought into line. “It is vital that solicitors are aware of their duty to act in the bes ...

... trying to keep this under the radar by suggesting they are not advising on regulated business. . It seems there is still some way to go before St James Place, and certainly other firms not so well known, can be brought into line. “It is vital that solicitors are aware of their duty to act in the bes ...

View PDF - Mackenzie Investments

... Secondly, traditional portfolios have often failed to generate the risk adjusted returns and income required to meet the needs of Canadian investors - primarily those who have sought to generate reliable income in retirement. These developments, to an extent, have been driven by a weak domestic econ ...

... Secondly, traditional portfolios have often failed to generate the risk adjusted returns and income required to meet the needs of Canadian investors - primarily those who have sought to generate reliable income in retirement. These developments, to an extent, have been driven by a weak domestic econ ...

Mirae Asset Trigger Investment Plan (TRIP)

... How does the facility work? Suppose you prefer to invest in a mutual fund when markets are at specic levels, you would need to keep track of markets and invest on the day markets reach their desired level. With the TRIP facility, you need not keep track of market movements. You can simply set four ...

... How does the facility work? Suppose you prefer to invest in a mutual fund when markets are at specic levels, you would need to keep track of markets and invest on the day markets reach their desired level. With the TRIP facility, you need not keep track of market movements. You can simply set four ...

Chapter17

... known as beta (). For example, the returns from an asset with a beta of 0.5 will fluctuate by 5% for each 10% fluctuation in the market’s returns. It has been shown that the required risk premium for an asset is directly proportional to its beta. Therefore, the holder of an asset with a beta of 0.5 ...

... known as beta (). For example, the returns from an asset with a beta of 0.5 will fluctuate by 5% for each 10% fluctuation in the market’s returns. It has been shown that the required risk premium for an asset is directly proportional to its beta. Therefore, the holder of an asset with a beta of 0.5 ...

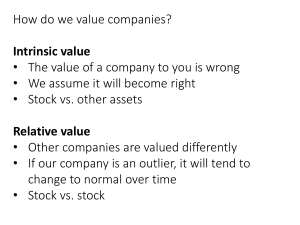

1 - McCombs School of Business - The University of Texas at Austin

... and corporate finance. The goal is to provide an understanding of financial markets, the financial instruments that are traded in these markets, and advanced corporate financial management decisions. You must have completed the Financial Management course in Fall 2006 (sessions 1 to 5) The class wil ...

... and corporate finance. The goal is to provide an understanding of financial markets, the financial instruments that are traded in these markets, and advanced corporate financial management decisions. You must have completed the Financial Management course in Fall 2006 (sessions 1 to 5) The class wil ...

Investment Policy Beaufort County Open Land Trust (BCOLT

... Board of Directors. The Finance Committee shall review this Investment Policy periodically to determine that the investment strategy of the Funds in agreement with this Investment Policy and that the objectives and policies set forth in this Investment Policy continue to be appropriate. The individu ...

... Board of Directors. The Finance Committee shall review this Investment Policy periodically to determine that the investment strategy of the Funds in agreement with this Investment Policy and that the objectives and policies set forth in this Investment Policy continue to be appropriate. The individu ...

Public Sector Discount Rates for Cost Benefit Analysis

... government’s opportunity cost of capital is much lower than indicated by the CAPM. This approach appears to be followed by Germany and the U.S., who set their discount rates equal to their pre-tax government borrowing rates. Some of these views may not be as irreconcilable as they seem. For example ...

... government’s opportunity cost of capital is much lower than indicated by the CAPM. This approach appears to be followed by Germany and the U.S., who set their discount rates equal to their pre-tax government borrowing rates. Some of these views may not be as irreconcilable as they seem. For example ...

FOR IMMEDIATE RELEASE Contact: Scott

... Capital Corporation of Boston. Founded in 1984 by CEO Tim Shanahan, Compass is a SEC registered investment advisor offering fee-based financial planning and investment management. The firm has more than 600 clients and actively manages in excess of $150 million of total assets. Compass has a collabo ...

... Capital Corporation of Boston. Founded in 1984 by CEO Tim Shanahan, Compass is a SEC registered investment advisor offering fee-based financial planning and investment management. The firm has more than 600 clients and actively manages in excess of $150 million of total assets. Compass has a collabo ...

SVLS Fact sheet FEB AW - International Biotechnology Trust plc

... Past performance is not necessarily a guide to future performance and may not be repeated. The value of investments, and the income from them, may go down as well as up, and is not guaranteed, and investors may not get back the full amount invested. Exchange rate changes may cause the value of overs ...

... Past performance is not necessarily a guide to future performance and may not be repeated. The value of investments, and the income from them, may go down as well as up, and is not guaranteed, and investors may not get back the full amount invested. Exchange rate changes may cause the value of overs ...

Sovereign debt crisis and banking system stress Financial Stability

... – These flows have pushed government bond yields to near record lows, facilitating easy financing of the nation’s high public debt. – Safe-haven flows have also driven the yen exchange rate to near historic highs, impacting Japanese exports and domestic production thus weakness in credit demand from ...

... – These flows have pushed government bond yields to near record lows, facilitating easy financing of the nation’s high public debt. – Safe-haven flows have also driven the yen exchange rate to near historic highs, impacting Japanese exports and domestic production thus weakness in credit demand from ...

Islamic Mutual Funds` Financial Performance and Investment Style

... – prevents a pure profit focus but might be good long term risk management – restricts market risk timing abilities, which, on average, do not generate value (e.g. Bollen & Busse, 2001) ...

... – prevents a pure profit focus but might be good long term risk management – restricts market risk timing abilities, which, on average, do not generate value (e.g. Bollen & Busse, 2001) ...

Investment Management Policy

... beginning of each year. The plan has to be checked each month to find out the variation. The monthly variations of the actual to be the plan to be adjusted in the flexible manner. Month-wise repayment schedule of the POs has to be prepared at the beginning of the year. Any variation to the plan ha ...

... beginning of each year. The plan has to be checked each month to find out the variation. The monthly variations of the actual to be the plan to be adjusted in the flexible manner. Month-wise repayment schedule of the POs has to be prepared at the beginning of the year. Any variation to the plan ha ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.