Key Trends Shaping the Rapid Growth of the Venture Capital

... 74% of telecommunications jobs 81% of software jobs 55% of semiconductor revenue 67% of electronics/instrumentation revenue ...

... 74% of telecommunications jobs 81% of software jobs 55% of semiconductor revenue 67% of electronics/instrumentation revenue ...

Equities and Indexes

... GenElec (GE) 0.40 2.43 14.68 74,123,574 16.75 16.35 16.44 -0.26 $0.10/Quarter ...

... GenElec (GE) 0.40 2.43 14.68 74,123,574 16.75 16.35 16.44 -0.26 $0.10/Quarter ...

Emerging Markets Corporate Bonds

... We believe EM corporate bonds may provide traditional portfolios with the potential for higher income and more complete diversification—and that this asset class may become a fixed income mandate in the near future. Consider that investments in EM corporate bonds can: + Provide investors with an opp ...

... We believe EM corporate bonds may provide traditional portfolios with the potential for higher income and more complete diversification—and that this asset class may become a fixed income mandate in the near future. Consider that investments in EM corporate bonds can: + Provide investors with an opp ...

PDF

... The Australian equity market, as measured by the industry standard S&P/ASX 300 Index, returned a total of 21.9 percent over the year ending June 30, 2013. As investors continued to favor quality or high-yielding stocks, three sectors led the gains: Financials, Telecommunications and Health Care. The ...

... The Australian equity market, as measured by the industry standard S&P/ASX 300 Index, returned a total of 21.9 percent over the year ending June 30, 2013. As investors continued to favor quality or high-yielding stocks, three sectors led the gains: Financials, Telecommunications and Health Care. The ...

Understanding private equity and private equity funds

... Merchant banks would step into distressed situations, take control of a troubled enterprise, reorganize its finances and put in place new management ...

... Merchant banks would step into distressed situations, take control of a troubled enterprise, reorganize its finances and put in place new management ...

File

... Management should first evaluate its working capital policies to ensure the most efficient stream of cash flow from operations Once this is done, then a short-term financing strategy should be developed ...

... Management should first evaluate its working capital policies to ensure the most efficient stream of cash flow from operations Once this is done, then a short-term financing strategy should be developed ...

Six Degrees of Separation In the simplest terms, what went wrong in

... origination process. Moreover, they probably didn’t even realize the extent of their risk taking. At the origination end, without the discipline of a skeptical buyer, abuses grew. The buyer was not sufficiently concerned with the process of loan origination and the broker was not subject to sufficie ...

... origination process. Moreover, they probably didn’t even realize the extent of their risk taking. At the origination end, without the discipline of a skeptical buyer, abuses grew. The buyer was not sufficiently concerned with the process of loan origination and the broker was not subject to sufficie ...

Non-Bank Finance Companies Criteria

... Another key difference between a bank and an NBFC is that, on a comparable basis, banks have historically defaulted very infrequently, while a number of NBFCs have defaulted over the years. This reflects the wholesale funding orientation of NBFCs, as well as the usual lack of any sovereign support w ...

... Another key difference between a bank and an NBFC is that, on a comparable basis, banks have historically defaulted very infrequently, while a number of NBFCs have defaulted over the years. This reflects the wholesale funding orientation of NBFCs, as well as the usual lack of any sovereign support w ...

Financial Institutions and Capital Markets

... securities/industries and start his own reinsurance company while at the same time avoiding any large investment in financial institutions, and how he is now looking for the “new Buffett.” The rest of the course contains the following three modules: 1. The first module, “Financial Institutions” (UVA ...

... securities/industries and start his own reinsurance company while at the same time avoiding any large investment in financial institutions, and how he is now looking for the “new Buffett.” The rest of the course contains the following three modules: 1. The first module, “Financial Institutions” (UVA ...

Investments

... 2. It is subsequently reported at fair value. 3. Unrealized holding gains and losses are reported as a component of other comprehensive income. 4. Interest and dividend revenue, as well as realized gains and losses on sales, are included in net income for the current period. ...

... 2. It is subsequently reported at fair value. 3. Unrealized holding gains and losses are reported as a component of other comprehensive income. 4. Interest and dividend revenue, as well as realized gains and losses on sales, are included in net income for the current period. ...

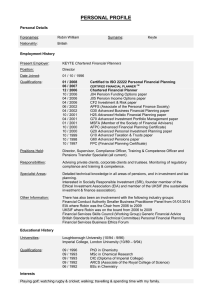

personal profile - Keyte Chartered Financial Planners

... The Sunday Times, the Financial Times and the Independent on Sunday, as well as featuring on Radio 4’s Money Box Live as one of the panel of specialists several times. Robin was a founding member of the Ethical Investment Association (EIA) and served as Chair and also on the board of UKSIF (the UK s ...

... The Sunday Times, the Financial Times and the Independent on Sunday, as well as featuring on Radio 4’s Money Box Live as one of the panel of specialists several times. Robin was a founding member of the Ethical Investment Association (EIA) and served as Chair and also on the board of UKSIF (the UK s ...

to 30 April 2016 - Allianz Global Investors

... because of the appreciation of the JPY (Japanese Yen). Market Background: The Japanese equity market declined in local currency terms on the back of concerns on China’s economy and US monetary policy. The BOJ (Bank of Japan) introduced negative interest rate policy in January 2016 which surprised th ...

... because of the appreciation of the JPY (Japanese Yen). Market Background: The Japanese equity market declined in local currency terms on the back of concerns on China’s economy and US monetary policy. The BOJ (Bank of Japan) introduced negative interest rate policy in January 2016 which surprised th ...

Why yield matters for investors – particularly now

... fixed interest investments it is the main driver – and the only driver if bond investments are held to maturity – but if the bond is sold before then there may be a capital gain or loss if the bond’s price has changed. For shares and property, capital growth (or loss) is of course a key component of ...

... fixed interest investments it is the main driver – and the only driver if bond investments are held to maturity – but if the bond is sold before then there may be a capital gain or loss if the bond’s price has changed. For shares and property, capital growth (or loss) is of course a key component of ...

Landing in Investment Banking

... Overview of careers in a variety of areas of Finance and Investment Banking. The website includes information on careers, major players, job skills and requirements, and ...

... Overview of careers in a variety of areas of Finance and Investment Banking. The website includes information on careers, major players, job skills and requirements, and ...

Triangle Capital Corporation to Begin Trading on the New York

... solutions to lower middle market companies located throughout the United States. Triangle's investment objective is to seek attractive returns by generating current income from debt investments and capital appreciation from equity related investments. Triangle's investment philosophy is to partner w ...

... solutions to lower middle market companies located throughout the United States. Triangle's investment objective is to seek attractive returns by generating current income from debt investments and capital appreciation from equity related investments. Triangle's investment philosophy is to partner w ...

Australian Financial Markets: Looking Back and Looking Ahead

... banking arms (the expansion into new lending products such as home-equity loans and margin lending), part has been by supplying assets to the funds managers through securitisation, and part has been by moving directly into funds management, insurance and so on. One market segment that has benefited ...

... banking arms (the expansion into new lending products such as home-equity loans and margin lending), part has been by supplying assets to the funds managers through securitisation, and part has been by moving directly into funds management, insurance and so on. One market segment that has benefited ...

Le$$ PowerPoint Slideshow

... couples today want to begin with multiple cars and the type of home Mother and Dad worked a lifetime to obtain. Consequently, they enter into long-term debt on the basis of two salaries. Perhaps too late they find that changes do come, women have children, sickness stalks some families, jobs are los ...

... couples today want to begin with multiple cars and the type of home Mother and Dad worked a lifetime to obtain. Consequently, they enter into long-term debt on the basis of two salaries. Perhaps too late they find that changes do come, women have children, sickness stalks some families, jobs are los ...

Reasons to Include ESG Factors in Security Selection

... Some research suggests that companies with strong ESG profiles also tend to make good decisions about allocating capital.4 This makes sense to us as ESG decisions require the same kind of sound, long-term thinking as management of finances and capital expenditures. For more information, please refer ...

... Some research suggests that companies with strong ESG profiles also tend to make good decisions about allocating capital.4 This makes sense to us as ESG decisions require the same kind of sound, long-term thinking as management of finances and capital expenditures. For more information, please refer ...

Corporate finance under asymmetric information

... Hazard and Credit Rationing: An overview of the issues. In, Agency Theory: Information and Incentives, (Ed. Bamberg and Spremann). Heidelberg: ...

... Hazard and Credit Rationing: An overview of the issues. In, Agency Theory: Information and Incentives, (Ed. Bamberg and Spremann). Heidelberg: ...

synta pharmaceuticals corp. - corporate

... More detailed financial information and analysis may be found in the Company’s Quarterly Report on Form 10-Q, which was filed with the Securities and Exchange Commission (SEC) on November 5, 2015. Guidance The Company expects its cash resources of approximately $88.3 million as of September 30, 2015 ...

... More detailed financial information and analysis may be found in the Company’s Quarterly Report on Form 10-Q, which was filed with the Securities and Exchange Commission (SEC) on November 5, 2015. Guidance The Company expects its cash resources of approximately $88.3 million as of September 30, 2015 ...

FIN_Course_SLO

... 6. Explain how real estate value is determined by market supply and demand, as well as capital market conditions. 7. Make mortgage calculations, e.g. monthly payment, amortization table construction and effective borrowing cost. 8. Interpret a real estate listing contract and a sales contract. ...

... 6. Explain how real estate value is determined by market supply and demand, as well as capital market conditions. 7. Make mortgage calculations, e.g. monthly payment, amortization table construction and effective borrowing cost. 8. Interpret a real estate listing contract and a sales contract. ...

simibtopic4 - Homework Market

... (cf. Lindblom, 1959; and Johnson, 1988). • Investment decisions and actual investment commitments are made incrementally as uncertainty is successively reduced. • The more the firm knows about a foreign market, the lower the perceived market risk will be and, consequently, the higher the actual inve ...

... (cf. Lindblom, 1959; and Johnson, 1988). • Investment decisions and actual investment commitments are made incrementally as uncertainty is successively reduced. • The more the firm knows about a foreign market, the lower the perceived market risk will be and, consequently, the higher the actual inve ...

Fact Sheet - Franklin Templeton Investments

... 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The value of investments and the income from them can ...

... 199205211E. This document is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The value of investments and the income from them can ...

Re-building Standalone Strength

... requirements in order to comply with Basel III range from $400-800 bln. ─ Most of the increased demand is likely to be for short maturity, highly liquid securities, whose risk weighting is zero. • Money market mutual funds: regulatory changes are requiring them to shorten up on the maturity of their ...

... requirements in order to comply with Basel III range from $400-800 bln. ─ Most of the increased demand is likely to be for short maturity, highly liquid securities, whose risk weighting is zero. • Money market mutual funds: regulatory changes are requiring them to shorten up on the maturity of their ...

trs report - Illinois Retired Teacher`s Association

... periodically underperform. Investors will face numerous temptations to eliminate or reduce currently underperforming high quality managers. However, if all managers are outperforming at the same time, the investment program/asset class/style may not be appropriately diversified. The first presentat ...

... periodically underperform. Investors will face numerous temptations to eliminate or reduce currently underperforming high quality managers. However, if all managers are outperforming at the same time, the investment program/asset class/style may not be appropriately diversified. The first presentat ...

Leveraged buyout

A leveraged buyout (LBO) is a transaction when a company or single asset (e.g., a real estate property) is purchased with a combination of equity and significant amounts of borrowed money, structured in such a way that the target's cash flows or assets are used as the collateral (or ""leverage"") to secure and repay the borrowed money. Since the debt (be it senior or mezzanine) has a lower cost of capital (until bankruptcy risk reaches a level threatening to the lender[s]) than the equity, the returns on the equity increase as the amount of borrowed money does until the perfect capital structure is reached. As a result, the debt effectively serves as a lever to increase returns-on-investment.The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO), management buy-in (MBI), secondary buyout and tertiary buyout, among others, and can occur in growth situations, restructuring situations, and insolvencies. LBOs mostly occur in private companies, but can also be employed with public companies (in a so-called PtP transaction – Public to Private).As financial sponsors increase their returns by employing a very high leverage (i.e., a high ratio of debt to equity), they have an incentive to employ as much debt as possible to finance an acquisition. This has, in many cases, led to situations, in which companies were ""over-leveraged"", meaning that they did not generate sufficient cash flows to service their debt, which in turn led to insolvency or to debt-to-equity swaps in which the equity owners lose control over the business and the debt providers assume the equity.