* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download chapter 5

Internal rate of return wikipedia , lookup

Individual Savings Account wikipedia , lookup

Debt settlement wikipedia , lookup

Debt collection wikipedia , lookup

Investment management wikipedia , lookup

Debtors Anonymous wikipedia , lookup

Modified Dietz method wikipedia , lookup

Pensions crisis wikipedia , lookup

Business valuation wikipedia , lookup

Investment fund wikipedia , lookup

International asset recovery wikipedia , lookup

Government debt wikipedia , lookup

Private equity secondary market wikipedia , lookup

Stock selection criterion wikipedia , lookup

Early history of private equity wikipedia , lookup

Private equity wikipedia , lookup

Private equity in the 1980s wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Stock valuation wikipedia , lookup

Household debt wikipedia , lookup

Securitization wikipedia , lookup

Global saving glut wikipedia , lookup

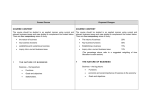

CHAPTER 5 USING FINANCIAL STATEMENT INFORMATION EXERCISES E5–5 a. Current Ratio = Current Assets ÷ Current Liabilities 2004: $6,304 ÷ $2,242 = 2.81 2005: $5,239 ÷ $1,942 = 2.70 2006: $5,029 ÷ $2,272 = 2.21 b. Gross Profit as a % of Sales = Gross Profit ÷ Net Sales 2004: $6,381 ÷ $16,267 = .39 2005: $5,869 ÷ $16,023 = .37 2006: $5,649 ÷ $15,943 = .35 c. Inventory Turnover = Cost of Goods Sold ÷ Average Inventory 2005: $10,154 ÷ [($1,814 + $1,696) ÷ 2] = 5.79 2006: $10,294 ÷ [($1,696 + $1,796) ÷ 2] = 5.90 Average Days Supply of Inventory = 365 ÷ Inventory Turnover 2005: 2006: d. 365 ÷ 5.79 = 63 days 365 ÷ 5.90 = 62 days Over the three-year period, solvency has deteriorated, as has the profitability per sale. Inventory turnover has improved slightly, reducing the average shelf time of the inventory by one day. E5–7 a. (1) Current Ratio = Current Assets ÷ Current Liabilities 2008: $385,000 ÷ $170,000 = 2.26 2009: $400,000 ÷ $460,000 = 0.87 (2) Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) ÷ Current Liabilities 2008: ($30,000 + $10,000 + $95,000) ÷ $170,000 = 0.794 2009: ($15,000 + $225,000+ $90,000) ÷ $460,000 = 0.717 b. Receivables Turnover = Net Credit Sales ÷ Average Accounts Receivable 2008: $780,000 ÷ [($100,000 + $95,000) ÷ 2] = 8.00 2009: $800,000 ÷ [($95,000 + $90,000) ÷ 2] = 8.65 Number of Days Outstanding = 365 ÷ Receivables Turnover 1 2008: 365 ÷ 8.00 = 45.625 2009: 365 ÷ 8.65 = 42.197 c. Solvency refers to a company's ability to meet its debts as they come due. Current liabilities represent the debts that are expected to come due first. Therefore, to be solvent, a company must have sufficient cash or near-cash assets to meet these current liabilities. Total current assets is one measure of near-cash assets. As indicated by the change in the company's current ratio, the company has insufficient current assets available to settle its current liabilities. The company's quick ratio worsened during 2009. Given that the company has insufficient current assets and insufficient cash, marketable securities, and accounts receivable to meet its debts, it can probably be concluded that the company's overall solvency position is not strong. E5–9 a. Current Ratio = Current Assets ÷ Current Liabilities 2006: 2007: 2008: 2009: $20,000 ÷ $8,000 = 2.500 $24,000 ÷ $13,000 = 1.846 $31,000 ÷ $25,000 = 1.240 $35,000 ÷ $30,000 = 1.167 Debt/Equity Ratio = Total Liabilities ÷ Total Stockholders' Equity 2006: 2007: 2008: 2009: ($8,000 + $15,000) ÷ ($20,000 + $10,000) = 0.767 ($13,000 + $35,000) ÷ ($20,000 + $20,000) = 1.200 ($25,000 + $40,000) ÷ ($20,000 + $32,000) = 1.250 ($30,000 + $40,000) ÷ ($20,000 + $38,000) = 1.207 Return on Assets = (Net Income + [Interest Expense (1 – Tax Rate)]) ÷ Average Total Assets 2006: 2007: 2008: 2009: ($13,000 + [$2,000 (1 - .3)]) ($14,000 + [$4,000 (1 - .3)]) ($21,000 + [$5,000 (1 - .3)]) ($24,000 + [$5,000 (1 - .3)]) b. ÷ ÷ ÷ ÷ [($53,000] = [($53,000 + $88,000) ÷ 2] = [($88,000 + $117,000) ÷ 2] = [($117,000 + $128,000) ÷ 2] = 2009 Current assets Noncurrent assets Total assets Current liabilities Long-term liabilities Capital stock Retained earnings Total liabilities and stockholders' equity 2008 0.272 0.238 0.239 0.224 2007 2006 27.34% 72.66 100.00% 26.50% 73.50 100.00% 27.27% 72.73 100.00% 37.74% 62.26 100.00% 23.44% 31.25 15.62 29.69 21.37% 34.19 17.09 27.35 14.77% 39.77 22.73 22.73 15.09% 28.30 37.74 18.87 100.00% 100.00% 100.00% 100.00% c. Solvency measures a company's ability to meet its debts as they come due. The current ratio provides one measure of a company's solvency. Based upon this ratio, Lotechnic has sufficient current assets to meet its current obligations. However, the trend in its current ratio indicates that the company's excess of current assets over current liabilities is decreasing. Therefore, the company has relatively fewer current assets available to meet its current 2 obligations. This trend indicates that Lotechnic Enterprises' solvency position may be worsening. The debt/equity ratio provides an indication of a company's capitalization, which, in turn, indicates how risky a company is. Lotechnic is relying increasingly on debt relative to stockholders' equity to finance operations. At some point in time, the company will have to repay this debt. The company will either have to repay this debt by (1) generating cash from operations, (2) selling assets, (3) borrowing additional cash, or (4) acquiring cash by issuing stock. From the statement of cash flows, the cash generated from operations has been decreasing and is now negative; therefore, it appears that the company cannot rely on operations to generate cash. The statement of cash flows also indicates that the company has been using cash for investment purposes every year. This implies that the company may have some assets that it could sell. But if these assets are used in operations, the company's operations may be adversely affected by selling them. Since total assets equal the sum of total liabilities and stockholders' equity, the proportion of total liabilities to the sum of total liabilities and stockholders' equity reported on the commonsize balance sheet equals the proportion of total liabilities to total assets. This measure indicates the proportion of total assets (based upon book value) that would have to be sold to satisfy all the company's obligations. To meet its obligations, Lotechnic Enterprises would have to sell approximately 55% of its total assets, which would virtually decimate its asset base. Based upon the trend in the current ratio, the debt/equity ratio, cash flows from operations, and the proportion of total liabilities to total assets, it appears that Lotechnic Enterprises may face severe solvency problems as its long-term debt matures. Earning power is defined as a company's ability to increase its wealth through operations and to generate cash from operations. Earning power and solvency are closely related. A company must have adequate resources to generate wealth. If a company experiences solvency problems, it will most likely have to divert its resources to paying its obligations. Therefore, due to its solvency problems, Lotechnic Enterprises may not have strong earning power. Although Lotechnic's net income has increased every year, the company's effectiveness at managing capital, as indicated by ROA, has decreased every year. This trend indicates that the company may have limited earning power. This conclusion is also supported by the trend in the company's cash flows from operations. It must be remembered, however, that this analysis is based on very limited information. To adequately analyze a company, additional information would be needed. Complete financial statements, financial information for similar companies, and general economic information should all be considered when analyzing a company's earning power and solvency position. E5–10 Transaction Quick Ratio Current Ratio Debt/Equity Ratio (1) – – + (2) NE NE + (3) – – – (4) – – +a b (5) + + – (6) + + – __________________ a Wage Expense would be closed into Retained Earnings at the end of the accounting period as part of the closing process. Thus, recording wage expense would decrease stockholders' equity, and thereby increase the debt/equity ratio. 3 b This transaction would increase both Sales and Cost of Goods Sold. Both of these accounts would be closed into Retained Earnings as part of the closing process. Since the sales price exceeds the cost of the inventory, the net effect of this transaction would be to increase Retained Earnings. Thus, total stockholders' equity would increase, and thereby decrease the debt/equity ratio. PROBLEMS P5–6 In order to consider an investment in Goodyear, let us first compute the following ratios: 1. Return on Equity = Net Income ÷ Average Stockholders’ Equity 2005: $ 228 ÷ [($73 + $74) ÷ 2] = 310.2% 2006: $(330) ÷ [($(758) + $73) ÷ 2] = (96.35%) 2. Return on Sales (Net Income + [Interest Expense (1 – Tax Rate)]) ÷ Net Sales = 2005: ($228 + [$411 (1 – 0.30)]) ÷ $19,723 = 2.61% 2006: ($(330) + [$451 (1 – 0.30)]) ÷ $20,258 = (0.07%) 3. Current Ratio Current Assets ÷ Current Liabilities = ÷ ÷ 2005: $ 8,616 2006: $10,179 4. Debt/Equity Ratio = 2005: $15,532 2006: $17,787 $5,441 $4,666 = = 1.58 2.18 Total Liabilities ÷ Total Stockholders’ Equity ÷ ÷ $73 ($758) = = 212.77 NA Generally, an equity investor would have much more information available to make a decision than what is provided by Goodyear. However, based on the information provided, an equity investment in Goodyear would be unwise. The company is showing a net loss on its income statement and has negative equity on its balance sheet and is producing a decreasing amount of cash from opeations. Until Goodyear can turn around its operations, it is not an attractive opportunity. P5–11 As a loan officer, I would be concerned with whether a potential borrower has the ability to meet its debts as they come due. Since both companies are requesting only nine-month loans, I would be interested in the potential borrowers' short-term solvency. Therefore, I would examine their current ratios and quick ratios. Further, I would consider the effect of the potential loan on these ratios. The current ratio is calculated as current assets divided by current liabilities. Selig Equipment: Mountain Bike: $715,000 ÷ ($285,000 + $125,000) = 1.74 $835,000 ÷ ($325,000 + $125,000) = 1.86 It appears that both companies have more than sufficient current assets to meet their current obligations, including the new loan. However, some current assets, such as prepaid expenses and inventory, are not near-cash assets. Thus, a better measure of a potential borrower's ability to 4 meet its current obligations is the quick ratio. This ratio is calculated as the sum of cash, marketable securities, and accounts receivable divided by current liabilities. Again, the effect of the new loan should be considered. Selig Equipment: Mountain Bike: ($15,000 + $215,000) ÷ ($285,000 + $125,000) = .561 ($160,000 + $470,000) ÷ ($325,000 + $125,000) = 1.400 Based on the quick ratio, Mountain Bike, Inc. appears to be a much better risk than Selig Equipment. Mountain Bike has approximately 2.5 times more near-cash assets available than Selig Equipment to meet its current obligations. Therefore, Mountain Bike does not have to rely as heavily on converting other assets to cash as Selig does to meet its obligations. The company that can most readily convert its inventory and receivables to cash might be the better risk. Two possible measures of a company's ability to generate cash from its receivables and inventory are the turnover and number-of-days ratios. Receivables turnover is calculated as net credit sales divided by average accounts receivable, and the number of days for receivables is calculated as 365 divided by the receivables turnover. Receivables turnover: Selig Equipment: $1,005,000 ÷ $215,000 = 4.67 Mountain Bike: $1,625,000 ÷ $470,000 = 3.46 Number of days: Selig Equipment: 365 ÷ 4.67 = 78.16 Mountain Bike: 365 ÷ 3.46 = 105.49 These ratios indicate that Selig Equipment, on average, collects its receivables 27 days quicker than Mountain Bike. Therefore, Selig Equipment can more easily convert its receivables to cash than Mountain Bike can. Inventory turnover is calculated as cost of goods sold divided by average inventory, and the number of days is calculated as 365 divided by inventory turnover. Inventory turnover: Selig Equipment: $755,000 ÷ $305,000 = 2.48 Mountain Bike: $960,000 ÷ $195,000 = 4.92 Number of days: Selig Equipment: 365 ÷ 2.48 = 147.18 Mountain Bike: 365 ÷ 4.92 = 74.19 These ratios bode well for Mountain Bike. Mountain Bike sells its inventory, on average, 73 days sooner than Selig Equipment sells its inventory. This difference implies that Mountain Bike generates more sales which, in turn, implies that it generates more accounts receivable. Although Mountain Bike does not turn over its receivables as often as Selig Equipment, it has a larger amount of receivables to turn over. Thus, Mountain Bike potentially has more assets that can easily be converted into cash than Selig Equipment. Based upon Mountain Bike's superior quick ratio and potential ability to generate cash from its larger receivables base, I would recommend that the bank grant the loan to Mountain Bike, Inc. 5 P5–12 a. Watson Metal Products' 2010 income statements under the different financing alternatives would be as follows. Income from operations* Interest expense Net income before taxes Income taxes Net income * $16,500,000 Alternative 1 Alternative 2 Alternative 3 $ 16,500,000 4,000,000 $ 12,500,000 5,000,000 $ 7,500,000 $ 16,500,000 4,750,000 $ 11,750,000 4,700,000 $ 7,050,000 $ 16,500,000 4,375,000 $ 12,125,000 4,850,000 $ 7,275,000 = $15,000,000 2010 income from operations from non-French operations per the 2009 income statement + $1,500,000 2010 income from operations from French operations. The formulas for the requested ratios are: Earnings per Share Return on Equity Return on Assets Financial Leverage Debt/Equity Ratio = = = = = Net Income ÷ Average Number of Common Shares Outstanding Net Income ÷ Average Stockholders' Equity (Net Income + [Interest Expense (1– Tax Rate)]÷ Average Total Assets Return on Equity – Return on Assets Total Liabilities ÷ Total Stockholders' Equity Note: Although several of the ratios use averages, ending balances were used as specified in the problem. Alternative 1 EPS: $7,500,000 ÷ (2,000,000 shares* + 200,000 shares) = $3.41 * 2,000,000 shares = $6,600,000 2009 net income ÷ $3.30 2009 earnings per share ROE: $7,500,000 ÷ ($45,000,000 + $5,000,000a + $7,500,000b) = .1304 a $5,000,000 = 200,000 shares $25 per share b $7,500,000 = 2010 net income ROA: ($7,500,000 + [$4,000,000 (1 – .4)]) ÷ ($35,000,000 + $45,000,000 + $5,000,000 + $7,500,000) = .1070 Leverage: .1304 – .1070 = .0234 Debt/Equity: $35,000,000 ÷ ($45,000,000 + $5,000,000 + $7,500,000) = .609 6 P5–12 Continued Alternative 2 EPS: $7,050,000 ÷ 2,000,000 shares = $3.53 ROE: $7,050,000 ÷ ($45,000,000 + $7,050,000) = .1354 ROA: ($7,050,000 + [$4,750,000 (1 - .40]) ÷ ($35,000,000 + $45,000,000 + $5,000,000 + $7,050,000) = .1076 Leverage: .1354 – .1076 = .0278 Debt/Equity: ($35,000,000 + $5,000,000) ÷ ($45,000,000 + $7,050,000) = .768 Alternative 3 EPS: $7,275,000 ÷ (2,000,000 shares + 100,000 shares) = $3.46 ROE: $7,275,000 ÷ ($45,000,000 + $2,500,000* + $7,275,000) = .1328 * $2,500,000 = 100,000 shares $25 per share ROA: ($7,275,000 + [$4,375,000 (1 - .4)]) ÷ ($35,000,000 + $45,000,000 + $5,000,000 + $7,275,000) = .1073 Leverage: .1328 – .1073 = .0255 Debt/Equity: ($35,000,000 + $2,500,000) ÷ ($45,000,000 + $2,500,000 + $7,275,000) = .685 b. Alternative 2 prevents a dilution of the stockholders' position. Since this alternative did not require any additional shares of stock to be issued, it provides the largest earnings per share. Alternative 2 allows the company to more effectively manage its stockholders' investment, as evidenced by return on equity, and all investments, as evidenced by return on assets. The only potentially serious drawback of this alternative is that it makes the company more risky, as evidenced by it having the largest debt/equity ratio. Further, Alternative 2 allows the company to use debt to benefit stockholders more effectively than is allowed with either of the other two alternatives. Under Alternative 3, stockholders earn a slightly smaller return on their equity, but incur fewer risks, since the company has issued less debt. Alternative 1 provides a marginally lower return to stockholders, but imposes even less risk on them. Stockholders must trade off the risk from issuing debt against the benefits of issuing debt. If the company is close to violating debt covenants or projects weak future cash flows, then Alternatives 1 or 3 would probably be preferable. Otherwise, Alternatives 2 or 3 would probably be preferable. 7 P5–12 c. Concluded Alternative 1 $3.30 = ($6,600,000 + Net income from expansion project) ÷ (2,000,000 shares + 200,000 shares) Net income from expansion project = $660,000 Alternative 2 $3.30 = ($6,600,000 + Net income from expansion project) ÷ 2,000,000 shares Net income from expansion project = $0 Alternative 3 $3.30 = ($6,600,000 + Net income from expansion project) ÷ (2,000,000 shares + 100,000 shares) Net income from expansion project = $330,000 ISSUES FOR DISCUSSION ID5–15 Profile #1 – EchoStar Profile #2 – US Airways Profile #3 – Wal-Mart EchoStar is a relatively new company with a relatively new product. The company has been growing, as more consumers switch from traditional and cable television services to satellite television. The growth of the company has generated positive cash from operations. However, the company has had to take that cash and invest it back into its business; the negative cash from investing in all three years shows that the company is growing its business by investing in longterm assets. The growth is not sufficiently funded by operations, so the company is raising money from debt and equity sources (financing activities) to fund its business. At the present time, the company is not returning cash to its shareholders or repaying debt. It is borrowing additional funds and raising additional equity to fund its growth. US Airways operates in a difficult industry. The company has been unable to generate a positive cash flow from its operations, a definite red flag for any business. The cash outflow from operations has been paired with negative cash from investing activities, as the company must reinvest in long term assets (aircraft) to remain competitive in its industry. The only source of cash to fund the negative operations and the investments is financing (issuing debt and selling equity). The long term prospects for the company do not look healthy. No business can sustain itself through endless financing activities to fund cash; if the company is going to survive, it will eventually have to generate cash from its operations so that it can eventually repay debt and return some cash to shareholders. Wal-Mart is an excellent example of a successful company that has reached the stage in its maturity that its operations throw off enough cash to fund the company’s still-impressive growth (investing activities) AND to return cash to shareholders and/or repay debt (financing activities). The company can rely on its daily operations to generate cash, which is then used to add more stores and fund dividends and debt reduction. 8