* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Forecasting Business Failures Using a Poisson Regression Model

Survey

Document related concepts

Transcript

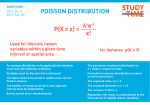

Statistics FORECASTING BUSINESS FAILURES USING A POISSON REGRESSION MODEL Vasanthakumar N. Bhat Lubin School of Business, Pace University, New York, NY 10038 In this paper, we present a Poisson regressioo model for business failure rates in the United States. The yearly business failure rates follow a skewed probability distribution fimction with nonnegative values. There are many business estab1ishments and probability that a particular business establishment will close is very small. These facts conform to a Poisson specification. The empirical results suggest that the percentage change in gross national product, money supply, and inventmy to sales ratio inversely and the average nmnber of businesses formed in the previous five years as a proportion of current existing businesses and unemployment rate directly effect failme rates. The Poisson regression ana1ysis is an extremely usefUl method to model Poisson dependent variables such as claim rates in insurance, mortality rates in health care and so on. Business failures ire of siguificant concern to policy makers. Business failures represent inability of businesses to endure financial difficulties. Businesses, particularly small ones, are the nation's job generators. Therefore, failures of businesses can significantly affect employment and consumer coDfidence. The purpose of this paper is to examine the macroeconomic determinants of business failures in the United Stales. We also evaluate the effect of the Bankruptcy Reform Act of 1978 on business closings. In this paper, we deal with business failures per 10,000 establishments covered by the Dun and BradsIreet Corporation. Business fajlures denote the number of estabHshments that close because they owe money to creditors. Such businesses include those which close because of comt proceedings such as foreclosure, bankruptcy and attachment or receivership. Businesses which close voluntarily either with some arrangements with creditors or by leaving 1IIlpaid debts are also included in this category of business failures. One common feature about all these failures is that these establishments close withont fully paying their creditors. Therefore, businesses which close due to lack of capital, inadequate profits, poor health or retirement of the owner and change of name or location are excluded from our analysis. Dun and Bradstreet COIporation publishes business failure data weekly, monthly and quarterly. This data is based on a UDiverse count· of firms and consequently does not have any sampling errors. The failure data denotes the number of corporations and llDincorporated businesses which go out of business owing money to creditors. The data is collected from court records, credit management groups and newspapers. The failure data published by Dun and BradsIreet differs ftom banknlptcy statistics published by the Adminislrative Office of the U.S. Court because d!ey are based on case numbers. For example. when a partnership firm goes bankrupt, Dun and Bradstreet counts that as one business failure though each partner might have been assigned one case number. Similarly, the courts may classify a bllllkruptcy as business though it might not have been actually in business. Dun and Bradstreet does not include tax shelter firms, establishments represented by persons moonlighting on second job and so on. The universe of businesses in the Dun and Bradstreet data base is therefore smaller than thenumber of taxable firms in Internal Revenue Service statistics. There are only a few studies that analyze various factors that influence business failures. Hudson and Cuthbertson(I993) present a general autoregressive dislributedlag (ADL) model for personal bankruptcies in the UK using data from 1971 to 1988. Shepard(1984) presents an ordinary least square regression model for nonbusiness bankruptcies in the United States for the period 1948-1979. Hudson(I986) analyzes reasons for companies to go into banlauptcy and provides a regression model for voluntary and compuIsoty liquidations in UK In Exhibit 1, we indil:ate businesses failure rates in different years from 1946 to 1991. Approximately 97,000 busin ems failed in 1992. lhat n:plesents failures ofahout 11000+ ss:sper 10,000. There are about 8.82 miI1ion businesses in the U.S. The probability that a particular establishment will fail is very low and is only 0.011 in 1992. In Exhibit 2, we present empirical disCribution of failure rates per 10,000 firms in clifferent years. This distribution is neither normally nor symmeIricaIIy disIributed deosity function. The empirical distribution is skewed. Since the failure rate is not normally distributed, ordinary least square regression models cannot be used to ideatifY macroeconomic factors which affect failure rates. Failure rates do not take negative values. They are not symmetricaJly distributed. The probability that a particular firm will fail in a year is veJY sman and there are many firms that can fail. Poisson disbibuti.on is ex1remely suited to model such random variables. We therefore, use Poisson regression to model business failure rates. This papeI" is organized into five sections. In the next section, we briefly describe Poisson regression model. We discuss various macroeconomic factors that 615 NESUG '96 Proceedings Statistics atIect failure rates of businesses. We use changes in the gross national product to represent changes in the economicvitality of a nation. The percentage changes in the gross national product should be inversely related to failure rates. Unlike large films, most small firms depend on credit for their capital requjrements. Therefore, availability of credit and its costs can significantly affect weD-being of a firm. Fast growing firms and marginally profitable firms require ample credit for their survival. Therefore, lack ofcredit can drive many firms, especially the small ones, to failure. There are several measures that can be a proxy for credit availability. Money supply is one of1he measures of credit availability. We use money Sllpply M-2 published for the month of June of each year as a measure to lepn:sent credit availability in this paper. Unemployment measures number of persons withont jobs actively seeking work. It inclndes an persons 16 years and older who lost or quit previous jobs and others who reenter workforce. The unemployment rate denotes the percentage of unemployed in the labor fcirce. Since the unemployment rate measures the proportion of people seeking jobs, this is one of the most important indWators of economic vitality. High unemployment rates can dampen consumer confidence and spending which in turn can increase failure rates. Consequently, the unemployment rates are directly related to the business failure rates. Inventcuy to sales ratio has direct affect on the future production levels. The inventory-sales ratio is calculated by dividing inventory by sales. Two different measures of inventory-sales ratios are published. The inventory to sales ratio published by the Census Bureau deal with inventories and sales of manufacturers, merchant wholesalers and retailers. The inventory-sales ratio published by the Bureau of Economic Analysis include only final sales to consumers, businesses, government and foreigners and omits raw materials, supplies and semi-finished products. In this paper, we use the inwntoIyto sales ratio compiled by the Bureau of Census for the month of June of each year. Capital JlI8Iket retom is an excellent indicator of future economic activity. Rising stock prices increase weaII:h and improve consumer confidence. FaDing stock prices, on the other hand, hamper new capital issues 'Mlk::h in tum discourage spending. There are a variety of stock market indexes. The stock market indexes oompiledby the New York Stock Exchange. Standard &. Poots Corporation, Dow Jones and Wilshire Associates are some of the popular ones. In this paper, we use total stock market return for each year as compiled. by Ibbotson Associates. Since stock market return is a leading indicator, we use stock market retnrns of the previous year as our independent variable. The early years of a business are its most affect failure rates in the subsequent section. We then discuss results. We close this paper with conclusions in the last section. Poisson Regression Model Poissson regression has been extensively used to model the aualysis of discrete count data. Multiple linear regRSSion is typically used to identify relationships between a dependent variable and several independent variables. However, in many settings, the dependent variable we wish to model may be discrete rather than contiauous. In addition, the dependent variable may take only DOIIlleg8Iive values. Therefore, the dependent variable may not have normal distribution which is continuous and can take negative values. Therefore, we could improve multiple linear regression with a model that accounts for these characteristi.cs. From Exhibit 2, it is obvious that failure rate per 10,000 businesses are Uwed towards right. Poisson distribution is well suited to model such situations. In this model, the failure rates are assumed to be arising from a Poisson distribution. This disIribu1ion accounts for the iofrequent and discrete nature offailures. Ifwe assume that each firm has some probability ofbeiog faikd, the expected rate of failures in year t, A,. can be modeled as a function of failure rate per 10,000 businesses and the number of businesses in 10,000's. We can formulate failure rates as an exponential function of macroeconomic factors which ensure that the failure rates are nonnegative. If the macroeconomic variables are denoted by the vector X. , the failure rate can be written as: A, = exp(XP)· If failure rates are assumed to be Poisson, then the parameters can efficiently and consistently estimated by JIIaYimmn likelihood techniques. Poisson regression has been used to model accident rates of ships [McCullagh and NeIder(1983»), highway fatalities [Michener and Tlghe(I992)] and airline accidents [Rose(1990)]. One drawback ofPoisson regRSSion is its implicit assumption that the variance equals the mean. Uulike ordinaJy least square regression method, Poisson regression tends to give the largest observation more weight than the smaller ones. Macroeconomic Factors The purpose of this paper is to identify macroeconomic factors that worsen failures of businesses. The following macroeconomic factors are considered to cause business failures: Percentage change in the gross national product, Credit availability, Unemployment, lnventcuy-sa1es ratios, Capital market retnrns, and Business survival. Overall business acIivity can influence sales and pro.fits of an enterprise. Economic health of a nation can NESUG '96 Proceedings 616 Statistics critical periods. About half the busmesses do not survive beyond five years. By the end often years, about two in three businesses fail. In Exhibit 3, we present survival rates ofbuslnesses by age of businesses for 1980, 1985 aod 1990. We find that business failure rates are high in early years and 1hen 1hey flatten out with time. Therefore. longer a business survives, higher are its chances that it will outlive still longer. In order to account for 1his phenomenon, we take average number of businesses formed in 1he previous five years as a proportion of total businesses for each year as an independent variable. Bankruptcy laws have significant effect on business failores. The Bankruptcy Act of 1978 (official1y Public Law 95-598) is a major revision since 1938 when 1he Baokruptcy Act of 1898 was amended. In addition to sUeamJioing adminisIrative mechanism in the bankruptcy code, this code reforms and consolidates various provisions into 1hree chapters 7, 11 and 13. A single pelSOIl or a family in financial trouble can either resort to Chapter 7 or Chapter 13. Chapter 7 deals with straight bankruptcies in which a debtor discharges his debt for paying something to creditors. Chapter 13 allows a debtor to keep his assets and but promise payment of debt over three to five years. According to Chapter 13, it is no longer necessaxy to have approval of creditors for repayments plans. The courts and debtors have CODSiderable discretion on this matter. New chapter 11 deals with matters relating to corporate capital structure reorgauization, arrangement with unsecured creditors, non-corporate real estate cases and railroad reorganizatious. Chapter 11 gives exclusive monopoly to the company management to propose a plan of reorganization within 120 days. The bankruptcy courts can extend this management's exclusive privilege indefinitely. Therefore, the management of a company does not have to fear that they will lose control of their orgauization if it opts for baukruptcy. Small businesses can use Chapter 13 and enjoy some ·of its liberalized provisions. In short, the new law has made business closings attractive. Regression Results We use business failure rates as reported by Dun and Bradstreet in its Bwiness Failure Records as a depeudent variable. The failure data were expanded in 1984 by adding agriculture. forestly and fishing; finance, iDsaraoce, and real estate", and an services. To account for these changes, we use a dummy variable D84 whose value will be 0 if year is smaller than 1984 and 1 for years greater than 1983. We also use dummy variable BD to account for the Bankruptcy Reform Act of 1978 which wmt into effect on 1st October 1979. The dummy variable BD is 1 for years 1980 and greater and 0 for years less than. 1980. We use business failure rates as a dependent variable and percentage change in the gross national product, M-2 money supply, inventory"sa1es ratio, tmemploymeDt, stockrelumin the previous year, average number of businesses formed in the last five years as a proportion of existing total businesses and dummy variables to account for revisions in the data in 1984 and passage of Bankruptcy Reform Act of 1978. All variables, o1her than the dmnmy variables, are expressed in 1heir logarithms to base 10. Exhibit 4 displays variable definitions and their sources. The mean and standard deviations of ctifferent variables are given in Exhibit 5. In Exhibit 6, we present Poisson and ordinary least squares (OLS) regression outputs. The dependent variable in the OLS regression model is the logarithm of failurerates. We indicate parameter name, the estimated parametervalue, and p-value associated with Waid Chisquare and t statistics for testing the significance of the parameter in Poisson and OLS models. Since the estimated parameters are elasticities, the coefficients should be directly comparable. One of the implicit assumption in a Poisson regression model is that the variance equals its mean. However, there could be either overdispersion or underdispersion of data in the fitted model. One way to test for over or underdispersion is to verify whether Deviauce divided by degrees of freedom is close to 1 (SAS, 1993). In our case, we get deviance per degrees of freedom of 1.0716 which is close to 1. Therefore, Poisson regression analysis is an appropriate method to model business failure rates. We compare appropriatenessofPoisson model against OLS model. In OLS model, we get an R2 of 0.9067. The R2 for Poisson model is 0.99. In addition, we also evaluate DurbinWatson statistics in both cases to verify autocorrelation betweenresidnals The Durbin-Watson statistic for OLS model is 1.070 and for Poisson model 1.23 again indicating suitability of Poisson model. Both Poisson and OLS models have identical signs for coefficients of various independent variables. Accordingtotheresu1ts presented in Exhit 6, we find the percentage change in GNP, money supply, inventory to sales ratio, and stock retums in the preceding year inversely affect the business failure rates. The unemployment rate and businesses formed in the preceding five years as a proportion of total existing business increase failure rates. The dummy variable representing the passage of Bankruptcy Reform Act of 1978 has a positive coefficient indicating increase in failure rates as a consequence of this act. The dummy variable is also statistica1ly sigDificant at 0.05 level in both models. This suggests that the Bankruptcy Act of 1978 has exaceroated business failures. The coefficient for BD in the OLS model is .3129 and in the Poisson model.2860. Based OllPoisson Regression model, out of 11742 businesses closed in 1980, 2936 business closings can be attributed to the passage of the Bankruptcy 617 NESUG '96 Proceedings Statistics Quality:Economic Determinants of Airline Safety Refonn Act of 1978. The average liability of businesses closed in 1989 is about $0.395 million. Therefore closings attributed to the passage of the bankruptcy code can be estimated to be $1.132 billion in 1980 alone. There are several statistical models for predicting failure of a business establishment. A good description of failure prediction models for small businesses can be fonud in Storey et aI. (1987) and statistical models for baukmptcy prediction in Altman(l981). However, many of these models use company specific information and do not consider macroeconomic factors. Our regression model indicates that IlIlICl'OeIXIJlC factors do worsen business failures. It is therefore important that 1end.ing institutions such as banks do consider future economic environment in addition to staIisIicaI. failure prediction models when they make lending decisions. Effects of macroeconomic factors on failure rates of varions industries are going to be different. Therefore, it is essential to combine IDIlC1'OeCOIlOD factors along with industry and company specific information to improve the 8CClll'acy of failure prediction models. Conclusions In this paper, we present Poisson and OLS regression models of business failures. Unlike a multiple regression model, Poisson regression considers skewness in the probability density function and nonnegativity of failure rates. Poisson specification conforms to the fact that the probability of a failure of a business establishment is very low and at the same time the number of establishments that can fail is Vel)' high. Our Poisson regressionmodel indicates that economic factors do affect failure rates and therefore it is important to incorporate them in the failure prediction models. The Bankruptcy Reform Act of 1978 has adversely affected business closings. Performance," Journal ofPolitical Economy, 98 (1990) 944-64. SAS., Bas Technical Report P-243 SASlSTAT Software:The GENMOD Procedure, Release 6.09, Cary, NC:SAS Institute Inc, Shepard, L, Personal failures and the bankruptcy reform act of 1978, Journal of Law & Economies, xxvn (1984) 419-437. Storey,D.,K~,K., Watson,R, Wynarczyk,P., The performance ofsmal/firms, London:Routledge, 1989. ·· · ·II· J · ·· ·· ~---Ed'IM 1 : BuIIIinesII""'1848-81 1 -- - - - - 1• J. ---. References Altman, E.I. Avery, RE. SiDky, J.F., Application of classification techniques in business banking and finance, Greenwich, CT, USA:Jai Press Inc, 1981. American Enterprise Institute., Bankruptcy Reform, Washington, DC:American Enterprise Institute, 1978. Hudson, J., An analysis of company liquidations, Applied Economics, 18 (1986), 219-235. Hudson, J., Cuthbertson, The determinants of bankruptcies in the U.K.:1971-1988, The Manchester Schoo/Vol.LXI (1993), 65-81. McCuIIagb, P., and J.Nelder Genera/ized Linear Models, London:Chapmau andHaU, 1989. Michener, R, and C.Tighe "A Poisson Regression Model of Highway Fatalities," American Economic Review, Papers and Proceedings, 82 (1992), 452-456. Rose, Nancy L., "Profitability and Product NESUG '96 Proceedings ~ I . J• ....- _ _ _ ffIIIIJ 618 _1110 Statistics Exhibit 4 Variable BFAIL GNPCH MONEY UNEMP INVSAL PTOCK NEWS BD D84 Exhibit 5 Variable BFAIL GNPCH MONEY INVSAL PTOCK NEWB Variables and their data sources Description Number of businesses failed per year per 10,000 businesses Change in GNP + 1 Source Dun and Bradstreet Failures Record Survey of Current Business (Bureau of Economic Analysis) Federal Reserve Board Bulletin Monthly Labor Review (Bureau of Labor Statistics) Survey of Current Business (Bureau of the Census) Ibbotson Associates Money supply M2 Unemployment rate Inventory-Sales Ratios Total Stock Market Return (for preceding year) + 1 Average number of businesses Business Failures Record formed in the previous five (Dun andBradstreet Years/Total businesses Corporation) Dummy variable 1 if year is greater than 1979 (to account for Bankruptcy Reform Act of 1979 which went into effect on October 1, 1979) otherwise 0 Dummy variable 1 if year is greater than 1983 (to account for inclusion of agriculture, forestry and fishing, finance, insurance, and real estate; and all services to failure data) otherwise o. Means and standard deviations of various variables. N 45 45 45 44 44 41 Mean 0.0055 0.0729 7.2575 0.4248 0.1126 -0.6930 std. Dev. 0.0027 0.0317 0.3844 0.0487 0.1516 0.4738 Minimum 0.0014 -0.0050 6.6619 0.3075 -0.3075 -1. 7824 Maximum 0.0120 0.1450 7.8128 0.5365 0.4228 -0.0594 All variables except BFAIL are expressed as logarithm to base 10. Exhibit 6 Poisson and OLS Regression Results for 1946-91 POISSON OLS Variable Coefficient Pr>Chi Coefficient Dependent Variable: Failure Rates. Intercept GNPCH MONEY INVSAL UNEMP PTOCK BD D84 NEWS N 9.8970 -4.8152 -1.6968 -3.6688 0.1057 -0.0409 0.2860 0.9190 1.2350 0.0000 0.0001 0.0000 0.0000 0.0595 0.8389* 0.0192 0.0000 0.0000 +9.6993 -4.6531 -1.6724 -3.7711 0.0891 -0.0950 0.3129 0.6946 1.1767 41 0.99 Durbin-Watson 1.23 Deviance 34.2909 Degrees of Freedom 32 Deviance/Degrees of freedom 1. 0716 Pr>t 0.0008 0.0010 0.0001 0.0001 0.1118* 0.6722* 0.0360 0.0001 0.0001 41 0.91 1.07 R2 Not significant at the 10-percent level. 619 NESUG '96 Proceedings