* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Exchange Rate Regime Choice with Multiple Key Currencies

International status and usage of the euro wikipedia , lookup

Foreign exchange market wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Bretton Woods system wikipedia , lookup

Purchasing power parity wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Reserve currency wikipedia , lookup

Currency war wikipedia , lookup

International monetary systems wikipedia , lookup

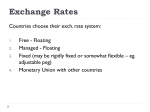

Fixed exchange-rate system wikipedia , lookup