* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download bYTEBoss Chapter_11

Value at risk wikipedia , lookup

Generalized linear model wikipedia , lookup

Risk management wikipedia , lookup

Financial economics wikipedia , lookup

Birthday problem wikipedia , lookup

Enterprise risk management wikipedia , lookup

Probability box wikipedia , lookup

Probability amplitude wikipedia , lookup

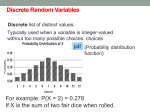

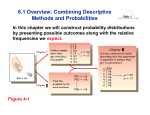

Chapter 11 – Introduction to Risk Analysis Why do individuals, companies, and stockholders take risks? Terminology Risk - possibility of an undesired outcome Probability - expected relative frequency of an event Terminology Risk and uncertainty Risk - probabilities of outcomes is known -- casino Uncertainty - outcomes not known with certainty – reality Probability discrete distributions - - number of probability occurrences is finite continuous - infinite number of occurrence - range of outcomes Terminology Subjective versus objective probability - someone’s opinion Objective - can be measured Subjective Terminology Variation versus event risk Event risk - probability of a certain , such as bankruptcy Variation risk- probability of a range of outcomes around an event typically measured by standard deviation Terminology Diversifiable versus nondiversifiable risk Diversifiable risk -- risk that can be reduced or eliminated by combining one investment with another Must have a correlation less than +1 Nondiversifiable risk -- risk that remains after combining large numbers of projects Probability Rules Mutually add exclusive events - the probabilities of the events Independent events build a table of possible combinations of events multiply the probabilities to get table values Dependent build events a table where the probabilities of outcomes for the second event are dependent on the first event Stages of Risk Measurement Stage 1 -- Descriptive and Subjective listing of things that might go wrong good for identifying the important variables Stage 2 -- Sensitivity analysis look at possible outcomes over a range of values for a critical variable (such as sales) do not attempt to assign probabilities example -- breakeven analysis Stages of Risk Measurement Stage 3 -- Event probability assign probabilities to the various outcomes one in ten chance of bankruptcy Stage 4 -- Summary measures of probability distributions Measures of central tendency Measures of dispersion Summary Measures: Central Tendency Expected value: possibilities time probabilities Median: Center outcome; probability of outcome above median equals probability of outcome below median. Mode: Most common outcome Geometric mean (Pi = probability of outcome i): [(1+ return1)^P1][(1+ return2)^P2] . . . . Summary Measures: Dispersion Variance Multiply squared distances from the expected value by the probability, then sum Standard deviation Square root of the variance Same unit of measure as the original problem Coefficient standard of variation deviation/ expected value adjust for the scale of the project Summary Measures: Dispersion Semivariance computed like variance, but considers only outcomes below the expected value used when the distribution is not normal (skewed) Quartile There range is a 25% probability of a value greater than X and a 25% probability of a value less than Y Summary Measures Normal using distributions and standard deviations a z-table you can find the area under the normal curve (probability of a range of outcomes) Utility Theory Assumptions Completeness -- you can judge your preference in all situations Rational -- consistent in judgements order of presentation does not matter Transitivity -- if A is preferred over B and B is preferred over C then A is preferred over C Utility Theory Types of utility functions Increasing -- risk seeker or lover -- will pay to take the riskier project -- casinos and lottery tickets Constant -- risk neutral -- is indifferent to risk -- will accept the same expected return for risky as well as safe projects Decreasing -- risk averse -- prefer safety to risk and must be compensated for accepting additional risk Utility Theory Problems with utility functions in reality Hard to measure Whose utility should we measure? Once measured then the decision can be made by the analyst Utility theory is important to arbitrage pricing theory equal expected utilities should have equal prices Risk Perspectives Single investment perspective Proposing manager -- Chapter 12 Company perspective Senior management and board -- Chapter 13 Shareholder Shareholder -- Chapter 14 Contingent claims Option writer, debt-holder -- Chapter 15 Overall perspective economy Everybody