* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download put

Survey

Document related concepts

Transcript

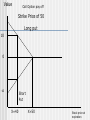

C) Option markets and contracts identify the basic elements and describe the characteristics of option contracts; An option is a contract. It gives one party (the holder of the option) the right to choose, during a specified period of time, to buy (or sell, respectively) a specified quantity of a specified asset (for instance a stock) at a given price. The other contract party (the writer of the option) has the obligation to fulfill the holder's right. Put Option LongBuyer of PutHolder Short- Call Option Long- Buyer of Seller of PutPutHolder Writer ShortSeller of Put- Writer define European option, American option, money ness, payoff, intrinsic value, and time value American option: may be exercised at any time up to and including the contracts expiration date European option: can be exercised only on the contract’s expiration period. At expiration an American and an European on the same asset and the same strike price are equal define European option, American option, money ness, payoff, intrinsic value, and time value.. Contd .. If 2 options are identical in all respects, except that one is American and the other is European, tha value of an American option will equal or exceed the value of European option Options Terminologies. In-the-money: At-the money Out of Money CALL OPTION 160 ITM 162 ITM 164 166 OTM 168 OTM 170 OTM BUY SP SP MP SP SP SP PUT OPTION SELL 160 OTM 162 OTM 164 MP 166 ITM 168 ITM 170 ITM Intrinsic Value of an Option.. An option’s intrinsic value is the amount by which the option is in-the money. It is the amount that an option owner would receive if the option were exercised. An option has a zero intrinsic value if it is it is at the money or out of money, regardless of whether it is a call or put Intrinsic Value of an Option..contd Lets look at the value of a call option at expiration. If the expiration date date price of the stock exceeds the strike price of the option. The call owner will exercise the option and receive S-X. if the price of the stock is less that the strike price, the call holder will let the option expire and get nothing. Intrinsic Value of an Option..contd The intrinsic value of the call option at expiration is the greater of (S-X) or 0. That is C= max(0, S-X) Value Put Option pay off Strike Price of 50 Long Call 5 0 -5 Short Call X=50 X=55 Stock price at expiration Value Call Option pay off Strike Price of 50 Long put 10 0 -10 Short Put X=40 X=50 Stock price at expiration Time Value The time value of an option is the amount by which the option premium exceeds the intrinsic value and is sometimes called the speculative value of the option. Option value= intrinsic value+time value. As discussed earlier, the intrinsic value of an option is the amount by which the option is in the money At any point during the life of an option its value will be typically greater than its intrinsic value. This is because there is some probability that the stock price will change in an amount that gives the option a positive pay off at expiration greater that the current (intrinsic) value. Recall that an option’s intrinsic (to a buyer) is the amount of payoff at expiration and is bounded by zero. When an option reaches expiration there is no time remaining and the time value is zero. For American options and most cases for European options the longer the time to expiration, the greater the time value and other things being equal, the greater the options premium Identify different types of options Financial Options Options on futures Commodity Options Financial Options Bond Options Index Options*cash settled Stock Options Option on futures Sometimes called futures options, give the holder the right to buy or sell a specified futures contract on or before a given date enter into a long side of a futures contract at a given futures price. Assume that you hold a call option on a bond future @ 98 % of the face value and at the expiration the future price of the bond is 99. By exercising the call, you can take a long position in the futures contract, and the account is immediately marked to market on the settlement price. Your account will be credited with an cash amount of 1% of the face value of the face value of the bond. The seller of the exercised call will take a short position in the futures contract and the mark to market value of this position will generate the cash position deposited in your account a Compare IRO & FRA. IRO are similar to stock options except that the exercise price is an interest rate and the underlying asset is a reference rate IRO are also similar to FRA because there is no delivery asset, instead they are settled in cash Consider a long position in a LIBOR based Interest rate call option with a notional amount of $ 1000000 and a strike rate of 5%. If at expiration libor is greater than 5% the option can be exercised and the owner will receive 1000000*(LIBOR-5%). IF Libor is less than 5%, the option expires worthless Interest rate cap and floor An interest rate cap is a series of interest rate call option, having expiry dates that corresponds to the reset dates on the floating rate loan. Caps are often used to protect a floating rate borrower from an increase in the interest rates. Caps places a maximum limit on the interest rates on the floating rate Caps pay when rates rise above the cap rate. In this regard, a cap can be viewed as a series of interest rate call options which strike equals to the cap rate. Each option in a cap is called a caplet. Interest rate cap and floor An interest rate floor is a series of interest rate put option, having expiry dates that corresponds to the reset dates on the floating rate loan. Floors are often used to protect a floating rate lender from an decline in the interest rates. Floors places a minimum limit on the interest rates on the floating rate Floors pay when rates fall below the floor rate. In this regard, a floor can be viewed as a series of interest rate put options which strike equals to the floor rate. Each option in a floor is called a floor let Example Reset Reference Rate Cap Floor 90 days LIBOR 10% 5% In the event that LIBOR rises above 10%, the cap will make a payment to the cap buyer to offset any interest expenses in excess of an annual rate of 10% Loan Rate Loan rate without caps or Floors Received by cap owner 10% 10% cap 5% 5% floor Received by floor owner 5% 10% LIBOR Identify the minimum and maximum values of European and American Options St=price of underlying stock at time t x = exercise price of the option T = time to expiry ct= price of european call at time t, at any time t prior to expiration c t=price of Auropean call at time t, at any time t prior to expiration pt=price of european put at time t, at any time t prior to expiration Pt=price of American pur at time t, at any time t prior to expiration RFR Lower case letters are used to denote European style options Lower bounds for Options (Call & Put) for both American and European options. Theoretically no option will sell for less than its intrinsic value and no option can take a negative value. This means that the lower bound for any any option is zero for both Americans and European options Upper bounds for call Options (American and European ) The maximum value of either an American or European call option at any time t is the time t share price of the underlying stock. This makes sense because no one would pay a price for a right to buy an asset that exceeds the assets value. It would be cheaper to simply buy the underlying stock At time t=0, the upper boundary condition can be expressed respectively for American and European call option is American Option C0 <= S0 European Option C0 <= S0 Upper bounds for PUT Options (American and European ) The price for an American put option cannot be more than its strike price. This is the exercise value in the event the underlying stock price goes below zero. However, since the European puts cannot be exercised prior to expiration, the maximum value is the PV of the exercise price discounted at the RFR. Upper bounds for PUT Options (American and European ) Even if the exercise price goes to zero and is expected to stay zero, the intrinsic value X, will not be received until expiration date. At time t=0, the upper boundary condition can be expressed for American and European option can be expressed as P0<=X and p0 <=X/1+( RFR) ^ t Option Strategies. Basic Options Strategy: -Long on call -Short on call -Long on Put -Short on put Spread Strategies -Bull spread.(Buy call-Sell call @ Higher Exercise Price)-Market view Bullish -Bear spread. (Buy call-Sell call @ Lower Exercise Price).-market view Bears Option Strategies. Straddle-market View Mixed(volatile) -Long Straddle -Short Straddle Strangle -market View Mixed(Range bound) -Long Straddle -Short Straddle Spread Strategy Bull Spread Market View Bullish Action Buy Call, Sell call @ higher strike Profit potential Limited Loss Potentail Limited Bull Call Spread This involves purchase and sale of Call options at different exercise prices but with the same exercise date. The purchase call shud have a Lower Exercise 340 360 Bull Call Spread -16 9 Buy call 340; Sell call 360; Prem 9 Net P/L Prem16 Spot 300 -7 -16 9 310 -7 -16 9 320 -7 -16 9 330 -7 -16 9 340 -7 -16 9 350 3 -6 9 360 13 4 9 370 13 14 -1 380 13 24 -11 390 13 34 -21 400 13 44 -31 Bull Spread Payoff diagram of bull spread 15 5 -5 30 0 31 0 32 0 33 0 34 0 35 0 36 0 37 0 38 0 39 0 0 Sp ot Profit/Loss 10 -10 Reliance price Net P/L Spread Strategy Bear Spread Market View Bearish Action Buy Call, Sell call @ Lower strike Profit potential Limited Loss Potential Limited Bear Call Spread Bear Call Spread This involves purchase and sale of Call options at different exercise prices but with the same exercise date. The purchase call shud have a Higher Exercise 360 340 Bear Call Spread -9 16 Buy call 360; Prem Sell call 340; Prem 16 Net P/L 9 Spot 300 7 -9 16 310 7 -9 16 320 7 -9 16 330 7 -9 16 340 7 -9 16 350 -3 -9 6 360 -13 -9 -4 370 -13 1 -14 380 -13 11 -24 390 -13 21 -34 400 -13 31 -44 Bear Spread 10 Profit/Loss 5 0 Spot 300 310 320 330 340 350 360 370 380 390 -5 -10 -15 Reliance stock price Net P/L Straddle-market View Mixed LONG Straddle Long Straddle Market View Mixed Buy Call, Buy Put @ same Strike Spot 290 300 310 320 330 340 350 360 370 380 390 Pay Prm Action Profit Potential Buy call Buy Put Unlimited @ same Exercise Loss Potential limited Strike: 340 1 Call buy : Prem: Net P/L 16 1 Put buy; 21 -16 11 -16 1 -16 -9 -16 -19 -16 -29 -16 -19 -6 -9 4 1 14 11 24 21 34 340 Prem: 13 37 27 17 7 -3 -13 -13 -13 -13 -13 -13 Profit/Loss Payoff structure for Long Straddle 40 20 0 -20 290 300 310 320 330 340 350 360 370 380 390 -40 Reliance stock price Short Straddle Short Straddel Market View Mixed Action Profit Potential Sell call Sell Put limited @ same Exercise Loss Potential Unlimited Short straddle I M receiving Prm sell Call, sell Put @ same Strike Sold/short on call Strike: 340 Sold/short on put 340 Spot 290 300 310 320 330 340 350 360 370 380 390 Net P/L Call : Prem: 16 Put Prem: 13 -21 16 -11 16 -1 16 9 16 19 16 29 16 19 6 9 -4 -1 -14 -11 -24 -21 -34 -37 -27 -17 -7 3 13 13 13 13 13 13 Payoff structure for short straddle 40 Profit/Loss 30 20 10 0 -10 290 300 310 320 330 340 350 360 370 380 390 -20 -30 Reliance stock price Long Strangle Market View I PAY PRM Action Profit Potential Loss Potential Buy Call, Buy Put -Buy Call at higher SP Volatile Spot 280 290 300 310 320 330 340 350 360 370 380 390 400 Buy Call Premium: 12 Strike 350 Call:Prem 12 -12 350 Net P/L 28 18 8 -2 -12 -22 -22 -22 -12 -2 8 18 28 -12 -12 -12 -12 -12 -12 -12 -12 -2 8 18 28 38 Buy PUT Premium: 10 Strike 330 Put: Prem 10 -10 330 40 30 20 10 0 -10 -10 -10 -10 -10 -10 -10 -10 Payoff structure for Long Strangle 40 20 10 0 Reliance 400 -30 380 -20 360 340 320 300 -10 280 Profit/Loss 30 Short Strangle Market View I Recv PRM Action Profit Potential Loss Potential Sell Call, Sell Put Sell Call at higher SP Volatile Spot 280 290 300 310 320 330 340 350 360 370 380 390 400 Sell Call Premium: 12 Strike 350 Call:Prem 12 12 350 Net P/L -28 -18 -8 2 12 22 22 22 12 2 -8 -18 -28 12 12 12 12 12 12 12 12 2 -8 -18 -28 -38 Sell Put Premium: 10 Strike 330 Put: Prem 10 10 330 -40 -30 -20 -10 0 10 10 10 10 10 10 10 10 Short strangle payout structure 30 -30 -40 Reliance stock price 40 0 38 0 36 0 34 0 -20 32 0 0 -10 30 0 10 28 0 Profit/Loss 20 INTRINSIC VALUE For a call option: Intrinsic value = Price of the underlying - Exercise price For a put option: Intrinsic value = Exercise price - Price of the underlying FACTORS AFFECTING PREMIA There are five major factors affecting the Option premium: Price of Underlying Exercise Price Time to Maturity Volatility of the Underlying And two less important factors: Short-Term Interest Rates Dividends Intuition would tell us that the spot price of the underlying, exercise price, risk-free interest rate, volatility of the underlying, time to expiration and dividends on the underlying(stock or index) should affect the option price. OPTION Pricing Black and Scholes start by specifying a simple and well–known equation that models the way in which stock prices fluctuate. This equation called Geometric Brownian Motion, implies that stock returns will have a lognormal distribution, meaning that the logarithm of the stock’s return will follow the normal (bell shaped) distribution. The Black-Scholes (1973) option pricing formula prices European put or call options on a stock that does not pay a dividend or make other distributions Part I of the model In order to understand the model itself, we divide it into two parts. The first part, SN(d1), derives the expected benefit from acquiring a stock outright. This is found by multiplying stock price [S] by the change in the call premium with respect to a change in the underlying stock price [N(d1)]. Part II of the model The second part of the model, Ke(- t)N(d2), gives the present value of paying the exercise price on the expiration day. The fair market value of the call option is then calculated by taking the difference between these two parts. Assumptions of the Black and Scholes Model: The stock pays no dividends during the option's life European exercise terms are used Markets are efficient No commissions are charged Interest rates remain constant and known Returns are log normally distributed Value of PUT Option P=Ke^-rt N(D2) – S N (D1) Binomial tree A useful and very popular technique for pricing an option or other derivatives involves constructing what is know as Binomial tree One step Binomial tree We start by considering a very simple situation where a stock price is currently $ 20 and it is known that at the end of 3 months the stock price will be either $22 or $ 18 We suppose that the stock pays no dividend and that we are interested in valuing a European call option to buy the stock @ 21 in 3 months Simple binomial tree Stock Price $22 Option Price $1 Stock Price $20 Stock Price $18 Option Price $0 One step Binomial tree We set up a portfolio of the stock and the option in such a way that there is no uncertainty about the value of the portfolio at the end of 3 months. We also argue that since the portfolio has no risk, the return must be equal to the RFR. This enables to work out the cost of setting up the portfolio and therefore the option price. Since there are 2 securities ( the stock and stock option) and only 2 possible outcomes, it is always possible to set a riskless portfolio One step Binomial tree Consider a portfolio consisting of a long position in delta shares of the stock and a short position in one call option. We will calculate the value of delta that makes the portfolio risk less. IF the stock price moves from 20 to 22, the value of the shares is Delta 22 and the value of the option is 1, so that the value of the portfolio is Delta 22-1 If the stock price moves down from 20 to 18, the value of the shares is Delta 18 and the value of the option is 0, so that the total value of the portfolio is delta 18 One step Binomial tree The portfolio is risk less if the value of delta is chosen so that the final value of the portfolio is the same for both the alternative stock prices. This means: 22Delta –1 = 18 delta Delta = 0.25 A risk less portfolio is therefore Long 0.25 share Short = 1 option One step Binomial tree If the stock price moves up to 22, the value of the portfolio is 22*0.25-1=4.5 If the value of the stock moves to 18, the value of the portfolio is 18*0.25 = 4.5 Note: regardless of whether the stock price moves up or down the value of the portfolio is always 4.5 at the end of the life of the option One step Binomial tree Risk less portfolio must, in the absence of arbitrage opportunity earn a RFR. Suppose in this case the RFR is 12%. It follows that the value of the portfolio today must be the PV of 4.5 or 4.5 e ^ -0.12*0.25= 4.367 The value of the stock price today is known to be 20. The value of the portfolio today is therefore , 20*0.25-F = 5 – F Therefore F = 0.633 One step Binomial tree This shows that in the absence of arbitrage opportunity the value of the option is 0.633 Interpreting volume and open interest While volume alone is not a useful determinant of market direction, used in conjunction with other data it can be very beneficial - especially to longer term traders - in identifying whether a continuation of or reversal in the prevailing trend is likely. Most traders incorporate Open Interest data with their volume analysis. Open Interest is the net number of open bullish positions in a futures market. Interpreting volume and open interest Volume at low levels reflects uncertainty regarding the future direction of the market in question. Conversely, high volume suggests a high level of confidence in the future direction Low levels of Open Interest reflect a market lacking in liquidity and, therefore, one which will be relatively more susceptible to being moved by a trade than a more liquid counterpart. When there are high levels of Open Interest, deals are likely to be rapidly swallowed up by the market due to the fact that there will be a vast array of participants eager to open new positions or take profits - and consequently have far less impact on the current price. Interpreting volume and open interest If volume is relatively high while the market is going up and remains relatively low during corrections, the inference is that the market is in a strong uptrend, which should continue. both open interest and prices are increasing, then new buyers are being brought into the market with a strong technical picture unfolding. Expect the uptrend to continue In the event of open interest declining while prices are also slipping, liquidation by long positions is the implication, therefore suggesting a technically strong market overall. In other words, the market is strong as open interest declining suggests no new aggressive shorts, as this would entail an increase in open interest. Risk Measures- Delta Delta Hedging Delta is defined as the rate of change of its price with respect to the price of the underlying asset.It is the slope of the curve that relates the derivatives price to the underlying asset price. For example, the price of a call option with a hedge ratio of 40 will rise 40% (of the stock-price move) if the price of the underlying stock increases. Typically, options with high hedge ratios are usually more profitable to buy rather than write since the greater the percentage movement - relative to the underlying's price and the corresponding little timevalue erosion - the greater the leverage. The opposite is true for options with a low hedge ratio. Theta The theta of a portfolio of a derivative, is the rate of change of the value of the portfolio with respect to time with all else remaining the same. Some times referred to as time decay Gamma The gamma of the portfolio of derivatives on an underlying asset is the rate of change of the portfolio;s delta with respect to the price of the underlying asset Vega The vega of a portfolio of derivatives is the rate of change of the value of the portfolio with respect to the volatility of the underlying asset If vega is high in relative terms, the portfolio’s value is very sensitivity to small changes and vice versa Rho The rho of a portfolio of derivative is the rate of change of the value of the portfolio with respect to interest rates. It measures the sensitivity of the value of the portfolio with respect to interest rates Exotic options Derivatives with more complex pay offs than the standard American or European options are sometimes referred to as exotic options Most exotics are traded over the counter and are structured by Financial institutions Types of Exotics Packages Non standard American option s Forward Start Options Compound options As you like it option Barrier options Look back options Asian options Package A package is portfolio consisting of standard European options call, standard European puts, forward contracts and cash Non standard American Option In Americans option exercise can take place at any time during the life of the option and the exercise price will be the same One type of non standard American option is known as Bermudan option. In this early exercise is restricted to certain dates during the life of the option. An example of a Bermudan option would be an American swap option that can be exercised only on dates when swap payments are exchanged Compound Options Compound options are options on options 4 main types of compound options, call on call, call on put, put on put and put on call Example call on call: on the first exercise date, the holder of the compound option is entitled to pay the first strike price and receive a call option. The call option gives the holder the right to buy the underlying asset for the second strike price on the second exercise date. The compound option will be exercised on the first exercise date only if the value of the option on that date is greater than the first strike price “As you like it “ An as you like it option (sometimes referred to as a choosers option), has the feature that after a specified period of time, the holder can choose whether the option is a call or a put option. Suppose that the time at which the charge is made is t1, the value of the as you like it option is max (c,p) Where c is the value of call Where p is the value of the put option Barrier option Barrier option are options where the payoff depends on whether the underlying assets price reaches a certain level during a certain period of time One of the product is CAPS Binary options Binary options are options with discontinuous pay offs A simple example of binary option is a cash or nothing call. This pays off nothing if the stock price ends up below the strike price and pays a fixed amount, if it ends up above the strike price “Look back” options The pay offs from look back options depend upon the maximum or minimum stock price reached during the life of the option. The pay off from a European style look back call option is the amount by which the final stock price exceeds the minimum stock stock price achieved during the life of the option The pay off from a European style look back put option is the amount by which the maximum stock price achieved during the life of the option exceeds the final stock price. Asian Options Asian pay offs are options where the pay off depends on the average price of the underlying assets during at least some part of the life of the option