* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Folie 1

Survey

Document related concepts

Foreign-exchange reserves wikipedia , lookup

Transformation in economics wikipedia , lookup

Economic globalization wikipedia , lookup

Systemically important financial institution wikipedia , lookup

Nouriel Roubini wikipedia , lookup

Balance of payments wikipedia , lookup

Transcript

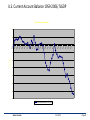

Reflections on Recent Financial Crisis and the Pre-Crisis Situation Prof. Julius Horvath, Ph.D. Head of the Department of Economics Central European University, Budapest 13-15 October 2010, Herľany Technická Univerzita Košice Národná a Regionálna Ekonomika VIII Not To Be Quoted Preliminary Financial Crises Are Nothing New, But − They come as surprise as they appear rarely − The current crisis had partial effects similar to 1929 − There have been crises in the last few decades. These were studied with focus on currency crises, not impact on banking and especially real economy Julius Horvath 14.X.2010 Page 2 A typical interpretation of financial crisis as of Hyman Minsky, Charles Kindleberger, and others: 1. Boom driven by exogenous event (new profitable opportunities for investment) 2. Boom financed by bank money, by new credit instruments – innovation 3. Boom leads to an euphoria (difficult to distinguish sound from unsound prospects); 4. Euphoria leads to a bubble, i.e. asset prices independent from fundamentals; 5. Boom leads to over-indebtedness, i.e. insufficient cash flow to service liabilities; 6. Some unexpected event begins to change monetary ease to monetary tightening; 7. Sales of assets, declining net worths, bankruptcies, bank failures and recession; Julius Horvath 14.X.2010 Page 3 Ability to Predict − The Blame on Economic Theory and Economic Model Building for not being able to predict the crisis and especially its magnitude − But also nobody predicted the Fall of the Soviet Union − Friedman’ 1953 essay, “The Methodology of Positive Economics” : it is the ability of models to predict what is important, not the realism of its assumptions what matters − Prevailing macro concentrated on being dynamic, having stochastic elements and not being partial equilibrium; none of these important for prediction of deep crisis; Representative agent assumption: does not consider informational asymmetry, redistribution, lending, bankruptcy; − Important issue: to concentrate research on normal states of economy and assume crisis away, or concentrate on conditions of crisis? Julius Horvath 14.X.2010 Page 4 Ability to Predict Theory that diversification leads to lower risk, more stable economy; and in practice an increase in overall systemic risk; Is spreading risk necessarily increasing utility? Maybe most behavior has to be represented as adaptive Our ability to predict is inherently limited The important task maybe not prediction but improving our understanding of the conditions marking the boundaries between stable and unstable situations in the economy Julius Horvath 14.X.2010 Page 5 Whom to Blame? − Blame the Theory − High innovation dynamics in the financial sector reflected the high innovation dynamics of research programs at the Departments of Finance and Economics across the world, but especially, in the US and England; − These contributions were typically created without taking into consideration the institutional, human, moral, traditional, and other factors. − Blame the Wall Street − It might seem unfair that mortgage brokers, investment bankers and others got rich causing the current mess, and all the rest has to pay to fix it; Julius Horvath 14.X.2010 Page 6 Whom to Blame? − Blame the Greed − The fundamental cause, according to some commentators, was greed and corruption on the Wall Street − Eichengreen (2008) says “emphasising greed and corruption as causes of the crisis leads to a bleak prognosis. We are not going to change human nature. We cannot make investors less greedy.” − Blaim the Hypocricy − Joseph Stiglitz: This financial crisis is the fruit of a pattern of dishonesty on the part of financial institutions, and incompetence on the part of policymakers; − „We had become accustomed to the hypocricy. The banks reject any suggestion they should face regulation, rebuff any move towards anti-trust measures – yet when trouble strikes, all of a sudden they demand state intervention: they must be bailed out; they are too big, too important to be allowed to fail.” Julius Horvath 14.X.2010 Page 7 Whom to Blame? − Nobody to Blame: − These Are the UnIntented Consequences of Right Decisions Eichengreen (2008) two decisions in the US created the atmosphere for the crisis, but both decisions the right ones; − 1. In the 1970s: deregulated commissions paid to stockbrokers. when fixed commissions investment banks make a comfortable living; deregulation meant competition and thinner margins. − 2. In the 1990s: removal of the Glass-Steagall Act; this allowed commercial banks to enter on the investment banks' territory; in response, investment banks into businesses of originating and distributing derivative securities. This gave rise to the causes of the crisis: originate-and-distribute model of securitization and extensive use of leverage. Julius Horvath 14.X.2010 Page 8 Comparison to the 1929 − Reaction of policy makers can be summarized by Bernanke’s comment that government had to be aggressive in intervening during such crisis; this aggressive government intervention is most likely behind the fact that panic basically did not reach general population; − Note that in the 1930s the Secretary of Treasury, who was also at the Federal Reserve Board, Andrew William Mellon (1855-1937) who was a passionate advocate of inaction; − Similarly Schumpeter in his Viennese accent, “Chentlemen, you are worried about the depression. You should not be. For capitalism, a depression is a good cold douche.” Julius Horvath 14.X.2010 Page 9 Pre-Crisis Boom in Asset Prices − From late 2002 until mid-2007, stock, credit and emerging markets all witnessed a synchronized surge − Less liquid markets like art, real estate and precious, industrial and agricultural commodities saw even bigger appreciation − In 2006 more than dozen equity markets registered gains of 40% of more, with China in the lead on almost 100% − The spread of the J. P. Morgan Emerging Bond Index over US Treasuries to just 150 basis points – a level not seen since before World War I Julius Horvath 14.X.2010 Page 10 Additional Pre-Crisis Atmosphere − The US current account deficit from 3% of GDP to 7% between 1999-2006 − US failed to established stable democracies; − High energy prices supported Iran, Venezuela, i.e. the political risk as observed at the West increased Julius Horvath 14.X.2010 Page 11 Explanations of the Asset Price Boom 1. Excess Liquidity View Interest rate cuts by the Federal Reserve afterwards the dot.com collapse and the 9/11 attacks flooded the world with cheap money 2. A Global Asset Shortage; For example Rajan 2006a, Caballero (2006) and Caballero et al. (2007) A shortage reflects the limited ability of emerging markets to generate financial assets as a store of value at the same pace as their economies grow. 3. US is Simply Better Cooper (2007) the US current account deficit reflects attractiveness to foreigners of American securities; It is often said, foreigners need to “finance” the U.S. current account deficit. It would be more correct to say that the desire of foreigners to invest in the U.S. economy results in the U.S. current account deficit. 4. Fergusson and co-authors An increase in the returns on capital (East Asian workforce into the global economy) together with a decline in the cost of capital. Julius Horvath 14.X.2010 Page 12 Not an Excess Liquidity − The idea that it has been excessive liquidity creation by central banks which led to asset price bubble sounds plausible. − What happened to the ratio of a narrow or broad monetary aggregates to nominal GDP? − A ‘liquidity bubble’ when the supply of money (as M3 growth) grows faster than the demand for money (nominal GDP growth) − But it was relatively stable, in the US, Europe, China, Latin America Julius Horvath 14.X.2010 Page 13 M3 to Nominal GDP; Source OECD (2006) Julius Horvath 14.X.2010 Page 14 Not a Shortage of Financial Assets − Caballero: emerging markets contribute to global growth and wealth, but have only a limited capacity to create financial assets as a store of value − In their search for financial assets, emerging markets turn to the Anglo-Saxon world, creating global imbalances and driving up asset prices − Financial assets from emerging market have grown at a rapid pace before crisis. BIS: March 2005 and March 2007 the issuance of debt securities by developing countries rose by 74% from $480 billion to $870 billion; Over the same period, equity issuance increased by 250%; − Thus no unusual divergence between GDP and asset issuance Julius Horvath 14.X.2010 Page 15 Net Issuance of Securities and the World GDP Source: BIS (2007), IMF (2007) Julius Horvath 14.X.2010 Page 16 Increase in company profits around the globe. − Company profits in the United States, Euroland, Japan and China at highest level, both in absolute terms and relative to GDP (UBS 2007); − Synchronous profit boom might be a consequence of the globalization Julius Horvath 14.X.2010 Page 17 US Corporate Profits, USD, billions Source: BEA (2007) Julius Horvath 14.X.2010 Page 18 Corporate Profits to GDP 1990-2006 Source: Fersuson and Schularick (2007) Julius Horvath 14.X.2010 Page 19 Integration of the East and South Asia into the Global Economy − The aggregate labour force of China, India, Vietnam, Indonesia and Pakistan, is around 1.5 billion (World Bank 2006); of the OECD around 500 million − Only a small portion of Asian labor force is integrated into the world economy but still the global labor has increased twofold since 1990 − But the global capital stock has increased only little, because the capital stock in the poor economies of China and India remains quite low. − Freeman (2006a) estimates that the integration of China, India and the former communist countries reduced the global capital labour ratio to roughly 60% of what it was before these economies joined global markets Julius Horvath 14.X.2010 Page 20 Costs of Capital − How about costs of capital? − Use long-term nominal interest rates deflated by current consumer price inflation to proxy the cost of capital in the world economy − The cost of capital is exceptionally low by historical standards Julius Horvath 14.X.2010 Page 21 Global Costs of Capital: World Real Interest Rate Source: Fergusson and Schularick (2007) Julius Horvath 14.X.2010 Page 22 Return and Costs of Capital − Fergusson and Schularick (2007): global real interest rates do not reflect the increase in the return on capital due to globalization. − They calculate that because of the shift in the global capital–labour ratio, returns on capital roughly 25% higher than before − Global real interest rates should be about 25% above their previous average of 3.20%, namely at around 4%. − The actual global cost of capital currently stands at a low of 2.25%, a little more than half what it should be given the changes in the world economy. Julius Horvath 14.X.2010 Page 23 US 10 Year Government Bond Yield and Nominal GDP Growth Source: Ferguson and Schularick (2007) Julius Horvath 14.X.2010 Page 24 If Profits High, Costs Low: Borrow and Buy − Depressed cost of capital and huge corporate profitability; what follows that it is smart to borrow money and buy earnings streams − The world witnessed a golden age for private equity investment and leveraged buyouts; − Private equity investors were exploiting the wedge between returns on capital and the cost of capital. Julius Horvath 14.X.2010 Page 25 Total Value of Global Leveraged Buyouts 1981–2006 (USD, bn) Julius Horvath 14.X.2010 Page 26 So Called ‘Fed’ Model − The ‘Fed model’ compares the earnings yield of the S&P 500 with the nominal ten-year bond yield. − Over longer time horizons assumed extreme divergences should be corrected − The Fed model correctly indicated stock market overvaluation ahead of the crashes of 1987 and 2001 − What the Fed model has been telling investors since early 2003: buy stocks – they are too cheap compared with bonds and sell bonds – they are too expensive compared with equities Julius Horvath 14.X.2010 Page 27 10 Year Bond Yield – S&P 500 Earnings Yield Julius Horvath 14.X.2010 Page 28 China and the United States Julius Horvath 14.X.2010 Page 29 The US – China Economic Relationship − „Let me be more positive: if I had an agreement with my tailor that whatever money I pay him returns to me the very same day as a loan, I would have no objection at all to ordering more suits from him.” − Jacques Rueff (1965) Julius Horvath 14.X.2010 Page 30 U.S. Current Account Balance 1959-2006, %GDP US Current Account Balance 2 1 20 05 19 97 19 99 20 01 20 03 19 89 19 91 19 93 19 95 19 81 19 83 19 85 19 87 19 73 19 75 19 77 19 79 19 65 19 67 19 69 19 71 19 59 19 61 19 63 0 (% of GDP) -1 -2 -3 -4 -5 -6 -7 Current account balance (% of GDP) Julius Horvath 14.X.2010 Page 31 China and the United States − China generate massive trade surpluses which they immediately lend back to the United States − By channelling surplus savings through government hands into U.S. government paper, Chinese depress the long-term interest rate in the U.S. − China does not allow private individuals to invest abroad, a substantial part of China’s savings have been channelled by the State Administration for Foreign Exchange into US government debt. − The composition of Chinese foreign currency reserves not disclosed, assumed a dollar share of 70% ; Julius Horvath 14.X.2010 Page 32 Chinese Reserve Increase and Issuance of US Treasury Debt Source: Morgan Stanley (2007) Julius Horvath 14.X.2010 Page 33 Source of Chinese Savings − China’s current account surplus increased from about 2% of GDP in 2000– 2003 to about 10% in the first half of 2007 − Where the sudden surge in savings came from? − Chinese household savings rate falling quite significantly; − The rapid surge in savings from Asia has not come from households but from the Chinese corporate sector (profit surge, manufacturing and mining); − Extraordinary profits, not the savings of households used to build-up China’s foreign reserves as a cushion against any future financial crisis Julius Horvath 14.X.2010 Page 34 Corporate vs. household savings in China (% of GDP) Source: Barnett and Brooks (2006), Kuijs (2005) Julius Horvath 14.X.2010 Page 35 Why do funds flow to the U.S. ? − Under neoclassical assumptions, excess national savings should flow to regions of the world where return to capital is highest, and those in turn are assumed to be generally low-income regions with a low ratio of capital to labor. − Because of the size and institutional arrangements in the U.S. economy, many marketable securities are much more liquid than in other financial markets; the market offers a wide diversity of financial assets in terms of their risk characteristics. − In addition, property rights are secure in the United States, and dispute settlement is relatively speedy and impartial − Effective confiscations during the last decade in Argentina, Russia, Bolivia, and Venezuela have reminded investors that foreign private investment in other countries may not be secure. Julius Horvath 14.X.2010 Page 36 Why do funds flow to the U.S. ? − In some years yields on U.S. debt instruments have been higher than those in many other rich countries, as Japan and continental Europe − Foreign investors in the United States face the risk that a weaker dollar would hurt their rate of return measured in home currency, − Trade-weighted index of the dollar: dollar depreciated in real terms from the mid-1980s by 22 percent to a low in 1995, appreciated by 28 percent (to its 1986 level) in 2002, and then depreciated by 21 percent to the fourth quarter of 2007 − Foreign investors may believe that in the long run appreciations will roughly balance depreciations Julius Horvath 14.X.2010 Page 37 References − − − − − − − − − − − − − − − − − − − Bank for International Settlements (2006), ‘OTC Derivatives Market Activity in the First Half of 2006’, Monetary and Economic Department, November 2006. Bank for International Settlements (2007), ‘Securities statistics and syndicated loans’, September 2007. Available at http://www.bis.org/statistics/secstats.htm. Barnett, Steven, and Ray Brooks (2006), ‘What’s Driving Investment in China?’, IMF Working Paper No. 265, November 2006. Bernanke, Ben (2005), ‘The Global Saving Glut and the US Current Account Deficit’, Homer Jones Lecture, St. Louis, Missouri, 15 April 2005. Bureau of Economic Analysis (2007), ‘National Economic Accounts’, Department of Commerce. Available at http://www.bea.gov Caballero, Ricardo, ‘On the Macroeconomics of Asset Shortages’, NBER Working Paper No. 12753, December 2006. Richard N. Cooper, Global Imbalances: Globalization, Demography, and Sustainability, JEP, 2008 Cooper, Richard (2007), ‘Are Global Imbalances a Serious Problem?’, Economics Department Working Paper, Harvard University, May 2007. De Rato, Rodrigo (2006), ‘Shared Responsibilities: Solving the Problem of Global Imbalances’, speech at the University of California at Berkeley, 3 February 2006. Desroches, Brigitte, and Francis Michael (2006), ‘Global Savings, Investment, and World Real Interest Rates’, Bank of Canada Review, Winter 2006–2007, 3–17. Dooley, Michael, David Folkerts-Landau and Peter Garber (2003), ‘An Essay on the Revived Bretton-Woods System’, NBER Working Paper No. 9971, September 2003. European Central Bank (2006), International Relations Task Force, ‘The Accumulation of Foreign Reserves’, ECB Occasional Paper No. 43, February 2006. Eurostat (2007), ‘European Sector Accounts’, European Commission. Available at http://ec.europa.eu/eurostat Freeman, Richard B. (2006a), ‘The Great Doubling: The Challenge of the New Global Labor Market’, Draft, Harvard University, August 2006. Freeman, Richard B. (2006b), ‘Labor Market Imbalances: Shortage, Surplus, or Fish Stories’, Draft, Harvard University, June 2006. International Monetary Fund (2007b), World Economic Outlook, Chapter 5 ,Washington DC, April 2007. International Monetary Fund (2007c), Financial Stability Report, Washington DC, April 2007. Greenspan, Alan (2005), Testimony of Chairman Alan Greenspan, Federal Reserve Board’s semiannual Monetary Policy Report to the Congress Before the Committee on Banking, Housing, and Urban Affairs, US Senate, 16 February 2005. Fergusson, Schularick, International Finance 2007 Julius Horvath 14.X.2010 Page 38 References − − − − − − − − − − − − − − − − − − − − Goldstein, Morris (2006), ‘Renminbi Controversies’, Cato Journal, 26(2), 251–65. Goldstein, Morris (2007) ‘A (Lack of) Progress Report on China’s Exchange Rate Policies’, Working Paper 07-5, Peterson Institute for International Economics, June 2007. Jen, Stephen (2007), ‘Proposing an ‘Asset Shortage Hypothesis’’, Morgan Stanley Research, 22 March 2007. Kuijs, Louis (2005), ‘Investment and Saving in China’, World Bank Policy Research Working Paper No. 3633, June 2005. Magnus, George (2006), ‘Capital Flows and the World Economy’, UBS Economic Insights, 20 November 2006. OECD (2007), ‘The Private Equity Boom: Causes and Consequences’, Financial Market Trends, 55–87. Organisation for Economic Co-Operation and Development (2006), Quarterly National Accounts. Paris: OECD Publishing. Rajan, Raghuram G. (2006a), ‘Is There a Global Shortage of Fixed Assets?’, Remarks at the G-30 Meetings in New York City, 1 December 2006. Roach, Stephen (2007), ‘Past the Point of no Return’, Morgan Stanley Research Global Economic Comment, 11 May 2007. Rosenberg, David (2006), ‘Is a Shortage of Financial Assets Driving up Prices?’, Economic Commentary, Merrill Lynch, 22 November 2006. Rueffer, Rasmus, and Livio Stracca (2006), ‘What Is Global Excess Liquidity, and Does It Matter?’, ECB Working Paper No. 696, November 2006. Setser, Brad (2007), ‘Estimating the Currency Composition of China’s Reserves’, RGE Monitor, May 2007. UBS (2007), ‘World Inc.’, UBS Investment Research, 1 May 2007. World Bank (2006), ‘World Development Indicators 2006’, Washington DC, 2006. Warnock, Francis E., and Veronica Warnock (2005), ‘International Capital Flows and US Interest Rates’, Board of Governors of the Federal Reserve System, International Finance Discussion Papers No. 840, September 2005. Allan, Franklin, INET Presentation Cambridge April 2010 Foley, Duncan K., “Mathematical Formalism and Political-Economic Content,” INET Conference, King’s College, April 8-11, 2010 Lawson, Tony, Really Reorienting Modern Economics, INET Conference, King’s College, April 8-11, 2010 Siegel, Jeremy, Efficient Market Theory and the Recent Financial Crisis, INET Conference, King’s College Cambridge, April 8-11, 2010 Stiglitz, Joseph, Rethinking Macroeconomics: What Went Wrong and How to Fix It: INET Budapest, September 2010 Julius Horvath 14.X.2010 Page 39