* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download The Dividend Controversy

Survey

Document related concepts

Pensions crisis wikipedia , lookup

Negative gearing wikipedia , lookup

Financialization wikipedia , lookup

Individual Savings Account wikipedia , lookup

Internal rate of return wikipedia , lookup

Early history of private equity wikipedia , lookup

Financial economics wikipedia , lookup

Modified Dietz method wikipedia , lookup

Present value wikipedia , lookup

Business valuation wikipedia , lookup

Public finance wikipedia , lookup

Short (finance) wikipedia , lookup

Mergers and acquisitions wikipedia , lookup

Global saving glut wikipedia , lookup

Transcript

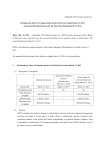

The Dividend Controversy Should firms pay high dividends? Trap question one: An investor buys a share. It never pays a dividend. Is it valueless? No. The investor resells it before any dividends are paid. The buyer gets dividends. Trap question two: A firm never pays dividends to any investor and is never expected to do so. Is it valueless? No. Think of any small start-up. The typical start-up firm is bought by another. Its investors get cash or shares in the acquiring firm. Dividend policy alternatives: Either high dividends now, low later, or Low now, high later. Dividend policy is irrelevant! The firm has done all projects with NPV > 0. It has some cash. What are the alternatives? Separation theorem interpreted for dividends (Figure 18.4) C1 L o w -d iv id e n d firm F u tu re r e tu rn or s lo p e = - ( 1 + r ) H ig h - d iv id e n d firm d iv id e n d n o w C0 Homemade dividends Investors who want higher dividends sell some shares to get cash. Those who want lower dividends use high dividends to buy more shares. Example of partial tax sheltering by capital gains Alternative one: dividend of $10,000. Pay taxes on all of it. Compare to capital gains of the same amount. Tax shield continued, homemade dividend Alternative two: capital gains of $10,000. Sell stock worth $10,000. The stock was bought when the price was half the current price. Realized capital gains = $5,000 Pay taxes on $5,000. Some tax-class clienteles prefer dividend income because they have tax exemptions, e.g., non-profit institutions, pension funds, corporations etc. Some tax-class clienteles prefer capital gains because they can't shelter dividends from taxes, but they can shelter capital gains. High income investors, for instance. Implications of clienteles Some cash flows in the high-dividend channel. Some in the low-dividend channel. Like the Miller channels model. Dividend equilibrium H iD iv value per $1 LoD iv value per $1 V *=1/Rh V *=1/RL E quilibriu m H iD iv E q u ili b riu m L o D iv $ of operating cash flow s ... Value is invariant to dividend policy. In equilibrium i.e., almost all the time Out of equilibrium i.e., after tax law changes, firms can increase value by appropriately changing their dividend policy. Example of disequilibrium Suppose that the capital gains tax rate is lowered. LoDiv cash flows are more valuable. Demand for LoDiv cash flows increases. Cut in capital gains tax rates HiDiv value LoDiv value Increased value of old equity More LoDiv firms $ of operating cash flows in the economy Real-world evidence for not changing dividend policy and for existence of tax-class clienteles. Evidence Actual dividends are highly smoothed Earnings fluctuate much more. Smooth means constant or increasing at a constant rate. Smooth means pleasing to the tax-class clientele that holds the shares. A problem for the low-dividend firm The firm has a quantity of spare cash after all NPV>0 projects are done. Dilemma Pay dividends: Shareholders pay extra taxes. Invest in financial markets: Firm becomes a mutual fund. Solution: use the cash to buy stock Investors who sell are those who want cash. Stock price is unaffected ... because the value of the firm falls by the value of the repurchased shares. The IRS understands this game. Stock buyback for tax avoidance is illegal. Therefore... Excuses, excuses always another reason for a stock buyback, usually ... our shares are a good investment or...we disburse cash to prevent takeover. Summary Dividend policy is like capital structure. It probably doesn’t matter. If it does, it matters because of taxes, and even that is temporary. In equilibrium, firms cannot increase value by changing capital structure or dividend policy