* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download The orthogonal deviations GMM dynamic panel estimator

Survey

Document related concepts

Transcript

Academy of Economic Studies, Bucharest

Doctoral School of Finance and Banking

AN ANALYSIS OF THE CONDITIONING ROLE OF FINANCIAL

DEVELOPMENT ON THE IMPACT OF EXCHANGE RATE

VOLATILITY ON ECONOMIC GROWTH

Supervisor:

PhD. Univ. Professor Moisă Altăr

M. Sc. Student:

Petre Dicu

Bucharest

July 2009

This paper examines the influence of real effective exchange rate

volatility on GDP per capita growth rate and the way this impact

depends on the level of financial development of the countries;

It follows the specification of Aghion, P., P. Bacchetta, R.

Ranciere and K. Rogoff (2006) (with regard to regression,

variables and estimation techniques);

It conducts a dynamic balanced panel data analysis using GMM

dynamic panel data estimators;

It employs a data set for the non-EMU EU countries for a time

period of 10 years (1999 - 2008).

2

Structure of the presentation

The estimated model specification

Estimation techniques

Results of analysis and comparisons

Conclusions

Tests

3

The model tested using real data closely follows Aghion, P., P.

Bachetta, R. Ranciere and K. Rogoff (2006)

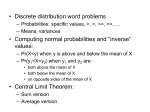

yi,t - yi,t-1= (α – 1)yi,t-1 + β1eri,t + β2pci,t*eri,t + β3pci,t + γ1gei,t +

γ2iri,t + γ3oti,t + γ4popi,t + µt + ηi + vi,t

(1)

yi,t = real GDP per capita,

eri,t = real effective exchange rate volatility,

pci,t = financial development (private credit to GDP),

gei,t = government expenditure,

iri,t = inflation,

oti,t = openness to trade,

popi,t = population growth rate,

ηi = an unobserved individual-specific time-invariant effect for each

country,

vi,t = the disturbance term,

µt = a time specific effect,

The series are in logarithms.

4

The overall coefficient of eri,t (the volatility of real exchange rate)

is a linear function of pci,t (the financial development):

Equation (1) can be written as:

yi,t - yi,t-1= (α – 1)yi,t-1 + [β1 + β2pci,t]eri,t + β3pci,t + γ1gei,t + γ2iri,t

+ γ3oti,t + γ4popi,t + µt + ηi + vi,t

(2)

The assumption β1 < 0 and β2 > 0 shows a level of threshold for

financial development: pc* = - (β1 / β2), meaning that

∂ (yi,t - yi,t-1)/ ∂ (eri,t) = β1 + β2pci,t > 0 for pci,t > pc* = - (β1 / β2) and

∂ (yi,t - yi,t-1)/ ∂ (eri,t) = β1 + β2pci,t < 0 for pci,t < pc* = - (β1 / β2)

5

GMM estimators are used to address the issue of endogeneity

in explanatory variables

I used 2 estimators:

The GMM dynamic panel data estimators developed in

Arellano, M. and S. Bond (1991) and Arellano, M. and O.

Bover (1995),

Both estimators are based on the assumption of no serial

correlation (or limited serial correlation) in the errors,

Both are included in Eviews 6,

They deal with the time specific effect by applying period

dummy variables,

They deal with the country specific effect in different ways,

as presented below.

6

The GMM estimator from Arellano, M. and S. Bond (1991)

(“The first difference GMM dynamic panel estimator”)

The one-step estimator developed in Arellano, M. and S. Bond

(1991):

This one step estimator is robust to heteroskedasticity over

individuals and over time (Arellano M. and S. Bond (1991),

p 285);

The regressions are estimated in first differences;

Differencing the equations is the way the country specific

effect is eliminated, since for each country i, Δηi = 0.

7

The GMM estimator from Arellano, M. and O. Bover (1995)

(“The orthogonal deviations GMM dynamic panel estimator”)

The orthogonal deviations estimator developed in Arellano, M.

and O. Bover (1995):

The transformation that eliminates the individual effect is

applied to the first T-1 equations;

It consists of subtracting the mean of the remaining future

observations available for each period and using time

weights (presented in Arellano, M. and O. Bover (1995), pp

41 and 42);

The regressions remain in levels.

8

Estimations and comparisons versus similar estimations in

Aghion, P., P. Bachetta, R. Ranciere and K. Rogoff (2006):

Coefficients of variables:

Table 2,

column

[2.2][1]

Table 2,

column

[2.4][2]

First

difference

GMM

estimation

Orthogonal

deviations

GMM

estimation 1

Orthogonal

deviations

GMM

estimation 2

Real exchange rate volatility

-3.124

(1.204)

-3.319

(1.208)

-6.6068

(4.891)

-2.6785

(1.4214)

***

-4.6800

(1.9684)

**

Financial development * real exchange

rate volatility

0.677

(0.262)

0.706

(0.277)

1.4609

(1.2378)

0.3162

(0.3626)

0.9004

(0.4907)

***

Initial per capita GDP

-0.530

(0.474)

-0.828

(0.404)

-0.2611

(0.0866)

*

-0.1555

(0.0210)

*

-0.0886

(0.0387)

**

0.53

0.86

Sargan p-values

0.241

0.187

0.30

* means significant at 1%, ** means significant at 5% and *** means significant at 10%

[1] Aghion, P., P. Bacchetta, R. Ranciere and K. Rogoff (2006), p35

[2] Aghion, P., P. Bacchetta, R. Ranciere and K. Rogoff (2006), p35

9

The results are better with the orthogonal deviations GMM

estimator in terms of smaller s.e., coefficient and Sargan p-values

10

Estimation results summary:

The orthogonal deviations GMM estimators yield more significant

results;

(This is in line with the observation in Blundell, R. and S. Bond (1998) (p

115) that the widely used first difference GMM dynamic panel data estimator can

be less precise when the autoregressive parameter in the regression is moderately

large:

The estimated regression: yi,t - yi,t-1= (α – 1)yi,t-1 + … yi,t = αyi,t-1 + …

In the estimations, α – 1 belongs to {-0.2611; -0.1555; -0.0886} => large

values for α)

Results presented in the last two columns in the comparative table

above indicate that exchange rate volatility has a significant negative

impact on economic growth, but only the estimations in the last column

indicate a positive and significant interaction term of real exchange rate

volatility and financial development; those estimations in the last

column are also most reliable among my results, as they result from

using the best specified of all estimators.

11

Threshold level analysis:

For the “orthogonal deviations” estimation with significant

coefficient for the interaction term, the computed threshold

level = 4.68/0.9 = 5.2 => a ratio of e5.2 ≈ 1.81 private credit to

GDP, which is a high rate, suggesting it could be biased

upwards (supportive of this are the threshold levels of private

credit to GDP estimated in Aghion, P., P. Bacchetta, R.

Ranciere and K. Rogoff (2006), p 35 - which are 1.01 and 1.10

- significantly smaller than 1.81

12

Conclusions

In the analysis of this paper, instead of looking at an individual effect of

exchange rate volatility on growth, an interaction term between volatility of

the real effective exchange rate and the financial development level was

also used, as in Aghion, P., P. Bacchetta, R. Ranciere and K. Rogoff (2006)

The balanced panel data analysis partly validated the predictions set in the

objectives of this paper.

The orthogonal deviations GMM estimators provide evidence that the real

effective exchange rate volatility influences the economic growth rate;

The first difference GMM estimator’s results are inconclusive;

The best specified GMM estimator employed yielded results similar to the

ones in Aghion, P., P. Bacchetta, R. Ranciere and K. Rogoff (2006):

It provided evidence that the real effective exchange rate volatility

influences the economic growth rate and there is a threshold effect of the

level of financial development, below which the volatility of the real

exchange rate diminishes growth and above which the exchange rate

volatility becomes growth enhancing and that the level of financial

development should be taken into account when a country chooses to adopt

a more flexible or a more fixed exchange rate system.

13

Tests employed - exemplified on the best estimator

Sargan test – for instruments validity

Under the null hypothesis that the overidentifying restrictions are valid, the

Sargan

statistic

(J-statistic)

is

distributed χ2(d.f. = instrument rank –

number of estimated coefficients,

including time dummies);

For

all tests, the over-identifying

restrictions seem to be valid,

considering that J-statistic < critical χ2

value => the null will not be rejected;

The p-values show that the validity of

the instruments (the null hypothesis)

can not be rejected and, in the last

estimation, the high value (0.86)

suggests almost certain acceptance of

the null hypothesis (that the variables

are valid).

14

Tests employed - exemplified on the first difference estimator

Wald test of joint significance of the

independent variables

Under the null of no relationship, the

Wald statistic is asymptotically

distributed as χ2(k), where k = the

number of estimated coefficients

(excluding the time dummies);

The

test is robust to general

heteroskedasticity (Arellano, M. and S.

Bond (1991), p 292; Blundell, Richard and

Stephen Bond (1998), p139; Windmeijer,

Frank (2005), pp 42 and 43);

For all tests, the Wald statistic >>

critical χ2 value => the null will be

rejected => a joint significance of the

variables used in the regression. Pvalues of 0.000 confirm that;

Individual coefficient tests can be

made, with similar conclusions.

The Wald statistic = 86.11

χ2(8, 5%) = 15.507

p-value = 0.000

The Sargan and Wald tests are also tests presented in Aghion, P., P. Bacchetta,

R. Ranciere and K. Rogoff (2006), whose benchmark specification I follow.

15

Testing for error serial correlation - exemplified on the first

difference estimator

Since both GMM estimators I use are

based on the assumption of limited or no

serial correlation of errors, I applied a

simple test using the residuals from the

GMM estimated equations. I regressed the

residuals against their first lag using a

panel LS estimator. The results are that

errors are not autocorrelated.

For α% significance, the criteria are:

DW > DW(U, α%) => the error

terms are not positively autocorrelated,

and

(4 – DW) > DW(U, α%) => the

error

terms

are

not

negatively

autocorrelated. (the critical values of the

statistics are taken from Greene, William

H. (2003), p 958, Table G.6)

For all three estimations the result is that

the errors are not positively nor negatively

autocorrelated

We can also assume the noncorrelation of

error terms by looking at the values of

adjusted R square, which are very small

(close to zero).

DW = 1.843594 > 1.63

4 – DW = 2.156406 > 1.63

DW (U, 5%, nr of regressors excluding intercept =

1, observations = 66) = 1.63

Adjusted R-square = 0.021369 << 1

16

Selected Bibliography

Aghion, Philippe, Philippe Bacchetta, Romain Ranciere, and Kenneth Rogoff, “Exchange Rate Volatility

and Productivity Growth: The Role of Financial Development”, Center for Economic Policy Research,

Discussion Paper no. 5629, April 2006

Arellano, Manuel and Stephen Bond, “Some Tests of Specification for Panel Data: Monte Carlo Evidence

and an Application to Employment Equations”, The Review of Economic Studies, vol. 58, no. 2, 277-297,

April 1991

Arellano, Manuel and Olympia Bover, “Another Look at the Instrumental Variable Estimation of Errorcomponents Models”, Journal of Econometrics 68, 29-51, 1995

Blundell, Richard and Stephen Bond, “Initial Conditions and Moment Restrictions in Dynamic Panel Data

Models”, Journal of Econometrics 87, 115-143, 1998

Bond, Stephen R., “Dynamic Panel Data Models: A Guide to Micro Data Methods and Practice”, CeMMAP

Working Paper 09, April 2002

Dubas, Justin M., Byung-Joo Lee, and Nelson C. Mark, “Effective Exchange Rate Classifications and

Growth”, NBER Working Paper 11272, April 2005

Husain, Aasim M., Ashoka Mody, and Kenneth Rogoff, “Exchange Rate Regime Durability and

Performance in Developing versus Advanced Economies”, Journal of Monetary Economics 52, 35-64, 2005

Levine, Ross, Norman Loayza, and Thorsten Beck, “Financial Intermediation and Growth: Causality and

Causes”, Journal of Monetary Economics 46, 31-77, 2000

Levy-Yeyati, Eduardo and Federico Sturzenegger, “To Float or to Fix: Evidence on the Impact of Exchange

Rate Regimes on Growth”, The American Economic Review, vol. 93, no. 4, pp. 1173-1193, Nov. 2003

Rogoff, Kenneth, Aasim M. Husain, Ashoka Mody, Robin Brooks and Nienke Oomes, “Evolution and

Performance of Exchange Rate Regimes”, IMF Working Paper 243, Dec. 2003

17

Back up slides

The choice of instrumental variables 1/2

For the regressors I mention the following possibilities:

endogenous (correlated with current and past shocks, but

uncorrelated with future shocks); predetermined (correlated

with past shocks and uncorrelated with present and future

shocks) or strictly exogenous (uncorrelated with past, present

or future shocks);

In the assumption of lack of serial correlation, than values of

the dependent variable lagged 2 and longer are valid

instruments for the regressions in first differences (Arellano,

M. and S. Bond (1991), p 278); so are lagged values of 2 or

higher order of endogenous regressors in first differenced

equations; the predetermined ones from the lag -1 and higher

order, and the strictly exogenous can be used for all lags

(Bond, Stephen R. (2002), p16; Windmeijer, Frank (2005);

Arellano, M. and S. Bond (1991), p 280).

19

The choice of instrumental variables 2/2

For the orthogonal deviations estimators, the transformation

ensures that lags of predetermined variables are valid

instruments in the transformed equations and that if the

original vi,t are not autocorrelated, than so are the transformed

errors;

As with the first difference estimator, limited or lack of serial

dependence in vi,t allow for lags of the dependent variable to

be predetermined variables in the model and thus to be used as

valid instruments.

20

Tests employed - exemplified on the best estimator for AR(4)

The Breusch-Godfrey test for

errors serial correlation, using the

F statistic:

P-value (F-statistic) = 0.187853 > 0.1

=> the null hypothesis (that errors are

uncorrelated) can not be rejected ;

F-stat = 1.77 <= 2.943 = critical F

(v11=, v2=10) => H0 accepted (errors

uncorrelated);

Also by looking at the adjusted Rsquare, the very small value indicates a

misspecified regression, implying the

noncorrelation in error terms;

Similar tests can be conducted for

AR(r) for all the estimations conducted

in this paper’s application.

21