* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download The systematic analysts` forecast errors are predictable

Survey

Document related concepts

Transcript

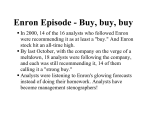

STOCK MARKET LIQUIDITY, AGGREGATE ANALYST FORECAST ERRORS, AND THE ECONOMY Ji-Chai Lin Ping-Wen (Steven) Sun Department of Finance Louisiana State University Dec 16, 2011 Agenda Background Research Question Conjecture Hypothesis Related Literature Data Empirical results Conclusion Implications Background Næs, Skjeltorp, and Ødegaard (2011) find Stock market liquidity change could predict future economic state (ex. GDP growth), especially from small stocks The flight-to-quality or flight-to-liquidity behavior from smart investors Stock Market Liquidity and Business Cycle Research Question What is the mechanism in the economic forecastability of stock market liquidity? More specifically, Why are investors willing to buy shares (provide liquidity) sold by smart investors? Do analysts play a role? Conjecture Smart investors foresee economy change unexpected by most of the investors The expectation of most investors is market expectation Financial analysts produce information and affect investors’ expectation Smart investors foresee economy change unexpected by “analysts”! Hypothesis Information content of analysts’ forecasts We assume that through aggregation, we can isolate the systematic analysts’ forecast errors The systematic analysts’ forecast errors are predictable Hypothesis Flight-to-quality behavior from smart investors We assume smart investors exploit the systematic analysts’ forecast errors through trading Hence, aggregate analysts forecast errors provide a channel through which stock market liquidity is a good future economy indicator Literature Review Analysts’ information production Informative? Givoly and Lakonishok(1979) Fried and Givoly (1982) Literature Review Biased? Analysts’ behavior Dreman and Berry (1995) Easterwood and Nutt (1999) Francis and Philbrick (1993) Clayman and Schwartz(1994) Lim (2001) Hong and Kubik (2003) Literature Review Security offering & M&A Ljungqvist et al. (2009) Kolasinski and Kothari (2008) Large and small traders Malmendier and Shanthikumar (2007) Global Settlement Kadan et al. (2009) Literature Review Benefits of Aggregation? Sadka and Sadka (2009) Howe, Unlu, and Yan (2009) Hameed, Morck, Shen, and Yeung (2008) predictability increases in the process of aggregation. Aggregation cancels out the idiosyncratic components of analyst forecasts and isolate their common response to systematic factors information spillovers as the source of stock return comovement, where one (neglected) stock is priced using readily available information about other stocks that share similar fundamentals Literature Review Flight-to-quality (flight-to-liquidity) behavior of investors Longstaff(2004) Næs, Skjeltorp, and Ødegaard (2011) Literature Review Longstaff(2004) Flight-to-liquidity premia are related to a variety of market sentiment measures Changes in consumer confidence Amounts of funds flowing into equity and money market mutual funds Supply of Treasury securities Næs, Skjeltorp, and Ødegaard (2011) Table VII Major Hypothesis Revisit Information content of analysts’ forecasts The systematic analysts’ forecasts are predictable Flight-to-quality behavior from smart investors Aggregate analysts forecast errors provide a channel through which stock market liquidity is a good future economy indicator Data From 1987Q1 to 2010Q4 BEA (Bureau of Economic Analysis) I/B/E/S (Institutional Brokers’ Estimate System) CRSP (Center for Research in Security Prices) NYSE common stocks (shrcd = 10 or 11) only Share price >$1 Listing for the whole calendar year Data Standardized Analyst Forecast Error (SAFE) SAFE Quarterly actual EPS - Expected quarterly EPS from analysts Standard deviation of EPS difference in the prior eight quarters December, Year t-1 March, Year t June, Year t September, Year t January, Year t April, Year t July, Year t October, Year t February, Year t May, Year t August, Year t November, Year t Q1, year t Q2, year t Q3, year t Q4, year t Data Data GDP growth (logarithm difference) dGDPRt ln( GDPRt / GDPRt 1 ) Data Stock market liquidity (Amihud (2002) daily price impact) DT Ri ,t t 1 VOLi ,t ILLIQi ,T 1 / DT Data Qt-2 Qt-1 Ex: April, May, June Ex: July, August, September Stock market liquidity change Smart investors Qt Ex: October, November, December GDP growth Aggregate analysts forecast errors Data Control variables Market volatility (equally-weighted quarterly individual stock return standard deviation) Market excess return (3-month cumulative monthly S&P500 index return and risk-free rate difference) Term-spread (10-year T-note yield and 3-month Tbill rate difference) Default-spread (Moody’s Baa – Moody’s Aaa) Fama and French (1989) Default spread is a long-term business condition variable (high during periods when business is persistently poor and low during periods when the economy is persistently strong) Term spread is a short-term business cycle variable (tends to be low near business cycle peaks and high near troughs) Empirical results Empirical results Empirical results Empirical results Empirical results Empirical results Empirical results Empirical results Conclusion Detrended aggregate analyst forecast errors highly correlate with concurrent GDP growth A large part of the forecast errors can be predicted using lagged macro variables Conclusion Once we control for the predicted forecast errors, the economic forecastability of stock market liquidity disappears Conclusion Stock market liquidity change has virtually no predictable power on the component of future GDP growth unrelated to aggregate analyst forecast errors, suggesting that systematic analyst forecast errors possess all pertinent information for stock market liquidity as an economic leading indicator Implications Analysts are too optimistic before recessions start and too pessimistic before recessions end From the fact that analysts’ forecast errors are predictable, analysts do not fully take into account of macro variables (market return, volatility, term spread, and default spread) in their prediction process Investors bear an information risk by following analysts’ forecast Companies may make better investment decisions through a better prediction of future economy state Future Research Industry fixed effects: some industries might be a better predictor of economic activity than others Information risk: firms with higher analyst forecast errors may have higher returns Smart investors: institutional investors with more trading, mutual fund managers (stock picking and market timing) International comparison: analysts’ quality and institutional ownership differs in different countries Thank You!