* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Understanding Volatility/Standard Deviation within investment funds.

Land banking wikipedia , lookup

Systemic risk wikipedia , lookup

Private equity secondary market wikipedia , lookup

Rate of return wikipedia , lookup

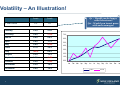

Shadow banking system wikipedia , lookup

Greeks (finance) wikipedia , lookup

Beta (finance) wikipedia , lookup

Financial economics wikipedia , lookup

Modern portfolio theory wikipedia , lookup

Fund governance wikipedia , lookup

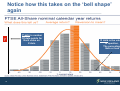

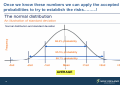

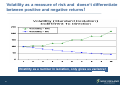

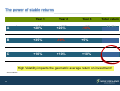

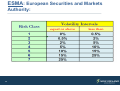

For Financial Brokers and Advisors Only Understanding Volatility/Standard Deviation within investment funds. March 2015 Andy Ivory-Corr, QFA, Grad Dip, CFP® Head of Investments New Ireland Assurance Measuring Risk! ESMA CESR 2 What does risk actually mean? 3 Volatility? 4 Volatility – is just a measure of Standard Deviation.....but what does that mean?! 5 What exactly is volatility or Standard Deviation? • A measure of the variation of price of a financial instrument over time. (has many other uses outside of finance). • The more volatile an investment is, the greater the variation of it’s returns (the higher the up’s and down’s of the investment are). • Volatility does not measure the direction of prices changes, merely their dispersion! (hence nobody minds ‘positive’ volatility!) • So when we think about investment risk, what we are interested in is, the likelihood and size of ‘deviations’ from ‘expected return or outside the Normal distribution of return’. 6 Volatility – An Illustration! Q1 – Would you be happy with this return? Q2 – Would you invest more with each manager? Fund A Fund B 6% 6% January 0.5% 2.0% February 0.4% -1.0% 7.0% March 0.6% 0.8% 6.0% April 0.8% 1.7% May 0.8% -2.4% June 0.7% 3.0% July -0.2% 0.9% August 0.5% 1.5% September 0.5% -1.4% October 0.5% -1.4% November 0.5% 1.4% December 0.4% 1.0% 1 Year Return 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Jan Feb Mar Apr May Jun Fund A 7 Jul Aug Sep Fund B Oct Nov Dec Jan We also need to know how ‘dispersed’ the data is, as well as the average return! = 16 = 16 or Volatility or Standard Deviation! ESMA then categorises funds, by risk category depending on the historic volatility of the underlying fund. (is this enough???) 8 So why has the use of ‘volatility’ become so important in our investment world in the last few years? • • • • • 9 Risk Management after 00, 01, 08 now much more important to advisors and clients. Derivative instruments now available to help fund managers try to manage risk – volatility controlled, PAF, GRRF, IBOF! Dynamic asset allocation allows managers much more flexibility to move in and out of assets to try to control this volatility, MRI with SSgA, DSC ILAC etc. ESMA ratings now categorise funds based on volatility so that we can now assess the potential downside risks of investing in a particular fund. (this has limitations and must be viewed with caution!) With advisors building their ‘own’ portfolios’ understanding volatility has become vitally important. Think of the mandate problems that the ‘Balanced Managed Funds’ caused in 2008 crisis and how volatility changed. Some Terminology – Normal Distribution? A normal distribution of data for anything being measured using Standard Deviation simply means that most of the examples in a set of data are ‘close to the average’ Lets look at an example of this ………….. 10 Lets start by looking at some short term price movements of an asset: Share Price BT – What observation would we make? 11 Examining this graph we can see most of the movements are clustered around the -2% to +2% with much fewer instances of -4% or +4% (lower probability!) 12 Turning the graph we can see the pattern that gives us our ‘bell curve’ which is typically how Standard Deviation is illustrated! Most of the returns are clustered around -2% to +2% with much fewer to the left or right of the graph! 13 Look how different the volatility appears depending on the timeframe under examination! 14 So lets apply this principle to world equity returns and how does it look…………a wide dispersal of returns! 15 Notice how this takes on the ‘bell shape’ again Y axis is number y Of data points for Each value on X Axis X axis is the values In question, The percentage Gain or loss x 16 Lets not worry about ‘how to calculate’ it but instead lets consider how to use the information. • We must understand a few important points before we can use volatility to estimate risk. 1. The average return of the asset or fund in question. 2. The Standard Deviation figure (volatility number), which is generally based on 5 yr historic numbers. Using Standard Deviation in finance is very different to other applications where the inputs are much more defined. Example would be getting the SD of the heights of everybody working in New Ireland – inputs are definite and not subjective! 17 Once we know these numbers we can apply the accepted probabilities to try to establish the risks……...! AVERAGE 18 Example: Fund Average return 8% with Volatility of 10% • We assume what our ‘range’ of returns are likely to be, from knowing these numbers. 1. 68% probability of return being within 1 Std Dev of average which is 8% plus or minus 10%. Our range then +18% to -2% 2. 95% probability of return being within 2 Std Dev of average which is 8% plus or minus 20%, Our range then +28% to -12% 3. 99% probability of return being within 3 Std Dev of average which is 8% plus of minus 30%, our range then + 38% to -22% But lets not forget that the probability of a 3 Standard Deviation event is also very low! 19 Volatility can’t measure extreme events! 1. It can’t account for every eventuality in the market place, and extreme events can cause large ‘tail effects’ which fall outside normal ‘probabilities’ 2. It assumes the returns of the underlying assets to be ‘normal’. As derivative structures don’t always display a normal distribution of returns, Standard Deviation may not be the best measure of risk within certain funds. (hedge funds, Property funds) 3. It does not give you any measure of ‘risk adjusted’ returns. 20 Volatility as a measure of risk and doesn’t differentiate between positive and negative returns! Volatility as a number in isolation, only gives us varience! 21 22 Date 09/08/2005 09/07/2005 09/06/2005 09/05/2005 09/04/2005 09/03/2005 09/02/2005 09/01/2005 09/12/2004 09/11/2004 09/10/2004 09/09/2004 09/08/2004 09/07/2004 09/06/2004 09/05/2004 09/04/2004 1.5 09/03/2004 09/02/2004 09/01/2004 09/12/2003 09/11/2003 0.9 09/10/2003 09/09/2003 09/08/2003 09/07/2003 09/06/2003 09/05/2003 Unit Price Lets remember ‘Volatility’ can change over time! Comparison of Volatility 1.6 Fund A 1.4 1.3 1.2 1.1 Fund A Fund B 1 Fund B 0.8 0.7 0.6 Volatility – Statistics from our example Daily Prices Fund A Fund B Average move: 0.32% 0.76% Max move: 1.6% 5.1% Std. Deviation: 9% 15% ! 23 Remember this is only telling us about what has happened in the past and tells us nothing about what might happen in the future! The Funds to which stats relate? *ESMA ratings are calculated using 5 yrs historical data. Fund A: Balanced Managed Fund (May 2003 to August 2005) = 9% would be ESMA rating 4! Fund B: Balanced Managed Fund (January 2008 to April 2010) = 15% would be ESMA rating 6! ! 24 The problem? As the markets got riskier so too did the fund! Year 1 Year 2 Year 3 Total return A A +20% +20% +20% +20% -10% -10% +29.6% +29.6% B B +35% +35% -10% -10% +5% +5% +27.6% +27.6% C C +10% +10% +10% +10% +10% +10% +33.1% +33.1% High Volatility impacts the geometric average return on investment! Source: Newton 25 ESMA: European Securities and Markets Authority: 26 New Ireland portfolios…. 27 ESMA a great tool, but not a panacea! 28 So to sum up, volatility the limitations as a measure of risk. • It doesn’t take into account valuations, are assets cheap or expensive? (Bonds!) • Could underestimate the risk of some assets or funds, example Property. (7th April 09 – 7th April 2014 Volatility 3.16%) Source Moneymate • Volatility can change over time. • Not suitable for risk rating every type of investment fund, example Lifestyling! • Extreme events can’t be modelled with reliable statistics. • Finally…..Volatility measures the past, but customers invest for the future! 29 30 Warning: The value of your investment may go down as well as up. Warning: These funds may be affected by changes in currency exchange rates. Warning: Past performance is not a reliable guide to future performance. Terms and conditions apply. Where relevant life assurance tax applies. This presentation is of a general nature and should not be relied upon without taking appropriate professional advice. The content is for information purposes only and does not constitute an offer or recommendation to invest in the Funds. All opinions and estimates constitute best judgement and are subject to change. Davy is a member of the Irish Stock Exchange and the London Stock Exchange. Davy Asset Management is regulated by the Central Bank of Ireland. Kleinwort Benson Investors Dublin Ltd is regulated by the Central Bank of Ireland. BNY Mellon Global Real Return Fund is a Sub-Fund of BNY Mellon Global Funds, plc. BNY Mellon Global Funds, plc is an open-ended umbrella type investment company with variable capital (ICVC) and segregated liability between sub-funds, incorporated with limited liability under the laws of Ireland. It qualifies and is authorised in Ireland by the Central Bank of Ireland as an undertaking for collective investment in transferable securities pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2003 (S.I. No 211 of 2003), as amended. The Manager of BNY Mellon Global Funds, plc is BNY Mellon Global Management Limited. BNY Mellon Global Management Limited, 33 Sir John Rogerson's Quay, Dublin 2, Ireland. The Manager is approved as a management company and regulated by the Central Bank of Ireland under the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2003 (SI No 211 of 2003), as amended. The Global (ex. US) Distributor of BNY Mellon Global Funds, plc is BNY Mellon Asset Management International Limited. BNY Mellon Asset Management International Limited, BNY Mellon Global Management Limited (BNY MGM), Newton and any other BNY Mellon entity mentioned are all ultimately owned by The Bank of New York Mellon Corporation. State Street Global Advisors Ireland Limited is regulated by the Central Bank of Ireland. Incorporated and registered in Ireland at 2 Park Place, Upper Hatch Street, Dublin 2. Registered number 145221. Member of the Irish Association of Investment Managers. New Ireland Assurance Company plc is regulated by the Central Bank of Ireland and a member of Bank of Ireland Group 31 .