* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Solutions to Problems

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Monetary policy wikipedia , lookup

Global financial system wikipedia , lookup

Interest rate wikipedia , lookup

Real bills doctrine wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

International monetary systems wikipedia , lookup

Balance of payments wikipedia , lookup

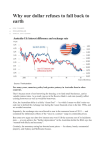

Solutions to Problems Chapter 28 1a. The Australian dollar depreciates. As the Australian economy recovers from recession domestic income rises, increasing induced consumption. Some of this increased consumption spills over into increased induced imports. The demand for foreign exchange rises, shifting the demand curve to the right (see figure 1a). The Australian dollar depreciates. 1b. The Australian dollar appreciates. The discovery of large new reserves of oil increases the quantity of Australia's exports. This shifts the supply curve for foreign exchange to the right (see figure 1b). The Australian dollar appreciates. 1c. The Australian dollar appreciates. As domestic monetary policy is tightened, domestic interest rates rise, increasing the value of Australian interest rates relative to rates overseas. Thus, the rate of capital outflow falls, reducing the demand for foreign exchange; and the rate of capital inflow picks up, increasing the supply of foreign exchange (see figure 1c). Additionally, the higher interest rate reduces domestic spending, shifting the AD curve to the left. As spending falls, import demand falls and this further reduces the demand for foreign exchange. The Australian dollar appreciates. 1d. The Australian dollar appreciates. A strong economic recovery aboard will increase foreign aggregate demand and real GDP, increasing foreign imports and domestic exports. The supply of foreign exchange curve will shift to the right (see figure 1b). The Australian dollar appreciates. 1e. The Australian dollar depreciates. As monetary policy is tightened abroad, foreign interest rates rise, changing the interest rate differential and reducing foreign spending. In the domestic economy, the rate of capital outflow increases, increasing the demand for foreign exchange. The rate of capital inflow falls, reducing the supply of foreign exchange. Additionally, the fall in foreign spending will reduce domestic exports, further reducing the supply of foreign exchange (see figure 1d). The Australian dollar depreciates. 1f. The Australian dollar depreciates and then appreciates. As government expenditure increases, domestic aggregate demand increases and real GDP rises. The increase in real GDP increases imports, and the demand for foreign exchange rises (see figure 1a). The Australian dollar depreciates. At the same time domestic interest rates will rise with increased government spending and the consequent fall in national saving. National saving = (T G) + (S I) The higher domestic interest rates will increase the rate of capital inflow, increasing the supply of foreign exchange and reduce the rate of capital outflow, reducing the demand for foreign exchange (see figure 1c). The Australian dollar appreciates. Forex Market–Problems 1&2 Exchange rate (AUD/FX) Exchange rate (AUD/FX) Forex Market–Problems 1&2 S0 e1 e0 • • b a S0 S1 a • e0 e1 b • D1 D0 D0 q0 q1 q0 q1 Quantity of FOREX Figure 1a Figure 1b Forex Market–Problems 1&2 Forex Market–Problems 1&2 Exchange rate (AUD/FX) Exchange rate (AUD/FX) Quantity of FOREX S0 S1 e0 •a e1 • b S1 S0 e1 •b e0 • a D1 D0 D0 D1 Quantity of FOREX Quantity of FOREX Figure 1c 3. Figure 1d Both the US dollar and Australian dollar depreciate against all other currencies not linked to the US dollar. The US monetary authorities loosen their domestic monetary policy. In the United States, as the money supply expands, US interest rates fall. This changes the interest rate differential and the United States sees an increase in its capital outflow and a decrease in its capital inflow. This increases US demand for foreign currencies and reduces world demand for the US dollar. The US dollar depreciates, or other currencies appreciate in terms of the US dollar. Additionally, US real GDP rises as interest rate fall and US imports increase, further increasing US demand for foreign currencies. Thus, the rest of the world exports to the US increase. If the Australian dollar is tied to the US dollar the Australian dollar will depreciate against all other currencies, other than the US dollar. This is shown figure 2 with the exchange rate moving from e 0 to e1. The depreciation of the Australian dollar encourages increased exports to all other countries not linked to the US dollar and increases the quantity of foreign exchange supplied a move from point a to point c in figure 2. The depreciation of the dollar also discourages imports from all other countries not linked to the US dollar and reduces the quantity of foreign exchange demanded a move from a to b in figure 2. The Australian dollar is undervalued and there is a surplus (q 1q0) of foreign exchange. The Reserve Bank needs to buy the surplus of foreign exchange with Australian dollars if it is to keep the exchange rate between the US and Australian dollars fixed. The supply of foreign exchange available in forex markets moves from S 0 to S1 and the Reserve Bank accumulates foreign exchange reserves. An excess of foreign exchange reserves is seen as undesirable because it represents a loss of potential GDP. NZ exchange rate – Problem 4 S1 e1 e0 b • S0 c a • • Exchange rate (NZD/FX) Exchange rate (AUD/FX) Aust. exchange rate – Problem 3 S0 S1 •a e0 e1 b • c • D0 D0 q0 q1 q0 Quantity of FOREX Figure 2 q1 Quantity of FOREX Figure 3 5a. The Australian dollar depreciates. If the Australian economy was growing faster than the world economy Australian imports would be expected to grow faster than Australian exports. The growth in demand for foreign exchange rises faster than the growth in supply of foreign exchange having the effect of a rightward shift of the demand curve for foreign exchange (see figure 1a). The Australian dollar depreciates. If the strength of the Australian economy attracted increased foreign investment, the supply of foreign exchange would increase and reduce the size of the Australian dollar depreciation. 5b. The Australian dollar appreciates. If Australia’s inflation rate is less than that of its major trading partners Australia’s exports will become relatively cheaper overseas and Australia’s imports will become relatively more expensive. Australia’s net exports will increase. The increase in exports will increased the supply of foreign exchange and the fall in imports will reduce the demand for foreign exchange. The Australian dollar appreciates (see figure 1c). The exchange rate moves to restore purchasing power parity. If prices have increased in the rest of the world faster than in Australia, then people will generally expect that the value of the Australian dollar on the foreign exchange markets must rise, as foreign demand for Australian goods increases and Australian demand for foreign goods falls. In this situation, the Australian dollar is expected to appreciate. The supply of foreign exchange increases and the demand for foreign exchange decreases. The exchange rate falls and the Australian dollar appreciates, as expected and purchasing power parity is restored. 5c. The Australian dollar appreciates. If Australian interest rates are rising faster than rates overseas the rate of capital outflow from Australia falls, reducing the demand for foreign exchange; and the rate of capital inflow into Australia picks up, increasing the supply of foreign exchange (see figure 1c). The Australian dollar appreciates. Funds move to get the highest return available. If for a few seconds a higher return is available in Sydney than in New York, the demand for US dollars falls, the demand for Australian dollars rises and the Australian dollar appreciates until expected rates of return are equal. Adjusted for risk, interest rate parity prevails. 7 The increased government expenditure will, in the long run, ‘crowd-out’ net exports. An increase in government expenditure on goods and services will affect the value of the dollar and net exports directly through the market for goods and services and indirectly through money markets. In the goods and services market the increase in government expenditure increases aggregate planned expenditure and shifts the AD curve to the right. Macroeconomic equilibrium shifts from point a to point b in figure 4a, at a point of above fullemployment and an inflationary gap. Real GDP and the price level rise. The increase in real GDP increases induced imports, increasing the demand for foreign exchange. In figure 4b the economy moves from a balanced trade account at Yp (point a) to a deficit of (b/b) on the trade account at Ye. This outcome is reinforced to some extent by the rise in the domestic price level, which makes some domestic goods more expensive relative to overseas goods. Exports will fall and imports will rise the import function in figure 4b will begin to rise and the export function will begin to fall. The rise in imports and fall in exports sends net exports further into deficit. At the same time, the increase in demand for foreign exchange and the possible fall in supply cause the Australian dollar to depreciate. In the money market the increase in real GDP, caused by the increase in government spending will increase the demand for money; from MD0 to MD1 in figure 4c, and the rise in the price level will reduce the supply of real money; from MS0 to MS1 in figure 4c. The domestic interest rate will rise from 3% to 5%, increasing the interest rate differential (assuming Australian interest rates are already higher) and causing the Australian dollar to appreciate. The appreciation of the dollar increases the price of Australian exports in international markets and reduces the domestic price of Australian imports. This further reduces the balance of trade in figure 4b the import function moves upwards and the export function moves downwards. In figure 4d the trade account moves from being balanced at point a with an interest rate of 3% to a deficit of c /c at 5% interest. This is long run equilibrium, by the time these monetary effects have worked through the system the economy has moved back to potential real GDP (Yp) and the deficit on current account is c/-c in figure 4b. The increased government expenditure will, in the long run, crowd-out net exports. Figure 4a Figure 4b Figure 4c Figure 4d