* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Document

Survey

Document related concepts

Transcript

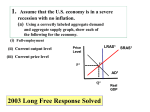

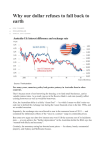

AP Economics: International Review FRQs May 2016 International FRQs 1. Assume that an increase in government spending increases the budget deficit in Country A. a) Using a correctly labeled graph of the loanable funds market, show the effect of the increase in Country A’s budget deficit on the real interest rate. Correct labels; downward sloping Demand for Loanable Funds curve; upward sloping Supply for Loanable Funds curve; D shifts to right; increasing quantity and real interest rates. b) Given your answer in a), what is the effect on business investment in Country A? Increase in real interest rates causes decrease in Investment c) The exchange rate between Country A’s dollar and Country B’s peso is determined in a flexible exchange market. Using a correctly labeled graph of the foreign exchange market for Country A’s dollar, show how the interest rate change you identified in a) affects the international value of Country A’s dollar. Correct labels; increase in real interest rates increases demand for Country A’s dollar, exchange rate increases d) Given your answer to c), explain how the competitiveness of Country A’s goods changes relative to Country B’s goods. The appreciation in the Dollar makes exports more expensive to consumers in other nations, hurting their competitiveness. 2. Due to an internal financial crisis, Canada experiences a significant outflow of funds to other countries. Explain the effect that this outflow of funds will have on the following: a) the international value of the Canadian dollar Outflow of funds increases demand for other currencies and increases the supply of the Canadian dollar (CAD), causing value of CAD to depreciate b) Canadian net exports Depreciation of CAD causes Canadian products to look less expensive to consumers in other nations, causing increase in exports (this is why many nations attempt to depreciate their own currency, to increase XN and thus AD…Japan is notorious for this …) c) the real interest rate in Canada Outflow of funds causes decrease in supply of funds, causing real interest rates to increase d) the level of investment in Canada Increase in real interest rates causes decrease in investment 3. Assume an economy is in recession. a) Identify one monetary policy action and one fiscal policy action that could be used to help the economy out of the recession. Explain the effect of each policy on the price level and the equilibrium level of output. Expansionary monetary policies: 1) Buying securities increases MS, causing decrease in interest rates, causing increase in Investment, causing increase in AD, causing increase in both price level and output. 2) Reduce discount rate, causing decrease in interest rates, followed by same cause and effect as in (1). 3) Reduce reserve requirement, causing increase in MS, followed by same cause and effect as in (1). Expansionary fiscal policies: 1) Increase spending, increases AD, causing increase in price level and output. 2) Decrease taxes, increases disposable income, causing increase in C, causing increase in AD, causing increase in price level and output. b) Given your answer in part a) on the price level effect, explain the effect the policy actions you identified in part a) would have on the economy’s imports and its exports. The increase in price level makes products more expensive to consumers in other nations, decreasing exports. Imports will increase as products in other nations are relatively cheaper. c) Given your answer in part a) on the output effect, explain the effect the policy actions you identified in part a) would have on the economy’s imports and exports. Imports will increase as the increased AD will increase demand for imports as well as domestic goods. d) Given your answers above, explain what effect the policy actions would have on the international value of the dollar. The decrease in exports will decrease the demand for the dollar and the increase in imports will increase the supply of the dollar. Both cause depreciation of the dollar. 4. Year 1 2 Dollar 1 1 Exchange Rates Yen 350 350 Franc 4.0 5.8 Mark 1.8 2.3 a) Given the change of the value of the dollar between Year 1 and Year 2, as indicated in the table above, describe the effects this will have on United States tourism overseas. The appreciation of the dollar will increase US tourism to France and Germany b) Using an aggregate demand – aggregate supply graph, show and explain the impact of the change in the value of the dollar on the price and output levels in the United States. Correct labels; downward sloping AD curve; upward sloping SRAS curve; increase in value of dollar causes decrease in net exports, causing AD to shift to the left, decreasing both price level and output (more on next page) c) Explain what impact the change in the value of the dollar will have on the United States balance of trade. Moves toward deficit. Appreciation of dollar will cause exports to become relatively more expensive to consumers in other nations, and for imports to become relatively cheaper for US consumers, so balance of trade declines.