* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download af`fidavit marc lee i - Office national de l`énergie

Economics of global warming wikipedia , lookup

Surveys of scientists' views on climate change wikipedia , lookup

Economics of climate change mitigation wikipedia , lookup

Climate engineering wikipedia , lookup

Public opinion on global warming wikipedia , lookup

Climate governance wikipedia , lookup

German Climate Action Plan 2050 wikipedia , lookup

Solar radiation management wikipedia , lookup

Climate change mitigation wikipedia , lookup

Reforestation wikipedia , lookup

Climate-friendly gardening wikipedia , lookup

Climate change and poverty wikipedia , lookup

Carbon pricing in Australia wikipedia , lookup

Climate change feedback wikipedia , lookup

Decarbonisation measures in proposed UK electricity market reform wikipedia , lookup

IPCC Fourth Assessment Report wikipedia , lookup

Years of Living Dangerously wikipedia , lookup

Citizens' Climate Lobby wikipedia , lookup

Carbon Pollution Reduction Scheme wikipedia , lookup

Carbon capture and storage (timeline) wikipedia , lookup

Politics of global warming wikipedia , lookup

Low-carbon economy wikipedia , lookup

Mitigation of global warming in Australia wikipedia , lookup

nn t

Hearing Order OH-001-2014

File No. OF-Fac-Oil-T260-2013-03 02

IN THE MATTER OF

TRANS MOUNTAIN EXPANSION PROJECT

Name of persons bringing motion:

LYNNE M. QUARMBY, ERIC DOHERTY,

RUTH WALMSLEY, JOHN VISSERS, SHIRLEY

SAMPLES, FOREST ETHICS ADVOCACY

ASSOCIATION, TZEPORAH BERMAN and

others

MARC LEE

AF'FIDAVIT

I, MARC LEE, economist, of 1400-207 V/est Hastings Street, in the City of Vancouver,

in the Province of British Columbia, AFFIRM THAT:

1. I am an economist. I have been retained by the Applicants in this proceeding. I have

been asked to provide an affidavit addressing potential economic risk related to

climate change, including concepts such as theoocarbon budget" and "carbon bubble",

in the context of the Kinder Morgan Trans Mountain Pipeline Expansion Project'

2.

This statement refers to the National Energy Board's decision that it will not consider

submissions about'othe environmental and socio-economic effects associated with

upstream activities, the development of oil sands, or the downstream use of the oil

transported by the pipeline" in its hearings about the proposed Kinder Morgan Trans

Mountain Pipeline Expansion Project.

3. I have a Master of Arts in Economics from Simon Fraser University.

I am a Senior

Economist at the Canadian Centre for Policy Alternatives (ooCCPA"), where I have

worked for the past 15 years in the British Columbia office. Since 200'7,I have codirected the Climate Justice Project ("CJP"), a multi-year research collaboration led

by CCPA and including a wide range of academics and community organizations.

The CJP is studying the economic and social impacts of climate change policy,

I

nnç

UJr.d

primarily using BC as a case study. Among CJP research is

a

March2013

publication , Canada's Carbon Liabilities: The Implications of Stranded Fossil Fuel

Assets

for Financial Mørkets

and Pension Funds, which I co-authored with Brock

Ellis, and which is attached as Exhibit úrA" to my Affidavit. My curriculum vitae is

attached as

4.

Exhibit *8" to my Affrdavit.

What follows summarizes evidence from that research paper, and subsequent inquiry

into the topic by myself. In short, I argue that:

(a) constraints on carbon are likely at some point in the future;

(b) Canada is unprepared for such a world of constrained carbon, and needs to

pro-actively take this possibility into account when planning and approving

long-term infrastructure;

(c) Canada's share of a global carbon budget consistent with keeping global

warming below 2'C implies a "carbon bubble"

-

an over-valuation

of

Canadian fossil fuel companies and associated commercial enterprises; and

(d) the adverse impact on Canadian pension funds is of particular concern due

to its relevance for retirement incomes.

5. The increasing severity of extreme

weather events around the world is confirming

some of the most alarming predictions of climate science over the past couple

decades. Damages from climate change and fossil fuel development were estimated at

$1.2

trillion per year, or L6Yo of world GDP, in 2010, according to a report by DARA

and the Climate Vulnerable Forum (composed of governments from the global South

vulnerable to climate change); damages are anticipated to rise to 3.2o/o of GDP by

2030.1

6. Prominent

global organizations like the World Bank and International Energy Agency

have joined the Intergovernmental Panel on Climate Change

in calling attention to the

DARA and the Climate Vulnerable Forum (2012). Climate Vulnerability Monitor 2nd Edition: A Guide

to the Cold Calculus of a Hot Planet, September 2012,http:lldaraint.org/climate-vulnerability1

monitor/climate-vulnerability-monitor-20

I

2/

2

ci3

dangerous path of warming that human civilization is on. For example, in a landmark

November 2012 report the V/orld Bank concluded we are headed for a 4oC \¡/armer

world, "one of unprecedented heat waves, Severe drought, and major floods in many

regions, with serious impacts on ecosystems and associated services."

1.

2

Governments around the world have supported a maximum warming of 2oC, above

which is considered dangerous climate change, and are working towards a new

internationaltreaty (United Nations Framework Convention on Climate Change,

"UNFCCC") for 2015, to be implemented by 2020.

8. Evidence of changing climate patterns

and extreme weather events are having an

impact on public opinion and politics. The flooding of the US Eastern Seaboard, in

particular New York City, in the closing days of the 2012U5 presidential election

contest forced climate change into a campaign that had ignored the issue. Likewise,

Super-Typhoon Haiyan, which killed thousands and displaced millions in the

Philippines

, gavean enhanced sense of urgency to international climate talks,

resulting in a new international mechanism for loss and damage associated with

climate change impacts in the 2013 V/arsaw Conference of Parlies of the UNFCCC.

9.

The Fifth Assessment Reporl of the Intergovernmental Panel on Climate Change

("IPCC") (Working Group 1 report, released September 2013) notes that what matters

for warming is the total stock of greenhouse gas emissions going forward. For

a

two-

thirds (66%) probability of not exceeding 2"C,the world's remaining carbon budget

is approxim ately 943 billion tonnes of carbon dioxide (Gt CO2), and for a 50o/o

chance 1,053 Gt CO2 (converted by author). For context, annual emissions globally

from fossil fuel combustion are about 33 Gt COz. So the world's carbon budget is

approximately three decades of emissions at current levels.

10. This IPCC finding builds on previous research on carbon budgets in recent years.

In

2009, researchers with the Potsdam Institute conducted a probabilistic analysis aimed

at quantifying greenhouse gas emission budgets for the period 2000 to 2050 that

2

World Bank, Turn Down the Heat: Ilhy a 4"C l(armer l(orld Must be Avoided, November 2012,

4-degree_centrigrade

http://climatechange.worldbank.org/sites/default/files/Turn_Down-the-heat-Why-a

_warmer_world_must be_avoided.pdf

J

rt,

^,^.

would limit global warming to less than2"C, Their analysis concludes that a carbon

budget of no more than 886 Gt of COz can be released into the atmosphere if we are

to have a80o/o chance of staying under the2"C limit, and no more thanI,437 Gt COz

for a 50Yo chance.3

1

1.

A widely reported 201 1 report from the Carbon Tracker Initiative ("CTI") was the

first to argue that this represents a "carbon bubble." Starting with the 886 Gt carbon

budget from the Potsdam Institute study, CTI estimated the world's remaining carbon

budget at 565 Gt, due to emissions up to the end of 2010. It also calculated the

emissions potential of the world's proven oil and gas and coal reserves at2,795 Gt

COz

- that is, five times the estimated carbon budget.a Thus, as much as 80% of

global fossil fuel reserves must stay underground. In subsequent work, Carbon

Tracker argues that the carbon budget can be increased if more rapid action is taken

on non-CO2 greenhouse gas emissions such as methane.s

12.

A similar conclusion about fossil fuel reserves that must be left undeveloped was

reached by the International Energy Agency. Their analysis was based upon the larger

carbon budget representin g a 50o/o chance of staying below 2oC. Nonetheless, they

conclude: "No more than one-third of proven reserves of fossil fuels can be consumed

prior to 2050 if the world is to achievethe2"C goal, unless carbon capture and

storage technology is widely deployed."6

13.

My research report with Brock Ellis, Canada's Cqrbon Liabilitie,s, estimates Canada's

share

of

a global carbon budget based on share

of world GDP and based on world

population. A plausible carbon budget for Canada almost certainly falls between 2

and20 Gt. Even at the high end of a 20 Gt carbon budget, this would imply thatTSo/o

of proven reserves, and 89Yo of proven-plus-probable reserves, would need to remain

underground. When (if) the necessary policy action is taken to constrain the amount

M Meinshausen et al, "Greenhouse-gas emission targets for limiting global warmingto 2C" in Nqture,

April30,2009.p.l158,http://www.iac.ethz.ch/people/knuttir/papers/meinshausen09nat.pdf

3

a

Carbon Tracker Initiative, Unburnable Carbon: Are the world's financial markets carrying a carbon

bubble? http ://www. carbontracker. org/carbonbubble

5

Carbon Tracker Initiative. Unburnable Carbon 2013: Wasted capital and stranded assets'

6

International Energy Agency. World Energy Outlook 20 I 2.

http://www.iea.org/publications/freepublications/publication/English.pdf

4

ûii5

of carbon dioxide humanity is sending into the atmosphere, those reserves must

become stranded assets.

14, Our carbon

liabilities report evaluated top Canadian fossil fuel companies and their

vulnerability to becoming stranded assets. The Toronto Stock Exchange (TSX) is

highly weighted towards the fossil fuel sector, with total market capitalization of

fossil fuel companies around $400-500 billion. Fossil fuel companies account for

about 24Yo of the total value of the principal index of the Toronto Stock Exchange

(S&P/TSX60). These stocks would lose value under a new global climate regime,

with adverse impacts on individual investors, institutional investors, and the economy

as a

whole. This situation is exacerbated by the predominance of bitumen and coal in

the reserve mix because these particular fuel types are far more greenhouse gas-

intensive than other fossil fuel products, and are much more likely to be regulated

earlier under a global climate action framework. Our analysis did not consider

pipeline companies, as they do not hold reserves themselves; however, we note that

their business model would be adversely affected due to its reliance on fossil fuel

extractton.

15, We developed a database

of

1

14 fossil fuel companies operating

in Canada

- 103

listed on the Toronto Stock Exchange (assets greater than $70M for oil and gas, and

$50M for coal), and 11 foreign-owned subsidiaries. For each we compiled financial

data on revenue, assets and market capitalization, plus data on fossil fuel reserves

(proven and probable), which we converted into potential COz emissions. We then

compared financial data with an estimated range of their carbon liabilities by

multiplying reserves by a carbon price, which represents the estimated damages from

emitting a tonne of carbon (known as the social cost of carbon, ot SCC, based on

recent literature).

16. To summarize, business as usual for the fossil fuel industry is incompatible

with

action to address climate change that keeps global temperature increase fo 2"C or less.

Any plausible carbon budget for Canada means the vast majority of fossil fuel

reserves

will

need to stay in the ground. But because stock market valuations are

5

c

premised on companies extracting those resources, there is a "carbon bubble" in our

financial markets.

17

.In Canada's Carbon Liabilities, we found that pension funds have systematically

ignored this risk to their porlfolios, and that in doing so are not upholding their

fiduciary responsibility to their beneficiaries, in particular younger members whose

retirements will not happen for several decades hence. Pension funds are an asset

class that is second only to housing in importance to middle-class households. And as

we saw during the housing bubble collapse, many pension funds were left holding

sub-prime mortgage assets.

18. However, since then the situation has evolved as awareness of these issues has grown.

Pension fund managers around the world are now starting to ask questions about

climate risk. In October 2013, a group of 70 large institutional investors, representing

$3

trillion in

assets, demanded answers from fossil fuel companies about whether

their business plans are compatible with climate action.T

19.

A range of other institutional investors are raising similar concerns. Some municipal

governments, churches and universities have already announced divestment from

fossil fuels, while campaigns are underway in many others across North America.

The City of Vancouver is engaging the BC Investment Management Corporation

(who manage the province's public sector pension funds) about how it is considering

climate risk and carbon budgets in its investment portfolio. Divestmentmay also be

the result of moral concerns about climate change; however, the economic case for

asset stranding has also played a role in decision-making.

20. I acknowledge that I have a duty to provide impartial expert evidence on matters

relevant to my area of expertise and that this duty overrides any duty to a party to this

proceeding, that I have a duty to be independent and objective, and that I must not be

an advocate for any party.

t Press release from Ceres and Carbon Tracker, "Investors ask fossil fuel companies to

assess

how business

plans fare in low-carbon future," October 24,2014 http://www.ceres.org/press/press-releases/investorsLetter at:

ask-fossil-fuel-companies-to-assess-how-business-plans-fare-in-1ow-carbon-future.

http://www.ceres.org/files lcar-matslcar-release/compiled-company-letters/at-download/file

6

i)

,n

i\á

2|.lhave

no relationships to any of the persons bringing this motion that might affect

these duties.

I am acquainted with Tzeporah Berman and Eric Doherty. I have no

relationship to any other named person bringing the motion.

Affirmed before me at the City of

Vancouver in the Province of British

Columbia this 28th day of April,2Ùl4.

ñ,Tæ;r

)

)

)

)

MARC LEE

A Commis sione{for taking Affrdavits

for British Columbia

7

3

thtråË"¡ryof......dH$trå.\...**^m#Ì

FrflìilGTlf!]

gt ffi

sruürrc[s

n^û

I

¿jii.'i;li':: J 1'

?r r'¡

.' '.

i.:::i:ilrr(:,.1 i.r

.r! i,,l

¡

.!:

i:¡\

'

CCPA

CANADIAN CENTRE

f or POLIC'Y ALTERNATIVES

Marc Lee is a 5eníor Economisl wíth the

CENIRÊ CANADIEN

de PoLÍIQUES ALTERNATIVES

BC

0f-

fice of the Canadian Centre for Poticy Alternatives,

and the Co-Director of the Climate Justice Proiect.

Marc is the author of many CCPA and Ctimate Jus-

l58l'¡ 978-1-77115-064-7

This report is avaitabte free of charge at www.

poticyalternatives.ca. Printed copies may be ordered through the CCPA Nationat Office for

a

$10 fee.

PI.EÄ5Ë IIAI(E å DOIIATTON...

Help us to ronliíuê lû ofier

publications free online.

rür

tice pubtications, including Clímate Justice, Green

Jobs and Sustaínable Productìon in BC,

with

Ken-

neth Cartaw (September 2o1o), Faír and Effectíve

Carbon Pricing: Lessons from BC(February 2011),

and Enbridge Pípe Dreams and Níghtmares: The Eco-

nomic Costs and Benefits of the Proposed Northern Gateway Pipeline (March 2012).

Brock Ellís worked as a research assistant for the

With your support we can continue to produce high

quatity research

-

and make sure it gets into the hands

of citìzens, journalists, poticy makers and progressive organizations. Visit www.poticyatternatives.ca

or catt 613-563-1.347

f or

more information.

C[imate Justice Project with the BC office of the Ca-

nadian Centre for Policy Atternatives. He recentty

completed a Masters of Public Poticy from 5ìmon

Fraser University. Brock's research for his capstone

project [ooked at financial market disclosure ofclimate change information.

THI UNIVLRSITY OF BRITISH COLUMBfÀ

¡rl

å:"":"iäixi¿1:g*"" :J::::"';Jå*$;åï".. canadä

Vancity

vaÍ.¡: iuver

foundatior¡

tcflil 0rtED6ËHËflTs

The authors woutd tike to thank Naomì Klein and

Bitl McKibben for their inspiration in developing

this study, and the fotlowíng for comments on

an

earlier draft of the paper: Lynell Anderson, Seth

Klein, and three anonymous reviewers. We also

This paper is part of the Climate Justice Project, a

five-year research project ted by the CCPA-BC and

thank the Carbon Tracker Initiative for theír semi-

the Universíty of BC. The Ctimate Justice Project

is also shaped by insights from interviews hetd

studíes the sociat and economic impacts of climate

with a number of professionals ìn the financìal ín-

change and devetops innovative green policy so-

dustry, including Peter Chapman, Maureen Cure-

lutions that are both effective and equitable. The

project js supported primarity by a grant from the

and Rudy North.

Social Sciences and Humanities Research Coun-

ciI through its Community-University Research

A[tiance program. Thanks atso to Vancity and the

Vancouver Foundation for their fìnanciaI support

of the Climate Justice Project.

The opínions and recommendatíons ín this report,

and any errors, are those of the authors, and do not

necessaríly reflect the views of the publíshers or

funders of this report.

nal Unburnable Carbon report in 2011. This study

ton, Dermot Fotey, David levi, Catheline Ludgate,

5

Summary

12 Introduction; UnburnableCarbon

15 Doing the Math: Implications for Canada

20

Carbon Liabilities, Stranded Assets

Canada's Fossil Fuel investments in GlobalContext

29 Pension Funds and flimate Risk

Ignoring Climate Risk

Coming Clean on DÌrty Energy

36 lleflatingthe

Carbon Bubble

Establish a National Carbon Budget

Make Market Prices Tetl the Truth About Carbon

Develop Green Bonds

Public Sector Leadership

Mandate Carbon Stress Tests

42 Conclusion: Getting these

44 TechnicalAppendix

51 l{otes

Reforms Right

Summary

MoUNTING EvIDENcE

or climate

change impacts worldwide

will inevit-

ably lead to a new global consensus on climate action. Based on recent research, between two-thirds and four-frfths of knor¡rn fossil fuel reserves have

been deemed tobe unburnable carbon

-

that cannot safely be combusted.

This is of profound importance to Canada, a nation making fossil fuel

development and expansion the centrepiece of its industrial strategy. This

study looks at the implications of unburnable carbon for the Canadian fossil fuel industry and in particular for frnancial markets and pension funds.

We argue that Canada is experiencing a carbon bubble that must be stra-

tegically deflated in the move to a clean energy economy.

Doing the Math

A carbon budget is the maximum amount of CO, that can be emitted in the

future, based on scientifically-estimated probabilities of staying below

zoC

of global warming, above which would lead to catastrophic or "runaway"

climate change beyond humanity's capacity to manage. The world's carbon

budget is now approximately 5oo billion tonnes (Gt) of carbon dioxide, an

amount that would provide an SoVo chance at staying under zoC.

Canada's share of that global carbon budget would be just under 9 Gt

based on its share of world GDp, and 2.4 Gt based on share of world popu-

lation. An internationally negotiated carbon budget for Canada could go

Canada's Carbon

Liabilities

5

n

up depending on export arrangements with other countries, or down if larger historical emissions mean disproportionate reductions from rich coun-

tries. A plausible carbon budget for Canada would almost certainly fall between z and zo Gt.

Canada's reserves of fossil fuels are signifrcantly larger than Canada's

fair share of a global carbon budget:

.

Canada's proven reserves of oil, bitumen, gas and coal are equiva-

lent to 9r Gt of CO,, or

.

t8o/o

of the global carbon budget.

Adding in probable reserves boosts this f,gure to r74 Gt, or

ZSo/o of.

the global carbon budget.

.

A final, more speculative category including all possible reserves is

t,t9z Gt

-

more than double the world's carbon budget.

This means that business as usual for the fossil fuel industry is incompat-

ible with action to address climate change that keeps global temperature

increase to zoC or less. Even at the high end of a zo Gt carbon budget, this

would imply that Z8% of Canada's proven reserves, andSg/o of proven-plusprobable reserves, would need to remain underground.

Carbon Liabilities, Stranded Assets

The Toronto Stock Exchange

(rsx)

sector. At the end of.zott, the

rsx had 4oS listed oil and gas companies with

is highly weighted towards the fossil fuel

a total market capitalization of over $:Zq

billion. When coal producers are

added this number rises further.

To assess the implications of Canada's carbon bubble, we developed a

database of u4 fossil fuel companies operating in Canada

the

rsx

-

ro3 listed on

(assets greater than $7oM for oil and gas, and $5oM for coal), and

n

foreign-owned subsidiaries. For each we compiled flnancial data on revenue,

assets and market capitalization. Then we added data on fossil fuel reserves

(proven and probable), which we converted into potential CO, emissions.

We develop an estimated range of their carbonliabilities by applying a car-

bon price, representing the estimated damages from emitting a tonne of car-

bon (known as the social c ost of carbon, or

sc

c, based on recent literature).

For the Canadian-listed companies:

. Our low estimate considers a $5o per tonne

scc applied only to the

proven reserves category and amounts to $844 billion in carbon lia-

6

Canadian Centre for Policy Alternatives

{'}

Jl-

n

bilities

-

more than two and a half times the market capitalization

and nearly double the assets of those companies.

. Our high estimate

of $zoo per tonne

sc

c applied to their proved-plus-

probable reserves yields a figure just under $5.7 trillion, an amount

times larger than market capitalization and

17

.

13

times assets.

sap/rsx

6o index,

total

carbon liabilities are between $o.S and $¡.S trillion. Even the low

esti

For tz companies in our database included in the

mate of carbon liabilities exceeds both assets and market capitalization.

For foreign companies, the estimated carbon

liability of their Canadian fos-

sil fuel reserves is between $o.; and $r.z trillion. The latter amount, incredibly, is larger than the full market capitalization of foreign companies, and

8r% oftheir assets, even though market capitalization and assets are based

on global operations.

This situation is exacerbated by the predominance of bitumen and coal

in the reserve mix because these particular fuel types are far more cnc-intensive than other fossil fuel products, and are much more likely to be regulated earlier under a global climate action framework.

r Bitumen and coal account for more than three-fifths of both the

proved and proved-plus-probable potential emissions in our database.

.

If synthetic oil is added, which is crude oil produced from oil sands

bitumen, the proportions iump to more than four-frfths for both categories ofreserves.

An important consideration is that Canada's oil and gas sector has a very

high degree of foreign ovrnership.

.

Foreign corporations owned ¡S% of the sectot's $Sr8 billion in assets

in zoto, and received roughly half of the sector's revenues and profits in zoro.

.

US

corporations have been the principal foreign investors, although

their share has declined in recent years from nVoin 2oo1 to 6q%in

zoro. Recent takeovers of oil and gas assets by China's cnooc and

Malaysia's Pentronas in

-

lale2or2- deals worth $zr billion combined

have increased the foreign-owned share.

Canada has a unique role in the global economy with regard to fossil fuels.

Some 8o% of the world's oil reserves are held by state-owned companies;

Canada's Carbon

Liabitities

f

I

L]

c

that is, countries who have made public ownership of this strategic asset

a top priority. Of the remaining global oil reserves, two-thirds are found in

Canada, making the country a top destination for private investments.

As foreign capital flows in, so it may flow out. External drivers such as

international, regional or national rules that shrink Canada's export markets for fossil fuels, or successful divestment campaigns in other jurisdictions could have a spillover effect that could trigger

a

withdrawal of capital

from Canada. This is an additional source of instability or external shock

that could lead to a bursting carbon bubble.

Pension Funds and Climate Risk

The recent experience ofhigh-tech and housing bubbles should serve as a stern

warning to policy makers. In zoo8, the collapse of a housing bubble (in particular, in the United States and Europe) threatened the global frnancial system as

a

whole. The fallout from the housing crash affected

a

broad segment of soci-

ety because housing is the most important asset for middle-class households.

Next to home ownership, the right to future income through employer

pension plans is the second-most important asset for a wide swath of middle-class households. Registered pension plans cover more than 6 million

members in Canada, and the total market value of trusteed pension funds

in zorz was over $r.r trillion, of which almost one-third was held in stocks.

At a system-wide level, however, it is diffrcult to ascertain the exposure of

Canadian pension funds and other investment types to the carbon bubble.

'

More than half of Canada's pension system is in the form of employer

pension funds (ss%), followed by nnse assets holdings (¡s%), and

the Canada Quebec Pension Plans (under ro%).

.

In the US, pension funds alone owned almost one-third of oil company stocks in zou.

. About one-third ofthe

assets ofthe Canada Pension Plan are invested

in publicly traded equities, representing $r: billion in Canadian equities and $+¡ billion in foreign equities, as of the end of zorz.

Addressing risk is inherent to frnancial market investment, which routine-

ly must account for risks due to inflation, currency movements, regulatory

changes, political turmoil and general economic conditions. However, there

has been a general failure to account for climate risks, and a tendency to view

I

Canadian Centre for Policy Atternatives

11

4

n

U

any screening for environmental purposes to be detrimental to f,nancial per-

formance. Our analysis turns this on its head: by not accounting for climate

risk, large amounts of invested capital are vulnerable to the carbon bubble.

There is an important inter-generational equity argument built into the

management of pension funds. While pension funds have to generate max-

imum current return value for existing (and soon-to-be) pensioners, at the

same time they are legally obligated to ensure the long-term sustainabil-

ity of the fund. That is, funds must equally represent the interests of young

workers for their eventual retirements.

Deflating the [arbon Bubble

Pension funds and other institutíonal investors need to be part of the solu-

tion. Other private savings vehicles, such

as RRSPs,

and public investments

through the Canada Pension Plan, are also in need of a "managed retreat"

from fossil fuel investments. We recommend the following to green Canada's f,nancial markets.

. Establish a National

Carbon Budget

-

In order to do their job prop-

erly, and contribute to achieving a zero-carbon Canada (and world),

flnancial markets need a clear and credible long-run climate

ac-

tion commitment that provides investment security and certainty. In addition to credible emission targets, Canada needs to estab-

lish a national carbon budget to manage its fossil fuel resources for

wind-dor¡¡n. A corollary to this is that the federal government must

acknowledge that a large share of proven and potential reserves is

indeed "unburnable carbon." These reserves should be effectively

taken out of circulation, leaving only Canada's fair share of the re-

maining global carbon budget.

.

Make Market Prices TeIl the Truth about Carbon

-

Shifting the terraín

towards clean or renewable sources of energy from fossil fuels requires policies that make sure the costs of greenhouse gas emissions

are reflected

in market prices. Broad framework policies to level the

playing field for clean energy alternatives and internalize costs include: carbon pricing; removal of subsidies to fossil fuel producers;

regulations and standards; and public investments.

.

Develop GreenBonds

-

Pension funds and other investors divesting

from fossil fuel companies need an alternative place to put their money,

Canada's Carbon

Liabitities

9

,.

!J

,t

\J -_

and one major transitional support could be the development of a

national green bonds program (along with complementary provincial programs). The long-run investment horizons of pension funds

align nicely with long-term bond issues, and the need to invest in

public infrastructure for climate action. While carbon taxes are an

ideal source for funding climate action it will take time for those revenues to ramp up with a rising carbon tax. Green bonds can bridge

this gap by essentially borrowing against future carbon tax revenues.

. Publíc

Sector Leadershíp

-The government of Canada should dir-

ect the Canada Pension Plan Investment Board to divest from fossil

fuel companies. If pension plans on behalf of public sector retirees

and employees (or their relevant investment management boards)

join this effort, this would provide

a

powerful signal to other pension

funds. Outside of pensions, divestment is broadly applicable to other

related investment funds, such as university endowments or investments held by municipalities and Crown corporations. The federal

government should also make changes to private savings vehicles,

such as Registered Retirement Savings Plans (nnsp) and Tax Free

Savings Accounts

(rrse) by restricting preferential tax treatment

to funds or investments that meet certain green economy criteria.

. Mandate CarbonSfress

Tesfs

-

Canadian f,nancial markets need a

mandatory system of c/im ate stress tesús for new f,nancing commitments and for outstanding portfolios. Disclosure of climate change

information must be standardized to provide high-quality and comparable information (ideall¡ internationally comparable) about climate change policies and assessment of risks. The federal govern-

ment could lead in developing selection criteria to be used in the

screening of investment opportunities, and in requiring ratings agencies to report on climate risk and the implications of unburnable car-

bon in their evaluations. Securities and accounting oversightbodies

should be involved in developing a harmonized Canadian approach

to climate risk.

Our suggested reforms would go a long way to providing the foundation necessary for taking Canada's economy towards a cleaner future. A coherent

and credible action plan led by the federal government that includes action

to better regulate f,nancial markets will make it much easier for investors

to account for climate change in their risk-return assessments. Our hope is

10

Canadian Centre for Policy Atternatives

{-.'

,.J

0:"?

that these actions can steadily reduce the exposure of Canadian pension

funds and other investors, and the Canadian economy as a whole, by deflating the carbon bubble.

Until such time

as our governments take decisive

action, we should right-

ly see an expansion of divestment efforts by civil society groups

puses,

-

on cam-

within churches, by credit unions, and by other community-based

organizations seeking to influence the investment choices of major institu-

tions. Such efforts are encouraging

that

a

-

they signal an early understanding

managed retreat is preferable to a financial meltdor¡trn.

Canada's Carbon

Liabilities

tt

O:E

Introduction:

Unburnable Carbon

INVE sTMENTS

IN rHE fossil fuel industry have become

a

hot topic on Amer-

ican university campuses, energized by environmentalist Bill Mcl(ibben's

zorz popular article, "Global Warming's Terrifying New Math", in Rolling

Stone magazine. Similar to the South Africa divestment campaigns of the

r98os, students are calling on their administrations to remove coal, oil and

gas stocks

from university endowment funds.' Beyond the moral arguments

on university campuses for divestment, pension funds and other institution-

al investors are beginning to question whether owning fossil fuel stocks is

a

wise frnancial move in light of climate change.

The problem is the disconnect that exists between the desire to maxi-

mize investment returns, which has historically involved investing in fossil

fuels, and the need to reduce atmospheric greenhouse gas concentrations.

In Mclübben's words:

We have five times as much

oil and coal and gas on the books as climate

scientists think is safe to burn. ... Yes, this coal and gas and oil is still tech-

nically in the soil. But it's already economically aboveground

-

it's ñgured

into share prices, companies are borrowing money against it, nations are

basing their budgets on the presumed returns from their patrimony. ... The

numbers aren't exact, ofcourse, but that carbon bubble makes the housing bubble look small by comparison.'

t2

Canadian Centre for Policy Alternatives

l'\ ' r',

u...

ii

This reality of.unburnable carbonis of profound importance to Canada'

a nation making fossil fuel development and expansion the centrepiece

of

in particularwith the recent push for new bitumen

and natural gas pipelines, and expansion of coal port facilities on the West

Coast.r While Canada ostensibly has targets for cttc emission reductions

its industrial strategy

-

as part of the zoog Copenhagen Accord

zozo relative to 2oo5 levels

-

-

a qvo reduction in emissions by

its actions suggest an ever-greater reliance on

fossil fuel extraction with little regard for climate consequences.

We argue that mounting evidence of climate change impacts worldwide

will inevitably lead to a new global consensus that keeps unburnable carbon underground. Extreme drought and Hurricane Sandy put climate change

back on the radar for the United States, and impacts around the world are

almost impossible to ignore. Canada may be dragged kicking and screaming into a new global climate treaty

gressive the terms of that treaty

-

and the longer the delaythe more ag-

will need to be - but a new treaty is surely

coming. All that remains in doubt is the timing.

In other parts of the world, such as the United lüngdom, there is a growing awareness that the value of fossil fuel companies is vastly overstated because of unburnable carbon. In January 2012, a group of flnance and pension organizations wrote to then-Bank of England governor, Mervyn l(ing,

of concerns that "the UI('s exposure to high carbon investments might pose

a

systemic risk to our f,nancial system ... [and] the depth and breadth of our

collective financial exposure to high catbon, extractive and environmentally unsustainable investments could be come a major problem as we transition to a low carbon economy"'4 Oxford University recently announced a

new research program into the potential for climate action to lead to "stranded assets."s Stranded assets refer to f,nancial assets whose value under cer-

tain circumstances or policy scenarios, such as a reasonable price on carbon, have the potential to be reduced signif,cantly.6

In Canada, fossil fuel extraction and production is the second-largest contributor (after the ñnancial sector itself) to the market capitalization of Canada's stock market, representing approximately z4% of the

total market capitalization of the sae/rsx 6o.7 The core business model,

and share prices, of fossil fuel companies are premised on their ability to

convert fossil fuel reserve assets into marketable products and cash-flow.

Yet, these companies, and Canada's ñnancial sector as a whole, have, to

date, largely ignored the realities of climate change. Global bank, HSBC,

garnered major headlines for its analysis that major oil companies could

lose 4o-6o% of their value if the world was to meet existing Copenhagen

Canada's Carbon

Liabilities

13

t30

Accord targets, with expensive proiects like Alberta's oil sands among the

frrst to be shelved.s

South of the border, the fossil fuel divestment campaign by:So.org (of

which Bill Mclübben is a founder) on university campuses is beginning to

show some earþ success (4 divestments as of the time of writing, and active

campaigns on more than 3oo campuses). The divestment campaign has

spread north, through Fossil Free Canada, targeting Canadian university

endowments. Moreover, divestment concerns are spreading from university campuses, drawing on both moral and frnancial arguments. The Cities

of Seattle and San Francisco are reviewing investments in fossil fuels, in-

cluding pension funds.s US churches are considering similar actions, such

as the United Church of Christ, a r.z million-member church, who

will be

holding a national vote in |une on divestment.'o

This report considers Canada's growing petro-state and reviews the case

for a carbon bubble in Canadian flnancial markets, with a closer look at the

relative contributions of Canada's largest fossil fuel companies. This analysis suggests signifrcant potential consequences for Canada's flnancial mar-

kets, in particular pension fund assets upon which many middle-class house-

holds are relying for their retirement. The report also looks at how Canada

can implement institutional and policy reforms to transition from carbonintensive investments to green investments that transition to

a

zero-carbon

economy. In concert with a coherent climate policy ftamework, the capital

of public and private pension funds, university endowments and private

savings vehicles could be levered to accelerate the low-carbon transition.

l'tt

Canadian Centre for Policy Alternatives

Doing the Math:

Implications for Canada

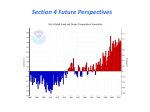

woRLDWIDE, ExTREME wEATHER events from drought and floods to

powerful storms and record-breaking temperatures are making a powel-

ful statement that climate change can no longer be denied. Calls for action

to change course are no longer coming solely from climate scientists and

environmental goups. For example, in a landmark November 2ou report

the World Bank concluded we are headed for a 4oC warmer world, "one of

unprecedented heat waves, severe drought, and maior floods in many regions, with serious impacts on ecosystems and associated services."" The

Managing Director of the International Monetary Fund, Christine Lagarde,

was even more frank at the January zor3 meetings of the World Economic

Forum: "Unless we take action on climate change, future generations will

be roasted, toasted, fried and grilled."o

There is international agreement that global temperature increase

should be kept below

zoC (above

pre-industrial levels) in order to avert the

worst climate impacts. Beyond this threshold there is

a

very high likelihood

of "runaway climate change" that is beyond humanity's capacity to manage. Already, global temperature has risen o.8oC, and even ifgreenhouse

gas emissions wefe cut to zero overnight the inertia of emissions over the

past few decades would still cause additional warming of o'5 to l.ooC.': A

number of participating countries in international negotiations, those from

small island states and less developed countries, have called for

a

Canada's Carbon

lower lim-

Liabitities t5

fì

n.1

.,

,r,

v'

it of r.5oC, given existing climate impacts and the need for prudence in the

face of uncertainty about where tipping points in the global climate system

may actually lie.

How much space exists for further emissions before climate change becomes irreversible is uncertain. Atmospheric carbon dioxide (C0,, the most

significant greenhouse gas) levels were stable at approximately z8o parts

per million (ppm) from the end of the last ice age approximately ro,ooo

years ago up to the beginning of the industrial revolution.'q As of February

2013, atmospheric concentrations of CO, had reached 397 ppm,with annual

emissions growing by approximately z.r ppm per year over the past decade

(though this includes the zooS-ro recession).'s

Stabilizing emissions at 45o parts per million has been cited as a target in international negotiations, and would still provide a roughly So/So

chance of overshooting the zoC target.'6 This amounts to about twenty years

of emissions at current levels, less if annual emissions continue to rise. NASA

climate scientist lames Hansen's analysis of previous transitions between

climatic regimes concludes that a CO, level of 45o ppm or larger, if long

maintained, would push Earth towards an ice-free state. Although the pace

of climate change would initially be limited by ocean and ice-sheet inertia,

"such a CO, level likely would cause the passing of climate tipping points

and initiate dynamic responses that could be out of humanity's control."'z

Hansen and others have supported 3So ppm as a long-term target that

would provide a high probability of not exceeding z'C. That is, not only

must emissions peak soon and then begin to fall steadily over subsequent

- which means phasing out fossil fuels and tackling other sources

of cHc emissions - but the existing stock of atmospheric CO, must be redecades

duced in absolute terms through aggressive tree planting and perhaps other

measures to sequester carbon underground.

The concept of a carbon budget

emitted in the future

-

-

a

maximum amount of CO, that can be

has been developed over the past decade. In zoo9,

researchers with the Potsdam Institute conducted a probabilistic analysis

aimed at quantifying emission budgets for the period zooo to zo5o that would

limit global warming to less than

zoC.

Their analysis concludes that a "car-

bon budget" of no more than 886 billion tonnes (gigatonnes, or Gt) of CO,

can be released into the atmosphere if we are to have a 8o% chance of stay-

ing under the

zoC

limit, and no more than y437

Gt CO, lor a soVo chance.'8

The "inconvenient truth" of this exercise is that the trajectory of the

world's emissions is far in excess of this carbon budget. Azott report from

the Carbon Tracker Initiative

16

(crt) was the frrst to point out that this rep-

Canadian Centre for Policy Alternatives

"

tl\i

The 3 Ps of Fossil Fue[ Reserves

According to the Canadían Aít and Gas Evaluation Handbook, based upon current technotogy and economic circumstances:

"Proved [or proven] reserves are those reserves that can be estimated with a high degree of certainty to be recoverabte. It ís likely that the actual remaining quantities recovered wi[1 exceed the estimatProven (P)

-

ed proved reserves."

"Probabte reserves are those additionat reserves that are less certain to be recovered

than proved reserves. It is equalty likety that the actuaI remaining quantities recovered witl be greater or less

Proven + Probabte {2P)

-

than the sum ofthe estimated proved + probable reserves."

"Possible reserves are those additional reserves that are less certain to

be recovered than probabte reserves. It is untikety that the actuaI remaining quantities recovered will exceed

the sum of the estimated proved + probabte + possible reserves."

Proven + Probabte + Possible (3P)

-

resents a carbon bubble. Based on the 886 Gt carbon budget from the Pots-

dam Institute study,

crl

estimated the world's remaining carbon budget of

565 Gt, due to emissions up to the end of zolo.

It also calculated the emis-

sions potential of the world's proven oil and gas and coal reserves at 2,795

Gt CO,

-

that is, flve times the estimated carbon budget.'r A similar conclu-

sion was reached by the International Energy Agency, although their analysis was based upon the larger carbon budget representin g a 5ooh chance

of

staying below zoC.'o Nonetheless, the IEA concludes: "No more than onethird of proven reserves of fossil fuels can be consumed prior to zo5o if the

world is to achieve the

zoC goal, unless carbon capture and storage tech-

nology is widely deployed.""

Approximately 36o Gt CO. of the world's carbon budget has already been

used up between zooo and zo1z, due to emissions from fossil fuel combus-

tion alone." In addition, we must also account for emissions from indus-

trial (non-combustion) emissions, agriculture, waste, and land use changes. Thus, conservatively, the world's carbon budget is now closer to 5oo

Gt for an 8o% chance at staying under zoC of warming, and

5oolo

l,ooo

Gt for a

chance. Because of the risks associated with the latter carbon budget,

we only consider the 5oo Gt carbon budget in the remainder of this paper.

What is perhaps most troubling about these studies is that they only

examined "proven" reserves, those that are already close to development.

Fossil fuel companies also have control over territories with "probable" and

"possible" recoverable reserves, which add considerably to the reserve and

Canada's Carbon

Liabitities

17

ô

{J

r\1'Å

FI6URE

I

Canada's Fossil Fuel Reserves vs GlobaI Carbon Budget

1400

Crude

0i[ (inc. bitumen)

t200

Coal

U

o

(.'

1000

-

800

-

NaturaI Gas (inc. shate gas)

o

E

c

o

o

600

u

m

400

200

o

Proven (P)

GtobaI carbon budget

Proven +

Probable (zP)

Proven+Probable+

Possibte (3P)

Notes (i) The "proven" (P) scenario refers to established reserves that are currently economically and technologically viabLe for extraction. (ii) The "proven + probable (2P)" scenario includes amounts from the ultimate potentiaI measure for resources that industry expects to be discovered and developed in the future. (iii) The

this volume, thjs scenario me¿sure the emissions effect if we were ¿ble to get al[ of

Cana da's

fossil fuel resources out of the ground.

Sources Allreservedatafor2009,summarizedinMLeeandACard,Peddling6HGs:WhatistheCarbonFootprintofCanadâ'sFossilFuetExports?,BehindtheNumbers,November 2011, Canadian Centre for Policy Alternatives. Reserve data for crude bitumenr NRc, Canadiãn Crude 0it, Naturat Gas and Petroleum Products: Review of 2009 & 0uttook to 2030, May 2011. ConventionaI crude: cApp, Statistical Handbook for Canada's [Jpstream Petroleum Industry, Aug 2011. NaturaUshale 8as: EiA, World Shale Gas Resources, Apr 2011; NE8, Energy Brief: Understanding Cãnadian 5hate Gas, Nov 2009. Coât: NRc, Canadian MineraL Yearbook 2009.

potential CO, totals (see sidebar).'3 Of particular relevance for Canada, the

crl

report comments that oil and gas reserve estimates may be artificially

low due to accounting practices for the oil sands and shale gas deposits that

only count reserves when their production is deemed to be "immin€l1t".zq

Converted into potential emissions, Canada's proven reserves ofoil, bitu-

men, gas and coal are equivalentto 9t.4 Gt of CO,, an amount that is about

three times global CO, emissions of 3o.6 Gt in zoro. Adding in probable reserves (2P) boosts this frgure to 174.3 Gt CO,, almost six times annual global

emissions. As Figure

1

shows, these reserves amount to tSoh and 35% of a

global carbon budget of 5oo Gt, respectively. The frnal category including

possible reserves (3P) is more speculative, based on total estimated volumes

in place, with extraction hinging on more favourable economics and technology. Nonetheless, it is estimated at a total

double the world's carbon budget.'s

18

Canadian Centre for Poticy Atternatives

of.

t,t9z Gt

CO,

-

more than

0

Yet, Canada's share of a 5oo Gt CO, global carbon budget would be iust

under 9 Gt based on share of world GDp,'6 and 2.4 Gt based on world population. An internationally negotiated carbon budget for Canada could go up

depending on export arrangements with other countries, or down if larger

historical emissions mean disproportionate reductions from rich countries.

Still, with

a

plausible carbon budget almost certainly falling between z and

zo Gt, the conclusion is inescapable: business as usual for the fossil fuel

industry is incompatible with action to address climate change that keeps

global temperature increase to

zoC

or less. Even at the high end of a zo Gt

carbon budget, this would imply that 78% of proven reserves, and 8g% of

proven-plus-probable reserves, would need to remain underground. When

(if) the necessary poliry action is taken to constrain the amount of carbon

dioxide humanity is sending into the atmosphere, those reserves must become stranded assets.

A separate issue is that climate change itself will have adverse econom-

ic impacts for different industries and regions of Canada. These include

costs arising from signifrcant sea level rise, increased likelihood of floods,

droughts and shocks associated with more intense storms.'7 Such events

will have significant economic impacts for both Canada and the world.

ada's National Round Table on the Environment and the

Can-

Economy (nnrrn)

has modelled the zoC scenario and indicated that costs to Canada's economy would rise from approximately $s billion per year in zozo to $zr-4¡ bil-

lion per year by the zo5os, with

a 5% chance

that the costs could be as high

as $9r billion per year, depending on worldwide emissions pathways and

Canada's own economic and population growth trajectories.'8 While this re-

flects a long-term challenge for different types of infrastructure and industries, we do not consider the impacts of climate change for frnancial markets in the remainder of this paper; instead, we focus on the carbon bubble

arising from the need for international mitigation efforts.

Canada's Carbon

Liabitities

19

\.J

rì ..

Carbon Liabilities,

Stranded Assets

rHE roRoNro srocl( Exchange (rsx) is highlyweighted towards the fossil

fuel sector, and has been called "the world's leading capital market for natural resource companies."'s For institutional investors like pension funds,

it

is difficult to hold a diversified portfolio constructed from Canadian secur-

ities without holding fossil fuel company stock. At the end of zott, the

had

¿+oS

rsx

listed oil and gas companies with a total market capitalization of

over $:Zg billion.¡o When coal producers are added this number rises further.

In this section we look at the intersection between Canadian fossil fuel

companies and their vulnerability to becoming stranded assets. A database

of n4 top fossil fuel companies operating in Canada was developed, includ-

ing oil and gas, and coal. Of these, ro3 companies are Canadian publiclytraded corporations, while another rr are foreign-owned subsidiaries.:'The

minimum asset base for inclusion was $7o million for oil and gas and $SS

million for coal. Private companies are not included in our sample, nor are

foreign companies for which we were unable to clearly differentiate Canadian

reserve holdings. The full table of rr4 companies is available in the Appen-

dix, along with more detail on how data was gathered and estimates derived.

Financial data was collected on assets, revenues, and market capitaliz-

ation. Canadian-listed companies in the sample had total revenues of $r8Z

billion,

assets of $45r

billion, and market capitalization of $:28 billion. For

foreign-owned companies with subsidiaries holding fossil fuel reserves in

20

Canadian Centre for Policy Alternatives

.,

i..

l

t:: 'l

FIGURE

2

Summary for Canadian-listed Companies

6000

5000

4000

ñ

o

õ

o

c

3000

o

ó

2000

1000

0

carbon tiability

Market Cap

Assets

Reven ue

(tow)

Carbon

liabilitv

(hich)

assets in the oil ðnd gas industry and more than $55 milLion for the coal industry.

Carbon liabiLity (low) estimated as CO,-equivalent proven reserves times $5O per tonne social cost of carbon (s c c). Carbon tiabitity (high) estimated as C0r-equiva [ent

proven+probabte (2P) reserves times $2OO per tonne scc. See lechnicaI Appendix for additionaI detaiLs on methodology.

l{otes Figure inctudes 103 Canadian-listed comp¿nies with more than $70 mittion in

Sources Authors' calculations based on 2011 annua[

fr

nanciãl reports.

Canada, total global revenues were $1.9 trillion, $r.s trillion in assets and

market capitalization of $r trillion. To put this information into perspective,

trillion in zon.

Next, we gathered data from annual financial reports on companies'

fossil fuel reserves (proven and potential) in Canada. Using standard conversion factors, these reserves were converted into potential emissions of

carbon dioxide. Total potential CO, equivalent emissions attributable to

the proven reserves of the rr4 companies in our sample amount to z3 bilCanada's cDp was about $r.7

líon tonnes (z: Gt)

-

an amount larger than the high end of a plausible car-

bon budget for Canada (see previous section). Adding proven plus probable

reserves, these companies have reserves equivalent to 35 Gt.3'The broader

category of possible reserves was not estimated, as these numbers are not

consistently reported.33

We compare this data on potential emissions to assets and market cap-

italization by estimating the associated "carbon liability" from burning fossil fuel reserves. Carbon emissions are a classic example of external costs

(or "externalities") that are not captured in market prices, and thus are

Canada's Carbon

Liabitities 2l

íl'

FI6URE

3

Summary for Foreign Companies with Canadian Subsidiaries

2000

1500

G

E

o

1000

c

o

@

500

0

Reven

u

Assets

e

Carbon liability

(tow)

Market Cap

Carbon [iabí[ítv

(hich)

bon tiability (high) estimated as Cor"equivaLent proven+probable (2P) reserves times $20o per !onne scc. see Technical Appendix for additionaL detaiLs on methodology.

Souftes Authors' calculations based on 2011 annual financiaI reports,

imposed on third parties, in other parts of the world and into the future.

That is, there is a "social cost of carbon" (scc), defrned as either the damage done by a tonne ofcarbon or, conversely, the benefits derived from re-

ducing a tonne of carbon.

Estimates of the social cost of carbon tend to be biased towards costs

that can be measured, and are biased towards impacts on human populations. They also tend to be conservative, based on cautious modeling of future climate impacts. Nonetheless, numerous researchers have calculated

this ñgure to understand how high carbon prices eventually need to be in order to reduce carbon emissions. Frank Ackerman and Elizabeth Stanton es-

timate

a

range for the

scc,

for the year 2o1o, between $n8 and $893.r+

¡¡¿t¡

Jaccard and Associates estimate that a zoC pathwaywould require a carbon

price of $5o per tonne of CO, in zoro, rising to $zoo in

2o2o.35

We present a range of results to illustrate the relationship between car-

bon liabilities, assets and market capitalization. Our low estimate considers a $5o per tonne scc applied only to the proven reserves category and

amounts to $8¿+ billion in carbon liabilities for the Canadian-listed com-

22

Canadian Centre for Policy Atternatives

Çr

¡'; ft

ñ

l-J ¡- .I)

TABLE

f.

Fossil FuelCompanies Featured on the

Assets

Company llame

s&p/rsx 60

Proven

Marketf,ap

Reserveg

mi[[ions of dollars

ARC Resources tTD

Canadian NaturaI Resources Ltd

Canadian Oit Sands Ltd

Cenovus Energy Inc.

Encana Corporation

tnerplus Corporation

Husky Energy Inc.

Imperia[

0il Limited

Penn West Petroleum Ltd.

Suncor Energy Inc.

Talisman Energy Inc.

Teck Resources Limited

Totals

5,324

47,278

8,620

22,194

33,918

5,723

32,426

25,429

15,584

74,777

2&,226

34,219

329,7f,8

Composite Index

Proven+ Carbon tiabitity Carbonliabitity

(tow)

Probable Serves

6,506

136.6

215.0

30,287

2,077.9

3,286.4

9,729

386.7

803.5

25,223

1,a42.6

t,423.O

15,278

455.9

642.O

2,617

óB

93,r

25,355

504.7

1,410.4

t6,311

2,O43.7

3,126.4

6,758

205.2

295.8

47,4ú1

L,7 45.8

3,116.8

12,03û

101.5

137.1

19"312

3.,2A6.3

2,850.0

2ñ,827

9,970

17,4ü)

(Hish)

millions of doItars

Mt C0,e

6,831

43,ôA4

103,897 657,277

19,334

160,691

284,59t

52,132

22,794

128,408

18,616

3,393.1

25,Oi4

282,882

tt2,1&7

625,288

1{},261

59,161

87,248

623,363

27,43{}

\,t77

60,317

570,OO3

498,50/¡ 3¿f9"9tt

l{ot€s AssetsandreservesdataareasofDecember3l,20ll;marketcapitalizationas0fJuly5,20l2.NexenwastakenoverbytheChinaNationaloffshore0itCorp0rationin

February 2013, and is no Longer inctuded in the s&P/Tsx 60.

Sourre Authors' c¿lculations based on 2011 annuat fin¿ncial reports.

panies, a figure more than two and a half times the market capitalization

and nearly double the assets of those companies. The high estimate ap-

plies a $zoo scc to the proved plus probable reserves, and yields a flgure

just under $5.7 trillion, an amount 17 times larger than market capitalization and

13

times assets.

For Canadian subsidiaries of foreign companies, the estimated carbon

liabilityis between

$zgZ

billion and $1.2 trillion. The latter amount, incred-

ibly, is larger than the full market capitalization of foreign companies, and

equal to 8r% of their assets, even though market capitalization and assets

are based on global operations.

Table r shows more detailed results for fossil fuel companies íncluded in the Toronto Stock Exchange's benchmark index, the

sanlrsx

6o (the

full list of u4 companies is in the Appendix). The index includes rz of the

companies featured in our database, which together account for a market

capitalization of $z¡Z billion

(as of July 5, 2or2)

-

-

nearly one-quarter of the index's total value

and assets of $33o billion. Total carbon liabilities are

between $o.S and $3.5 trillion for the rz companies, and account for threefrfths of the carbon liabilities in our database of Canadian-listed companies.

Canada's Carbon

Liabitities

23

ü3û

TABLE

2

Top 20 Canadian-Listed Companies Ranked by Carbon Liability

5herrjit International Corp.

(arhon liability (high)

Carbon liability (tow)

Asset¡

Company llame

millions of dollars

ratio to assets

millions of dollars

ratio to assets

37,858

21.2

619,937

95.4

6,498

1

Canadian Naturaf Resources Ltd

47,278

ro3,B97

2.2

657,277

13.9

Imperial 0it Limited

25.429

toz,t87

4.O

625,288

24.6

Suncor Energy inc.

7

4,777

87,248

1,2

623,363

8.3

Teck Resources Limited

34,219

6A317

1.8

570,003

16.7

22,r94

52,732

2.3

284,590

12.8

160

51,013

318.8

229,889

1.431.4

Husky Energy Inc.

j2.,476

25,434

û.8

282,O82

8.7

Encana Corporation

13,918

22,794

t.7

128,408

3.8

Energy Corp.

6,2AL

20,264

3.3

235,811

38.0

Canadian Oil Sands Ltd

8"62A

19,334

2.2

160"691

18.ó

16,236

o.B

775,679

8.8

I ?t

L3,875

11,4.4

55,500

457.4

156

12,214

78.3

58,r52

372.t

't8,996

314.8

Cenovus Energy Inc,

Coalspur Mines Limited

lare

Nexen Inc

20,ûó8

Cardero Resource Corp.

Fortune Minerals

[td.

Cline Mining Corporation

Penn West Petroleum

ARc Resources

ltd.

LTÐ

Ërdene Resources Corp.

Crescent Point Energy Corp

Talisman Energy Imc.

Top 2O Totals

251

12,LA6

48.2

L5,584

tû"267

û.7

59'16X

>,3¿+

ó,8tr

1_3

41,Ûû1+

8.r

5,874

ß4.9

91.985

1678.5

9.7)

n?

35,386

4"1

2!t,226

5,û77

o.2

27,43Ð

166.,7Æ

ft4,423

2"t

5'{l¿13'669

56

8,73t4

\

Source Authors'ralcut¿tìons b¿sed on 2011 annuãl financial reports

While there is a range of outcomes for different companies, even the low

es-

timate of carbon liabilities exceeds both assets and market capitalization.

Table z contains a list of the top 20 Canadianlisted companies in our

sample, ranked by carbon liability (low estimate). This sub-group includes

goVo of the carbon

liabilities in our database of Canadian-listed compan-

ies, and they would be the most vulnerable to carbon budget constraints.

This includes most of the companies in Table r, but in Table

2

we also con-

sider the ratio between estimated carbon liability and assets. The relationshíp between assets and carbon liabilities is more relevant to understand-

ing Canada's carbon bubble, since market capitalization will be a function

of assets as well as holdings of fossil fuel reserves. The table shows some

2lt

J. {t

Canadian Centre for Poticy Alternatives

x3.8

n?1

L,' U -I.

Carbon-Intensity of Fossil Fuel Reserves

Bitumen is a thick, sticky form of crude oil that is so heavy and viscous that it wítl not flow untess it is heated or dituted with iíghter hydrocarbons" At room temperature, bitumen looks much tike cold molasses and at

Lloc it can be as hard as a hockey puck. It typicatty contains more sulphur, metals and heavy hydrocarbons

than conventionaI crude oi1.

Synthetic Crude Oil is created by heating the bitumen to extremely high temperatures, which breaks up 0r

"cracks" the [arge complex bitumen hydrocarbon molecules into smatter hydrocarbon chains. This material

then goes through a secondary upgrading process where hydrogen is added to stabilize the remaining hydrocarbon molecules and impurities like sulphur and nitrogen are removed.

extreme outcomes, where carbon liability dramatically exceeds the assets

of the company.

While it is clear that

a

very large portion of the reserves of Canadian fos-

sil fuel companies would be rendered unburnable as

a

result of international

climate action, this situation is exacerbated by the predominance of bitumen

and coal in the reserve mix. These particular fuel types are far more onc-intensive than other fossil fuel products. Figure 4 shows the emissions poten-

tial ofproven and probable reserves by fossil fuel type. Together, these two

products account for nearly two-thirds of both the proven (6rolo) and proved

plus probable (62%) emissions in our sample. If synthetic oil, which is the

crude oil produced from oil sands bitumen,:ø is added, more than four-ñfths

(8r% of proven and 8z% of proven-plus-probable emissions) come from the

fossil fuels that are the dirtiest from a carbon perspective.

The oil sands industry is, on average, three to four times more carbon-intensive than the conventional oil industrywhen producing a barrel of oil.¡z

Even on a lifecycle (or "well-to-wheels") approach, emissions from fuel pro-

duced from oil sands are 8 to glohhigher than conventional sources. These

estimates do not take into account new findings that a by-product of bitumen refining, petroleum coke (or petcoke),

if used as a fuel, emits 5-ro%

more CO, than coal per unit of energy produced. And it is estimated that the

proved reserves of Canada's oil sands would yield

billion tonnes of petcoke.3s

For Canada's other main fossil fuel resource, coal, the problem is just

S

as evident. Coal is generally regarded as being the dirtiest of the fossil

fuels. According to the United Nations Intergovernmental Panel on Climate Change, coal's carbon content per unit ofenergyproduced is, on average, 20 percent higher than crude oil and approximately 4o percent higher than

îatural gas.rr

Canada's Carbon

Liabitities

25

I'rJ

n

v,Jt-

rIGuRt

4 Emissions

Potential of Reserves

74

Proven Emissions

!z

Probabte EmissÍons

10

-

ú

o

U

(5

-

6

4

2

0

Light and

ediu m 0it

M

Heavy

0il

Synthetic

0il

Bitumen

Natural Gas

Liqui ds

-

Coa [b ed

Natual Gas

Sha

le Gas

Note ThjsfiBUreonlyjncludesestimatesofreservesfromthel14companíesinourdatðbase

sour(e Authors'calculations bâsed on 2o11 annual reports.

While unconventional natural gas does not frgure prominently into the

carbon liabilities of the companies in our database, we note that extensive

new reserves (beyond those in Figure r) of shale gas, tight gas and coalbed

methane might also be off-limits in a carbon-constrained world. Recent research has questioned whether gas extraction through hydraulic fracturing,

or fracking, is superior to coal per unit of energy. Field tests in the United

States have shonm high methane leakage rates, large enough to offset any

advantage relative to coal. There is a lack ofindependent research on methane leaks in fracking operations in Canada. Planned export ofliquifted nat-

ural gas (lrric) to Asia would require additional energy-intensive pipeline

and gas compression infrastructure.4o

This reality places Canada's energy reserves, and the companies exploiting them, in conflict with any meaningful international treaty intended

to combat climate change. While our analysis looks only at fossil fuel producers, this type of analysis would be relevant to pipeline companies like En-

bridge and TransCanada, and to supplier industries, neither of which have

holdings of reserves per

26

se

but whose business model is also based on the

Canadian Centre for Policy Alternatives

Methane

Coa I

nî1

U '-i

r..)

exploitation of unburnable carbon. This type of analysis is also relevant

across the broader economy, particularly for companies whose business

model is heavily reliant on fossil fuels as an input, and for which there are

no or few known alternatives. Technological advances and shifts to renewable power sources could mitigate such concerns, depending on the industry. Certain transportation industries, for example, such as air travel would

be hard pressed to move off of fossil fuels, at least in the short- to medium-

term. This type of analysis would be a logical extension of our research but

we do not consider those impacts further in this paper.

Canadal Fossil Fuel Investments in Gtobal Context

From a purely frnancial perspective, high market valuations are justified because the oil and gas industry is the most profrtable in the world. The Big 5

global oil and gas companies earned a combined $ug billion in profits in

zorz.¿' A review of the 5o most profitable Canadian corporations in zoro found

that frnance (rz corporations) and resources (17 corporations) were dominant, with lwo-thirds of the total profrts of the top 5o. The top 5o in turn captured 8o% ofthe total profits ofthe top looo corporations.4'

Defence of prof,t streams has led companies to fund climate change de-

nial, and entrench political influence through extensive lobbying' Yet,

above, a major cost of their operations

-

greenhouse gas emissions

as

-

noted

are not

included in market prices, nor do they form part of their financial statements.

Profits in the industry come at the expense of people living today and into the

future who have not benef,tted from consuming or producing fossil fuels but

whose livelihoods are adversely affected by droughts, floods and extreme weather events arising from climate change. These costs are piling up, with one re-

cent estimate of $r.z trillion per year in global damages from climate change

(impacts such as extreme weather, us$696 billion), and from a carbon-intensive economy (related environmental disasters and impacts, us$542 billion).a:

An important consideration is that Canada's oil and gas sector has a

very high degree of foreign ownership (including both foreign ownership

stakes in canadian-listed companies and foreign-owned subsidiaries). For-

eign corporations owned yo/o of.the sector's $Sr8 billion in assets in zoto,

and received roughly half of the seitor's revenues and profits in zoro.aa US

corporations have been the principal foreign investors, although their share

has declined in recent years from no/o in 2oo1 to 6+% in zoro. Recent takeovers of oil and gas assets by China's cNooC and Malaysia's Pentronas

Canada's Carbon

in

Liabitities

27

f\?

t\

U.-;'T

late zorz

-

deals worth $zr billion combined

-

have increased the foreign-

owned share.

Canada has a unique role in the global economy with regard to fossil

fuels.a5 Some 8o% of the world's oil reserves are held by state-owned com-

panies; that is, countries who have made public ownership of this strategic

asset a top priority. Of the remaining global oil reserves, two-thirds are found

in Canada, making the country

a

top destination for private investments.q6

Indeed, while Canada does not have a state-owned oil company at all, stateowned companies from other countries are investing in Canadian oil. Tech-

nically speaking, the public owns fossil fuel reserves, which are then leased

to private companies, who only own the resources once extracted and a roy-

alty reflecting public ownership is paid.

As foreign capital flows in, so it may flow out. This is a lesson learned

by many countries, from Thailand to Argentina to Russia to Greece, over the

past couple decades. While those concerns pertain more to flows of short-

term "hot money", there is an analogue to Canada due to the particularþ

large role of oil and gas in the Canadian stock market. Foreign investment

in Canada may not be vulnerable to a "tush for the exits" but external drivers such as international, regional or national rules that shrink Canada's

export markets for fossil fuels, or successful divestment campaigns in other

jurisdictions could have

a

spillover effect that could trigger

a

withdrawal of

capital from Canada. This is an additional source of instability or external

shock that could lead to a bursting carbon bubble.

28

Canadian Centre for Policy Atternatives

Pension Funds and

Climate Risk

rHE

RECENT EXeERIENCE of high-tech and housing bubbles should serve

warning to policy makers. In zoo8, the collapse of a housing bubble (in particular, in the United States and Europe) threatened the global

flnancial system as a whole. Massive bailouts to private banks, near-zero

as a stern

interest rates from central banks, and large government deficits have been

invoked to prevent a market meltdown and minimize harm from a recession. The immediate financial crisis has passed, but the lingering effects of

deleveraging and devaluing of assets (also known as "depression econom-

ics") can be seen in ongoing economic difficulties in key European nations

(compounded by the adoption of austerity policies) and sluggish economic performance in North America.