* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

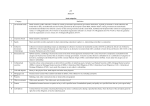

Download A Framework for Analyzing Large Scale Asset

Private equity secondary market wikipedia , lookup

History of the Federal Reserve System wikipedia , lookup

Investment management wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Securitization wikipedia , lookup

Financialization wikipedia , lookup

Global saving glut wikipedia , lookup

Public finance wikipedia , lookup

Financial economics wikipedia , lookup

Interest rate wikipedia , lookup