* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Absorption Approach

International monetary systems wikipedia , lookup

Bretton Woods system wikipedia , lookup

Reserve currency wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Currency war wikipedia , lookup

Purchasing power parity wikipedia , lookup

Foreign exchange market wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Fixed exchange-rate system wikipedia , lookup

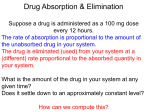

INTERNATIONAL MONETARY AND FINANCIAL ECONOMICS Third Edition Joseph P. Daniels David D. VanHoose Copyright © South-Western, a division of Thomson Learning. All rights reserved. Balance-ofPayments and Exchange-Rate Determination Elasticities Approach and Absorption Approach Overview of the Elasticities Approach • The elasticities approach emphasizes price changes as a determinant of a nation’s balance of payments and exchange rate. • The elasticities approach is helpful in understanding the different outcomes that might arise from the short to long run. 2 Traditional Approaches • Traditional approaches to balance-of-payments and exchange-rate determination assume that capital flows occur only to finance real-sector transactions. • Hence, the quantity of foreign exchange demanded and the quantity of foreign exchange supplied depend only on international transactions of goods and services. 3 The Demand for and Supply of Foreign Exchange • The demand for a nation’s currency is dependent upon foreign residents’ demand for its exports, that is, it depends on foreign residents’ desire to obtain the domestic currency to facilitate their purchases of the domestic country’s exports. • The supply of a nation’s currency is dependent upon (among other things) domestic residents’ demand for imports, that is, when a nation’s residents import, they supply the domestic currency as payment. 4 U.S Import Demand and the Demand for the Euro The left-hand panel illustrates an import demand curve for the United States as combinations of the quantities of champagne demanded at various prices. The right-hand panel illustrates the corresponding demand for foreign exchange as combinations of the quantities of foreign exchange demanded at various exchange rates. 5 Review of Elasticity • Price Elasticity of Demand is a measure of the responsiveness of quantity demanded to a change in price. • If quantity demanded is highly responsive to a change in price, then demand is said to be relatively elastic. • If quantity demanded is not very responsive to a change in price, then demand is said to be relatively inelastic. 6 Elasticity of Import Demand and the Elasticity of Foreign Exchange Demand In the left-hand panel, the import demand curve denoted D′C is more elastic that the demand curve DC. In the right-hand panel, the foreign exchange demand curve denoted D′€ is more elastic than the foreign exchange demand curve D€. 7 The Export Supply Curve and the Supply of the Euro The left-hand panel illustrates an export supply curve for the United States as combinations of the quantities of music CDs supplied at various prices. The right-hand panel shows the corresponding supply of foreign exchange as combinations of the quantities of foreign exchange supplied at various exchange rates. 8 Elasticity of Export Supply and the Elasticity of Foreign Exchange Supply In the left-hand panel, the export supply curve S′CD is more elastic than the supply curve SCD. In the right-hand panel, the foreign exchange supply curve S′€ is more elastic than the foreign exchange supply curve S€. 9 The Effect of Exchange Rate Changes • The exchange rate is an important price to an economy. • When a nation’s currency depreciates, domestic goods become relatively cheaper and foreign goods relatively more expensive in the global market. • Hence, we would expect the nation’s exports to rise and imports to decline. 10 The Responsiveness of Imports and Exports • The elasticities approach, therefore, considers the responsiveness of the quantity of imports and the quantity of exports to a change in the value of a nation’s currency. • For example, if import demand is highly elastic, a depreciation of the domestic currency will cause a relatively larger decline in the nation’s imports. 11 Surpluses and Deficits • It follows that an excess quantity supplied of the domestic currency is equivalent to a current account deficit. • Likewise, an excess quantity demanded of the domestic currency is equivalent to a current account surplus. • The current account is in balance when the quantity of the domestic currency supplied and the quantity demanded are equal. 12 The Current Account The current account deficit is equivalent to the difference between the quantity of foreign exchange demanded and the quantity of foreign exchange supplied. At the spot exchange rate of 1.00, U.S. residents demand €220 million in foreign exchange and European residents supply €180 million. Hence, the current account deficit is €40 million. 13 The Role of Elasticity • The previous chart illustrated a current account deficit for the United States. • The amount of depreciation required to eliminate this deficit depends on elasticity. • When demand and supply are relatively more elastic, a smaller deprecation is required to eliminate the current account deficit. 14 The Marshall-Lerner Condition • Will a depreciation always improve the current account balance? • The Marshall-Lerner condition specifies the necessary conditions for the current account to improve. • According to this condition, the current account balance will improve if the sum of the elasticity of import demand and the elasticity of export supply exceed unity. 15 The J-Curve Effect • The current account balance may respond differently to a currency change in the short run relative to the long run. • The J-Curve effect refers to a phenomenon in which a depreciation of the domestic currency causes a nation’s balance of payment to worsen before it improves. 16 The J-Curve Initially there is a current account deficit of $40 million. At time t, the dollar depreciates. In the short run, import demand and export supply may be inelastic and the current account widens to $48 million. Eventually, as businesses and households have time to adjust their planned expenditures on imports and exports, the deficit improves. 17 Pass-Through Effects • Pass-through effects are also important to understanding the response of the current account to changes in the exchange rate. • A pass-through effect is when the domestic price of an imported good rises following the depreciation of the domestic currency. 18 The Absorption Approach • The absorption approach emphasizes changes in real domestic income as a determinant of a nation’s balance of payments and exchange rate. • Because it treats prices as constant, all variables are real measures. 19 Expenditures • A nation’s expenditures fall into four categories, consumption (c), investment (i), government (g), and imports (m). • The total of these four categories is referred to as domestic absorption (a) a c + i + g + m, 20 Real Income • A nation’s real income (y) is equivalent to total expenditures on its output y c + i + g + x, where x denotes exports. 21 The Current Account • During the time (early Bretton Woods era) that the absorption model was developed, capital flows were not very important. Trade flows, therefore, determined the current account balance. Hence, the current account (ca) is equivalent to ca x - m. • Then, for example, if exports exceed imports, x > m, and the nation is running a current account surplus. 22 Current Account Determination • The absorption approach hypothesizes that a nation’s current account balance is determined by the difference between real income and absorption, which can be written as: • y - a = (c+i+g+x) - (c+i+g+m) = x - m, or y - a = ca. 23 Contractions and Expansions • Though a simple theory, the absorption approach is helpful in understanding a nation’s external performance during contractions and expansions. • For example, when a nation experiences an economic contraction, does its current account necessarily improve and does its currency definitely appreciate? • Does the opposite necessarily hold during an economic expansion? 24 Balance of Payments Determination • Consider the case of an economic expansion. Real income rises, thereby increasing real expenditures or absorption. • Whether the current account balance improves or worsens depends on the relative changes in these two variables. 25 Current Account Adjustment • If real income rises faster than absorption, then the current account improves • y > a → ca > 0. • If real income rises slower than absorption, then the current account worsens • y < a → ca < 0. • Similar conclusions can be reached for a nation experiencing an economic contraction. 26 Exchange Rate Determination • The absorption approach can also be used to examine how changes in income affect the value of a nation’s currency. • Recall that y - a = x - m. • For example, if real income is rising faster than absorption, then exports must be increasing relative to imports. Hence, the nation’s currency will appreciate. 27 Policy Implications • A nation may resort to absorption instruments or expenditure switching instruments to correct an external imbalance. • The effectiveness of these instruments, however, is uncertain, as can be seen in the model. 28 Policy Instruments • Absorption Instrument: Influences absorption by altering expenditures. • Suppose the government reduces its expenditures (g). Absorption will decline as g declines. • However, since expenditures decline, so does output. The absorption instrument is effective only if absorption declines faster than output. 29 Policy Instruments, Continued • Expenditure Switching Instrument: Alters expenditures among imports and exports by changing relative prices. • Suppose the government devalues the domestic currency. Imports are relatively more expensive, and exports are relatively cheaper. • If households and businesses switch directly between imports and domestic output without changing overall absorption or income, there is no impact on the current account balance. 30 Conclusion • The Absorption Approach emphasizes real income in balance-of-payments and exchange-rate determination. • The approach hypothesizes that relative changes in real income or output and absorption determine a nation’s balance-ofpayments and exchange-rate performance. • It is not clear that expenditure switching and absorption instruments are effective. 31