* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Diagnostic Tables - Description

Bretton Woods system wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

International monetary systems wikipedia , lookup

Foreign exchange market wikipedia , lookup

Currency War of 2009–11 wikipedia , lookup

Currency war wikipedia , lookup

Reserve currency wikipedia , lookup

Fixed exchange-rate system wikipedia , lookup

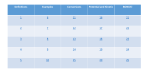

ICP 6th Regional Workshop for 2011 round in Western Asia Region; 21 – 27 January 2013; Istanbul, Turkey Quaranta Tables (QT) Dikhanov Tables (DT) Skainov Tables (ST) PLI expresses the price level of a given country relative to another, by dividing the Purchasing Power Parities (PPPs) by the current nominal exchange rate (XR). PLIs can be calculated for individual BHs, or for aggregates. Rank of the country based on geometric mean (4); Minimum PLI; Maximum PLI; Unweighted geometric mean of all BH PLIs; Set upper limit for BH PLIs (here 2 times the geometric mean); Set lower limit for BH PLIs (here 0.5 times the geometric mean); Number of missing BH PLIs (hence missing PPPs); Number of BHs below set threshold in (5); Number of BHs above set threshold on (6); and Total number of problematic BHs, a sum of (7), (8) and (9). If a base country approach is used in the calculation of the PPPs, missing BHs can be caused either by missing price data for the given country, or for the base country. Country variation coefficient, which measures dispersion among a country’s PPPRatios for a Basic Heading. Basic Heading variation coefficient, which measures dispersion among all the PPPRatios for a BH. XR-Price: the average prices in national currency in column converted to the numéraire currency with the exchange rates. XR-Ratio: Standardized price ratios based on the XR converted prices. The XR-Prices expressed as a percentage of their geometric mean. PPP-Price: The average prices in national currency converted to the numéraire currency with the PPPs. PPP-Ratio: Standardized price ratios based on the PPP converted prices. The PPP-Prices expressed as a percentage of their geometric mean. Standard deviation of each country’s CPD or CPRD residuals for the basic heading or aggregate. It can be converted to a country variation coefficient by multiplying by 100. Market exchange rates of countries expressed as the number of local currency units per US dollar. Exchange rates rebased to the numéraire currency. Number of local currency units per unit of numéraire currency. PLI expresses the price level of a given country relative to another, by dividing the Purchasing Power Parities (PPPs) by the current nominal exchange rate (XR). PLIs can be calculated for individual BHs, or for aggregates. Coefficient of Variation: Price observation variation coefficient XR Ratio: Price ratios based on XR converted prices. The converted prices expressed as a percentage of their geometric mean. CPD or CPRD residuals by product and country. CPD residuals in the DT are equal to the logarithms of the PPP-Ratios in the QT. The Temporal Analysis Table was created by the RO to compare item prices between quarters for the same country and monitor the variation percentage from one quarter to the other. The Variations are highlighted using various color themes referring to different levels of variation. Below 15 or greater Between 15 and 25; -15 and -25 Between 25 and 40; -25 and -40 Greater than 40 or lesser than -40