* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download A Case for Active Management - Mawer Investment Management

Investor-state dispute settlement wikipedia , lookup

Beta (finance) wikipedia , lookup

Land banking wikipedia , lookup

Private equity wikipedia , lookup

Early history of private equity wikipedia , lookup

Stock trader wikipedia , lookup

Syndicated loan wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Stock selection criterion wikipedia , lookup

Private equity secondary market wikipedia , lookup

Fund governance wikipedia , lookup

Investment management wikipedia , lookup

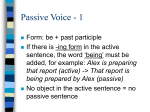

mawer INSIGHT Volume 40 – July 2013 The Great Debate: A Case for Active Management 2 Volume 40 – July 2013 Let’s not mince words. The topic of passive versus active investing is a contentious one, with staunch, passionate supporters on both sides. Often media sound bites are heard disparaging either viewpoint: “Active managers aren’t worth the fees they charge.” “Passive investing is investing in mediocrity.” Before we get into a he said/she said situation, we should explain why this is such a prevalent topic. There has been a lot of change in the mutual fund industry over the last few decades as the industry has evolved. Much to the chagrin of the proponents of active management, passive investing is on the rise. Just six years ago, there were only two Canadian providers of Exchange Traded Funds (ETFs) with $15 billion in assets, but by the end of 2012, there were seven providers managing in excess of $56 billion.1 The range of products has also exploded. In December 2006, there were only 32 Canadian ETFs on the market, but entering 2013, there were 208…and counting. In the U.S., 2013 ETF inflows are on pace to break the 2012 $191 billion record2 and Vanguard, an American mutual fund company specializing in traditional passive investing, currently has $2.4 trillion in assets under management.3 The growth of passive investing since Vanguard launched the world’s first index mutual fund in August 1976, has been nothing short of phenomenal. As an active manager, we have to ask ourselves why this trend is happening. The simplest reason for passive investing’s rise in popularity is due to the general public’s focus on cost – notably so since the 2008 financial crisis – and it is true that index funds and ETFs are often cheaper than actively managed funds. If an index fund is cheaper than an actively managed fund but the actively managed fund produces higher returns, investors will choose the active strategy, correct? The problem, as Charley Ellis, a legend among index fund investors, recently declared in an interview with CNNMoney, is that “some 80% of [active fund managers] would slightly beat the market, but after fees, their returns end up being below the market.”4 Investors also are flocking to passive mutual funds and ETFs for the sake of simplicity and convenience. With so many actively managed funds available, it is difficult for the average person to properly research them all in depth. If passive investing is on the rise due to the belief that it produces better net performance with more convenience, the big question for us is: should Mawer just pack it in and close its doors? Absolutely not. The following discussion will highlight why actively managed funds do have the potential to provide superior returns over passively managed funds and can be the better option for many investors. THE CONTENDERS Imagine a tourist visiting an exotic locale. She has never been there before. Does she: a) Sign up for a pre-determined tour of the most popular attractions? b) Hire an experienced guide to lead her to the hot spots, but also hope he helps her find some hidden gems? Tour “a” represents the passive fund investor. A passive index fund manager’s goal is to closely match or mirror the returns of a market or benchmark. ETFs either track an index, a commodity or a basket of assets in a similar way to an index fund, but unlike an index fund, they are securities that trade like a stock on an exchange. Passive investing holds to the theory that markets are basically efficient (Efficient Market Hypothesis) and because existing stock prices have incorporated all relevant information into their value, it should be impossible to beat the market. Just as the tourist will see all the popular spots and there will be no big surprises, the passive investor will mimic a predetermined benchmark and can only expect to perform as the market performs. But there are no guarantees. The tourist could find a popular site closed for renovations, the weather could provide poor visibility or the bus she’s on could get a flat tire. Likewise, the passive investor must weather the ups and downs of the markets. Tour “b” represents the actively managed fund investor. An active fund manager’s aim is to beat the return of an index or benchmark through security selection and/or market timing. Active investing asserts that the market is inefficient whereby securities are not always priced accurately and tend to deviate from their true value. Just as the tourist expects the experienced guide to not only take her to all the regular tourist spots, but also to find some hidden gems, an investor in active management expects their manager to use their knowledge and expertise to uncover, and act on, mispriced securities. A great tour guide may even tell the tourist to shun the more popular attractions completely, as they can be overrated and ruined by large crowds. An active manager that is not afraid to be different from the market, can shun those securities he believes to be over-hyped and has many more opportunities to discover top notch, undervalued companies. But buyers beware. For the tourist, it is of utmost importance that she researches the background of the guide she chooses, or she could end up penniless, in the seedy part of town. Similarly, the investor in active funds should perform their due diligence prior to selecting an investment manager. THE PRICE OF PASSIVE Individuals in favour of passive investing argue that the fees and operational expenses are lower. When most people hear “lower fees” they quickly translate that into meaning more money in their pockets at the end of the day (or less of a loss). In a much cited August 2000 Journal of Finance article, Russ Wermers researched stock holdings from 1975 to 1994 and concluded that active fund managers outperformed the market by an average of 1.3% per year. But he also found that on a net basis, or after fees were taken into account, the same funds lagged the market by approximately 1%.5 The information that investors are not inundated with is that passive funds and ETFs do not “beat,” or even equal, the market because they are not free, after all, and their fees will almost always cause them to lag behind their corresponding index. Critics of active investment management often mistakenly overlook the fees associated with passive investing and make apples to oranges comparisons. Volume 40 – July 2013 Chart A depicts the management expense ratios (MER) for a few of iShares most popular ETFs: 3 Chart B RBC Investor Service’s Risk and Investment Analytics Rates of Return for Periods Ending March 31, 2013 (gross) Chart A iShares ETFMER (%) (As of May 31, 2013) DEX Universe Bond Index Fund 0.33 S&P/TSX Capped Composite Index Fund 0.27 MSCI World Index Fund 0.47 Source: www.iShares.com Many passive investors believe that they get to mimic the market at practically no cost and this is simply a myth. If someone was to invest $10,000 over 10 years (assuming a 7% annualized rate of return) in the iShares ETF, MSCI World Index Fund, they would shell out over $600 in fees; hardly a free ride. In addition to MERs, ETFs can also experience less visible costs or tracking error. Tracking error is the measure of how closely a fund follows the index to which it is benchmarked. Many people believe their index fund will perform exactly the same as its benchmark. This is not the case for a variety of reasons: 1) Cash drag – Unlike an index, ETFs and Index funds hold cash and the lag of receiving and reinvesting cash can cause variances. 2) Liquidity – Some indices hold illiquid securities and there can be a lag or outright discrepancy when an index fund or ETF manager must purchase or sell these securities in order to replicate the portfolio’s benchmark. 3) Currency Hedging – Occasionally, an international ETF will not follow its index due to the costs incurred from currency hedging. For example, due to currency hedging, the iShares S&P 500 (XSP) had a tracking error of over 0.70% in 2012, with a management expense ratio of 0.24%, making its effective cost 0.94%.6 In a volatile year, such as the 2008 financial crisis, the results can be much worse. To illustrate this point, in 2008, the iShares FTSE NAREIT Mortgage REIT lagged 11.8% behind its benchmark!7 OH, THE POSSIBILITIES But if, as Charley Ellis approximates, 80% of active fund managers do beat their benchmarks but lose out after fees are taken into account, why should an investor choose active management? Because there are active investment management firms providing added value, even after fees. If we examine the gross performance of the 25th percentile managers in the RBC Investor Services’ Risk and Investment Analytics for the end of the first quarter of 2013, we see that these “good” managers all beat their benchmarks over a 10-year period. Ten Year Value Canadian Equity Funds 25th Percentile 11.2 1.2 S&P/TSX Index 10.0 Canadian Small Cap Equity Funds 25th Percentile 13.9 BMO Small Cap Index 11.1 2.8 Fixed Income Funds 25th Percentile 6.3 DEX Bond Universe 6.1 0.2 US Equity Funds 25th Percentile 5.2 S&P 500 (C$) Index 4.6 0.6 Global Equities 25th Percentile 6.9 MSCI World (C$) Index 4.9 2.0 Non-North American Equities 25th Percentile 7.5 MSCI EAFE (C$) Index 5.7 1.8 As fees vary greatly among actively managed funds, some of the funds represented in these asset classes may have beaten their benchmarks when fees are taken into account, some not. But this is just a sampling from the top quartile managers. The top decile performers would have even greater success. As you can see in Chart C, Mawer’s three top decile equity strategies add a substantial amount of value over a 10-year period, even after fees. Chart C Mawer’s Top Decile Equity Funds vs. their Benchmarks Rates of Return for Periods Ending March 31, 2013 (net) Total Ten Year Value Add Mawer Canadian Equity Fund S&P/TSX Index 11.01.0 10.0 Mawer New Canada Fund BMO Small Cap Index 14.8 11.1 3.7 8.5 5.7 2.8 Mawer International Equity Fund MSCI EAFE (C$) Index Source: Mawer Investment Management Ltd. 4 Volume 40 – July 2013 And a little added value goes a long way. Chart D shows the growth of $10,000 over a 10-year period for these same Mawer equity funds versus their benchmarks: Chart D Growth of $10,000 over 10-Year Period (net) $45,000 $39,757 $40,000 $35,000 $30,000 $28,651 $28,394 $25,937 $25,000 $22,610 $20,000 $17,408 $15,000 $10,000 the downward swing, or, at the least, will recover when the irrational behaviour has passed. Likewise, an active manager can provide a greater degree of diversification within their portfolios. Sometimes a particular sector gets caught up in a frenzy and doubles or triples in value. An active manager might use this as an opportunity to take profits from overvalued securities and deploy the proceeds to those that are undervalued. The passive manager has no choice but to continue allocating greater and greater amounts of the portfolio to a sector or security that is trading at excessive valuations. And a passive investor can get hit hard if that security’s performance takes a dive. There is no better example of this than when Nortel accounted for over 30% of the TSE 300 Composite Index (now the S&P/TSX Composite Index) in July of 2000. Passive investors in the TSE 300 Composite Index woke up one morning to find almost a third of their capital invested in a single security, while active investors had plenty of opportunity to take profits from Nortel before its extraordinary decline—to zero. $5,000 MAWER’S TAKE $0 Mawer Canadian Equity Fund MawerS&P TSX Composite Mawer Canadian New Canada Equity Fund Mawer International Fund Mawer New Canada Fund Equity Fund S&P/TSX Index Cap Index (weighted) BMO Small Cap Index BMO Small Mawer International Equity Fund MSCI EAFE (C$) Index MSCI EAFE index (net) If a person had invested in the Mawer Canadian Equity Fund, the Mawer New Canada Fund or the Mawer International Equity Fund, she would have netted $2,457, $11,106, or $5,202, respectively, above the performance of their benchmarks over a 10-year period. (Of course, this is assuming the investor bought the indices for free — which we have already established is impossible.) This outperformance is primarily due to an adherence to a sound investment philosophy and fundamental “bottom up” investment approach that allows investors to benefit from mispriced securities, or hidden gems, uncovered by disciplined research. This would not be possible if the market was efficient at all times. BRACE YOURSELF… Most investment professionals agree that the market is fairly efficient. But sometimes “Mr. Market” falls off the wagon and goes on a bender. The Tech Bubble crisis of 2000 and the Financial Crisis of 2008 are good examples of why down market protection is a key factor for investors to incorporate into their portfolios. Investors in passive funds are at the whim of the forces of the day and are exposed to the fear and greed that can occasionally drive the market. A good active manager can provide some degree of protection in down markets by investing in quality securities that are either minimally affected by Passive investing has certainly been on the rise over the last few decades, and this trend does not seem to be going away. Nevertheless, there are clearly several shortcomings to investing in a passive strategy, such as being at the whim of a neurotic market and overexposure, at times, to certain securities and sectors. In addition, passive investors are not getting the free ride they expect when it comes to fees. In fact, passive investment fees are often not dramatically less than those of some active managers. And if the active manager provides superior returns after fees are taken into account...well, we think it’s a no-brainer. And at Mawer, we do believe that there are good managers out there. To us, being a good manager means following a disciplined investment philosophy and process that is logical, consistent and time tested. We are confident in our ability to add value over passive investment management because we have seen first-hand that security prices often deviate from their true value due to markets not being perfectly efficient or rational. We are proud of being independent tour guides and trust in our ability to offer an investment experience that exceeds that of our passive, cookie-cutter competitors. Joanna Crozier Business Communications Writer Mawer Investment Management Ltd. 1 “Canadian ETF Providers,” http://www.etfinsight.ca. Web. June 2013. 2 John Spence: “ETF Inflows May Hit $200 Billion in 2013,” http://www.efttrends.com/2013/05. Web. June 2013. 3 The Vanguard Group, Inc.: Key Facts and Figures, http://www.vanguardcanada.ca/individuals/about-vanguard.htm. Web. June 2013. 4 Penelope Wang: ”How much does your money manager cost you?” http://www.cnn.com/2013/05/01/investing/money-manager.moneymag/index.html. Web. June 2013. 5 Wermers, Russ. “Mutual Fund Performance: An Empirical Decomposition into Stock-Picking Talent, Style, Transaction Costs, and Expenses,” The Journal of Finance: Vol. LV, No. 4. 6 iShares S&P 500 Index Fund (CAD-Hedged) Annual MRFP, 21-Mar-2013. http://www.iShares.com/investor-resources/resource_library/regulatory_document.htm. Web. June 2013. 7 Macdonald, Larry. “ETF Tracking Error: Is Your Fund Falling Short?” http://www.investopedia.com/articles/exchangetradedfunds/09/etf-tracking-errors.asp. Web. June 2013. August 2000. Copyright © 2013 Mawer Investment Management Ltd. Readers may forward electronic versions of this article. To order reprints or receive an electronic copy, please contact us at [email protected] All information contained herein has been collected and compiled by Mawer Investment Management Ltd. All facts and statistical data have been obtained or ascertained from sources, which we believe to be reliable but are not warranted as accurate or complete. All projections and estimates are the expressed opinion of Mawer Investment Management Ltd. and are subject to change without notice. Mawer takes no responsibility for any errors or omissions contained herein, and accepts no legal responsibility from any losses resulting from investment decisions based on the content of this report. This report is provided for informational purposes only and does not constitute an official opinion as to investment merit. Based on their volatility, income structure or eligibility for sale, the securities mentioned herein may not be suitable for all investors.