* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download comgest growth mid-caps europe

Socially responsible investing wikipedia , lookup

Early history of private equity wikipedia , lookup

Private equity secondary market wikipedia , lookup

Fund governance wikipedia , lookup

Investment banking wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

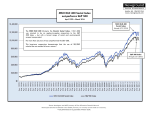

Environmental, social and corporate governance wikipedia , lookup

COMGEST GROWTH MID-CAPS EUROPE ISIN Domicile Fund Currency Total Net Asset Value (m) Net Asset Value per Share 31 March 2016 Quarterly Reporting Investment Team IE0004766014 Ireland EUR 113.02 21.30 Contact Eva Fornadi Rebecca Kaddoum Alistair Wittet [email protected] PERFORMANCE DATA* PERFORMANCE COMMENTARY CALENDAR PERFORMANCE The increased market volatility witnessed since the start of the year has put pressure on the European equity market, with the MSCI Europe index falling 7.1% in Euro over the period under review. European mid-caps also felt the pressure, particularly given their strong 2015 performance, however they managed to outperform their large-cap counterparts over the quarter. Without any clear support of corporate earnings, the market echoed the major swings seen in the price of oil, whilst the ECB announced another expansion of its stimulus package. At its March meeting, the Federal Reserve left its rates unchanged. In Europe, energy and basic resources were among the best performing sectors over the quarter while financials and healthcare suffered the most. On the currency front, the Euro regained some ground against the US Dollar, while the British Pound fell ahead of the June vote on a potential “Brexit”. 20.0 Quarterly Return 10.0 0.0 -10.0 -20.0 % Fund Index +/- Index Descrip tion 2006 13.90 29.29 -15.38 2007 0.38 -6.17 6.54 2008 -37.04 -48.42 11.37 2009 31.95 40.36 -8.42 CUMULATIVE PERFORMANCE SINCE INCEPTION 2010 19.82 19.48 0.34 2011 -5.17 -13.50 8.33 2012 33.90 20.59 13.30 2013 23.46 24.15 -0.69 % change Description 3 Months 200 Fund Performance Index Performance Fund Volatility Index Volatility 150 100 50 Fund 2015 31.04 15.10 15.95 YTD -9.25 -5.37 -3.87 ROLLING PERFORMANCE (%) 250 Dec 2004 2014 7.37 8.78 -1.40 Dec 2009 Dec 2014 Index -9.25 -5.37 1 Year 1.91 -7.17 18.54 19.58 Annualised 3 Years 5 Years 11.65 11.44 14.90 16.26 14.62 8.65 14.50 17.42 The major emerging market currencies stabilised at the end of the period. European economic growth remains positive but subdued, both in real and nominal terms: the ECB now forecasts 1.4% real GDP growth for the Eurozone in 2016 and inflation of 0.1%. Last but not least, the geopolitical environment remains tense. Against this backdrop, your portfolio holdings delivered quite satisfactory 2015 earnings and a good overall outlook for 2016. 10 Years Inception 7.82 3.73 15.77 20.87 4.88 3.56 15.12 19.29 *Past performance is no guarantee of future results. Indices are used for comparison of past performance only. Performance calculation based on NAV to NAV variation expressed in euros. Fund volatility is calculated using weekly performance data. The index used for comparative purposes was previously the DJ Stoxx and is now the MSCI Europe Mid-Cap index. PORTFOLIO PROFILE Asset Class Number of holdings Dividend yield Weight of top 10 stocks Index* *used for comparative purposes only Please see important information on final page Source: Comgest/FactSet, unless otherwise stated European equity: Mid-cap 28 1.20% 47.87% MSCI Europe Mid Cap - Net Return © 2016 Morningstar, Inc. All rights reserved. Ratings and awards mentioned in this document can change at any time and do not constitute a buy recommendation. The views expressed in this fact sheet are those of the portfolio manager at the time of preparation. They may be subject to change and should not be interpreted as investment advice. All information and performance data is as of 31 March 2016 and is unaudited (unless otherwise stated) COMGEST GROWTH MID-CAPS EUROPE | 31.03.2016 | page 1 of 4 COMGEST GROWTH MID-CAPS EUROPE 31 March 2016 Quarterly Reporting PORTFOLIO DATA PORTFOLIO POSITIONING / COMPANY-RELATED NEWS TOP 5 QUARTERLY CONTRIBUTORS Gemalto was the top contributor to the fund performance during the quarter. The group’s share price was boosted after the company released FY2015 results that were in line with expectations and reiterated its 2017 objective of profit from operations to reach 660m EUR. Straumann released strong 2015 results, having delivered 9% organic sales growth and 25% growth in operating profit. The revenue growth was led by the implant business, driven by strong volume expansion across all regions. Sartorius Stedim, a leading supplier for the biopharmaceutical industry, also closed 2015 on a strong note with robust 19.4% sales growth in constant currency and 59.5% earnings per share growth. The group benefited from strong demand for biopharma production equipment, a shift towards single-use products, as well as market share gains. Expecting these factors to continue to remain in place in 2016, management guided for mid-teen sales growth and further margin expansion. Chr. Hansen reported first quarter results which exceeded expectations, with 14% organic sales growth and 31% profit growth. The company raised its 2016 organic sales growth guidance as a result and now expects 9-11% growth. % contribution % average weight tesdfasdfsdf 0.43 Gemalto N.V. 0.27 Straumann Holding AG 0.20 Ambu A/S Class B 0.13 Chr. Hansen Holding... 0.12 Temenos Group AG 0.1 0.15 0.2 0.25 0.3 0.35 0.4 0.45 0.5 % performance tesdfasdfsdf tesdfasdfsdf 2.49 17.55 3.29 8.30 1.68 10.92 5.23 2.00 4.76 0.89 01 234 56 024681012141618 20 TOP 5 QUARTERLY DETRACTORS % contribution % average weight tesdfasdfsdf Wirecard AG -1.78 -1.58 STRATEC Biomedical AG -1.17 Hikma Pharmaceutica... -0.88 SimCorp A/S -0.71 JUST EAT plc -1.8 -1.6 -1.4 -1.2 -1 -0.8 -0.6 % performance tesdfasdfsdf tesdfasdfsdf 5.45 -28.39 4.61 -30.14 4.66 -20.01 3.84 -21.98 2.22 -28.96 -2-10123456 RECENT PORTFOLIO CHANGES A number of changes were made to the portfolio. % weight 7.36 5.51 5.23 4.57 4.52 France Denmark Switzerland United Kingdom France Health Care Materials Information Technology Health Care Health Care Data on holdings is provided for information purposes only and is not a recommendation to buy or sell the securities shown. Data on holdings is subject to change and excludes cash and cash equivalents. Past performance is no guarantee of future results. Please see important information on final page Source: Comgest/FactSet, unless otherwise stated Other performance detractors included Hikma Pharmaceuticals, which finalised the transformational acquisition of Boehringer Ingelheim’s US generics activities. While 2016 will be a transitional year for Hikma, this acquisition should support solid future sales growth thanks to a very strong pipeline of product launches. -30 -25 -20-15-10-50 TOP 5 HOLDINGS AS AT QUARTER END Sartorius Stedim Biotech S.A. Chr. Hansen Holding A/S Temenos Group AG Hikma Pharmaceuticals Plc Eurofins Scientific Societe... Wirecard, Europe’s leading online payment processor, was a major performance detractor. Its share price fell sharply on the back of a report from unidentified and anonymous sources. The report looks suspicious, relating mainly to old allegations (2005-2010) that had been cleared in the past. Wirecard’s management subsequently denied all claims officially. The nature of Wirecard's business (internet based with a disparate client base) lends itself to attacks which can be difficult to verify. As in the past we have found limited real ground for concern in these accusations but remain extremely vigilant. We initiated a position in Domino’s Pizza Group, the clear market leader in the UK pizza home delivery and takeaway market. A combination of new store openings, LFL growth and operational gearing should drive low-mid teen EPS growth in the medium term. We sold Zodiac, as the turnaround of its Aircraft Interior activities is longer and more costly than expected, therefore the group’s earnings profile has become fairly uncertain, and took profits in Stedim. Our existing positions in Essentra, Straumann, Just Eat and Ingenico were reinforced. The views expressed in this fact sheet are those of the portfolio manager at the time of preparation. They may be subject to change and should not be interpreted as investment advice. All information and performance data is as of 31 March 2016 and is unaudited (unless otherwise stated) COMGEST GROWTH MID-CAPS EUROPE | 31.03.2016 | page 2 of 4 COMGEST GROWTH MID-CAPS EUROPE 31 March 2016 Quarterly Reporting OUTLOOK PORTFOLIO DATA Earnings estimates for European equities have continued to be revised downward: consensus now expects less than 2% earnings per share growth in 2016 for the broader index, largely reflecting subdued external macro-economic factors. As a result and as always, we prefer to focus on businesses that can deliver growth despite, and not thanks to, the economic environment. At this stage of the year, 2016 looks similar to 2015 for a number of portfolio companies, at least at constant currencies. Growth should be delivered through market share gains in generally growing markets thanks to the holdings’ competitive advantages (brands, unique business models and innovative molecules to name a few). In addition, we expect your portfolio holdings to continue to make self-financed bolt-on acquisitions, whose contribution to value creation over the long run is sometimes underappreciated. As for currencies, based on current rates, they have become a slight headwind for portfolio earnings in Euro, compared to a tailwind last year. When share prices decline while portfolio earnings continue to increase, the valuation adjustment is made even more quickly. As a result, the premium necessary to buy quality stocks with sustainable growth prospects has narrowed. SECTOR BREAKDOWN CURRENCY BREAKDOWN % weight Information Technology Health Care Consumer Discretionary Materials [Cash] Industrials relative to index 31.5 31 18.3 9.8 7.4 2 +25.7 +25.4 -0.9 -2.4 +7.4 -19.4 % weight EUR GBP DKK CHF HKD USD relative to index 39.9 33 12.2 9.5 3.6 1.8 -5.2 +0.3 +7.2 -0.8 +3.6 +1.6 Breakdown based on MSCI sector classification. COUNTRY BREAKDOWN % weight United Kingdom France Germany Denmark Switzerland [Cash] Hong Kong Netherlands Italy United States relative to index 30.6 17.6 14.6 11.3 8.8 7.4 3.4 2.8 2 1.6 -1.8 +3.1 +5.3 +6.3 -1.5 +7.4 +3.4 -1.9 -1.9 +1.6 The views expressed in this fact sheet are those of the portfolio manager at the time of preparation. They may be subject to change and should not be interpreted as investment advice. Please see important information on final page Source: Comgest/FactSet, unless otherwise stated All information and performance data is as of 31 March 2016 and is unaudited (unless otherwise stated) COMGEST GROWTH MID-CAPS EUROPE | 31.03.2016 | page 3 of 4 COMGEST GROWTH MID-CAPS EUROPE 31 March 2016 Quarterly Reporting INFORMATION Legal Structure Investment Manager Countries registered for sale Initial NAV Contact for subscriptions and redemptions Cut-off A sub-fund of Comgest Growth plc, an openended umbrella-type investment company with variable capital and segregated liability between sub-funds incorporated in Ireland UCITS IV compliant Comgest Asset Management International Ltd (Regulated by the Central Bank of Ireland) 46 St. Stephen's Green Dublin 2, Ireland Tel: +353 (0)1 631 0100 www.comgest.com [email protected] Listed on the Irish Stock Exchange Recognised in Austria, Belgium, Finland, France, Germany, Italy, Luxembourg, Netherlands, Sweden, Switzerland, United Kingdom. EUR 10 per share on 17th May 2000 Minimum initial investment: EUR 50 Maximum sales commission: 4% Redemption fee: None RBC Investor Services Ireland [email protected] Tel.: +353 1 440 6555 Fax: +353 1 613 0401 12 noon Irish time on day D An earlier deadline for receipt of application or redemption requests may apply if your request is sent through a third party. Please enquire with your local representative, distributor or other third party. Investment Advisor ISIN: IE0004766014 SEDOL: 0476601 BLOOMBERG: COMGMCA ID Asset Class European equity: Mid-cap Comgest SA (Eva Fornadi, Rebecca Kaddoum & Alistair Wittet) Fund Codes Management Fee 1.5% per annum of the net asset value Dividend Policy: Capitalisation Trading frequency Daily, when the banks in Dublin and Luxembourg are open for business NAV calculated using closing prices of D NAV known D+1 Settlement D+3 RISK The value of shares and the income from them can go down as well as up and you may get back less than the initial amount invested. Movements in exchange rates can negatively impact both the value of your investment and the level of income received. A more detailed description of the risk factors that apply to the fund is set out in the full Prospectus. IMPORTANT INFORMATION Investment involves risk. Past performance is no guarantee of future results. Indices are used for comparison of past performance only. Figures used in this factsheet are for illustrative purposes only and are not indicative of the actual return likely to be achieved. This document is under no circumstances to be used or considered as an offer to buy any security. Under no circumstances shall it be considered as having any contractual value. Nothing herein constitutes investment, legal or other advice and is not to be relied upon in making an investment decision. You should obtain specific professional advice before making any investment decision. The fund is aimed at investors with a long-term investment horizon. Calculation of performance data is based on the net asset value which does not include any sales commission or redemption fees. If taken into account, sales commission and redemption fees would have a negative impact on performance. You should not subscribe into this fund without having first read the prospectus and the Key Investor Information Document ("KIID"). The prospectus, the KIIDs, the latest annual and interim reports and any country specific addendums can be obtained free of charge from the Investment Manager or Administrator. Further information or reporting may be available from the Investment Manager upon request. © 2016 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its information providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its information providers are responsible for any investment decisions, damages or losses arising from any use of this information or any information provided in conjunction with it. Source: MSCI. The MSCI data is for internal use only and may not be redistributed or used in connection with creating or offering any securities, financial products or indices. Neither MSCI nor any other third party involved in or related to compiling, computing or creating the MSCI data (the “MSCI Parties”) makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and the MSCI Parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to such data. Without limiting any of the foregoing, in no event shall any of the MSCI Parties have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. Contact details for local representatives/paying agents in countries where the fund is registered for distribution are available from the Investment Manager or Administrator and can be found in the fund documentation. The prospectus, the KIID, the latest annual and interim reports and any country specific addendums are also available from the local representatives including For Austria: Erste Bank der österreichischen Sparkassen AG, OE 0198 0984 / Foreign Funds Services, 1100 Wien, Am Belvedere 1. For Belgium: This factsheet is intended only for Belgian PROFESSIONAL CLIENTS (as defined in the Market in Financial Instruments Directive). Caceis Belgium, SA, avenue Port, 86C Bte 320, B-1000 Brussels. Tel: +32 2 209 26 40. The fund may invest in other France, Luxembourg or Ireland-domiciled funds within the Comgest range. For Germany: Marcard, Stein & Co AG, Ballindamm 36, 20095 Hamburg. For Switzerland: BNP Paribas Securities Services, Paris, Succursale de Zurich, Selnaustrasse 16, CH-8002 Zurich. Please see important information on final page Source: Comgest/FactSet, unless otherwise stated All information and performance data is as of 31 March 2016 and is unaudited (unless otherwise stated) COMGEST GROWTH MID-CAPS EUROPE | 31.03.2016 | page 4 of 4