* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Capital Structure Decision

Debt collection wikipedia , lookup

Financial economics wikipedia , lookup

Pensions crisis wikipedia , lookup

Greeks (finance) wikipedia , lookup

Debt settlement wikipedia , lookup

Systemic risk wikipedia , lookup

Debtors Anonymous wikipedia , lookup

Investment management wikipedia , lookup

Financialization wikipedia , lookup

First Report on the Public Credit wikipedia , lookup

Stock selection criterion wikipedia , lookup

Investment fund wikipedia , lookup

Business valuation wikipedia , lookup

Syndicated loan wikipedia , lookup

Short (finance) wikipedia , lookup

Government debt wikipedia , lookup

Household debt wikipedia , lookup

History of private equity and venture capital wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Private equity wikipedia , lookup

Private equity secondary market wikipedia , lookup

Early history of private equity wikipedia , lookup

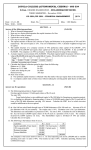

Capital Structure Decision It is a decision regarding debt equity mix. There is a Optimum mix of debt and equity which minimizes the cost of capital and in the total value of the firm. Factors affecting the capital Structure 1. The Profitability Model (i) EBIT-EPS Analysis EBIT-EPS analysis shows the impact of various financing option (debtequity mix on the EPS various level of EBIT) A company which has debt in the capital structure is said to be trading on equity if the return on investment is greater than the after tax cost of debt. The benefit of trading on equity is available even if the return on investment is greater than the after tax cost of debt. The benefit of trading on equity is available even if preference share are issued. But the benefit is greater, if debt is used since debt is cheaper than equity and because of the tax benefit on interest payment. If however the return on investment is lower than the cost of debt then the use of debt will reduce the EPS. It therefore stands to reason there is particular level of EBIT at which the EPS will remain the same whatever be the method of financing used ( indifference point EBIT). 2. Debt- Capacity of the firm: (i) Interest Coverage Ratio: The ability of the firm to borrow more is determined by the following ratios:(a) (b) EBIT = -----------Interest A high ratio indicates better ability to burrow. Another ratio is: Interest Coverage Ratio Debt Servicing Ratio It indicates the amount of EBIT to cover the interest and annual transfer of sinking fund for the redemption of debt. EBIT Debt Servicing Ratio = ----------------------------------------------------Interest + (Sinking Fund appropriation /1-tax) 3. Liquidity Aspect The company’s EBIT may be adequate to meet the commitments arising out of the debt issue. But the firm may not have sufficient cash since its income may be blocked in inventory or receivables. In the absence of cash the firm which is other wise profitable sound would have problem in paying the debts interest and the return of principal leading to financial distress. Hence the ability to generate sufficient cash profit would determine the level of debt to be issued. 4. Control Aspects If the main object of the management is to maintain control the company shall raise the additional capital requirements through debts or preference shares. So that they do not dilute the control. 5. Leverage Industry of Other Firm in The industry Compare debt-equity ratios of company’s in the same industry having a smaller business risk. This will tell us if the firms ratio is more or less then the industry in which case it should know the reason why is it difficult and be safety that there are good reason for such difficulty. 6. Nature of Industry (i) Sales:Firms whose sale fluctuates widely should employ less debt. The opening leverage will be high. Eg. Durable Consumer goods, Firms dealing in non durable consumer goods i.e. items with inelastic demand will rely more on debt. (ii) Competition:Firms operating is more high competitive market share depend more on equity. Public Utilities which are relatively free competition can use more debt. (iii) Life Cycle stage:In the infancy stage of the life cycle the firm should rely more on equity as the firm goes and reach the maturity debt can be relied upon. (iv) Capital Market considerations: The type of securities that the investors prepare to buy is an important factor determining the type of securities shall be issued. (V) Maintaining maneuverability for commercial strategy: Maneuverability refers to the firm ability to either increasing or decreasing its sources of funds in response to changes in the need of funds on while designing the capital structure it should not loose site of the future impact of its present financial plan. For example if the firm has exhausted its firms capital it may be force to issue equity shares for future financing on unfavorable term due to heavy debt. Hence the firm should all ways return some unused debt capacity for future needs. Flexibility also implies the firm’s ability to refund money when not required for which purpose it may have to incorporate a provision to refund the amount before the due date with adequate notice in the loan agreement. This facility can be obatain only at a higher cost far the funds barrowed. He has to assure himself that he is not buying flexibility at a higher cost than is warranted by the gains arising from flexibility. 7. Timing of Issues: Public offer should be made at a time when a stated economy as well as the capital market is ideal to provide funds. High debenture yields indicate a relater security of debenture funds and a P.E ratio is an indicate of scarcity Equity funds. The financial manager expends interest rate to fall in future borrowings may be postponed and vice-versa. 8. Characteristics of the Company Small firms will have more depends on owners funds. Large firms have a choice of different sources of funds. Firms enjoying the high credit standing can raise different source of funds. 9. Tax Planning Under Income tax Act, interest on burrowed fund is allowed as deduction for computing taxable profit. Whereas dividend on shares cannot be deducted. With effect from 1.7.91, company has paid 10% of tax on dividend declared and distributed. Cost of raising fund for burrowing is deductible in the year of burrowing. Cost of issue of equity shares is allowed as deductible over 5 years. 10. Legal Framework: Long Term are available on securities. Debentures can be issued and redeemable after 18 months from the date of issue. Credit rating shall be issued secured debentures only. No such approval is necessary for raising loans for financial institution. 11.Agency Costs: Since Equity share holders control the firms’ management and decision making. Their interest will dominate the interest if debenture holders take some protective action form of condition with loan agreement such as i. Debenture nominee of the board of directors ii. Appointment of Debenture trustee. iii. Maintaining a maximum current ratio. iv. Fixing the maximum dividend payable. v. Regular follower and reporting. Conclusion There is no standard Debt equity mix which is suitable for all firms some of the factors discussed above are conflicting in nature. The determination of most desirable Debt-Equity Mix is corrected by risk, control, flexibility and maintains these factors should be given taking into account and also consider the nature of industry and the position of the company. Q1) A Ltd has an equity capital consisting of 5000 Equity shares of Rs 100 each. It plans to raise Rs. 300000 for the financial expansion programme and identify four options for raising funds. 1. Issued Equity shares of Rs 100 each 2. Issue 1000 Equity shares of Rs.100 each and 2000 8% Preference shares of Rs 100 each 3. Burrow of Rs 300000 at 10% interest p.a 4. Issue 1000 Equity shares of Rs.100 each and Rs. 200000, 10% debentures This company has EBIT of Rs 150000 of its expansion. Tax rate is 50%. Suggest the source in which funds should be raised. Sol. Statement showing EPS Particulars Option I Option II Option III Option IV 5000Eq.S+ 5000+1000=6000 2000 PS @8% 300000 @ Eq. shares & dividend 10% Rs.200000 deb. 5000+3000=8000 5000+1000Eq.S+ Eq. Shares only debenture @ 10% EBIT 150000 150000 150000 150000 - Interest - - 30000 20000 EBT 150000 150000 120000 130000 -Tax @ 30% 75000 75000 60000 65000 EAT 75000 75000 60000 65000 -Pref. div - 16000 - - Profit available 75000 59000 60000 65000 8000 6000 5000 6000 9.375 9.83 12 10.83 for E. S Holders (1) No of E. Shares (2) EPS (1)/(2) Option 3 will be selected because it has higher EPS Q.2) AB ltd gives you the following figures EBIT Less: 12 % Debenture Int Less: Income tax @ 50% EAT 300000 60000 240000 120000 120000 No. of Equity shares = 40000 120000 EPS = ------------ = Rs 3 per share 40000 Market price per share = Rs.30 Market Price Per share Price Earning Ratio (PE) = -----------------------EPS 30 = ------ = 10 3 The company has undistributed reserves of Rs.600000 It requires Rs.200000 for expansion. This amount will earn the same rate of return on funds employed as it is earned now. You are informed that the Debt-Equity ratio = (Debt/ Debt + Equity) higher than 35% will reduce the PE ratio to 8 and raise the interest rate on additional funds burrowed to 14%. The company would prefer to raise the entire funds required through equity or through debt. Which would you recommend? Sol. Total Funds employed at Present Equity Capital (40000 * 10) 400000 Add: Reserves 600000 Debentures (600000* 100/12) 500000 Total Funds Employed 1500000 EBIT Return on Funds employed = ---------------------- X 100 Funds Employed 300000 X 100 = ----------------------150000 = 20% Total Funds after expansion will be = 1500000 ( existing ) + 200000 ( new) = Rs 1700000 New EBIT after expansion = 1700000 * 20 % = Rs. 340000 Working Note New Debt Equity Ratio = Debt 500000 + 200000 ------------------------------------ = ----------------------------Debt + Equity 700000 + 1000000 700000 = ---------------X 100 = 41% 1700000 Debt Equity ratio is more than 35 % Therefore PE ratio in the first option is 8 Statement Showing EBIT rticulars Debt Equity EBIT 340000 340000 Less: Deb. Interest: Existing 500000 * 12% New 200000 * 14% (60000) 60000 (28000) EBT 252000 280000 Less : Tax at 50% 126000 140000 EAT 126000 140000 Less: Pref. Dividend - - Amount available to Eq. shareholders 126000 140000 No. of Equity shares 40000 40000+6667 =46667 EPS 3.15 3 Market Price per share= PE ratio * EPS 8*3.15 = 25.20 10 * 3 = 30 Note It is assumed a new Equity shares will be issued at the current market price Rs 30 each. Therefore no of new shares issued will be 200000/30 = 6667 shares Normally we decide the financing option by finding out which option gives the highest EPS. But if the PE ratio is given we calculate the market price of the shares and determine which option gives the highest market price. That option will be selected. In the above case the company should financial expansion with equity issue. Q.3) From the following details relating to K ltd. EBIT Less: - 8% Debenture Int 2300000 80000 2220000 Less:- 11% Loan Int 220000 EBT 2000000 Less:- Tax at 50% 1000000 EAT 1000000 No of Equity shares ( Rs 10 each) = 500000 shares Market Price per shares = Rs 20 PE ratio = 10 The company has undistributed Reserves of Rs 2000000 . It requires Rs, 3000000 to redeem the debentures and modernize its plant which has the following financial option- 1. Borrow 12% loan from banks 2. Issue 100000 Equity shares of Rs. 20 each and balance from a 12% bank loans The Company expects to improve its rate of return by 2% as a result of modernization However the PE ratio is likely to reduce if entire amount is burrowed. Advice the company. Sol: Computation of Existing Capital employed Reserves 8 % Debentures ( 80000 * 100/8) Loan ( 220000 * 100/11) E share( 500000 * 10) 2000000 1000000 2000000 5000000 10000000 Existing Return on Capital employed = EBIT 2300000 ------------------ X 100 = --------------- X 100 = 23 % Cap. Employed 10000000 Existing Return on Capital = 23% Add:- Increased by 2% Return after modernization 25% on New capital employed Existing Capital employed Add:- New Fund raised Less: Redemption of Reserves 10000000 3000000 13000000 1000000 12000000 New EBIT = 12000000 * 25% = Rs. 3000000 Particulars Option I Option II 12% loan Rs. 2000000 shares Rs. 3000000 loan Rs.1000000 loan EBIT 3000000 3000000 12% Less:- Interest 11% loan 220000 220000 360000 120000 EBT 2420000 2660000 Less:- Tax @ 50% 1210000 1330000 PAT 1210000 1330000 EPS 2.42 2.22 12% loan Market Price = 6 * 2.42 = 19.36 In case of Equity and Debt issue the P/E remains the same Market price is also assumed to be the same i.e. Rs 20 As Market price is higher in the second option debt and equity issue is preferred. Q.4) X ltd has to make a choice between debt issue and equity issue for its expansion programme. Its current position as follows- The capital structure consist of 5% Debentures Rs. 20000: E. Share Capital (Rs.10) Rs 50,000 and Reserves Rs. 30000. Its income statement is as follows Sales Less:- Total Cost EBIT Less: Interest EBT Less: Tax EAT 300000 269000 31000 1000 30000 10500 19500 The Expansion Programme is expected to cost Rs. 50000. This si financed through debt the rate of Interest will be 7% and the PE ratio will be 6. If the expansion is financed through Equity the new shares are sold Rs.25 each and the PE ratio will be 7. The expansion will increase the sales by 50% with the return of 10% on the new sales before interest and Taxes. Advice the company. Solution. New Sales from expansion 300000 * 50% = 150000 EBIT on New sales (150000 * 10%) 15000 (+) Existing EBIT 31000 New EBIT 46000 Particulars Option I Option II Debt Equity EBIT 46000 46000 Less:- Interest Existing 1000 1000 New Int (50000 * 7%) 3500 - EBT 41500 45000 Less:- Tax (10500* 100/30000)= 35% 14525 15750 EAT 26975 29250 No of Shares 5000 7000 EPS 5.395 4.18 Market Price= EPS * PE ratio 32.37 29 Option I is better because it has highest market price. Indifference Point EBIT It is the level of EBIT at which EPS is same for two option in financing, since the EPS is same , the firm will be indifferentiate between the two option.1. EPS under Equity only EBIT [ 1- Tax] No of Equity shares 2. EPS with debt and Equity ( EBIT – Interest ) ( 1- Tax) No. of Equity shares 3. EPS with debt, Equity and Preference shares ( EBIT – Interest ) ( 1- Tax) – Preference dividend No. of Equity shares Q.1) The New project under consideration requires Rs. 3000000. The financing option are1. Issue of Equity shares of Rs. 100 each 2. Issue Equity shares of Rs. 2000000 and 15% debentures for Rs. 1000000 Tax rate is 50%.Calculate the indifference point EBIT Solution a) EPS under option I (EPS under equity only) EBIT [ 1- Tax] No of Equity shares b) EPS under Option II ( EPS with debt and equity) ( EBIT – Interest ) ( 1- Tax) No. of Equity shares EBIT (1- Tax) No. of Equity shares = ( EBIT – Interest ) ( 1- Tax) No of Equity shares EBIT ( 1- 0.5) 30000 = ( EBIT – 150000 ) ( 1- 0.5) 20000 2 EBIT = 3 EBIT – 450000 3 EBIT – 2 EBIT = 450000 EBIT = 450000 Q.2) X ltd requires Rs. 200000 for expansion. It has the following financial option. a) 100% equity shares of Rs 10 each at Rs 10 Premium b) 50% equity issue of Rs. 10 each at Rs 10 Premium and 50% , 8% debentures c) 50% equity issue of rs. 20 each and 50%, 10% preference shares The company expects return of 10% on its investment after expansion. Which financing option would you recommend and also calculate indifference point of EBIT between various plans. Sol. EBIT after expansion = 200000* 10% = 20000 Statement showing EPS Particulars Option (a) Option (b) Option ( c ) EBIT 20000 20000 20000 Less: Interest - 8000 - EBT 20000 12000 20000 Less:- Tax @ 50% 10000 6000 10000 EAT 10000 6000 10000 Less: Pref Dividend - - 10000 10000 6000 Nil 200000/10 100000/20 100000/20 = 10000 =5000 =5000 1 1.20 Nil No. of Equity shares EPS Option (b) should be recommended because it has high EPS. Indifference Point between (a) and (b) EBIT (1- Tax) No. of Equity shares = EBIT ( 1- 0.5) = 10000 5 EBIT = 10 EBIT – 80000 ( EBIT – Interest ) ( 1- Tax) No of Equity shares ( EBIT – 8000 ) ( 1- 0.5) 5000 10 EBIT – 5 EBIT = 80000 5 EBIT = 80000 EBIT = Rs 16000 Indifference Point between (a) and (c) EBIT [ 1- Tax] No. of Equity shares EBIT [ 1- 0.5] 10000 EBIT [0.5] 10000 = ( EBIT – Nil ) ( 1- 0.5) – 10000 5000 = = ( EBIT – Interest ) ( 1- Tax) – Preference dividend No of Equity shares EBIT ( 0.5) – 10000 5000 2.5 EBIT = 5 EBIT -100000 5 EBIT – 2.5 EBIT = 100000 2.5 EBIT = 100000 EBIT = Rs. 40000 Indifference Point between (b) and (c) ( EBIT – Interest ) ( 1- Tax) No. of Equity shares ( EBIT – 8000 ) ( 1- 0.5) 5000 EBIT – 8000 (0.5) 5000 2.5 EBIT – 20000 = ( EBIT – Nil ) ( 1- 0.5) – 10000 5000 = EBIT ( 0.5) – 10000 5000 = = ( EBIT – Interest ) ( 1- Tax) – Preference dividend No. of Equity shares 2.5 EBIT – 50000 2.5 EBIT – 2.5 EBIT = 50000-20000 EBIT = 30000/0 = Nil Therefore there is no indifference point between them. Q.3) A company approaches the financial institution for a sum of Rs 60000 for expansion 10% loan provided the company as debt- Equity ratio of 1:3 1. The present capital structures consist of 1000000 Equity shares of Rs 10 each only which option should the company adopts. 2. At what level of EBIT, the firm will be indifferent between the two financing option. 3. Calculate the level of EBIT at which the uncommitted EPS would be the same if sinking fund obligation in respect of Debenture issue of Rs. 250000 p. annum Assume tax rate 50% Note: The new share will be issued at a premium of Rs 40 each. Sol: The total fund offer expansion will be – Existing E. share 100000 * 10 = Rs 100 lakhs Add: funds for expansion = 60 lakhs 160 Debt Existing Debt equity ratio = ------------ = 1:3 Equity = 1+3 = 4 Existing & New amount = 160/4 = 400000 Debt = 4000000*1 = 400000 Equity = 4000000 * 3 = 12000000 Option I The company will burrow from the financial institution only Rs 4000000 at 10% interest and the remaining Rs 2000000/50 through equity shares. i.e 40000 Option II Rs 600000 for equity shares only that is 600000/50 = 120000 shares Which option company adopts if the post expansion EBIT is Rs 6000000 Statement showing EPS Particulars Option I Option II EBIT 6000000 6000000 Less: Interest 400000 - EBT 5600000 6000000 Less: Tax @ 50% 2800000 3000000 EAT 2800000 3000000 No. of Equity shares 1040000 1120000 EPS Rs. 2.69 Rs. 2.68 Option I should be accepted because it has a high EPS. Indifference point two option ( EBIT – Interest ) ( 1- Tax) No of Equity shares = EBIT [ 1- Tax] No. of Equity shares ( EBIT – 400000 ) ( 1- 0.5) 1040000 = EBIT [ 1- 0.5] 1120000 112 EBIT – 44800000 = 104 EBIT 112 EBIT – 104 EBIT = 44800000 8 EBIT = 44800000 EBIT = Rs 5600000 3. Sinking Fund Obligation and Option IV ( EBIT – Interest) ( 1- Tax) No of Equity shares = EBIT [ 1- Tax] No. of Equity shares ( EBIT – 400000 ) ( 1- 0.5) 1040000 = EBIT [ 1- 0.5] 1120000 56 EBIT – 50400000 = 52 EBIT 56 EBIT – 52 EBIT = 50400000 4 EBIT = 50400000 EBIT = Rs. 12600000