* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Fixed Income Municipal Bonds

Survey

Document related concepts

Transcript

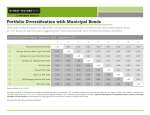

Private Wealth Management Products & Services | January, 2010 Fixed Income Municipal Bonds Tax-exempt municipal bonds are among the most popular types of investments in the market today. They offer a wide range of benefits, including: • Tax-free income • Safety • Predictable cash flow • Diversification • Liquidity What Are Municipal Bonds? Municipal bonds are debt obligations issued by states, cities, counties and other governmental entities to raise money for schools, highways, hospitals and sewer systems, as well as many other public projects. There are two basic types of municipal securities: • General Obligation Bonds – Principal and interest are secured by the full faith and credit of the issuer and usually supported by the issuer’s limited or unlimited taxing power. • Revenue Bonds – Principal and interest are secured by revenues from tolls, charges or rents paid by users of the facility built with the proceeds of the bond issue. Some examples of projects financed by revenue bonds include airports, toll roads, bridges, water and sewer systems, hospitals and low-income housing. When you invest in a municipal bond, you are lending money to an issuer who promises to pay a specified amount of interest, known as the coupon, which is usually paid semiannually. The issuer also promises to return the principal on a specific maturity date. How Safe are Municipal Bonds? When purchasing bonds, an investor’s primary concern should be the issuer’s ability to meet its financial obligations. Historically, municipal bonds have been one of the safest investments available, second only to U.S. Treasury obligations. One way to evaluate an issuer is to examine its credit rating. Two of the primary bond rating agencies are Moody’s and Standard and Poor’s. Bond ratings are important because they reflect a professional assessment of the issuer’s ability to repay its debt. The rating symbols of the two agencies are defined as follows: Credit Risk Prime Excellent Upper Medium Lower Medium Speculative Very Speculative Default Moody’s Aaa Aa A Baa Ba B, Caa Ca, C Standard & Poor’s AAA AA A BBB BB B, CCC, CC D ©2009 Robert W. Baird & Co. Incorporated. Member NYSE & SIPC. Robert W. Baird & Co. 777 East Wisconsin Avenue, Milwaukee, Wisconsin 53202. 1-800-RW-BAIRD. www.rwbaird.com First Use: 01/2010 Page 1 of 3 Municipal Bonds, continued. Credit ratings should not be the sole basis for any investment decision. The ratings cannot, for example, take into account market trends or unforeseen natural disasters. In addition to their stand-alone creditworthiness, municipal bonds may be insured by outside agencies. These insurers guarantee that they will pay bondholders their principal and interest if the issuer defaults. Some of the larger and more well-known municipal bond insurers are Municipal Bond Insurance Association (MBIA), American Municipal Bond Assurance Corporation (AMBAC) and Financial Guaranty Insurance Company (FGIC). Insurance does not eliminate market risk and is limited to the strength and credit quality of the issuer. Tax Exemption Under present federal income tax law, the interest income earned from investing in municipal bonds is exempt from federal income taxes. If an investor is subject to the Alternative Minimum Tax (AMT), interest income from certain municipal securities must be included in calculating the tax. In most states, interest income from securities issued by governmental entities within the state is also exempt from state and local taxes for residents of that state. In addition, interest income from securities issued by U.S. territories, such as Puerto Rico, is exempt from federal, state and local taxes in all 50 states. Taxable Equivalent Yield One of the best ways to appreciate the tax-exempt advantage of a municipal security is to compare it to a similar taxable investment. Municipal bonds may not be appropriate for all investors, especially those in lower tax brackets. To determine if a municipal bond investment is suitable, you can use a figure called the taxable equivalent yield to calculate how much you would need to earn on a taxable bond to equal what you are earning on a municipal bond. Taxable equivalent yield is calculated as follows: Taxable Equivalent Yield = Tax-free yield 1 - Tax Rate Using this formula, calculate the return received on the taxable bond after federal income taxes have been deducted, then compare that to the yield earned on the tax-exempt bond. If it is less than the tax-exempt yield, then the municipal bond would be the better investment. It would be an even better investment if you accounted for state and local income taxes when calculating the returns on the taxable bond. Taxable Municipal Bonds Not all municipal bonds offer income that is exempt from both federal and state taxes. A separate market of municipal issues that are taxable at the federal level still offer a state tax exemption on interest paid to residents of the state of issuance. Taxable municipal bonds exist because the federal government does not subsidize the financing of certain activities that do not provide a significant benefit to the public. Some examples would be investor-led housing issues, local sports facilities and borrowing to replenish a municipality’s under-funded pension plan. Diversification Investors can diversify their bond holdings by choosing from a wide range of maturity dates, credit quality, geographic locations, issuers and types of bonds. This allows the bondholder to have his or her assets allocated over various sectors of the market. Municipal bond investors may also have the opportunity to invest locally in projects taking place in their own communities. ©2009 Robert W. Baird & Co. Incorporated. Member NYSE & SIPC. Robert W. Baird & Co. 777 East Wisconsin Avenue, Milwaukee, Wisconsin 53202. 1-800-RW-BAIRD. www.rwbaird.com First Use: 01/2010 Page 2 of 3 Municipal Bonds, continued. Liquidity/Secondary Market Holders of municipal securities can sell their bonds in an active secondary market through a dealer firm that is registered to buy and sell municipal securities. Municipal bonds are bought and sold in the over-the-counter market. It is important to understand that during the life of a bond, the market price changes as market conditions change. If you sell your municipal bonds prior to maturity, you will receive the current market price, which may be more or less than your original cost, and may generate gains or losses. Interest Rate Considerations An investor in municipal bonds should also understand how the direction of interest rates may affect the value of his or her bond holdings. Prices increase when interest rates decline, and prices decline when interest rate rise as explained below: • When interest rates fall, new issues come to market with lower yields than older securities, making older securities worth more; therefore the increase in price. • When interest rate rise, new issues come to market with higher yields than older securities, make the older ones worth less; therefore the decline in price. Call Features Many bond issues allow the issuer to call, or retire, all or a portion of the bonds at a premium or at par, before maturity. When buying bonds, it is important to understand and be aware of all potential redemption provisions. Your Financial Advisor will quote the yield to call and the yield to maturity when the yield to call is lower. This will generally occur when the bonds are trading at a price above the initial call price. Are Municipal Bonds For You? To find out if Municipal Bonds fit into your overall investment strategy, call your Baird Financial Advisor or contact the Baird office nearest you. *Please visit emma.msrb.org for more information about municipal securities. ©2009 Robert W. Baird & Co. Incorporated. Member NYSE & SIPC. Robert W. Baird & Co. 777 East Wisconsin Avenue, Milwaukee, Wisconsin 53202. 1-800-RW-BAIRD. www.rwbaird.com First Use: 01/2010 Page 3 of 3