* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download investment management of banks

International investment agreement wikipedia , lookup

History of the Federal Reserve System wikipedia , lookup

Rate of return wikipedia , lookup

Land banking wikipedia , lookup

Internal rate of return wikipedia , lookup

Pensions crisis wikipedia , lookup

Modified Dietz method wikipedia , lookup

Early history of private equity wikipedia , lookup

Securitization wikipedia , lookup

History of pawnbroking wikipedia , lookup

Credit card interest wikipedia , lookup

Stock selection criterion wikipedia , lookup

Credit rationing wikipedia , lookup

Quantitative easing wikipedia , lookup

Present value wikipedia , lookup

Investment fund wikipedia , lookup

Investment management wikipedia , lookup

Interbank lending market wikipedia , lookup

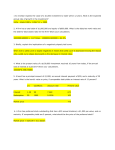

INVESTMENT MANAGEMENT OF BANKS OBJECTIVES • • • • • Stabilize Bank’s Income Offset Credit Risk Exposure Usage as Collateral Flexible Asset Composition Enhance Liquidity PORTFOLIO INVESTMENT • When deposits are low and loan demand is high – Use investments as collateral and borrow and utilize this to meet loan demand – Sell investments to meet loan demand PORTFOLIO INVESTMENT • When deposits are high and loan demand is weak – Use investments to increase earnings capacity of banks – Retrieve pledged investments to convert it into an earning asset FACTORS AFFECTING PORTFOLIO INVESTMENT • Return • Risk • Tax INVESTMENT PORTFOLIO OF A BANK I Investments in India in Government Securities. 157738,10,12 143727,26,29 Other approved securities 4194,47,61 4527,26,17 Shares 901,89,75 992,52,85 Debentures and Bonds 15874,94,56 16166,26,61 Subsidiaries and/or joint ventures 1436,03,94 1189,49,38 Others (Units / Commercial Papers etc.) 1538,90,23 1282,79,48 TOTAL 181684,36,21 167885,60,78 Reference: http://www.rbi.org.in/scripts/PublicationsView.aspx?id=13895 Continued.. INVESTMENT PORTFOLIO OF A BANK II Investments outside India in Government securities (including local authorities) 202,93,60 381,38,12 Subsidiaries and/or joint ventures abroad 276,73,05 216,32,44 Other investments (Shares, Debentures etc.) 3512,45,42 3864,59,38 GRAND TOTAL 3992,12,07 4462,29,94 INVESTMENTS OF SCHEDULED COMMERCIAL BANKS Items Year 1 Amount Per share cent (1) (2) 657606 97.8 Investments by offices in India A. Indian Government 502498 Securities 1 Central Government 423089 2 3 State Governments 78505 Others * 904 (Amount in Rs. crore) As on March 31 Year 2 Year 3 Amount Per Amount Per share cent share cent (3) (4) (5) (6) 767874 98.3 837559 98.4 74.8 584422 74.8 653496 76.7 62.9 475521 60.8 538091 63.2 11.7 0.1 107253 1648 13.7 0.2 115216 189 13.5 0 Continued.. INVESTMENTS OF SCHEDULED COMMERCIAL BANKS Items B. Other domestic securities, (Amount in Rs. crore) As on March 31 Year 1 Year 2 Year 3 Amount Per Amount Per Amount Per share cent share cent share cent 153967 22.9 180326 23.1 183246 21.5 bonds, shares, etc. 1 Other trustee securities 20459 (excluding units of UTI) 12472 2 Fixed Deposits 3 Shares and Debentures of 103470 Joint Stock Companies (market value) 3 20502 2.6 18865 2.2 1.9 19127 2.4 19631 2.3 15.4 105635 13.5 103531 12.2 Continued.. INVESTMENTS OF SCHEDULED COMMERCIAL BANKS Items 4 5 6 7 8 Initial contribution to Share Capital of UTI Units of UTI Certificate of Deposits and Commercial Papers Mutual Funds Others @ (Amount in Rs. crore) As on March 31 Year 3 Year 1 Year 2 Amount Per Amount Per Amount Per cent share cent share cent share 70 0 1 0 4 0 283 2940 0 0.4 17 2296 0 0.3 19 3450 0 0.4 5246 9027 0.8 1.3 9545 23203 1.2 3 10480 27266 1.2 3.2 Continued.. INVESTMENTS OF SCHEDULED COMMERCIAL BANKS Items (Amount in Rs. crore) As on March 31 Year 1 Year 3 Year 2 Amount Per Amount Per Amount Per cent share cent share cent share C. Foreign Securities 1141 1Foreign Governments’ Securities 2Other Foreign Investments 77 0.2 0 3126 82 0.4 0 817 — 0.1 0 1064 0.2 3044 0.4 817 0.1 Continued.. INVESTMENTS OF SCHEDULED COMMERCIAL BANKS Amount in Rs. Crore Items Year 1 Amount Per cent share Investments by Foreign Offices of Indian Banks 1 Indian Securities 2 Foreign Countries Securities 3 Other Investments Total As on March 31 Year 2 Year 3 Amount share Per cent Amount share Per cent 14558 2.2 13621 1.7 13995 1.6 0 3213 0 0.5 — 2920 0 0.4 — 3353 0 0.4 11345 672164 1.7 100 10701 781495 1.4 100 10642 851554 1.2 100 Continued.. INVESTMENT PERFORMANCE OF BANKS (in per cent) Ratios As on March 31 State State Bank of State State Bank of Bikaner Bank of Bank of India & Jaipur Hyderabad Indore Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 53.7 42.77 43.92 36.57 50.33 41.9 42.72 30.68 Investmentdeposit ratio Return on 8.37 investments Return on 3.48 investments adjusted to cost of funds 7.77 9.49 8.85 7.82 8.21 8.01 7.76 3.03 4.68 4.38 2.96 3.22 3.47 3.25 Continued.. INVESTMENT PERFORMANCE OF BANKS (in per cent) Ratios As on March 31 State State Bank of State State Bank of Patiala Bank of Bank of Mysore Saurashtra Travancore Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 42.67 34.78 46.47 38.08 48.25 42.81 43.89 40.89 Investmentdeposit ratio Return on 8.57 investments Return on 3.87 investments adjusted to cost of funds 7.66 7.85 7.11 9.7 9.11 8.58 8.47 3.15 3.23 2.45 4.76 4.23 3.82 3.59 Continued.. INVESTMENT PERFORMANCE OF BANKS (in per cent) Ratios Allahabad Bank As on March 31 Andhra Bank Bank of Baroda Bank of India Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 46.6 37.1 38.64 33.74 45.6 37.49 36.39 33.83 Investmentdeposit ratio Return on 8.47 investments Return on 3.58 investments adjusted to cost of funds 8.05 7.85 7.16 7.96 8.19 7.62 7.15 3.31 3.41 2.59 3.78 4.16 3.33 2.97 Continued.. INVESTMENT PERFORMANCE OF BANKS (in per cent) Ratios As on March 31 Bank of Canara Bank Central Corporation Maharashtra Bank of Bank India Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 50.2 42.2 39.31 31.66 50.76 43.08 37.68 32.4 Investmentdeposit ratio Return on 8.89 investments Return on 3.91 investments adjusted to cost of funds 8.52 8.28 7.61 8.59 8.61 8.4 8.16 3.64 3.67 3.04 3.96 4.08 4.2 3.89 Continued.. INVESTMENT PERFORMANCE OF BANKS (in per cent) Dena Bank Ratios As on March 31 IDBI Ltd. Indian Bank Indian Overseas Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 46.4 36.3 165.9 97.5 51.48 46.6 42.98 37.51 Investmentdeposit ratio Return on 8.35 investments 3.39 Return on investments adjusted to cost of funds 7.82 1.58 3.35 8.33 8.27 9.04 8.81 3.4 0.96 1.77 3.68 3.66 4.4 4.16 Continued.. INVESTMENT PERFORMANCE OF BANKS (in per cent) Oriental Bank Ratios As on March 31 Punjab & Sind Punjab Bank National Bank Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 38.33 33.5 49.97 41.1 49.12 34.3 Investmentdeposit ratio Return on 9.52 investments 4.85 Return on investments adjusted to cost of funds Syndicate Bank Year 1 Year 2 44 32.2 9.19 8.82 8.36 8.56 8.79 8.2 6.43 4.26 4.16 4.26 4.25 4.76 3.7 2.33 Continued.. INVESTMENT PERFORMANCE OF BANKS (in per cent) Ratios As on March 31 UCO Union Bank of United Vijaya Bank India Bank of Bank India Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 38.5 36 36.86 34.98 56.82 48.31 47.11 40.35 Investmentdeposit ratio Return on 8.08 investments Return on 3.47 investments adjusted to cost of funds 8.05 8.33 8.02 8.7 8.17 7.82 8.02 3.04 3.59 3.41 3.73 3.45 3.32 3.38 Continued.. INVESTMENT PERFORMANCE OF BANKS (in per cent) Ratios As on March 31 ABN Amro Abu Dhabhi American Antwerp Bank Bank Express Diamond Bank Bank Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 Year 1 Year 2 47.4 40.67 75.63 30.98 45.83 43.83 327.9 266.36 Investmentdeposit ratio Return on 7.91 investments 4.97 Return on investments adjusted to cost of funds 8.03 9.37 11.79 4.69 4.36 7.89 6.98 4.25 1.71 3.28 -0.88 -1.36 6.18 3.22 Continued.. YIELD CURVE • Yield curve is a graph that depicts the relationship between bond yields and maturities. • Investors use the yield curve as a reference point for forecasting interest rates, pricing bonds and creating strategies for increasing total returns. • Yield curve is a leading indicator of economic activity. CONTENTS OF THE YIELD CURVE • Yield on a bond is based on both the purchase price of the bond and the interest or coupon payments received. • Yield curve is a line graph that plots the relationship between yields to maturity and time to maturity for bonds of the same asset class and credit quality. • The plotted line begins with the spot interest rate, which is the rate for the shortest maturity, and extends out in time, typically to 30 years. 7.268462082 6.750656082 6.232850082 5.715044082 5.197238082 4.679432082 4.161626082 3.643820082 3.126014082 Maturity in years Source: http://www.nseindia.com/content/debt/debt_zcyc.htm, Accessed on 15 December 2010. 19.69580608 9 19.17800008 18.66019408 18.14238808 17.62458208 17.10677608 16.58897008 16.07116408 15.55335808 15.03555208 14.51774608 13.99994008 13.48213408 12.96432808 12.44652208 11.92871608 2-Nov-07 11.41091008 10.89310408 10.37529808 9.857492082 9.339686082 8.821880082 8.304074082 7.786268082 7.67 2.608208082 7 2.090402082 7.67 1.572596082 8 1.054790082 0.536984082 0.019178082 Spot interest rates ZERO COUPON YIELD CURVE Source: “www.nseindi.com Plot of the Estimated ZCYC 5-Nov-07 12 11 10 8.41 8.38 6 5 4 3 IMPLICATIONS OF RATE OF INTEREST • Yield curve depicts yield differences or yield spreads, that are due to differences in maturity. • This relationship between yields and maturities is known as the term structure of interest rates. • The normal shape or slope of the yield curve is upward, which means that bond yields usually rise as maturity extends. THEORIES ON YIELD CURVE • Pure Expectations Theory: The theory holds that the slope of the yield curve reflects only investors’ expectations for future short-term interest rates. Mostly investors expect interest rates to rise in the future, which accounts for the usual upward slope of the yield curve. Continued.. THEORIES ON YIELD CURVE • Liquidity Preference Theory: Here long-term interest rates not only reflect investors’ assumptions about future interest rates but also include a premium for holding long-term bonds, called the term premium or the liquidity premium. This premium compensates investors for the added risk of having their money tied up for a longer period. Because of the term premium, long-term bond yields tend to be higher than shortterm yields, and the yield curve slopes upward. Continued.. THEORIES ON YIELD CURVE • Preferred Habitat Theory: In addition to interest rate expectations, investors have distinct investment horizons and require a meaningful premium to buy bonds with maturities outside their preferred maturity or habitat. Proponents of this theory believe that short-term investors are more prevalent in the fixed-income market and therefore, longer-term rates tend to be higher than short-term rates. SHARP UPWARD YIELD CURVE • A sharply upward sloping or steep yield curve, has often preceded an economic upturn. The assumption behind a steep yield curve is interest rates will begin to rise significantly in the future. Investors demand more yield as maturity extends if they expect rapid economic growth because of the associated risks of higher inflation and higher interest rates. FLAT YIELD CURVE • A flat yield curve signals an economic slowdown. The curve flattens when the interest rates rise to restrain a rapidly growing economy. • Short-term yields rise to reflect the rate hikes, while longterm rates fall as expectations of moderate inflation prevails. • A flat yield curve is unusual and indicates a transition to either an upward or downward slope. INVERTED YIELD CURVE • An inverted yield curve can signal recession. • When yields on short-term bonds are higher than those on long-term bonds, it suggests that investors expect interest rates to decline in the future, usually in conjunction with a slowing economy and lower inflation. YIELD CURVE YIELD CURVE Future short-term interest rates will be higher. Investment managers will use this information by shifting their investments away from long-term securities and towards short-term securities. YIELD CURVE Future short-term interest rates will be lower. Investment managers will use this information by shifting their investments away from short-term securities and towards long-term securities. RIDING THE YIELD CURVE • When the yield curve slopes upward, as a bond approaches maturity or “rolls down the yield curve”, it is valued at successively lower yields and higher prices. • Using this strategy, a bond is held for a period of time as it appreciates in price and is sold before maturity to realize the gain. As long as the yield curve remains normal or in an upward slope, this strategy can continuously add to total return on a bond portfolio. INVESTMENT MATURITY STRATEGIES • Ladder or Spaced Maturity Policy • Front end Load Maturity Policy • Back end Load Maturity Policy • Barbell Investment Portfolio Strategy • Rate Expectations Strategy LADDER OR SPACED MATURITY POLICY LADDER OR SPACED MATURITY POLICY • Equal percentage of investments over short and long term maturing securities • Difficulty in finding good credit rated securities in all maturity profiles • Cost of building the investment policy is high FRONT END LOAD MATURITY POLICY FRONT END LOAD MATURITY POLICY • All investments are made in short-term maturity securities • Persistent revision of portfolio is required • Policy will be successful only in liquid markets BACK END LOAD MATURITY POLICY BACK END LOAD MATURITY POLICY • All investments are long-term maturity securities • Policy is subject to price and rate sensitiveness • Inflation risk is also to be borne by this policy BARBELL INVESTMENT PORTFOLIO STRATEGY BARBELL INVESTMENT PORTFOLIO STRATEGY • A balanced holing of short and long term maturity securities. • A bond investment strategy in which the maturities of the securities included in the portfolio are concentrated at two extremes. • Barbell strategy involves selecting only bonds with short and long term maturities. • The maturity structure of the portfolio can be lengthened or shorted by varying the amount of securities on either end of the maturity range. BARBELL INVESTMENT PORTFOLIO STRATEGY • Using this approach requires constant attention from the portfolio manager. • Bonds with short maturities need to be rolled over into new short term securities as they reach maturity. As long term bonds reach middle maturity, they have to be rolled over into new long term securities. • One disadvantage to a barbell strategy is its transaction costs. In addition, long term bonds are much more sensitive to interest rate changes. Therefore, the long term maturity side of the portfolio tends to have greater volatility than the short term maturity side. ACTIVE INVESTMENT STRATEGIES • Speculative strategies – Bond Swaps • Rate Anticipation Swaps, • Quality Swaps, • Yield Pick-Up Swaps. – Yield Curve Strategies. • Shift Strategies – Ladder Strategy – Bullet Strategy – Barbell Strategy RATE EXPECTATIONS STRATERGY RATE EXPECTATION • Strategy of buying bonds with high or low durations based on the expectation of an upward or downward parallel shift in the yield curve. It is a type of yield curve shift strategy. Expected in interest rates - Buy Short duration Investments Expected in interest rates - Buy Long duration Investments QUALITY SWAPS • Strategy of buying investments with high or low quality rating based on the expectation of a change in economy. Expect Economic Recession – Buy High quality investments; Sell low quality investments Expect Economic Expansion – Buy low quality investments; Sell high quality investments YIELD PICK UP SWAP • Strategy of identifying investments which are identical but do not yield the same rates. The assumption is that the return on the investments will eventually converge. Among identical investments (same quality, same maturity) Buy the under priced security Sell the overpriced security TYPES OF YIELD CURVE SHIFTS • Parallel Shifts: Rates on all maturities change by the same number of basis points (or by the same percentage). • Flattened Twisting: The difference in the yield to maturity of long term instruments to the yield to maturity of short term instruments are declining (YTMLT – YTMST). • Steeped Twisting: The difference in the yield to maturity of long term instruments to the yield to maturity of short term instruments are increasing (YTMLT – YTMST). TYPES OF YIELD CURVE SHIFTS • Positive Humped Shift: Short term and long term rates change more than intermediate interest rates. • Negative Humped Shift: Intermediate maturity interest rates change more than short term and long term rates of interest. BULLET STRATEGY • Portfolio of investments concentrated in one maturity area. All investments are heaped as a 5 year or a 3 year or any other specific maturity investment or around this short or long term maturity. • Example: 40% of the investment portfolio would have 4.5 years as maturity, 35% would have a maturity of 5 years and the remaining 25% of the investment portfolio would be having a maturity of 5.5 years. TOTAL RETURN ANALYSIS • Total return analysis involves determining the possible returns from different yield curve strategies given different yield curve shifts. CASE ANALYSIS • Consider three bonds: – Investment A: 5-year, 8% bond selling at par. – Investment B:15-year,10% bond selling at par. – Investment C: 10-year, 9% bond selling at par. • Two Possible Strategies: – Barbell: Invest 50% in A and 50% in B. – Bullet: 100% in Bond C. YIELD CURVE SHIFTS • Case 1 : Parallel Shifts – A rate change of 50 basis points • Case 2: Flattened Twist – C increases by 25 points, A increases by 50 basis points and B increases by 10 basis points • Case 3: Steep Twist – C increases by 25 points, A increases by 10 basis points and B increases by 50 basis points • Case 4: Positive Hump – C increases by 25 basis points, A and B increases by 50 basis points • Case 5: Negative Hump – A and B increases by 25 basis points, C increases by 50 basis points COMPUTATION OF CASE 1 • Investment A Time 1 2 3 4 Interest Rate 8 8 8 8 Discount at changed rate 0.921659 0.849455 0.782908 0.721574 0.665045 Discounted Value 7.373272 6.795642 6.263265 5.772594 71.82491 Interest Income Asset Appreciation/Depreciation (Value-100)/100 Total Return 0.085 5 108 Total Value 98.02968 0.085 -0.0197 0.065297 RETURN ANALYSIS Case 1 A C B Barbell Rates 8.5 Value 98.02968 Return 0.065297 0.063606 0.068031 0.063606 0.066664 Case 2 Rates A 9.5 Bullet 96.8606 96.30309 C 8.5 10.5 B 9.25 10.1 Value 98.02968 98.41309 99.24371 Return 0.065297 0.076631 0.093437 0.076631 0.079367 Continued.. RETURN ANALYSIS Case 3 A Rates C 8.1 B 9.25 Bullet Barbell 10.5 Value 99.60178 98.41309 96.30309 Return 0.077018 0.076631 0.068031 0.076631 0.072524 Case 4 Rates A C 8.5 B 9.25 10.5 Value 98.02968 98.41309 96.30309 Return 0.065297 0.076631 0.068031 0.076631 0.066664 Continued.. RETURN ANALYSIS Case 5 A C B 9.5 Bullet Barbell Rates 8.25 10.25 Value 99.00837 Return 0.072584 0.063606 0.083753 0.063606 0.078168 96.8606 98.12531 INTEREST RATES RISE Case 1 A C B Barbell Rates 8.5 Value 98.02968 Return 0.065297 0.063606 0.068031 0.063606 0.066664 Case 2 Rates A 9.5 Bullet 96.8606 96.30309 C 8.5 10.5 B 9.25 10.1 Value 98.02968 98.41309 99.24371 Return 0.065297 0.076631 0.093437 0.076631 0.079367 Continued.. INTEREST RATES RISE Case 3 A Rates C 8.1 B 9.25 Bullet Barbell 10.5 Value 99.60178 98.41309 96.30309 Return 0.077018 0.076631 0.068031 0.076631 0.072524 Case 4 Rates A C 8.5 B 9.25 10.5 Value 98.02968 98.41309 96.30309 Return 0.065297 0.076631 0.068031 0.076631 0.066664 Continued.. INTEREST RATES RISE Case 5 A C B 9.5 Bullet Barbell Rates 8.25 10.25 Value 99.00837 Return 0.072584 0.063606 0.083753 0.063606 0.078168 96.8606 98.12531 TOTAL RETURN ANALYSIS • Parallel Shifts: – For rate increases, the barbell strategy gives best results. – For rate declines the bullet strategy gives best results. • Flattening: – For rate increases, the barbell strategy gives best results. – For rate declines the bullet strategy gives best results. • Steepening: – For rate increases, the bullet strategy gives best results. – For rate declines the barbell strategy gives best results. Continued.. TOTAL RETURN ANALYSIS • Positive Hump: – For rate increases, the bullet strategy gives best results. – For rate declines the barbell strategy gives best results. • Negative Hump: – For rate increases, the barbell strategy gives best results. – For rate declines the bullet strategy gives best results.