* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Overseas Fund - First Eagle Investment Management

Survey

Document related concepts

Algorithmic trading wikipedia , lookup

Investment banking wikipedia , lookup

Interbank lending market wikipedia , lookup

Market (economics) wikipedia , lookup

Short (finance) wikipedia , lookup

Fund governance wikipedia , lookup

Rate of return wikipedia , lookup

Private money investing wikipedia , lookup

Private equity secondary market wikipedia , lookup

Stock trader wikipedia , lookup

Mutual fund wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Hedge (finance) wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Socially responsible investing wikipedia , lookup

Transcript

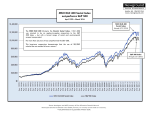

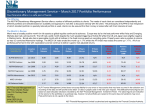

First Eagle Overseas Fund As of March 31, 2017 Class A SGOVX | Class C FESOX | Class I SGOIX | Class R3 EAROX | Class R4 FIORX | Class R5 FEROX | Class R6 FEORX Volatility Is Our Friend Many market professionals equate market volatility with risk. We disagree. We think the most serious investment risk is not the short-term waxing and waning of a portfolio, but the possibility of permanent impairment of capital. We seek to minimize this risk by investing in securities that we believe are trading at a discount to our estimate of their intrinsic value. We try to identify quality businesses through bottom-up research, develop our estimate of their intrinsic value, and purchase their shares only when they are available at a price substantially below our estimate of their intrinsic value. Volatility often makes this easier to accomplish. Our funds may lag in runaway bull markets, but they have historically outperformed the benchmark during certain periods of increased volatility. First Eagle Overseas Fund (A Shares w/out sales charge) during periods of increased volatility Dec. 1996 – Apr. 2003 70 Jul. 2007 – Nov. 2010 Jul. 2011 – Dec. 2011 60 50 Aug. 2015 – Sep. 2015 40 30 20 10 Jan-17 Jan-16 Jan-15 Jan-14 Jan-13 Jan-12 Jan-11 Jan-10 Jan-09 Jan-08 Jan-07 Jan-06 Jan-05 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 0 Jan-95 CBOE VIX Closing Price (Monthly) CBOE VIX Index Closing Prices (Monthly) January 1995 - March 2017 December 1996 – April 2003 July 2011 – December 2011 •SGOVX (w/out sales charge) returned 10.03% vs. -2.07% for the MSCI EAFE Index •SGOVX (w/out sales charge) returned -9.40% vs. -16.31% for the MSCI EAFE Index •Morningstar Foreign Large Blend Category Return -1.58% •Morningstar Foreign Large Blend Category Return -17.40% July 2007 – November 2010 August 2015 – September 2015 •SGOVX (w/out sales charge) returned 2.12% vs. -8.20% for the MSCI EAFE Index •SGOVX (w/out sales charge) returned -6.41% vs. -12.06% for the MSCI EAFE Index •Morningstar Foreign Large Blend Category Return -7.57% •Morningstar Foreign Large Blend Category return -10.97% The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at feim.com or by calling 800.334.2143. If sales charge was included returns would be lower. First Eagle Overseas Fund As of March 31, 2017 Average Annual Returns as of 3/31/2017 (%) First Eagle Overseas Fund MSCI EAFE Index Class A YTD 1 Year 5 Years 10 Years without sales charge SGOVX 6.39 9.01 5.89 4.92 with sales charge SGOVX 1.06 3.56 4.81 4.38 7.25 11.67 5.83 1.05 Expense Ratio* 1.14 The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at feim.com or by calling 800.334.2143. The average annual returns for Class A Shares “with sales charge” of First Eagle Overseas Fund give effect to the deduction of the maximum sales charge of 5.00%. *The annual expense ratio is based on expenses incurred by the fund, as stated in the most recent prospectus. There are risks associated with investing in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. These risks may be more pronounced with respect to investments in emerging markets. Investment in gold and gold related investments present certain risks and returns on gold related investments have traditionally been more volatile than investments in broader equity or debt markets. The principal risk of investing in value stocks is that the price of the security may not approach its anticipated value or may decline in value. The CBOE Volatility Index (VIX) is an unmanaged index, which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. One cannot invest directly in an index. The MSCI EAFE Index is an unmanaged total return index, reported in U.S. dollars, based on share prices and reinvested net dividends of approximately 1,100 companies from 21 developed market countries. One cannot invest directly in an index. 2016 Morningstar, Inc.© All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Morningstar Foreign Large Blend portfolios invest in a variety of big international stocks. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asian ex-Japan). The blend style is assigned to portfolios where neither growth nor value characteristics predominate. These portfolios typically will have less than 20% of assets in U.S. stocks. Investors should consider investment objectives, risks, charges and expenses carefully before investing. The prospectus and summary prospectus contain this and other information about the Funds and may be obtained by asking your financial adviser, visiting our website at www.feim. com or calling us at 800.334.2143. Please read our prospectus carefully before investing. Investments are not FDIC insured or bank guaranteed, and may lose value. First Eagle Funds are offered by FEF Distributors, LLC. www.feim.com First Eagle Investment Management, LLC 1345 Avenue of the Americas, New York, NY 10105-0048 F-F-OVSVOL