* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

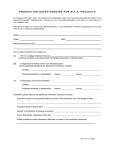

Download Purchase of Rental Property Form

Security interest wikipedia , lookup

Financialization wikipedia , lookup

Investment management wikipedia , lookup

Investment fund wikipedia , lookup

Financial economics wikipedia , lookup

Business valuation wikipedia , lookup

Credit card interest wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Land banking wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Credit rationing wikipedia , lookup

Interest rate swap wikipedia , lookup

Pensions crisis wikipedia , lookup

Present value wikipedia , lookup

Rate of return wikipedia , lookup

Internal rate of return wikipedia , lookup

Modified Dietz method wikipedia , lookup

PURCHASE OF RENTAL PROPERTY FORM This is a Microsoft Word document to be filled out on your computer by both you and your spouse. Do not print and fill out by hand. Various tables will have to be expanded to accommodate your additional information. This form has been designed for two purposes: To help evaluate the purchase decision, but it can also be used to evaluate an existing holding. To see what affect such a purchase will have on your Retirement Update Letter. This document may seem overwhelming. If so, we will be happy to help you complete the form. Client Name: Spouse Name: Date: STEP 1 – POINTS TO CONSIDER For areas of concern or interest, place an “X” in the adjacent box Planning – Having a deep bench of advisors is critical. In addition to discussing this idea with friends and family, have meetings been set up with operations experts in the field? Can someone mentor if have no experience? Planning – Has a meeting been scheduled with a banker to discuss financing if required? Planning – Has a meeting been scheduled with an accountant to discuss tax issues? Planning – Knowing how to terminate a venture is as important as creating the initial business plans. Is an exit strategy in place if termination in near future is required for unforeseen reasons? Planning – How will rental purchase impact retirement projections? Resources – Is financing available? If a balloon loan is required, what are the potential risks when this loan comes due? Resources – In the event of temporary illness, is there someone able to look after the rental? Resources – Is capital sufficient if renter is lost? How many months of cash are on hand to cover overhead? Risk – If the rental fails, will the losses be limited strictly to business assets or do creditors have the ability to access personal assets? Risk – Has a meeting been scheduled with the insurance agent to discuss insurance requirements? Risk – Has a meeting been scheduled with an attorney to discuss the advantages of establishing a Limited Liability Company (LLC)? Additional Points or Comments: Page 2 of 7 STEP 2 – CLARIFY THE RATE OF RETURN (ROR) There are two ways to evaluate Rates of Return (ROR): 1. Rate of return specific to the rental property only, which uses the Return on Asset (ROA) method. 2. Rate of return for the investor, which uses the Return on Equity (ROE) method. How do these methods differ? While both methods start out with the rate of return intrinsic for the rental property itself, the Return on Equity (ROE) method has the additional dimension of investor debt. Surprisingly, the addition of debt can cause widely divergent results between the two methods. An example will help clarify this point. Assume: The rental property costs $1,000,000 to purchase. Projected positive net income excluding interest expense of 10% ($100,000) annually. Projected unrealized capital appreciation of the rental property of 4% ($40,000) annually. A bank loan of $600,000 at 8% ($48,000) interest. Using the information above, the Rates of Return (ROR) using the two methods are: Return on rental property only using Return on Asset (ROA) method: ($100,000 + $40,000) / $1,000,000 = 14% Return to investor using Return on Equity (ROE) method: ($100,000 + $40,000 - $48,000) / ($1,000,000 - $600,000) = 23% These results indicate that the expected rate of return inherent to the rental property itself as revealed by the Return on Asset (ROA) method can almost be doubled if debt is introduced, as shown through the Return on Equity (ROE) method. Keep in mind that debt is a two edge sword. Debt has in the past caused Return on Equity (ROE) rates to drop below Return on Asset (ROA) rates, go negative, and even cause the rental property to fail. These events have occurred in the past, and can happen again: Difficulty in acquiring tenants creates problems in servicing the loan payments. When loans mature, interest rates have increased substantially from when loan was last refinanced. Economic distress causes bankers to abruptly cease lending to small landlords. When evaluating a rental property, the Return on Equity (ROE) method can obscure the fundamentals of the rental property, and should not be used. Be wary that seller is discussing rates of return from a Return on Equity (ROE) perspective, while buyer is thinking in terms of Return on Asset (ROA). How a rental property is financed between debt and equity should remain between the buyer, his financial advisors, banker and accountant. The availability of any buyer financing resources should not be factored when evaluating the soundness of the underlying rental property fundamentals. It is important to focus solely on market value by using the Return on Asset (ROA) method. If an investment cannot stand on its own fundamentals, regardless of buyer financing, it cannot stand at all. Page 3 of 7 STEP 3 – CONSOLIDATE YOUR PAPERWORK The following documents are needed to proceed with this form. When finished do not send the supporting documents but only this form to [email protected]. Your last Retirement Update Letter will be updated and then rerun to assess the impact on your retirement projections. Last year’s (or latest if retired) W-2 Forms-Client & Spouse Last year’s Tax Return Last year’s (or latest if retired) record or estimate of hours worked at regular job – Client & Spouse Recent rental property appraisal Credit history report from Experian, Equifax and Trans Union. A free copy from each of the agencies can be obtained from Annual Credit Report. Any errors should be cleared up immediately. FICO score (Please note there is a cost for the FICO score but not for the credit report). This website has a calculator which shows what people with different FICO scores can be expected to pay in different interest rates. Sellers paperwork which should include: 1. Purchase price or cost of rental property 2. Seller’s detailed list of assets, liabilities, income and expenses Estimated number of non-compensated hours needed at startup and then annually – Client & Spouse Annual unrealized capital appreciation growth rate if available Page 4 of 7 STEP 4 – DEFINING THE HURDLE RATE PERCENTAGE Assume an apartment building is valued at $1,000,000 and is generating $60,000 in net profits a year. The Return on Asset (ROA) is therefore 6%. Is the return adequate or not? Here is how people tend to answer this question: 1. Rental property is operating at above breakeven so return is adequate. 2. The return is greater than what can be earned at a CD at the bank, making it a good investment. 3. Making or losing money doesn’t matter because the apartment has been in the family for years and is therefore a sentimental investment. 4. The most common answer of all is admitting to never thinking about this question. The problem with the answers above is that investing in a rental property costs time and money, which are precious resources. Planning for retirement has enough pitfalls, without knowing whether an investment is helping or hurting. One needs to keep all investment cylinders firing to get to the retirement objective. How does one know if an investment is generating an adequate rate of return? The key is to have a relevant comparison. For example, one would not compare a real estate investment’s rate of return to a CD rate or some other arbitrary measure given the level of risk taken in such a venture. Instead, the annual rate of return (ROR) percentage of the oldest global Real Estate Investment Trust (REIT) mutual fund since inception will be the baseline. To this baseline figure various adjustment factors will be added. The sum will provide the minimum long-term total rate of return (ROR) percentage or Hurdle Rate. If the rental property’s projected return equals or is greater than the hurdle rate then proceed, but if less the project should be avoided. If the investment is currently owned and the rate inadequate, the rental property is in need of a turnaround and if that is not feasible, liquidated to avoid dragging down one’s retirement. Page 5 of 7 STEP 5 – CALCULATING THE HURDLE RATE FOR RENTAL PROPERTY Description Benchmark – The foundation is a widely diversified International Real Estate mutual fund. Russell Global Real Estate Securities Fund S (RRESX) long-term rate of return since 1989 is: The factors below will bridge the risk differential between holding the above widely diversified mutual fund and an individual property. Geographic risk – Applicable if client does not hold real estate across the globe. If concentrated enter 0.50%; enter 0.00% if property holdings are world wide. Sector risk – Applicable if client has holdings primarily in one real estate sector (apartment rental) instead of having diversified properties in motels, storage, malls, etc. If concentrated enter 0.50%; enter 0.00% if property holdings are across many sectors. Leverage risk – Applicable if client has leverage as there is risk of being unable to make loan payments and/or refinance the loan again after loan balloons in five to seven years. If financial resources limited use 2.00%, sliding down to 0.00% if self financed. Liability risk – Needed to reflect the possibility of legal litigation. Start with 0.75% sliding down to .25% if there is sufficient amounts of coverage. The percentage will never go to zero as there are often frivolous lawsuits with which to contend. Income risk – Reflects the potential income loss from vacancies or deadbeat renters. Start with 2.00%, sliding down to 0.50% if renters are reliable. Destruction risk – Needed to reflect the possibility that renter causes damages that exceed normal depreciation. Start with 2.00%, sliding down to 0.00% if the renters are high quality. Additional factors – Additional factors – Hurdle Rate Percentage (Client Salary ($ 1 STEP 6 – CALCULATE YOUR HOURLY RATE + Spouse Salary1) / (Client Hours2 + Spouse Hours2) = + $ ) / ( + ) = $ % 9.5 === Hourly Rate 1 Annual compensation comes from last year’s W-2 form. If retired use last year of employment. Annual hours worked comes from payroll records. If not available, use a best estimate. 2 STEP 7 – DETERMINE COST BASIS If an existing real estate venture, skip input and place recent Zillow.com value directly in COST BASIS field. Purchase Price + Startup Dollar Costs1 + (Startup Hours2 X Hr Rate3) = Cost Basis $ + $ + ( X $ ) = $ 1 Include any other one-time startup costs for the rental including fees, taxes, commissions and renovations. Do not include loan payments here. 2 Include estimated personal hours required to get the real estate project started, that will not be compensated by salary. 3 Place the hourly rate calculated in step #6 here. Page 6 of 7 Net Income2 $ STEP 8 – CALCULATE ANNUAL ECONOMIC BENEFIT1 Interest Unrealized LT Cap (Ongoing Hourly Annual Economic + + X = 3 4 5 6 Payments Appreciation Hours Rate ) Benefit + $ + $ - ( X $ ) = $ 1 A real estate investment creates positive economic gains through two sources, cash flow and unrealized capital appreciation. Annual Net Income comes from the most recent tax return, Supplemental Income and Loss (Schedule E), line 21 which shows the net gain or loss. If there is no tax return, temporarily skip to step 8A for a sub-table that will help to populate this field. 3 Add back the interest only (do not include principal) on any mortgage payments to be made annually. Refer to the most recent tax return, Supplemental Income and Loss (Schedule E), line 12 Mortgage interest paid to banks, etc. If there is no tax return, refer to BankRate.com for the interest rate payable for the desired loan term of 10, 15 or 30 years. Take the interest rate and multiply by the loan amount for an approximate dollar value to place in this field. Special Note – As this is not a primary residential purchase, the mortgage rate may not be the same as the going rate on a home mortgage. If there is a balloon payment interest rates may be higher when loan matures, or a loan may be difficult to attain. 4 Unrealized Long-Term Capital Appreciation is the annual increase in the value of the property. This gain will be recognized and not converted to cash flow until the real estate investment is sold, perhaps decades from now. A conservative approach is recommended. Historically since 1890 real estate has appreciated at the inflation rate of 3% annually. Add another 2% annually to reflect property improvements totaling to 5%. Multiply 5% by the market value of the property as found in Zillow.com to populate this field. 5 Include the personal time required annually for this property, which will not be compensated by salary. If owned for a while, estimate what has been spent in uncompensated hours on average over the years since real estate investment was bought. 6 Place the hourly rate calculated in step #6 here. 2 STEP 8A – NET INCOME SUB-TABLE Has this rental property been included in a former tax return? If yes, ignore this step and go back to step 8. Annual Rental Income1 + Property Taxes2 3 Insurance Utilities (E.G. – Electric, Water, Gas, Phone, Cable, Internet and Alarm)4 5 Upkeep (E.G. – Landscaping, Lawn Mowing and Snow Plowing) Minor Repairs & Maintenance6 7 Major Repairs & Depreciation of Large Items 8 Net Income or Loss = 1 If negotiations with renter have not produced a firm monthly rent figure yet, obtain an approximation by referring to the “Rent Z Estimate” found on Zillow.com. Take the monthly figure and multiply by 12 to annualize. 2 Property Taxes are usually listed on Zillow.com. If missing, take the market value for the property as found on Zillow.com times 2.5%. 3 Insurance Expense is the market value for the property as found on Zillow.com times 0.5%. 4 Utilities, if fully covered by the landlord, are calculated by taking the market value for the property as found on Zillow.com times 1.5%. Normally most, if not all, of the utilities expenses are paid by the renter, but some may be covered by landlord subject to lease negotiation. 5 Upkeep is the market value for the property as found on Zillow.com times 0.5%. 6 Minor Repairs & Maintenance is the market value for the property as found on Zillow.com times 1.0%. 7 Major Repair Expense & Depreciation of large Items the market value for the property as found on Zillow.com times 2.0%. 8 Net Income or Loss calculated here can now be entered back in Step 8. $ $ $ $ $ $ $ $ Page 7 of 7 STEP 9 – CALCULATE LONG-TERM TOTAL RATE OF RETURN (ROR)1 Annual Economic Projected Long-Term Total Rate of Return Cost Basis3 / = 2 Benefit (ROR) $ / $ = % 1 This is the annual Rate of Return (ROR) using the Return on Assets (ROA) calculation. Calculated in step #8. 3 Calculated in step #7. 2 STEP 10 – COMPARING PROJECTED RENTAL PROPERTY RETURN WITH HURDLE RATE Projected Long-Term Rate of Return (ROR) for Rental Property1 % + Hurdle Rate that Rental Property Must Surpass2 % Difference Between Projected Rental Property ROR and Hurdle Rate = % 1 Calculated in step #9. Calculated in step #5. 2 STEP 11 – EVALUATING THE FINDINGS As the projected long-term rate of return (ROR) for the business is greater (positive) than the hurdle rate, this test suggests that the rental property venture is attractive. Or As the projected long-term rate of return (ROR) for the business is less (negative) than the hurdle rate, this test suggests that the rental property venture is unattractive.