* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Augmented Returns for Riding the Yield Curve

Beta (finance) wikipedia , lookup

Yield spread premium wikipedia , lookup

Business valuation wikipedia , lookup

Financial economics wikipedia , lookup

Investor-state dispute settlement wikipedia , lookup

Present value wikipedia , lookup

International investment agreement wikipedia , lookup

Credit card interest wikipedia , lookup

Land banking wikipedia , lookup

Stock selection criterion wikipedia , lookup

Investment management wikipedia , lookup

Internal rate of return wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Modified Dietz method wikipedia , lookup

Rate of return wikipedia , lookup

Credit rationing wikipedia , lookup

United States Treasury security wikipedia , lookup

Investment fund wikipedia , lookup

Pensions crisis wikipedia , lookup

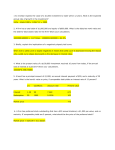

AUGMENTED RETURNS FROM RIDING THE YIELD CURVE Karen C. Barr, Pennsylvania State University – Beaver Campus [email protected] Raymond A. K. Cox, Central Michigan University [email protected] ABSTRACT This study evaluates the Riding-the-Yield-Curve (RYC) investment strategy using monthly intervals from 1993 to 2003. Other authors who have studied this strategy have reported mixed results. We find the RYC technique of purchasing a 180 day U.S. Treasury bill at a higher return in an upward sloping yield curve environment, holding it for 90 days, and then selling it as a 90 day Tbill with a capital gain augments returns. When compared to a buy-and-hold strategy equated to the planned investment period of 90 days the RYC provides an additional 62 basis points per annum for the eleven years of this study. I. INTRODUCTION The money market investment strategy called Riding-the-Yield-Curve (RYC) is a method used by many to augment returns. Interest rate conditions in the recent short term investment market have been extremely low even by historical standards with rates not seen since the 1930s. Techniques that enable investors to increase returns, even if by small amounts, need to be employed to meet operating costs such as management fees of money market mutual funds, commissions on trading activity and to overcome the bid-ask spread of transactions. Ideal conditions for the RYC method are an upward sloping yield curve. To conduct the RYC method an investor buys a debt security with a longer termto-maturity than the planned investment period. Then when the date of the planned investment period arrives the security is sold. If the yield curve was upward sloping and remained the same then the investor earns a higher yield. This higher yield is because of the higher income return from purchasing the longer term instrument as well as a capital gain from the sold security due to it providing a higher return than that required in the market for what is now a shorter term instrument. II. RESEARCH DESIGN The discount rates of the U.S. Treasury bills with 90 days and 180 days to maturity are gathered at monthly intervals from the Board of Governors of the Federal Reserve for the period January 1993 to December 2003. The reported discount rates must be converted to a discount price as follows: P 100 Yd x100 x N / 360 , (1) Where: P is the discount price of a par 100 bill, Yd is the reported discount rate, and N is the number of days to maturity. Then the effective yield is calculated: RE 100 P / P 1 365 / N 1 , (2) Where: RE is the effective yield. The expected return from the RYC strategy is then computed: E ( RYC ) R p [ R p E Rs ]N p N H N H , (3) Where: E(RYC) is the expected return from riding the yield curve, Rp is the effective yield of the T-bill when purchased, E(Rs) is the expected return of the T-bill when it is sold, Np is the number of days to maturity when the T-bill was purchased, NH is the number of days the T-bill was held. The E(RYC) generated in formula (3) is correct only if the yield curve does not change. Increases in the interest rate negate the benefits of the RYC technique and can even make the strategy inferior to the strategy of buying treasury bills equal to the planned investment period. On the other hand decreases in interest rates magnifies the augmented returns from the use of the RYC strategy. One method to measure the interest rate risk on the RYC strategy is to calculate the rate at the end of the planned investment period where the investor would be no better or worse off from the RYC strategy and the strategy of purchasing a bill with a maturity equal to the planned investment period. This estimated breakeven point is: RBEP R p ( R p RPIP ) N H / ( N p N H ) , (4) Where: RBEP is the breakeven rate when you sell the T-bill, RPIP is the return if you originally buy a bill with a maturity equal to the planned investment period. If Rs > RBEP the RYC strategy augments returns, otherwise it does not and can even reduce returns if Rs < RBEP. Moreover, the wider the distance between RBEP and the E(Rs) (when RYC augments returns) the better. This difference between the measures is called the margin of safety (MOS), determined by: MOS ( RBEP E ( Rs )) / E ( Rs )/ 100 , (5) Equation (5) implies that rates would need to increase by more than the MOS for the investor to be worse off from employing the RYC technique versus investing in a bill equal to the planned investment period. Finally, an investor’s actual return from RYC is: RYCY ( Ps P) / P 1 365 / N 1 , (6) Where: RYCY is the actual RYC yield, Ps is the selling price of the T-bill. III. RESULTS AND CONCLUSIONS The RYC strategy is to buy a 180 day U.S. Treasury bill, hold it for 90 days, and then sell it as a 90 day T-bill. This strategy is executed each month for 11 years. Observe Table 1 for the results reported by year (for monthly intervals) with the average 90 and 180 day T-bill discount rate, average expected RYC rate, average MOS and average actual RYC including an overall mean and standard deviation (based on the annual figures). On average the difference between 180 and 90 day U.S. T-bill during 1993 – 2003 was 15 basis points (100 basis points equals 1%). By executing the stated RYC technique the expected RYC increased by 57 basis points versus investing in a bill with a maturity the same as the planned (90 day) investment period. These results are consistent with (Cox and Felton, 1994) and (Bieri and Chincarini, 2004) as well as (Dyl and Joehnk, 1981). Rates could have declined on average by 9.11% (MOS) from the base rate. Even when considering the actual changes in the yield curve the RYC augmented return by 62 basis points. These results are more remarkable given that in the 11 year (132 month) period the yield curve was inverted for 12 months and was flat for 2 months. Even so, the Riding-the-Yield-Curve strategy is an effective technique to augment return as in each and every month for the 11 year period the actual RYC yield was superior to the return of the planned investment period. REFERENCES Bieri, David S., and Chincarini, Ludwig B. “Riding the Yield Curve: Diversification of Strategies.” http://econwpa.wustl.edu:8089/eps/fin/ papers/ 0410/0410002.pdf August, 2004. Cox, Raymond A. K., and Felton, James M. “Performance from Riding the Yield Curve: 1980-1992.” Journal of Business and Economic Perspectives, 20, 1994, 128-132. Dyl, Edward A. and Joehnk, Michael D. “Riding the Yield Curve: Does it Work?” Journal of Portfolio Management, 7, 1981, 13-17. TABLE 1 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Overall Average Standard Deviation Average 90 Day T-Bill Discount Rate 3.07 4.37 5.66 5.15 5.20 4.91 4.78 6.00 3.47 1.63 1.03 4.11 Average 180 Day T-Bill Discount Rate 3.22 4.82 5.82 5.29 5.39 5.02 4.94 6.17 3.45 1.72 1.08 4.26 Average Expected RYC 3.52 5.60 6.40 5.78 5.94 5.45 5.42 6.80 3.49 1.85 1.15 4.68 Average MOS 11.18 22.38 7.38 7.16 9.07 6.11 8.30 7.81 0.44 10.36 9.97 9.11 Average Actual RYC 3.45 4.90 6.63 5.74 5.95 5.63 5.10 7.01 4.44 2.00 1.21 4.73 1.63 1.68 1.88 5.26 1.84