* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Seminar in Financial Management

History of investment banking in the United States wikipedia , lookup

Investment management wikipedia , lookup

Negative gearing wikipedia , lookup

Capital gains tax in Australia wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Capital gains tax in the United States wikipedia , lookup

Investment banking wikipedia , lookup

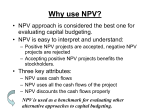

Seminar in Financial Management Kiky Natalia IBMP-16568 Article From CRP Title Capital Budgeting : NPV v. IRR Controversy Unmasking Common Assertions By Jan F.Jacob Topic Conflict between NPV and IRR Theory used by article/ research “Capital budgeting decisions are among the most important choices made by managers; selection or rejection of investment proposals defines the firm’s profitability and, in the end, its survival.” Keef and Roush (2001) Theory used by article/ research “The common assertion that the NPV v. IRR controversy hinges on the rate of reinvestment… is… based on a misunderstanding.. Conflict between IRR and NPV can be attributed entirely to the effects of scale.”(Keane,1979,55) Theory used by article/ research “ mathematics is a tool… economics [is] the master …[the] problem arises from confusion of this hierarchy-from trying to make economics conform to the mathematics (Herbst, 1982,92) Hypothesis of research The NPV-method and the IRR-method aren’t two measures of investment worth, but just one single method. The NPV/IRR-method is a plain mathematics and does not pretend to be ranking device; it cannot be used as such either. Variables used in research C= money units Discount rate ‘per’ period (discrete), for each of three period NPV Method of analysis Present value method or (a variant) the method of the internal rate of return. Result of the analysis/ research (Conclusion) The present value method fails in numerous cases in making sound capital budgeting decisions. This is because the fact that the NPV/IRRmethod meets only nominal’s. Article from Student Title Capital Budgeting with Taxes under Uncertainty and Irreversibility By Rainer Niemann, Tubingrn, and Caren Sureth, Paderborn Topic The derivation of post-tax investment rules and neutral tax systems under risk neutrality and risk aversion for irreversible investment projects. Theory used by article/ research Under condition of uncertainty and irreversibility, real option-based models 1. Are wideliy accepted for assessing investment project. Dixit/ Pindyck (1994), Trigeoris ( 1996) In recent years, public economics have extended real option literature by integrating taxation.Morreto (2000) 3. By doing so, its possible to derive investment rules considering managerial flexibility, irreversibility, tax effect, and to identify tax systems that are neutral with respect to investment decision. Harchauwill/ lassere (1996), Jow (200), Pennings ( 2000) Agliardi (2001) 2. Theory used by article/ research Deterministic examples for neutral tax systems are the cash flow tax and the taxation of true economics profits. Brown (1948) In recent years, public economist was especially interested in tax neutrality under uncertainty. Samuelson (1964), and Johansson (1969) Theory used by article/ research For risk neutral investors, neutral tax systems have been already been proved in the real option context, whereas neutral tax systems under risk aversion and irreversibility have not yet been derived. Niemann (1999), Sureth (1999), Sureth (2002) Integrating taxes reveals interesting differences, especially under risk aversion. Knudsen/Meister/Zervous (1999) Hypothesis of research Exercising option to invest is assumed completely irreversible, which implies that it is impossible to abandon a project during its economic life ending at time T. T maybe finite or infinite. Variables used in research Single profits tax Operating cash flow π Depreciation allowances d Interest taxation parameter Method of analysis General assumptions Derive the optimal investment rule under uncertainty and to assess the value of the option Dynamic Programming Result of the analysis/ research (Conclusion) The main reason for employing real option approach instead of traditional models of capital budgeting under uncertainty are the introduction of managerial flexibility in light of irreversibility and the possibility to abstract from individual risk preferences. Since neutrality conditions are always transformations of the underlying model assumptions, the differentiation between dynamic programming and contingent claims analysis is crucial with tax neutrality